The Disappearing Farm Bill Safety Net

photo credit: AFBF Photo, Mike Tomko

John Newton, Ph.D.

Vice President of Public Policy and Economic Analysis

Implications

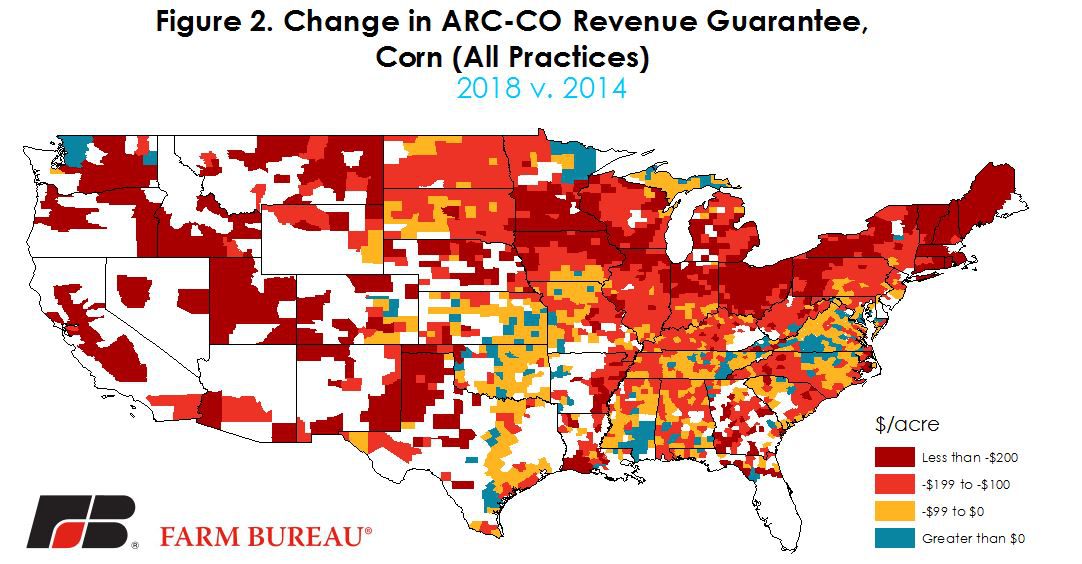

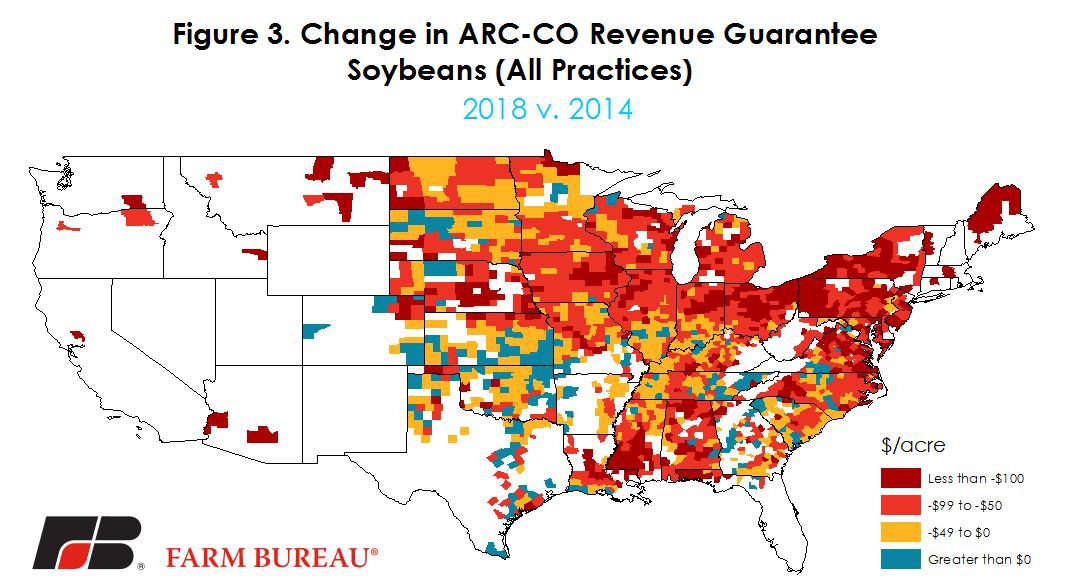

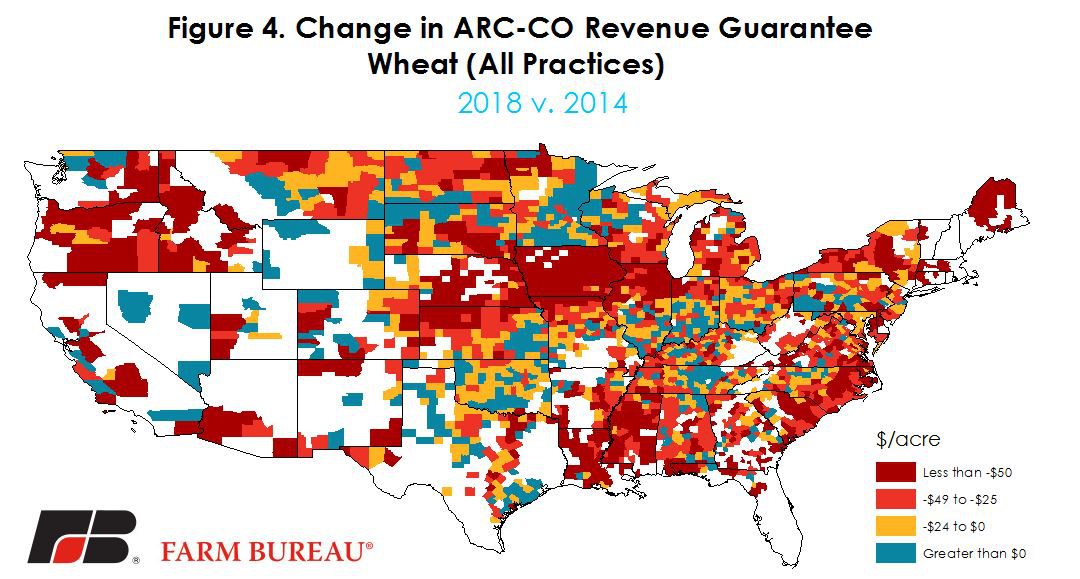

The impact of lower commodity prices is that the safety net protection provided by the 2014 Farm Bill’s Agricultural Risk Coverage is projected to decrease substantially. By fiscal year 2019 the Congressional Budget Office projects ARC-CO assistance for corn, soybeans, and wheat to drop by 63 percent, 12 percent, and 7 percent respectively from their 2015 levels. More than 80 percent of the counties with corn, soybeans, or wheat base acreage may experience a lower ARC-CO revenue guarantee for the 2018/19 crop year than they are provided this year.

What is Agriculture Risk Coverage-County Option?

The Agricultural Act of 2014 (2014 Farm Bill) introduced a revenue-based commodity safety net program called Agricultural Risk Coverage for covered commodities including but not limited to corn, soybeans, and wheat. Agriculture Risk Coverage, County Option (ARC-CO) uses the product of county average crop yields and national marketing year average prices, i.e. revenue per acre, to determine safety net assistance levels. For a detailed description of ARC-CO and how it’s working visit AFBF’s Farm Bill resources page.

Each crop year the ARC-CO revenue guarantee for a covered commodity is set at 86 percent of the benchmark revenue. The benchmark revenue is specific to each county and commodity, and is the product of the five-year Olympic Moving Average (OMA) marketing year average price and the OMA county-level crop yield. OMA smoothing drops the highest and lowest values from a sample and averages the remaining three values.

Prices used in the benchmark revenue calculation may not fall below the Farm Bill reference price and county yields may not fall below 70 percent of the county transitional yield. Reference prices for corn, soybeans, and wheat are $3.70, $8.40, and $5.50 per bushel, respectively.

ARC-CO makes payments when the actual revenue, defined as the county-level yield multiplied by the U.S. marketing year average price, falls below 86 percent of the benchmark revenue. For example, the 2014/15 crop year guarantee is based on the OMA prices and yields observed from the 2009/10 to 2013/14 marketing year. Any ARC-CO payment would be based on the positive difference between the revenue guarantee and the estimate of actual revenue. Since ARC-CO uses national average prices, variations in ARC-CO payment rates across the U.S. are driven only by differences in county-level crop yields.

