A Guide to Class I Milk Formula Options

photo credit: Mark Stebnicki, North Carolina Farm Bureau

Since the 2018 farm bill, the price for Class I milk, i.e., milk used to produce beverage milk products, has been calculated using the simple average of advanced Class III (cheese) and Class IV (milk powders) skim milk prices plus 74 cents. In years prior, the formula was the higher of advanced Class III and Class IV skim milk prices. The change was made at the request of dairy industry stakeholders and was intended to improve risk management opportunities for beverage milk. COVID-19-induced volatility combined with the 2018 farm bill formula change resulted in hundreds of millions of dollars in Class I pool revenue losses, renewing industry discussions on optimal Class I pricing methods. Dairy farmers are curious about how the multiple circulating proposals of Class I formula options differ and how they would each impact Class I revenues. Today’s Market Intel analyzes three alternatives to the current Class I pricing calculation and their associated revenue impacts for dairy farmers supplying the Class I marketplace.

Policy background on the initial 2018 change and an analysis of early 2020 revenue impacts of the change were discussed previously here: Impact of the Farm Bill Change to the Class I Milk Price on Dairy Farm Income. Other analyses on the financial impacts of milk and dairy commodity price volatility on producer price differentials, de-pooling and the ineffectiveness of dairy risk management tools to offset negative PPDs can be viewed in the following: De-Pooling and Record-Large Negative PPDs Continue Into July, Negative PPDs to Offset Milk Price Rally, Revisiting Record-Large Negative PPDs on Milk Checks and Lack of DMC Payments Does Not Reflect Dairy Farmers’ Difficulties.

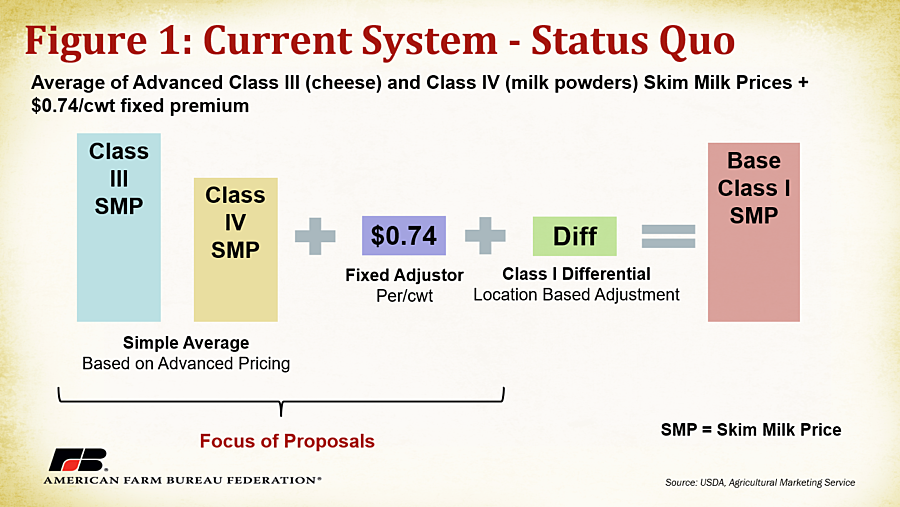

Understanding the structure of the current Class I pricing formula is essential to comparing alternatives. Figure I displays a diagram of the current calculation which, again, is the simple average of advanced Class III (cheese) and Class IV (milk powders) skim milk prices plus 74 cents. Any large disparity between the Class III skim milk price (SMP) and Class IV SMP is smoothed through the averaging feature, meaning the final Class I base calculation will not fully reflect the higher (or lower) option. The 74 cents was originally calculated using the historical difference between the Class III and IV skim prices to make dairy farmers and milk prices indifferent to the change over the long-term. The Class I location-based differential is included in our diagrams to reflect a final adjustment made for regional supply and demand differences, which currently range from $1.60 per hundredweight to $6.00 per hundredweight. Circulating Class I proposals focus on the first part of the equation, with a particular emphasis on the 74-cent adjustor.

