Dairy Revenue Protection is Here

photo credit: Alabama Farmers Federation, Used with Permission

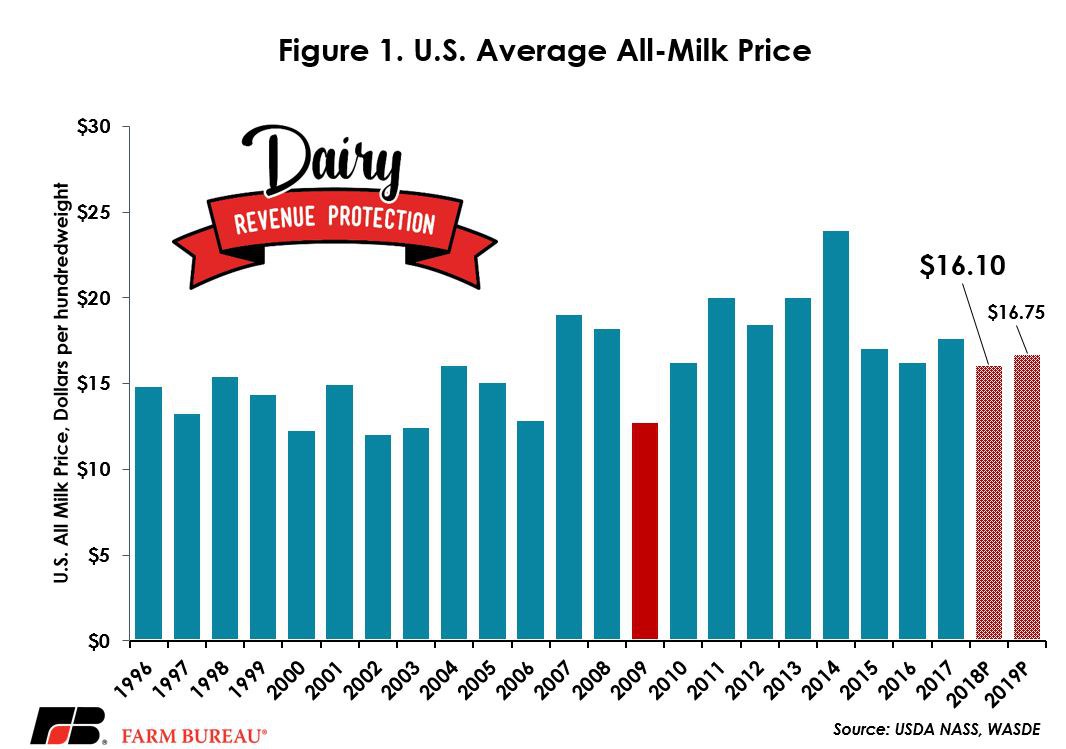

Since 2014 the annual average U.S. all-milk price has fallen by more than 30 percent. This year, it is projected to be at the lowest level since 2009, at $16.10 per hundredweight, Figure 1. Milk prices are projected to improve slightly in 2019 to $16.75 per hundredweight, but ongoing trade tensions in July compelled USDA to push its 2019 milk price projection down by 45 cents per hundredweight. The 45-cent revision represents a nearly $1 billion decline in projected milk revenue – in just one month in 2019.

Recognizing the need to enhance the federal risk management tools available to dairy producers, American Farm Bureau Federation, American Farm Bureau Insurance Services and other collaborators developed a new federal crop insurance product called Dairy Revenue Protection. Dairy Revenue Protection provides insurance for the difference between the revenue guarantee and actual milk revenue if prices or revenues decline. It also provides a greater choice of price risk management features, providing the ability to protect the value of milk based on the value of cheese to fresh milk, protein or butterfat.

Dairy Revenue Protection was developed and approved through the Federal Crop Insurance Act’s 508(h) process, which allows private parties to develop insurance products that are in the best interests of producers, follow sound insurance principles and are actuarially appropriate. USDA’s Risk Management Agency recently released detailed policy information on Dairy Revenue Protection on the RMA website’s Livestock page.

