EPA’s Renewable Fuel Proposal Boosts Volumes

photo credit: AFBF

Faith Parum, Ph.D.

Economist

The Environmental Protection Agency (EPA) published a Notice of Proposed Rulemaking (NPRM) on June 13 to increase Renewable Fuel Standard (RFS) volumes. Renewable fuels are produced from feedstocks — raw materials such as corn, soybeans, used cooking oil, and animal fats.

The NPRM includes higher volume targets for advanced fuels like cellulosic biofuel, which is made from crop residue, and biomass-based diesel, which is derived from soybean oil or animal fats. The proposal would also limit the use of imported materials to generate Renewable Identification Numbers (RINs), which are credits used to track compliance with RFS requirements. This change is intended to make U.S.-grown crops more competitive.

Overall, the proposal would help preserve demand for American feedstocks and expand market opportunities for U.S. farmers. This Market Intel outlines the proposed changes to the Renewable Fuel Standard and examines their potential impact on agriculture.

Renewable Fuel Standard Background

Created in the Energy Policy Act of 2005 to reduce greenhouse gas (GHG) emissions, reduce reliance on imported oil and grow the nation’s renewable fuels sector – and the domestic feedstocks that go into it, like corn and soybeans – the RFS program requires specific volumes of renewable fuel, called Renewable Volume Obligations (RVOs), to be blended into U.S. transportation fuel each year.

EPA sets these RVOs across four categories: total renewable fuel, advanced biofuel, cellulosic biofuel and biomass-based diesel.

RVO Definitions

- Total Renewable Fuel: The overall amount of renewable fuel that must be blended into U.S. transportation fuel each year. This includes all types of renewable fuels, such as corn ethanol and biodiesel. The EPA sets separate volume requirements for the categories below.

- Advanced Biofuel: Fuels made from non-corn sources, such as sugarcane ethanol or fuels from waste products.

- Cellulosic Biofuel: A type of advanced fuel made from non-edible plant parts, like ethanol made from corn stalks or switchgrass.

- Biomass-Based Diesel: A renewable diesel made from oils or fats, such as soybean oil or used cooking grease.

See this previous Market Intel for a closer look at each RVO. These standards are updated through the rulemaking process, as required by the Clean Air Act, to reflect projected fuel use and renewable fuel availability.

The key compliance mechanism that the RFS uses to ensure that obligated parties, i.e. refiners and blenders, meet their annual renewable volume obligation are Renewable Identification Numbers (RINs). RINs are credits that are based on the production of biofuels and fluctuate in value based on market supply and demand. Each gallon of renewable fuel produced is assigned a RIN, which stays with the fuel as it moves through the supply chain. Once the fuel is blended or sold, the RIN can be separated and traded on its own. Fuel refiners and importers use RINs to show they’ve met their renewable fuel obligations, and once a RIN is used to meet obligations, it is retired. The trading system helps companies meet blending targets in a more flexible and efficient way.

What’s in the Proposed Renewable Fuels Rule?