Returning to the Higher-of

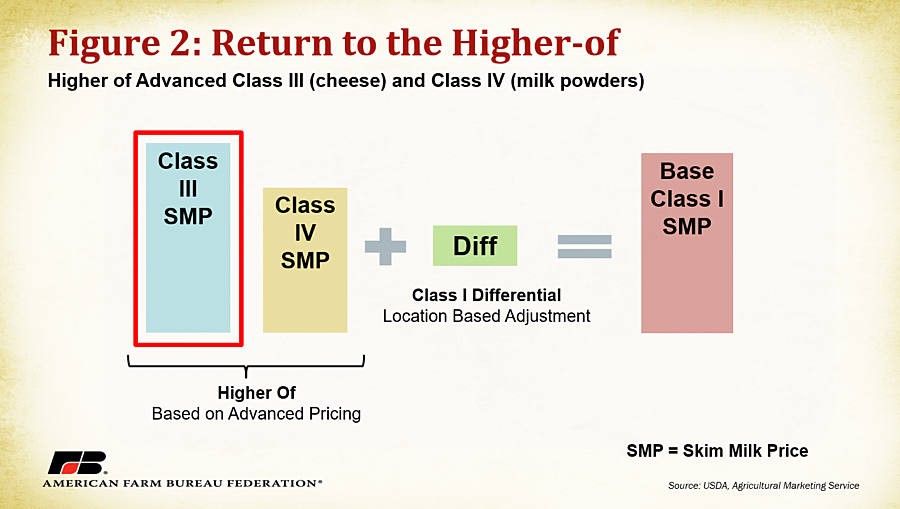

One of the major contenders for amending the Class I pricing formula is going back to the higher-of, which was used prior to the 2018 farm bill. Figure 2 displays the higher-of equation, which simply selects the higher price between Class III SMP and Class IV SMP. In the diagram example, the Class III SMP is higher and would be selected as the basis for the Class I SMP. The formula does not include a counterpart to the 74-cent adjustor of the current system and is often considered the easiest of the proposals to understand. It remains based on advanced prices which are calculated using values from the first two weeks of the preceding month.

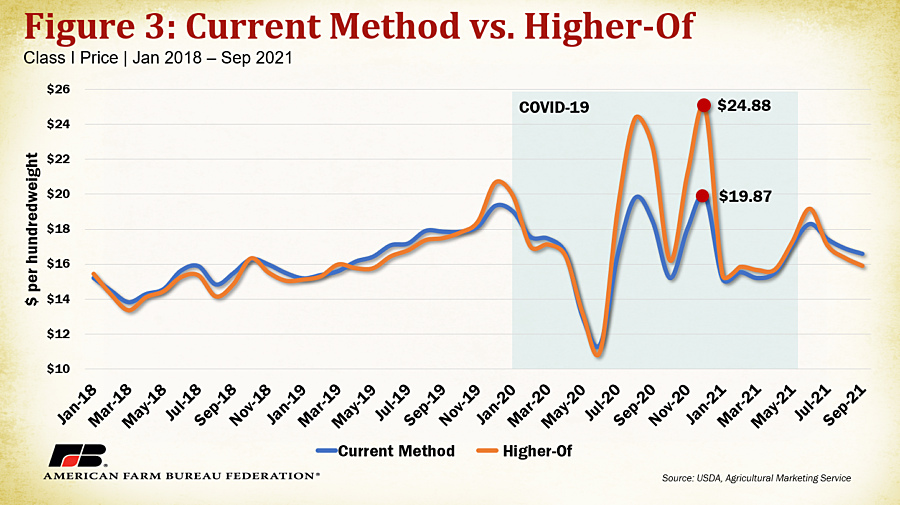

Figure 3 displays a comparison of Class I prices between the current formula and the higher-of option (if it was in place) from January 2018 to present, all else held constant. During 2020, following government intervention in cheese markets and co-op level supply reduction programs, cheese prices sharply rose while milk powder prices only increased marginally. Under a higher-of alternative, producers would have been able to reap the benefits of record Class III prices since the formula would have been directly linked to the higher option and not subject to smoothing effects of a simple average. That said, if the Class III and IV SMP prices are close in value, the 74-cent adjustment component of the current method may result in a higher Class III SMP than the higher-of option. This is common prior to the onset of COVID market forces.