The Disappearing Safety Net

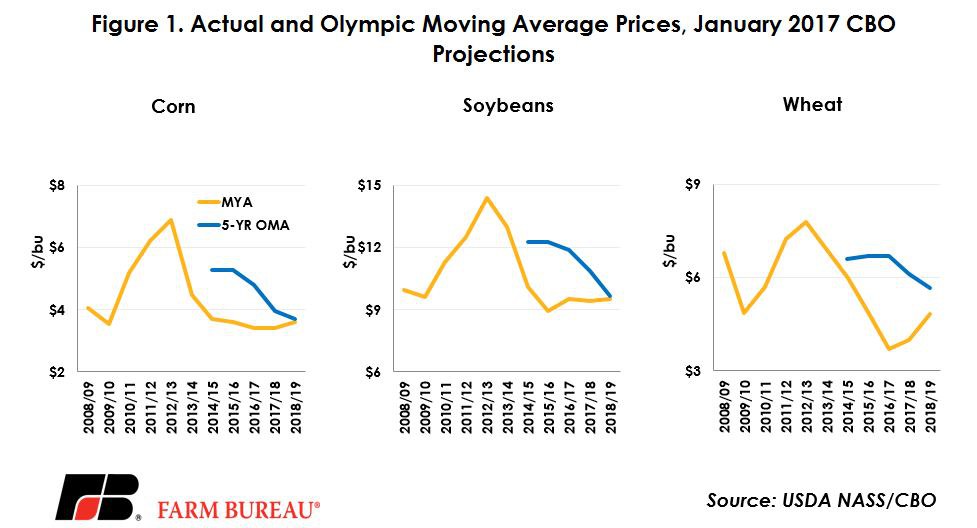

During the first year of ARC-CO, the OMA prices were $5.29 per bushel for corn, $12.27 per bushel for soybeans, and $6.60 per bushel for wheat. Over time, however, OMA smoothing is designed to adjust the crop revenue to reflect updated county-level crop yields and pricing conditions. Figure 1 highlights the relationship between actual marketing year prices and the OMA price for corn, soybeans, and wheat. Relative to the highs set in 2012, current year prices for corn, soybeans, and wheat prices are projected to decline by 51 percent, 34 percent, and 52 percent, respectively. Corn and wheat prices are forecasted to be at their lowest levels in more than a decade.

It’s clear that following several years of bumper crops, and expectations for continued low prices, the prices (and by extension revenues) used in the ARC-CO guarantee are going to be lower. As an example, for corn, by the 2018/19 crop year, only prices for this new-crop corn between $3.70 and $4.46 per bushel would increase the OMA price. Prices below $3.70 would be replaced by the reference price, and prices above $4.46 would be discarded as part of the OMA smoothing.

The January 2017 Congressional Budget Office (CBO) Agricultural Baseline projects 2018/19 crop year ARC-CO OMA prices for corn, soybeans, and wheat to drop by 30 percent, 21 percent, and 14 percent (respectively) from the levels set when the Farm Bill became law.

These lower commodity prices, even in the face of higher crop yields, are resulting in lower benchmark revenues across the U.S. Using CBO projections and trend yields to evaluate the ARC-CO guarantees through the 2018/19 crop year: 94 percent of counties with corn base acreage will see a lower ARC-CO guarantee; 90 percent of counties with soybean base acreage will see a lower ARC-CO guarantee; and 82 percent of counties with wheat base acreage will see a lower ARC-CO guarantee (Figure 2 through 4).

Some – admittedly very few - counties will see the ARC-CO guarantee increase as the impact of multi-year yield shortfalls (relative to the long-run trend) drops from the OMA yield calculation. However, many of these counties saw limited safety net protection from ARC-CO in the first few years of the Farm Bill due to the impact of multi-year yield losses on the benchmark revenue. The impact of poor crop yields over a multi-year horizon is one of the reasons ARC-CO payments vary substantially across political boundaries (read more on AFBF’s Farm Bill Resources Page).

The diminishing role of ARC-CO, as demonstrated in this article, is confirmed by CBO projections for total outlays. During the 2015/16 crop year ARC-CO made $5.8 billion in program payments for corn, soybean, and wheat base acres. By the 2018/19 crop year – the last year of this farm bill - CBO projects ARC-CO program payments for corn, soybeans, and wheat to drop by 47 percent to $3.1 billion.

A Switch to Price Loss Coverage Likely?

Due to the lower projected benefits of ARC-CO, the CBO currently estimates that many base acres will switch out of the ARC-CO program and into the Price Loss Coverage (PLC) program. PLC is a price based safety-net program that makes program payments when the marketing year average price falls below a set reference price. Currently 93 percent of corn, 97 percent of soybean, and 56 percent of wheat base acres are enrolled in ARC-CO. By 2019, CBO projects enrollment for corn, soybeans, and wheat base acres in ARC-CO to drop to 18 percent, 51 percent, and 16 percent respectively.

New-crop 2019 corn, soybean, and wheat prices are currently trading at or above reference price levels. Implied volatilities and basis levels may reveal a low probability of prices falling below reference price levels during the next coverage period.

Additionally, for farmers where the natural hedge is weaker, i.e. low price yield correlation, ARC-CO will continue to provide a revenue based safety net. The natural hedge is the regional yield-price relationship that works to offset yield losses with higher prices - smoothing farm revenue across marketing years. In areas where this relationship is low, ARC-CO will continue to help by offsetting non-systemic yield losses that are not accompanied by higher marketing year average prices.

Given these factors, switching to PLC may be a more complicated risk management decision for many farmers. A future Market Intel article will review these and other considerations as they pertain to the benefits of revenue- and price-based safety net programs.