Corn Planting is Stalled in the Midwest

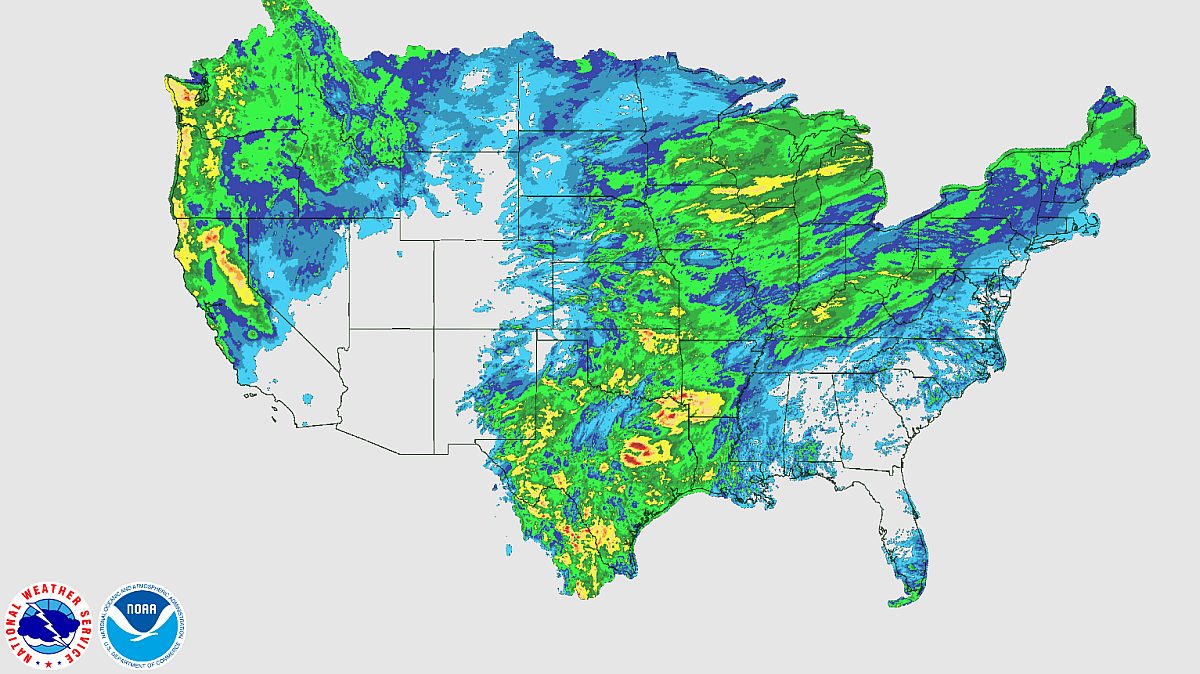

photo credit: National Weather Service Map Generator

John Newton, Ph.D.

Vice President of Public Policy and Economic Analysis

Implications

Excessive rainfall across the Midwest over the last week reduced the number of days suitable for fieldwork. As a result, the U.S. corn crop is only six percent planted, and is stalled relative to prior year and five-year average levels. It is early in the planting season as the most active period of corn planting continues through mid-May. Farmers will have opportunities, and have the technology, to recover from any early season slowdowns.

Corn Planting Window Opens

Due to the warmer climate, planting of corn in Southern portions of the U.S. typically begins in early March (USDA planting and harvest dates). However, across much of the U.S., corn planting begins in earnest in mid-April. USDA’s April 17 Crop Progress report is the first update following mid-April, and thus begins the annual process of closely monitoring crop progress, crop conditions, and the pace of harvest for a variety of field crops including but not limited to: corn, cotton, peanuts, rice, soybeans, and spring wheat.

While it is still very early in the planting season, USDA’s April 17 Crop Progress report revealed that U.S. corn planting was stalled across the Midwest, west of Indiana. Nationally, corn planting was six percent complete as of April 16, 2017. This total is up three percent from last week, but was on the lower bound of pre-report estimates of 6 to 11 percent planted.

