An H-2A Slowdown or a Weather-Induced Blip on the Radar?

TOPICS

Market Intel

photo credit: OSU Special Collections & Archives/Commons

Veronica Nigh

Former AFBF Senior Economist

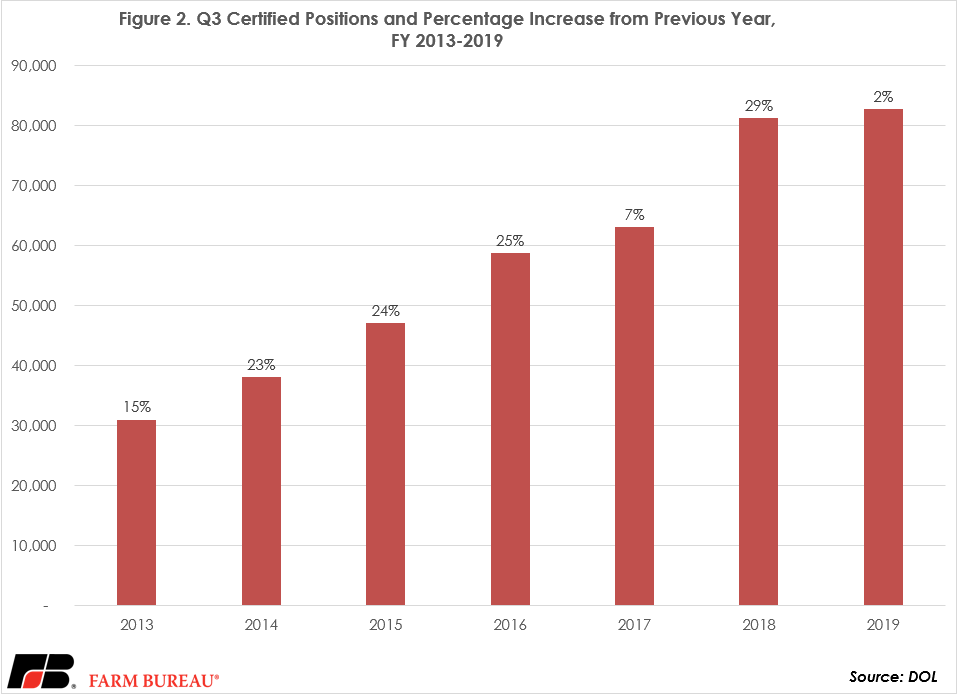

Despite a challenging growing year, farmers and ranchers continue to demand H-2A workers in record numbers -- although growth in program usage has slowed considerably. The number of certified positions during the third quarter of 2019 was up 2% compared to the third quarter of 2018. In comparison, the number of certified positions in the third quarter of 2018 was 29% higher than the third quarter of 2017. Such a tepid growth rate compels us to question whether program usage has matured, or are other factors at play?

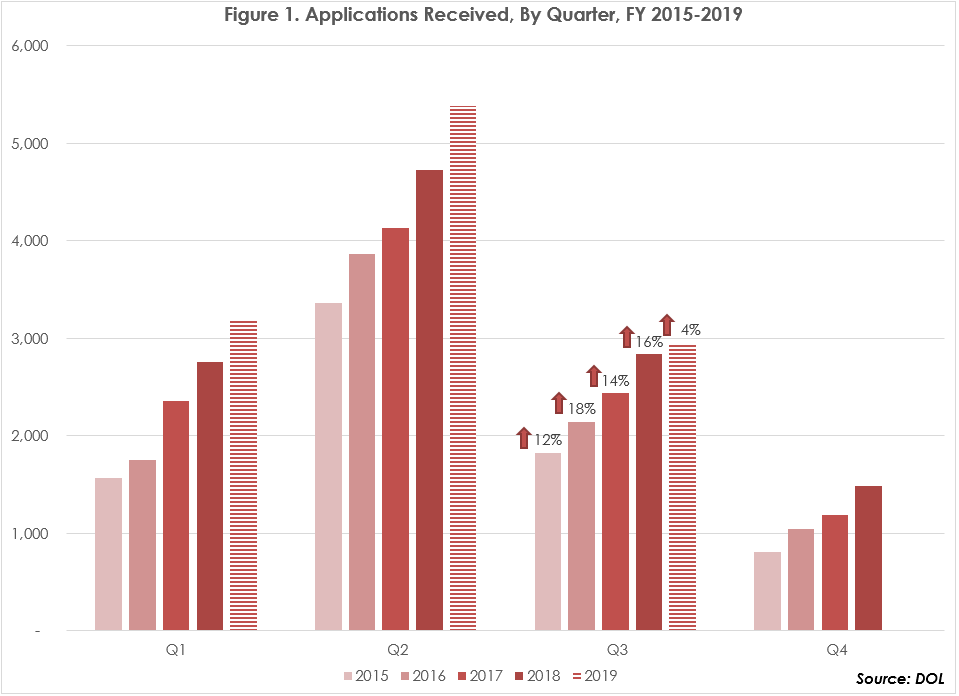

During the third quarter of 2019, DOL received the largest ever number of applications during the third quarter – 2,948. This represented an increase of 4% compared to the third quarter of 2018. Despite the increase, this is the slowest year-over-year growth rate since quarterly data was first released, in fiscal year 2012. In fact, this is the first time the growth rate has dipped below double digits, as highlighted in Figure 1.