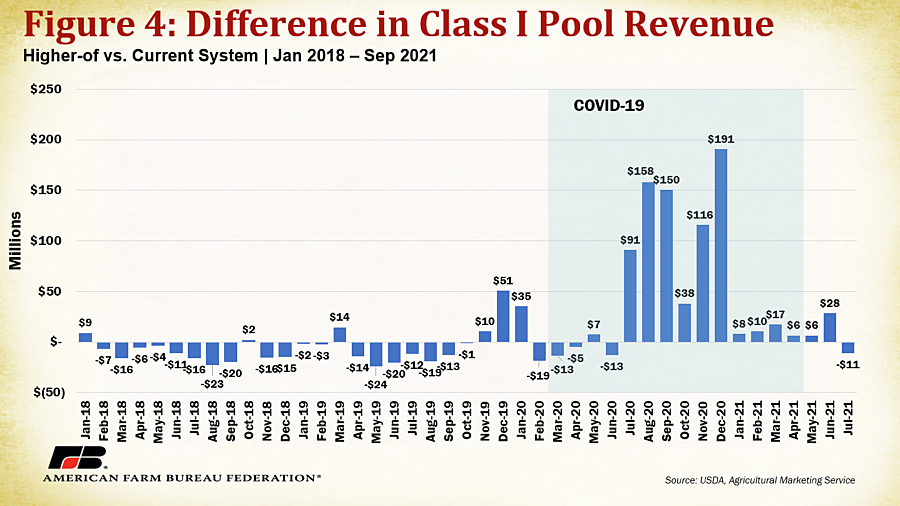

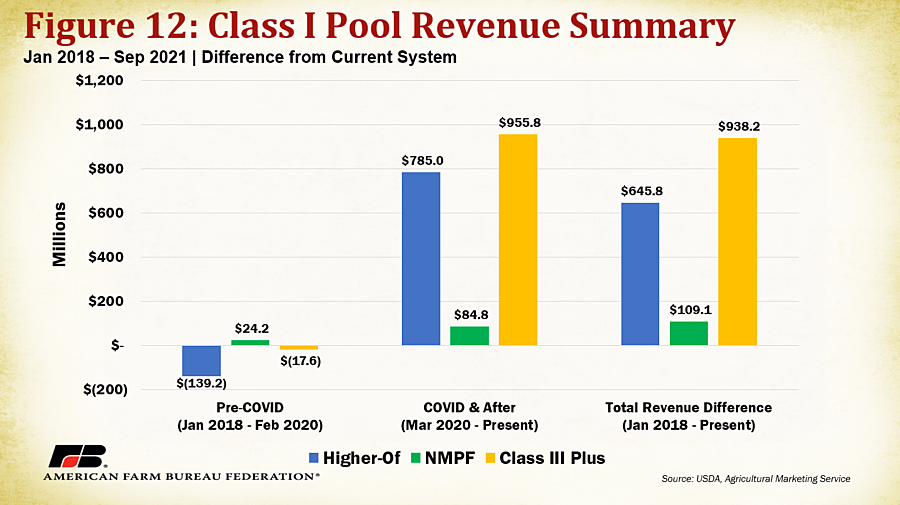

To estimate the impact on dairy farmer revenue, the difference in the Class I milk price between the current system and higher-of was multiplied by the Class I pool volume across all FMMOs. These calculations are presented in Figure 4. Between January 2018 and February 2020 (pre-COVID) the higher-of option would have provided positive Class I revenue pool benefits only 23% of the time. After February 2020, however, the higher-of would have provided over $785 million in Class I pool revenue benefits over the current system. Combined, this results in a $645 million revenue benefit of the higher-of over the current system within this timeframe. Consideration of this option must include the understanding of COVID’s unique marketplace effects, which resulted in massive pricing spreads the current pricing system could not adjust for. Expectations for large pricing spreads in the future keeps the higher-of option attractive.