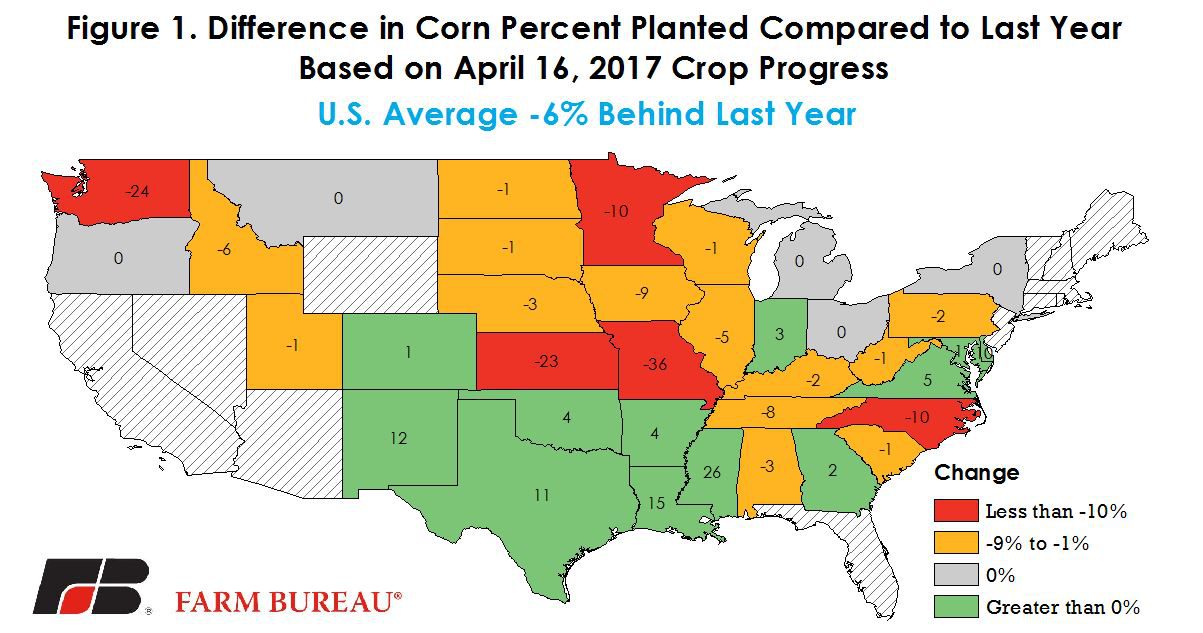

For the U.S., the pace of corn planting is six percent below prior year levels and three percent below the five-year average. At the state level the pace of planting is ahead of last year’s pace along the Mississipi in the Southeast and into much of the Southwest. Many Midwest states are behind last year’s planting pace, Figure 1. Notably, the “I-States” of Illinois, Indiana, and Iowa are below the five-year average pace.

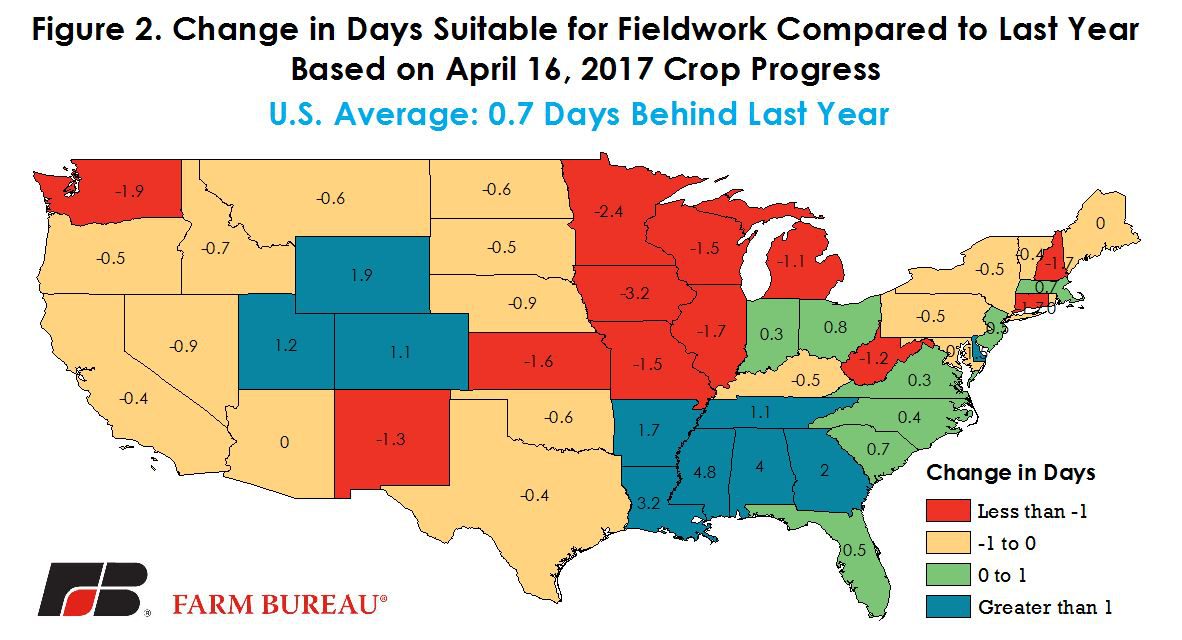

The pace of corn planting is below last year’s levels due to heavy rains and stalled fieldwork across much of the U.S. Midwest last week, Figure 2. USDA’s estimate of days suitable for fieldwork shows many states in these areas had fewer days, over the prior seven days, to make significant planting progress. For example, Iowa had 3.2 fewer days over the past week to plant corn, and as a result is nine percent behind last year’s pace and two percent below the five-year average.