During the third quarter of 2019, DOL also certified a record number of positions during a third quarter. The 82,776 certified positions represented an increase of 2% compared to the third quarter of 2018. As with the number of applications, despite the increase, this is the slowest year-over-year growth rate since quarterly data was first released, in fiscal year 2012, as shown in Figure 2.

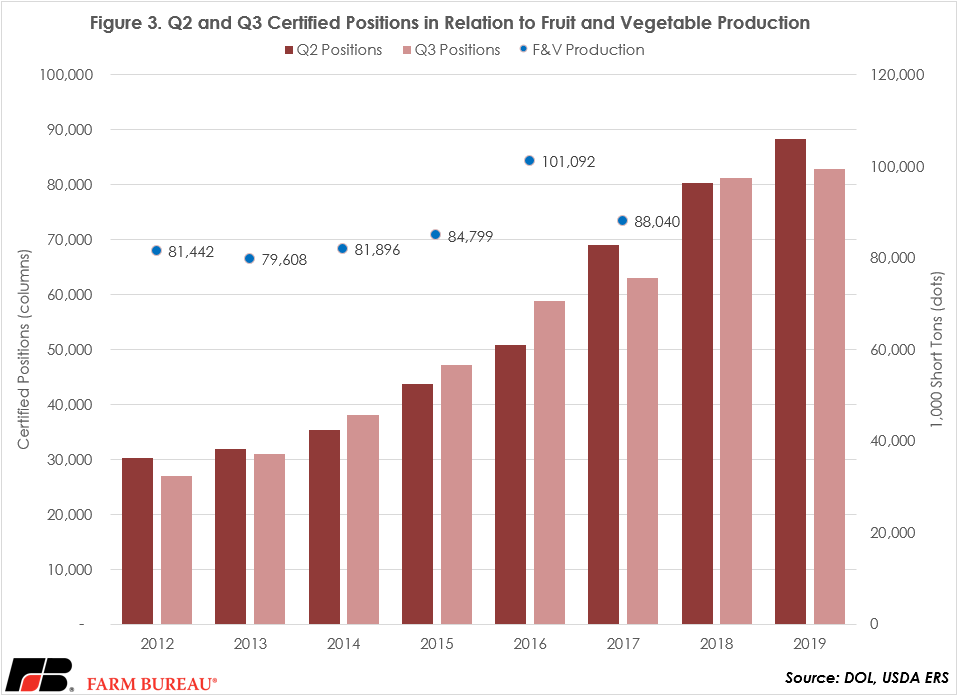

One explanation for slower growth in the number of applications and certified positions is that the demand for H-2A is maturing. Another is a challenging growing season for portions of the U.S. has reduced harvestable acres of fresh fruits and vegetables, the segment of agriculture that most heavily utilizes the H-2A program. Figure 3, which gives some credence to this theory, shows that during years of normal production of fresh fruits and vegetables, year-over-year growth in certified positions for the third quarter ranged from 15-29% from 2013 to 2018. The exception is fiscal year 2017, when the number of third quarter certified positions rose only 7%. This slow-growth in third quarter certified positions occurred as total production of fresh fruits and vegetables dropped by 13% in2017, compared to the previous year.