National Milk Producers Federation Option

Another major contender for amending the Class I SMP pricing formula was designed by the National Milk Producers Federation (NMPF) on behalf of their member cooperatives. The option keeps the same general structure as the current system, including advanced pricing, but makes the 74-cent adjustor more market reactive. Instead of the 74 cents being fixed, the NMPF option would make 74 cents a floor and allow the adjustor to move above 74 cents. Using a calculation of the difference between the prior two-year (May-April) moving average of the higher-of and simple average of Class III SMP and Class IV SMP would determine whether the adjuster would rise above 74 cents. Based on this framework, the current 74-cent adjustor would rise to $1.63 for 2021-2023 to account for large price spreads during COVID-19.

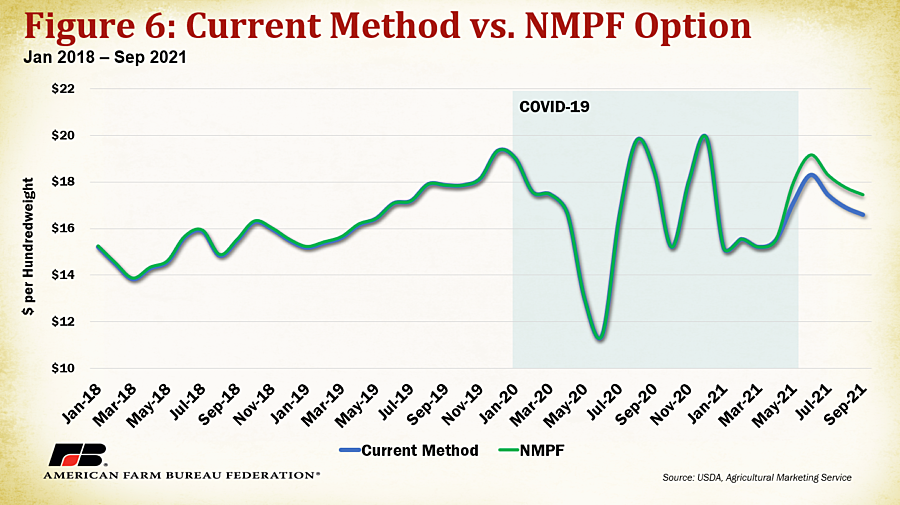

Figure 6 displays a comparison of Class I prices between the current formula and the NMPF option, if it was in place from January 2018 to present, all else held constant. Notably, the prices are nearly identical until May 2021. This is because the new adjustor calculation results in a marginal increase, from 74 cents to 79 cents, for May 2017 to April 2019 but drops back down to 74 cents for May 2019 to April 2021 since the actual result (53 cents) was below the 74-cent floor. In other words, from May 2019 to April 2021, the NMPF price formula option would result in the same Class I prices as the current system, all else held constant. Because it takes two years for the calculation to reset, COVID-19 volatility is not reflected in the adjustor until May 2021. This is demonstrated in Figure 6 where the prices separate after May 2021.

