Department Stores, Anchors in a Different Sense…

Bob Young

President

photo credit: Getty

Bob Young

President

Much of the political rhetoric around job losses for the last several months has focused on the impacts of trade. If you listened to any number of speeches, you would be convinced brilliant foreign economists are plotting to pick off every possible job in the nation. Some probably are, but there are other fundamental forces at work that are going to drive substantive restructuring of jobs not only in the manufacturing sector, but quickly moving over into retail services.

A decade or so from now, we may well look back to 2017 as the start of the end of the mall. Okay, it maybe started a while back, but if you had any doubt about the changes going on in the way we buy stuff, just consider the implications of the listing in a recent USA Today article (Sears, JCPenny, Kmart, Macy’s: These Retailers are Closing Stores in 2017. David Carrig, March 22, 2017) Sears – which has been under the gun for some time – set to close 150 Kmart and Sears stores in 2017. JC Penny ready to shutter 148 stores. Macy’s 68 stores, HH Gregg, 88 stores, as well as declaring bankruptcy. MC Sports is planning to locking up 68 stores and has filed for chapter 11 as has Gander Mountain. The tales of Radio Shack declaring bankruptcy for the second time and closing another 187 stores in 2017 is yet another example of the retail sector taking a hammering.

According to Statistics Brain Institute, an on-line data service on-line sales will total over $440 billion in 2017, two and half times larger than 2010 figures. Purchases ‘via a mobile device’ is projected at over $114 billion – and they don’t even report data for 2010 in that category.

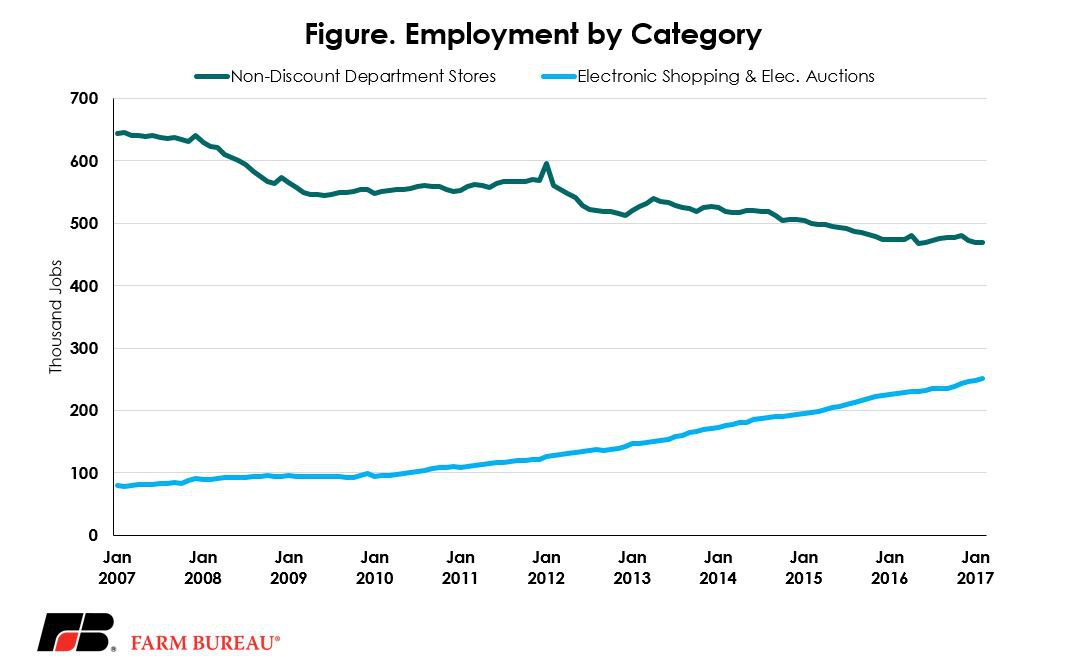

Total retail sales employment is a pretty big category – 15.8 million in March 2017. Needless to say, it contains a wide swath of sectors from motor vehicles and parts to home furnishings, from food stores to gas stations. One of the separate categories are Department Stores. This is no small category in its own right, accounting for 1,272,400 slots in March 2017. Except it accounted for 1,600,000 positions in December 2007. No question the recession hit this sector hard, but as recently as January 2012, it was back up to 1,580,000 positions. This data is broken down one more step to ‘Discount’ and ‘Except Discount’ department stores. The ‘Except Discount’ store employment is down 27 percent from January 2007.

A sign of how things are shifting, as these declines have occurred, employment by ‘Electronic Shopping and Mail Order Houses’ has actually grown by 171,000 positions.

The fall-off in Department Store employment is not likely to stop anytime soon. The list of closings discussed above clearly indicates our whole approach to buying things is going through some fundamental changes. The impacts of shuttering the department store in a shopping mall will go far beyond that business alone. Does the mall have the same draw without a large anchor? On the other hand, these ‘anchors’ are closing because people are not shopping there as they did before.

The data also suggest that we are not replacing those slots – at least in the same general areas. This quick shot did not take apart the transportation and delivery sectors, which have seen growth in the last few months. But a drop of 330,000 in higher end Department Stores is not made up by 171,000 new jobs in Electronic Shopping.

And again, with all of the announced store closings that have yet to actually take effect, the old Bruce Springsteen song line of ‘These jobs are leaving boys and they ain’t coming back’ seems to be very appropriate. But it is not because of a trade agreement, it’s because we are going through a radical change in the way we shop.

Top Issues

VIEW ALL