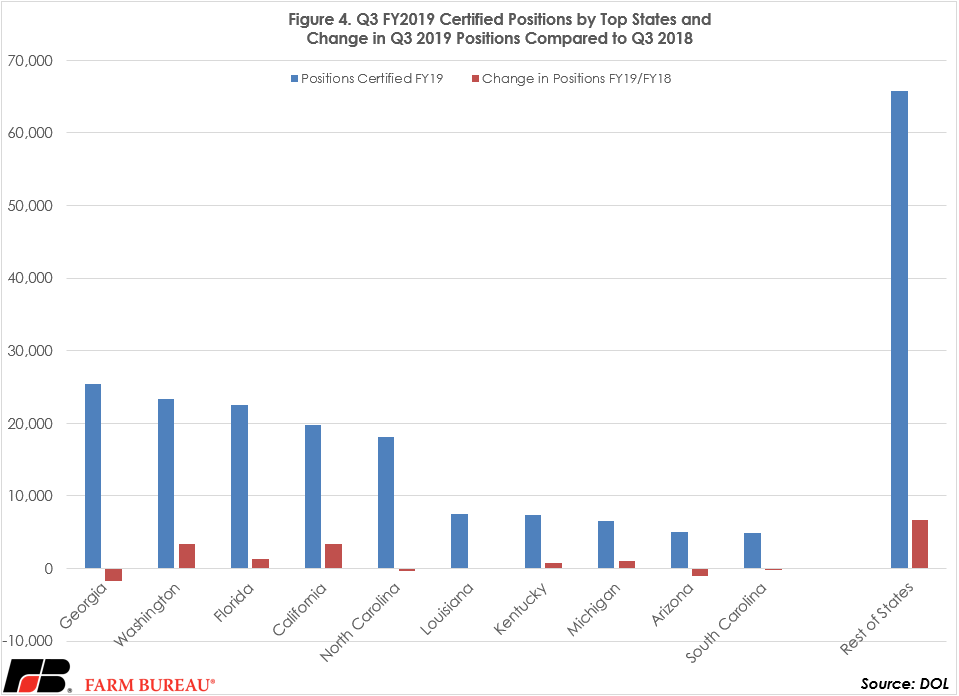

The top 10 states for H-2A program usage during the third quarter of the year have been the same over the last three years. Likely due to weather constraints, four of the top 10 states, Georgia, North Carolina, Arizona and South Carolina, requested fewer certified positions in the third quarter of 2019 than they did in the third quarter of 2018. Meanwhile, other program power users like Washington and California continued to post strong quarter over-quarter-growth, as illustrated in Figure 4.

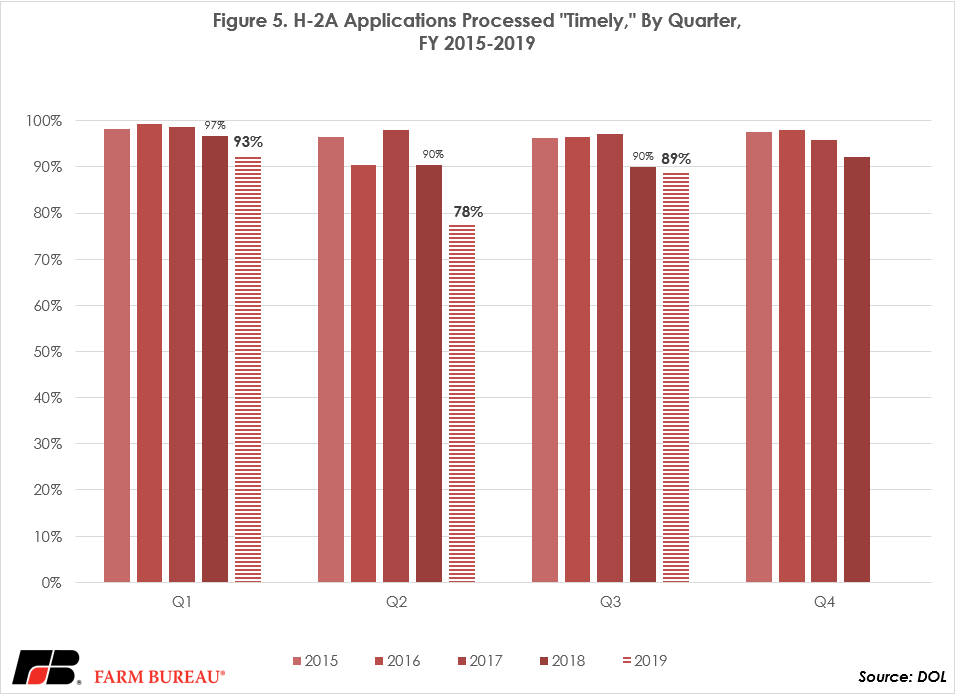

Along with the data on certified positions, DOL’s latest report provided some good news related to application processing time. Last quarter, we flagged the concerning statistic that only 78% of applications processed during the second quarter were done so in a “timely” manner, which, according to DOL, occurs when a complete H-2A application is resolved 30 days before the start date of need. With 89% of applications processed in a timely manner, the third-quarter was a dramatic improvement from the second. Despite the improvement, timeliness of approvals remains marginally below the percent achieved in fiscal years 2015-2018, as shown in Figure 5.

Summary

While DOL’s latest data on the number of H-2A applications received and certified for the third quarter of 2019 certainly gives us a good deal to think about, we need to see a few more quarters of data to determine if we’re beginning to see maturity in the usage of the H-2A program or if fiscal year 2019 is simply a weather-induced blip on the radar.