How Dairy Revenue Protection Works

Indemnity Under Dairy Revenue Protection

Dairy Revenue Protection is an area-based federal crop insurance product that provides quarterly revenue coverage for dairy farmers. The quarters available for coverage correspond to the quarters of the calendar year, i.e., January to March, October to December. Under Dairy Revenue Protection, an indemnity is paid to a dairy farmer if the actual milk revenue falls below the final revenue guarantee, i.e., Indemnity = max[Final Revenue Guarantee – Actual Milk Revenue, 0].

Final Revenue Guarantee

Under Dairy Revenue Protection, the final revenue guarantee is the product of the farmer’s coverage level, from 70 percent to 95 percent in 5 percent increments, and the final milk revenue, i.e., Final Revenue Guarantee = (Coverage Level) ×(Final Milk Revenue).

The final milk revenue is the product of the futures-implied value of milk and the amount of covered milk production elected by the dairy farmer, i.e., Final Milk Revenue = (Value of Milk)×(Covered Milk Production).

To accurately capture the farm-level revenue risk, dairy farmers will determine how their milk is priced under the policy by selecting a class- or component-based milk-pricing option. The class-pricing option uses a weighted average of a three-month average of Chicago Mercantile Exchange Class III and Class IV milk futures prices based on the insured’s declared class price weighting factor and corresponding to the months of the quarter.

The component-pricing option uses three-month averages of Chicago Mercantile Exchange butter, cheese and dry whey futures to derive implied values for butterfat, protein and other milk solids. The farmer then selects a component value of milk by declaring an amount of butterfat and protein in the milk. For the most part, the latter option reflects minimum milk prices due to dairy farmers pooling in Federal Milk Marketing Orders and allows farmers with higher component milk to capture the value of that milk in the policy.

Yield Adjustment Factor

Dairy Revenue Protection is not protecting against milk production declines or component test declines experienced on the farm. Instead, Dairy Revenue Protection uses USDA quarterly milk production data to calculate an expected milk yield and a yield adjustment factor.

Each quarter, once state-level milk production data has been announced by USDA, the yield adjustment factor will be calculated for policyholders. The yield adjustment factor is determined by dividing actual milk production per cow by expected milk production per cow, i.e., Yield Adjustment Factor = Actual Milk Production ÷ Expected Milk Production.

For example, if the expected milk production during the quarter is 5,000 pounds per cow and USDA publishes an actual milk per cow of 5,100 pounds, the yield adjustment factor would be 1.02, i.e., 1.02 = 5,100 ÷ 5,000. Similarly, if the actual milk production were 4,900 pounds per cow, the yield adjustment factor would be 0.98, 0.98 = 4,900 ÷ 5,000.

Yield adjustment factors greater than one will increase the actual milk revenue and reduce any indemnity due to the dairy farmer. Likewise, a yield adjustment factor of less than one will decrease the actual milk revenue and result in a greater indemnity.