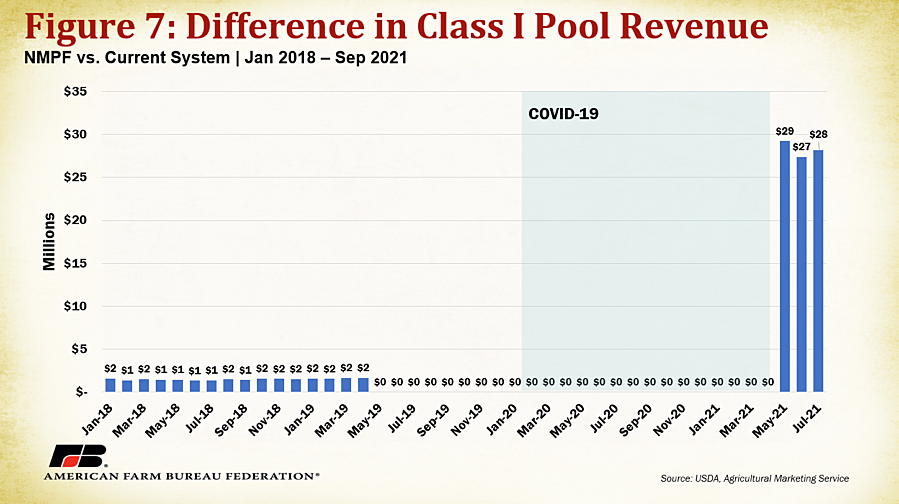

Similarly, this means there would be no Class I revenue pool benefits between May 2019 and April 2021. The 5 cent higher adjustor provides some revenue benefits early on (January 2018- May 2019) under the NMPF option, provides zero revenue for May 2019-April 2021 and jumps drastically when the $1.63 adjustor goes into effect in May 2021. Combined, the NMPF proposal would result in a $109 million revenue benefit over the current system within the analyzed timeframe. Consideration of this option must include the implications of the two-year lag time for the adjustor to reflect modern market conditions. No revenue relief would have been provided during the COVID-19 pandemic but it would have sizeable impacts on pricing calculations for 2021-2023.

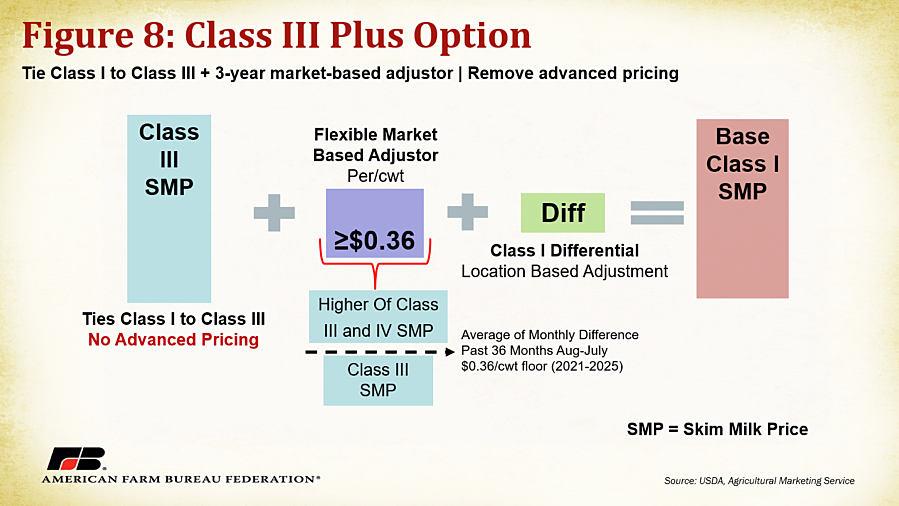

Class III Plus Option

The Class III plus option was designed on behalf of Edge Cooperative, the Dairy Business Association, Nebraska State Dairy Association and the Minnesota Milk Producers Association. Unlike the NMPF option, it changes both the first step of the Class I SMP price equation and the 74-cent adjustor. Firstly, the Class IV SMP is removed from consideration in the front end of the formula. This directly ties the Class I SMP price to Class III prices. It also replaces advanced pricing with announced pricing, removing time lag dynamics between the different classes of milk. Regarding the adjustor, it puts a market-linked value based on the average monthly difference of the past 36 months (August-July) between the higher of Class III and Class IV SMP and the Class III SMP. USDA would publish a new adjuster each September for the next year. Additionally, the adjustor would have a 36-cent floor until 2025 to account for COVID-19 losses. After 2025 the adjustor could go below 36 cents.

