Big Crops Could Get Bigger

TOPICS

Soybeans

photo credit: Arkansas Farm Bureau, used with permission.

John Newton, Ph.D.

Vice President of Public Policy and Economic Analysis

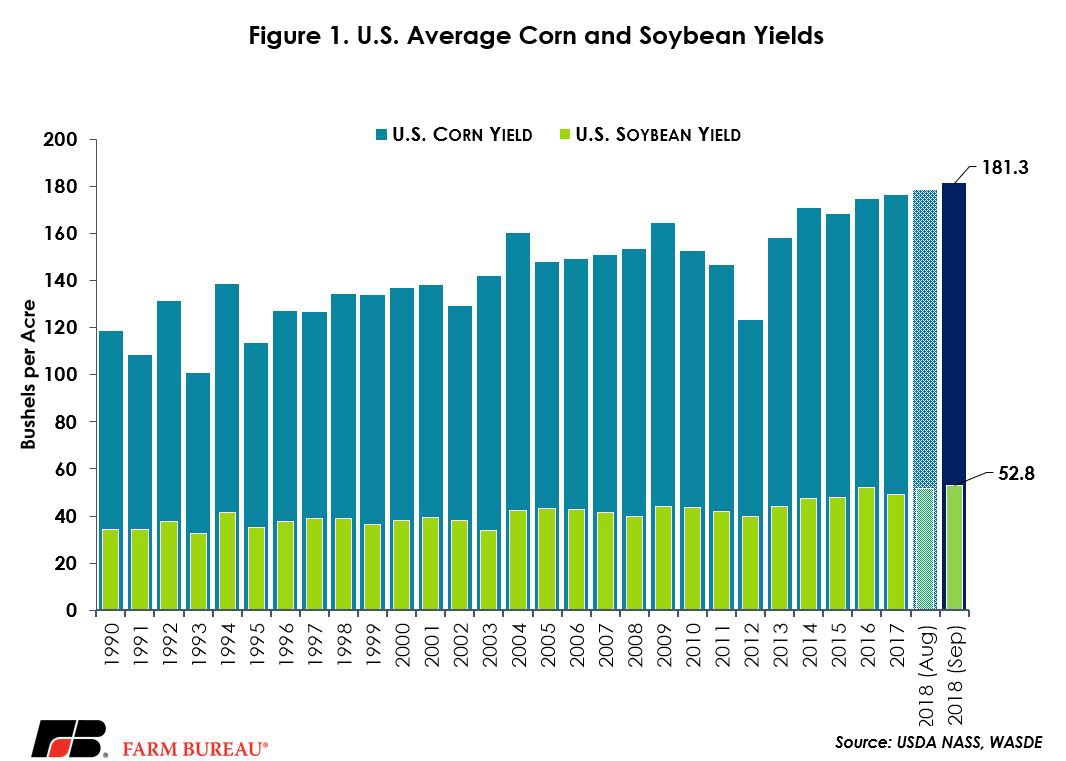

The September 12 World Agricultural Supply and Demand Estimates projected the 2018 U.S. average corn yield at a record-high 181.3 bushels per acre. That exceeds the previous record of 176.6 bushels per acre in 2016 by 4.7 bushels, or 3 percent, and is 11.3 bushels above the 1960-to-2017 unconditional trend yield of 169 bushels per acre. The September projection was also 2.9 bushels per acre above the August estimate and well above the average industry expectation of 177.8 bushels per acre. The U.S. corn crop is now projected to be second highest on record at 14.827 billion bushels.

The September WASDE also projected 2018 U.S. average soybean yields to be a record-high 52.8 bushels per acre. If realized, this would exceed the previous record of 52 bushels per acre in 2016 and would be 4.2 bushels per acre above the unconditional trend yield of 46.6 bushels per acre. The September projection was 1.2 bushels above the August projection but was in line with the average trade guess of 52.2 bushels per acre. The U.S. soybean crop is now projected to be at a record high 4.69 billion bushels. Figure 1 highlights U.S. average corn and soybean yields.

Do Big Crops Get Bigger?

There’s an old saying in the grain business that big crops tend to get bigger. This saying refers to USDA’s crop yield estimates and suggests that once USDA increases projections for crop yields, subsequent estimates will also get bigger, i.e., USDA is conservative throughout the growing season.