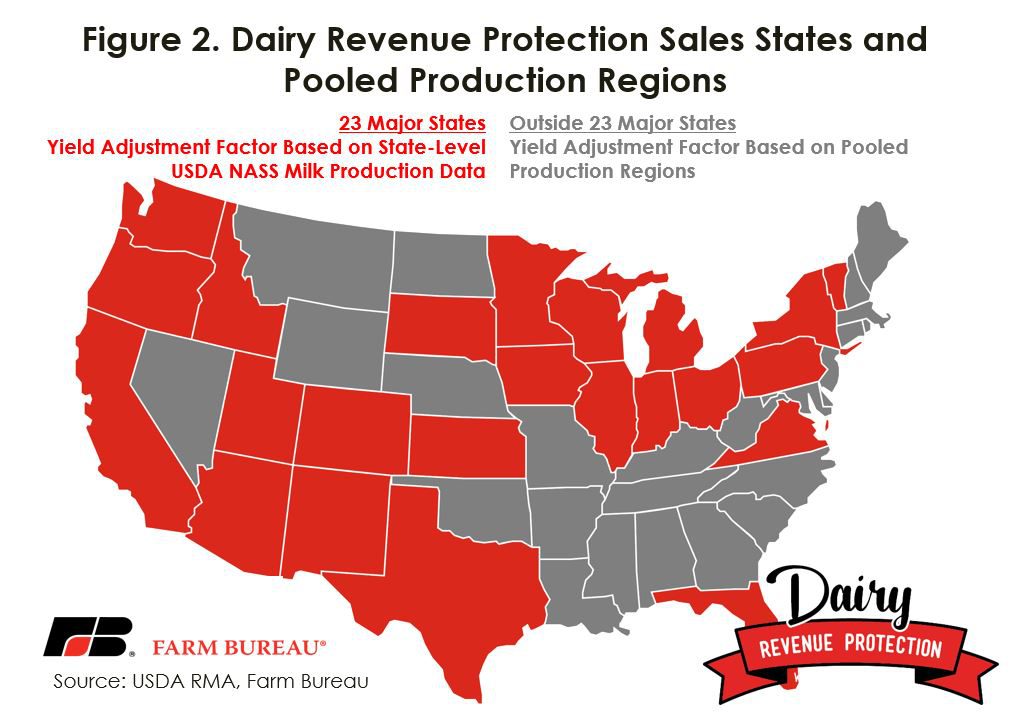

Yield adjustment factors will be calculated for the major 23 dairy states. Farmers in states outside the major 23 will be grouped into pooled production regions. Figure 2 identifies the major 23 milk-producing states and the areas of pooled production regions.

Actual Milk Revenue

The actual value of milk is based on final USDA-published prices for Class III milk, Class IV milk, butterfat, protein and other solids and a three-month average of these values. The actual value of milk will be calculated using the same class- or component-based pricing option declarations used to determine the final revenue guarantee.

The actual milk revenue under Dairy Revenue Protection is then the product of the actual value of milk, the covered milk production and the yield adjustment factor, i.e., Actual Milk Revenue = (Actual Value of Milk)×(Covered Milk Production)×(Yield Adjustment Factor).

If the actual milk revenue is below the final revenue guarantee then an indemnity is due to the dairy farmer. Indemnity = max[(Coverage Level) × (Value of Milk)×(Covered Milk Production) - (Actual Value of Milk)×(Covered Milk Production)×(Yield Adjustment Factor),0].

Optional Protection Factor

Because farm-level milk production is more variable than state-averaged values, Dairy Revenue Protection includes an option protection factor from 1.0 to 1.50 in 5 percent increments. In the event of an indemnity, the amount paid to a dairy farmer is scaled higher by the protection factor such that the total payment is equal to: Payment = (Indemnity)×(Protection Factor). For example, a farmer with a 1.5 protection factor and an indemnity of $10,000 would receive a $15,000 payment under Dairy Revenue Protection. The protection factor provides greater flexibility in matching farm-level production risk.

When is it Sold and How Much Will it Cost?

The new federal crop insurance product is expected to be available for purchase nationwide on October 9, 2018. Dairy Revenue Protection will be sold daily and offers flexibility to protect revenue at varying times by offering five quarterly insurance periods.

The price of the policy is actuarially fair, meaning it will vary daily based on the farmer-selected parameters and on the expected prices and risk in the market. In general, higher levels of liability and more deferred policies will be more expensive to purchase.