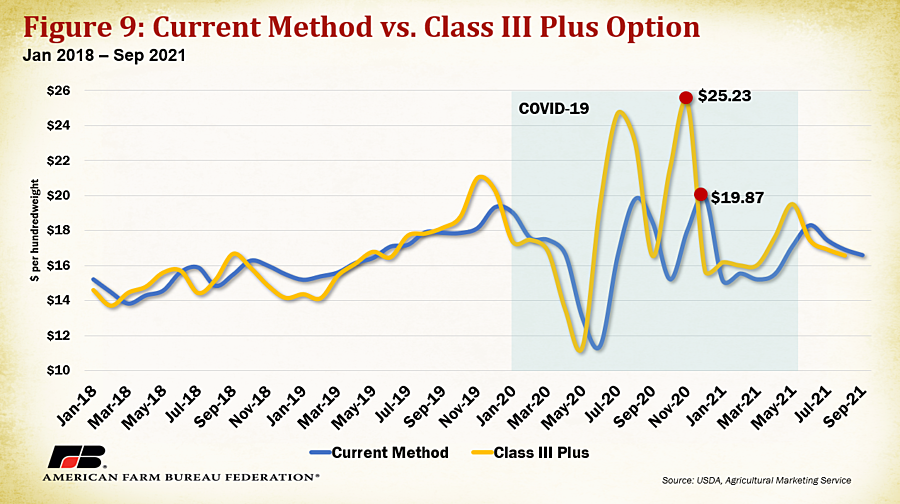

Figure 9 displays a comparison of Class I prices between the current formula and if the Class III plus option was in place from January 2018 to the present - all else held constant. You may notice Class III plus movements track those of the higher-of from Figure 3 closely. Since this option ties Class I to Class III and Class III prices were the higher-of option throughout 2020, the pre-adjustor base is often equal between both options. Class III plus results in slightly higher peak prices because of the market-based adjustor, which would have provided a 36-cent benefit from the higher-of throughout the analyzed period. Importantly, the Class III plus option is shifted backward a month. This is a direct result of replacing advanced prices with announced prices.

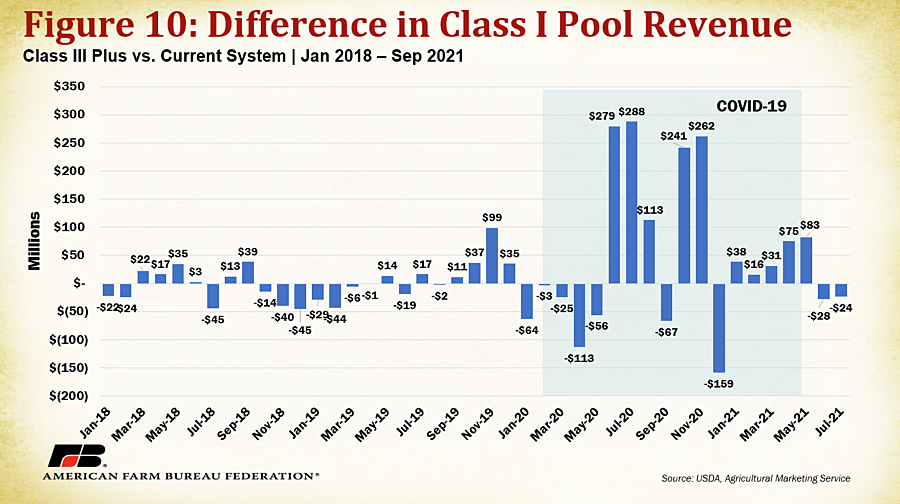

To estimate the impact on dairy farmer revenue, the difference in the Class I milk price between the current system and Class III plus was multiplied by the Class I pool volume across all FMMOs. These calculations are presented in Figure 10. Between January 2018 and February 2020 (pre-COVID) the Class III plus option would have resulted in a comparative loss of $17.6 million from the current system. After February 2020, however, the higher-of would have provided over $955 million in Class I pool revenue benefits over the current system -- the highest of any option. Combined, this results in a $938 million revenue benefit of the Class III plus over the current system within this timeframe. Importantly, this comparison uses the time-shifted values. An unshifted comparison would result in a marginally lower $929 million benefit of Class III plus. Consideration of this option must include the understanding of COVID’s unique marketplace effects, which heavily favored Class III prices. Expectations for Class III prices driving the milk market make this option attractive with the market-based adjustor providing some buffer when Class IV prices are higher.