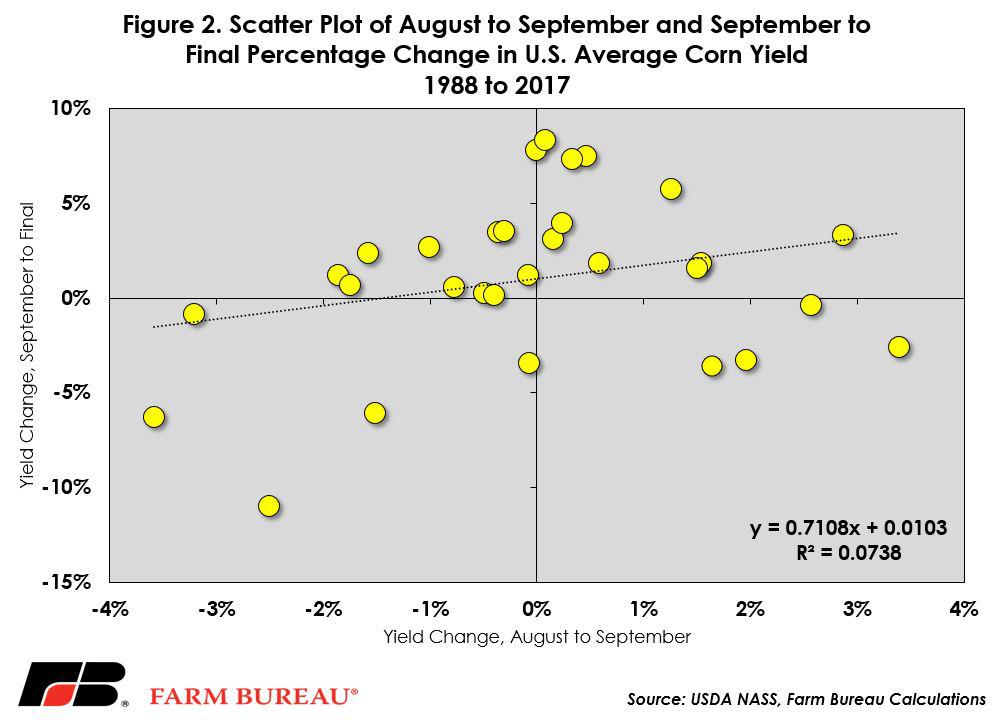

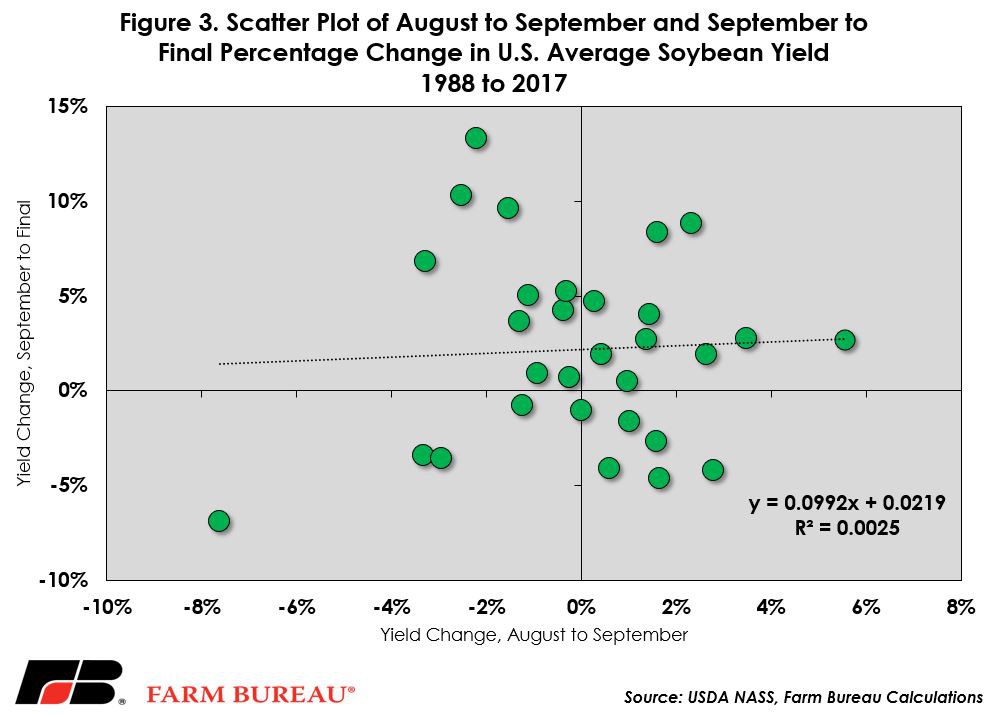

Figures 2 and 3 plot the percentage in crop yields for corn and soybeans, respectively, for the August to September and September to January changes in yields over the last 30 years. In the case of both corn and soybeans, the scatterplot shows poor model fit between the changes in crop yields from August to September and September to January, with an R-squared of 0.07 for corn and 0.003 for soybeans.