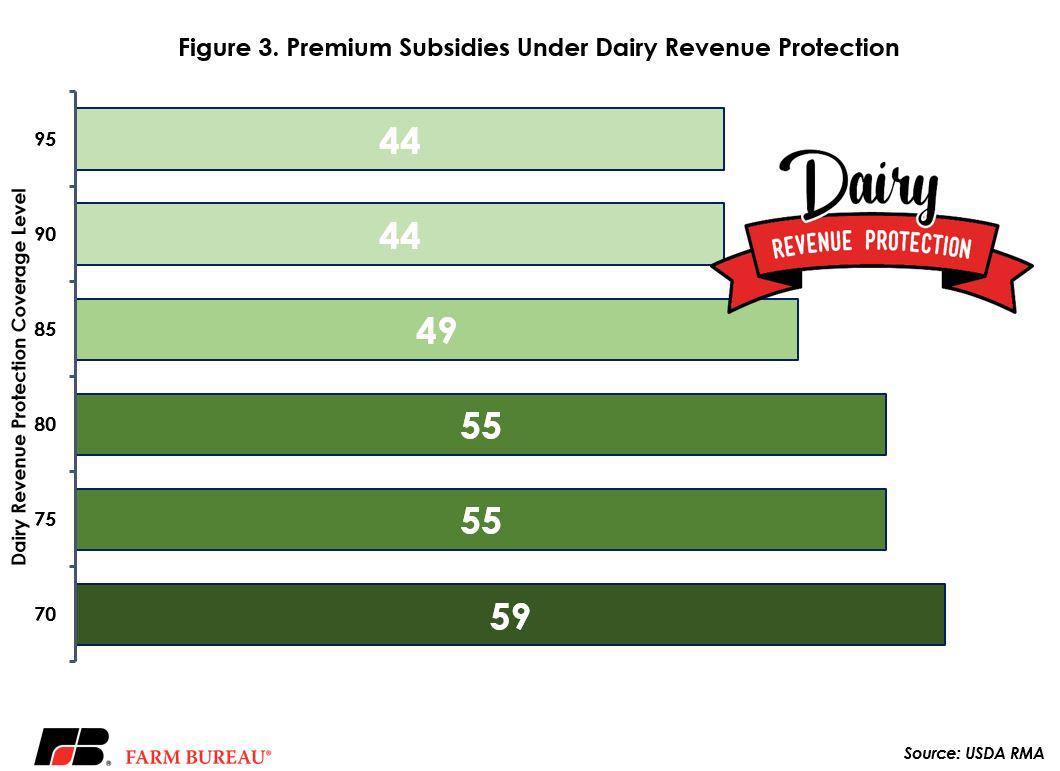

However, like other crop insurance products, the federal government will provide a premium discount to purchase Dairy Revenue Protection and the discount would increase as the farmer’s elected deductible increased, i.e., 70 percent coverage has a higher premium discount than 95 percent coverage. For example, if the total Dairy Revenue Protection policy premium for 95 percent coverage were 20 cents per hundredweight, the farmer would receive a discount of 9 cents and would pay 11 cents per hundredweight for the policy. Figure 3 highlights the premium discount for Dairy Revenue Protection based on the different coverage options.

Summary

The success of federal insurance programs is well documented. Insurance policies cover most of the field crop acreage planted each year. In recent years, nearly 90 percent of all corn, wheat, soybean, cotton and rice acres were protected by a revenue-based insurance policy. In addition to field crops, insurance policies covering risk are available for cattle, swine and lamb producers.

On October 9 dairy farmers across the U.S. will have a new USDA-sponsored risk management tool in the toolbox. Dairy Revenue Protection will protect against unexpected declines in milk revenue, declines in the value of milk or declines in the state or pooled production region-indexed milk production volume.

Under Dairy Revenue Protection a farmer has only five decisions to make:

- The method to value milk in the policy;

- The amount of milk production to cover;

- The level of coverage (from 70 to 95 percent of the revenue guarantee);

- Which quarterly contracts he/she wishes to purchase; and

- The optional protection factor.

Importantly, participating dairy farmers are not precluded from participation in USDA Farm Service Agency’s Margin Protection Program. Those interested in purchasing Dairy Revenue Protection must do so through an agent selling on behalf of an approved insurance provider such as American Farm Bureau Insurance Services, Inc.