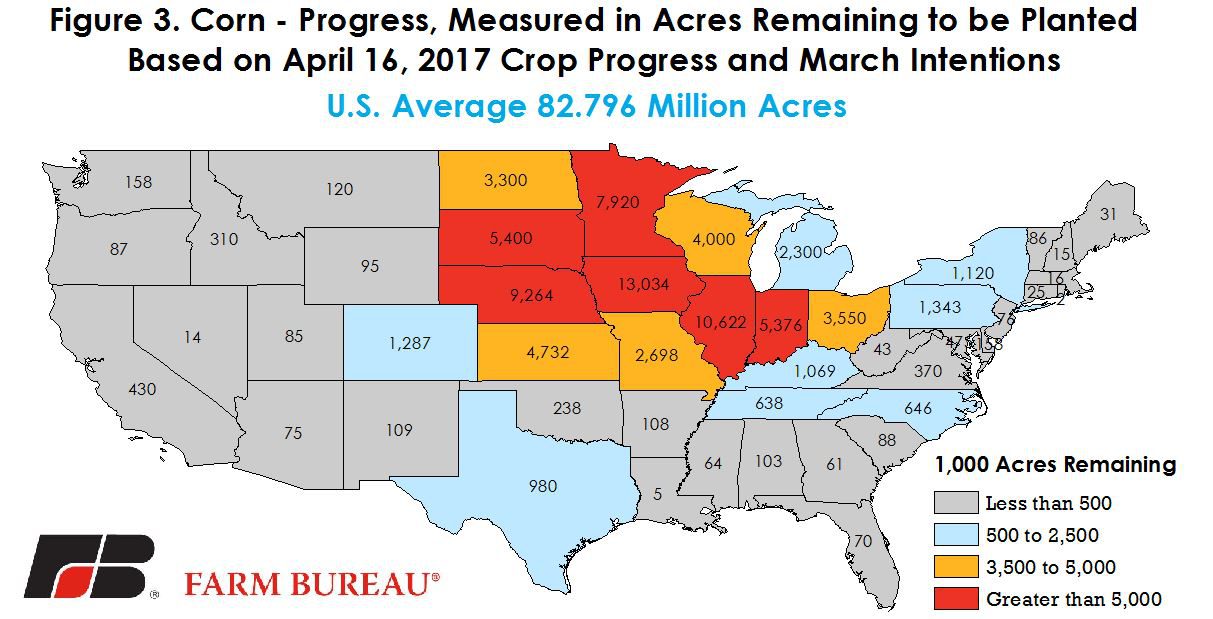

USDA currently projects U.S. farmers to plant four million fewer corn acres in 2017/18 at 89.996 million acres. Significant weather complications due to excessive moisture that delay or slow planting could ultimately lead to even fewer corn acres being planted. At six percent planted, and using the March intentions, 7.2 million acres have been planted and 82.796 million corn acres remain unplanted as of April 16, 2017, Figure 3. Weather will continue to play a critical role in the coming weeks as farmers seek to plant the remaining 83 million acres.

Weather Uncertainty Remains

While weather can slow planting it can also create complications for the crop. The old adage that “Corn Doesn’t Like to Get Its Feet Wet” is true. Excessive moisture impacts the overall health of the crop and issues related to soil quality, germination, and the probability of disease will become a bigger concern if moisture levels do not diminish.

Over the next 6 to 10 days the National Weather Service’s Climate Prediction Center is predicting normal to cooler temperatures in the Eastern Corn Belt and normal to above average precipitation in all areas of the U.S. except the Southwest. The potential for additional corn planting delays remain.

The likelihood of significant delays substantially reducing the crop acreage remain low. The most active period of planting continues through mid-May. In recent years, we’ve seen growers respond quickly to planting delays by increasing productivity later in the planting season. For example, in 2014, corn growers dropped 56 percent of the corn crop in the ground during the two weeks prior to the mid-May target. In 2013, growers planted 43 percent of the corn crop between May 19 and May 26. Farmers will have opportunities, and have the technology, to recover from any early season slowdowns.

Importantly, any reductions in corn acreage due to weather complications could pave the way for additional soybean acres due to their later planting window. USDA currently projects a record 89.5 million acres of soybeans will be planted this year.

As the pace of planting slows, attention will shift to crop conditions during the growing season as the market tries to anticipate the crop size. Weather will remain the key driver of uncertainty. Poor or very poor crop conditions could ultimately reduce crop yields and total production – improving prices along the way. On the other hand, “knee high by the fourth of July” could lead to another bumper crop and further test the price lows growers have experienced in recent years.

Top Issues

VIEW ALL