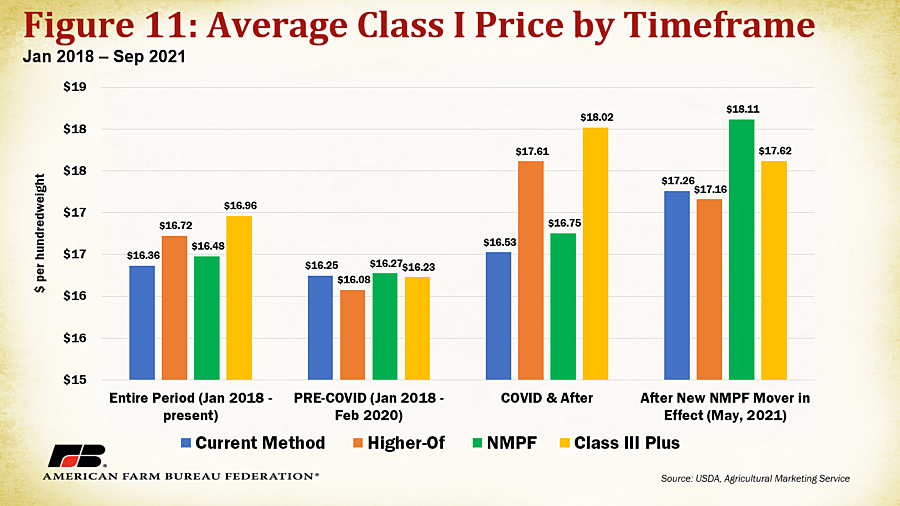

An important discussion related to these formula options is how they behave under different market conditions. Currently, much of the dissatisfaction with the current pricing system can be attributed to the losses associated with direct COVID-19 market effects. That said, preference for a formula in response to a specific market disruptor may not result in long-term, stable benefits. Figure 11 displays the average Class I SMP under each option categorized by timeframe. Notably, the current system and NMPF option provide the highest average price before COVID-19. The higher-of and Class III plus options result in strong gains during COVID-19, providing higher overall average prices for the entire period analyzed because of those gains. Once the updated NMPF proposal goes into effect (May 2021) it provides the highest average price. You may notice the variability between prices pre-COVID is low, with a range of only 19 cents. This may signal that under more “business as usual” forces, the benefits between formula options are not clear.

Similarly, Figure 12 shows the difference in Class I pool revenue from the current pricing system under different timeframes. In the analyzed period, prior to COVID-19, the higher-of and Class III plus options would have been $139 million and $17.6 million lower in Class I pool revenues than the current system, respectively. During COVID-19, however, the higher-of and Class III plus options would have provided dramatic pool revenue benefits ranging from $785 million to $955 million. Dairy farmers struggling from supply chain disruptions would have welcomed the near billion-dollar benefits of these options during the pandemic. That said, an acknowledgement that benefits this high were unlikely under more normal market dynamics. Additionally, the NMPF option may not have yielded real-time benefits during 2020, but would add millions in Class I revenues over the course of the next few years as a result of the higher $1.63 adjustor.

Conclusion

The 2018 farm bill change to the Class I milk pricing formula from the higher-of has stirred mixed emotions after its relatively weak performance during COVID-19 market volatility. Dairy farmers and industry stakeholders are actively considering going back to the higher-of or implementing the NMPF, Class III plus or another pricing option. Unfortunately, no option guarantees the highest benefits over the long run. Class III plus and the higher-of would have prevented a significant portion of Class I revenue-related pool losses associated with high Class III prices during 2020 but they performed weaker pre-COVID and in more recent months. NMPF’s option would not have provided farmers any real-time relief during 2020 but would provide some of those returns in the form of a higher adjustor until at least April 2023. Furthermore, there are basis risk implications associated with switching back to the higher-of or having a variable market-based adjustor that can inhibit farmers’ ability to effectively manage risk long-term.

In any case, the chosen option must better reflect current conditions across milk markets and account for the regional utilization and production differences across the U.S. Any changes should be made through a consensus-building, transparent rule-making process that allows stakeholders to provide testimony and evidence for the record. The current Class I milk pricing rules were required by law until April 2021. Now, the formula can be modified through a Federal Milk Marketing Order hearing or another act of Congress.

What We're Saying

U.S. Milk Remains Safe to Drink Among HPAI Outbreak

Apr 23, 2024

READ MORE

Updated Reference Prices Should be a Priority for Next Farm Bill

Apr 4, 2024

READ MORE

Farm Bureau and Farmers Union Collaborate on FMMO Modernization

Apr 2, 2024

READ MORE

AFBF Urges Congress to Pass Agriculture Funding Bills

Mar 5, 2024

READ MORE