While the scatterplots show poor model fit, they comingle years when the crop initially gets smaller with years when the crop gets bigger. If we examine only years when the crop gets bigger from August to September a more convincing case can be made that big crops do get bigger.

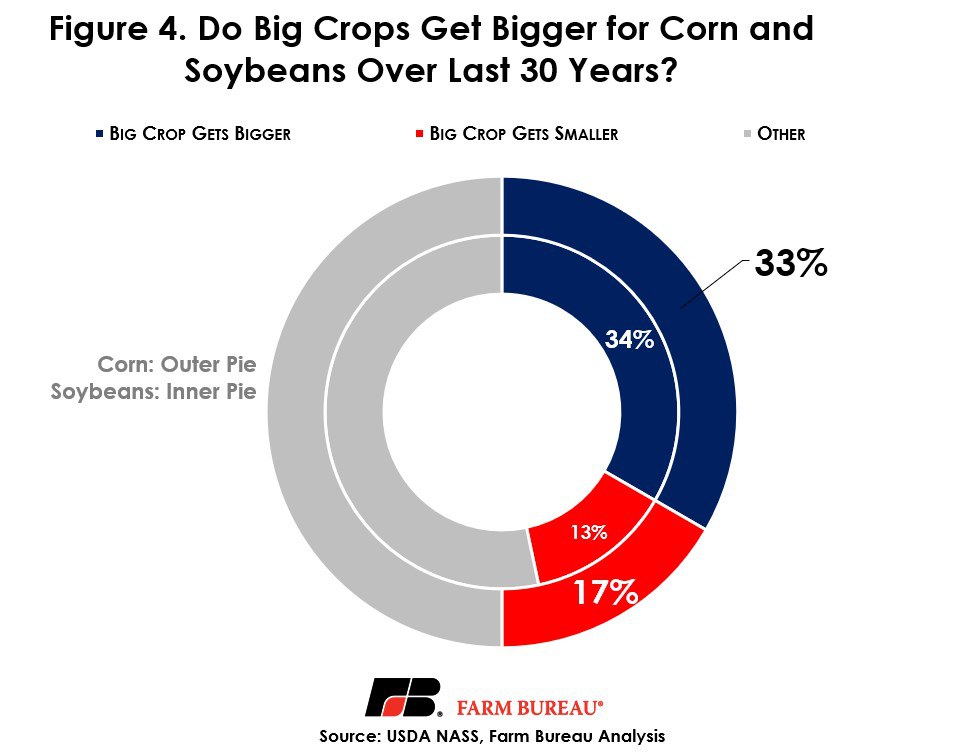

In 14 out of the last 30 years, USDA has raised yield projections for corn from August to September. In 10 of those years, the crop has gotten bigger, while in four of those years the crop has gotten smaller. Though this is backward looking, more than 70 percent of the time, once a crop has gotten big, it continues to get bigger, Figure 4.

Like corn, in 15 out of the last 30 years, USDA has raised the soybean yield forecast from August to September. In 10 of those years USDA has gone on to raise the yield estimate by January and in five years USDA has reduced the yield estimate. Again, this is a backward-looking analysis, but it does provide some historical evidence that supports the notion that the soybean crop could indeed get even bigger.

A series of Market Intel Minutes have documented the favorable growing conditions this crop year (As Conditions Improve, Corn Harvest Begins, Corn and Soybean Crop Conditions Hold Steady and Crop Conditions Hold Steady as Harvest Approaches).

These favorable growing conditions are above prior-year and five-year average levels across much of the U.S. and have led to record crop yields. USDA will continue to revise corn and soybean yield projections throughout the growing season and into harvest. However, with June to August weather now behind us, odds are favorable that this big crop will indeed get bigger once the combines start rolling.

Top Issues

VIEW ALL