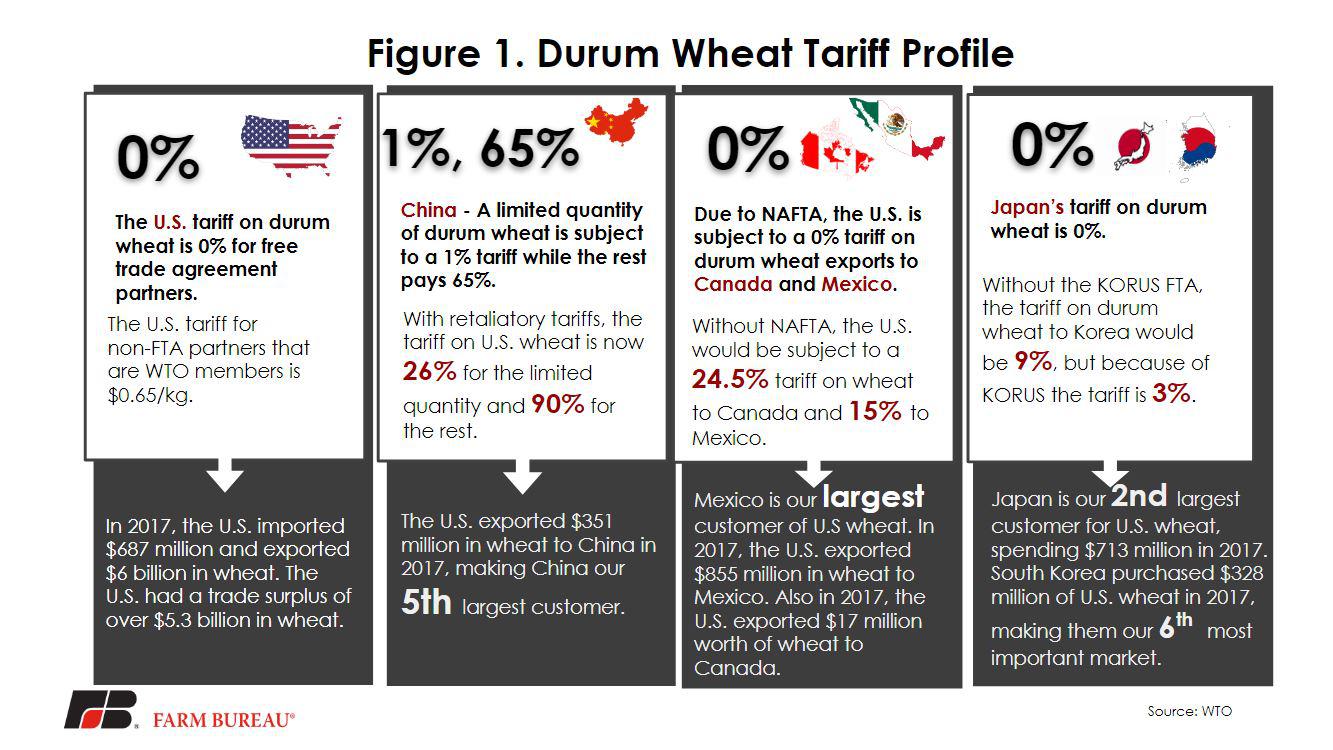

Durum Wheat Tariff Profile

TOPICS

Wheat

photo credit: AFBF photo/Morgan Walker

We continue our Market Intel series on commodity-specific tariff profiles with wheat.

The U.S. maintains a net trade balance on wheat of over $5.3 billion. As the second-largest exporter of wheat, the U.S. exported $6 billion in wheat and imported $687 million worth of the commodity in 2017. The U.S. charges a 0 percent tariff to all free trade agreement partners and charges a $0.65/kg tariff for all non-free trade agreement partners in the World Trade Organization.

China employs tariff-rate quotas for durum wheat. At the current rate, China charges a 1 percent tariff on a limited quantity of wheat coming into the country, after the quota is met, all other wheat imports are charged a 65 percent tariff. However, with the retaliatory tariffs in place right now, the U.S. is charged 26 percent for wheat imports that are in quota, and 90 percent for wheat imports that are out of quota.

In 2017, the U.S. exported $855 million in wheat to Mexico, our largest customer. With the North American Free Trade Agreement in place, the $855 million to Mexico and $17 million to Canada was charged a 0 percent tariff. Our competitors, on the other hand, are subject to a 24.5 percent tariff on wheat to Canada and a 15 percent tariff to Mexico.

Like NAFTA, the U.S.-Korea Free Trade Agreement, ensures that the $328 million in U.S. wheat purchased by South Korea in 2017 was charged a 3 percent tariff instead of the standard 9 percent tariff. The second-largest customer of U.S. wheat is Japan, charging a 0 percent tariff and purchasing $713 million worth of wheat in 2017. Figure 1 highlights these points and more.

The previous installment of our Market Intel series on commodity-specific tariff profiles included an overview on tariffs and a deep-dive into soybean tariffs.