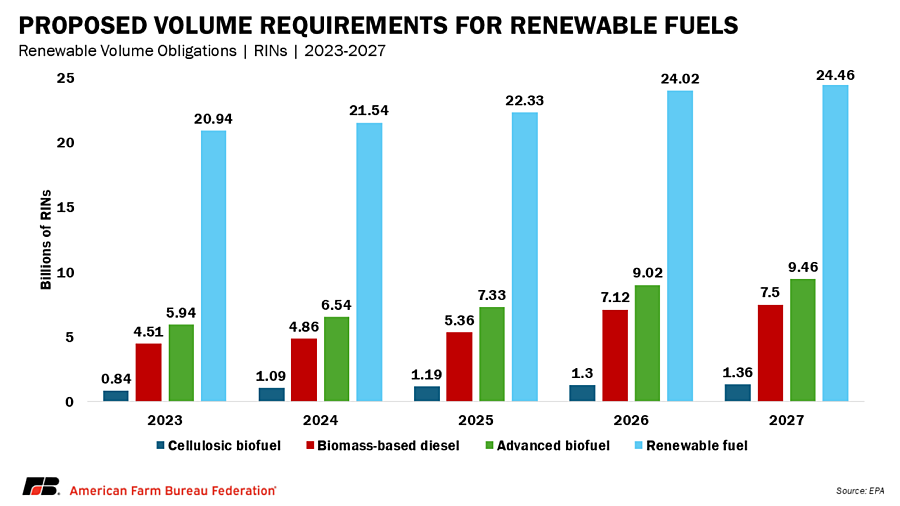

EPA’s proposal would increase the total renewable fuel mandate by 2.13 billion RINs, from 22.33 billion in 2025 to 24.46 billion in 2027, an overall increase of 9.5%. This includes a 7.6% increase from 2025 to 2026 and a 1.8% increase from 2026 to 2027. The proposal also raises the cellulosic biofuel target to 1.30 billion RINs in 2026, a 9.2% increase from 2025, and to 1.36 billion in 2027, a 4.6% increase from 2026. Altogether, the cellulosic target would rise by 14.3% over the two-year period.

Biomass-based diesel (BBD) RVOs are projected at 7.12 billion RINs in 2026, a 32.8% increase from 2025, and 7.50 billion in 2027, another increase of 5.3%. This is up from 6.54 billion RINs in 2025. Advanced biofuel obligations will also rise, reaching 9.02 billion RINs in 2026 (a 23% increase) and 9.46 billion in 2027 (a 4.9% increase). These higher volumes reflect continued growth in renewable fuel production and drive increased demand for soybeans, corn and other feedstocks that are vital to the agricultural economy.

The proposed rule adds a new factor that adjusts the value of RINs based on whether the biofuel or feedstock is sourced domestically or imported. Under this approach, RINs generated from foreign biofuels or feedstocks would be valued at only 50% compared to those from U.S. sources. This change is intended to reduce reliance on imports. It also aims to strengthen domestic markets for crops and other feedstocks.

In addition, EPA issued a partial waiver for the 2025 cellulosic biofuel requirement, lowering it to 1.19 billion RINs due to expected production limitations. Cellulosic biofuels are still an emerging industry. The EPA adjusts cellulosic biofuel targets when projected supply falls short of mandated levels due to production short falls. By adjusting the requirement, EPA aims to keep the program realistic while still supporting long-term growth in advanced biofuel production.

Impacts on Corn, Soybeans and Soybean Oil

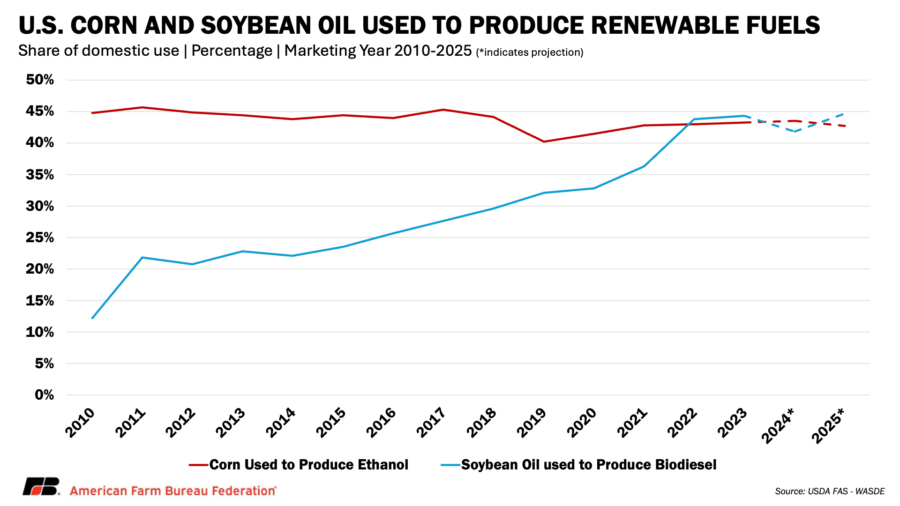

EPA’s proposed rule maintains the conventional renewable fuel requirement at 15 billion gallons for 2026 and 2027. While this does not represent an increase from previous years, it preserves a key source of demand for corn used in ethanol production. Corn ethanol remains the primary contributor to conventional renewable fuels and accounts for approximately 40% of annual U.S. corn use. By holding the renewable fuel RVO steady, the rule continues to provide support for domestic corn markets.

The proposal significantly increases biomass-based diesel obligations, from 5.36 billion RINs in 2025 to 7.12 billion in 2026 and 7.50 billion in 2027. The American Soybean Association expressed support for the rule, noting that it raises volume requirements for biomass-based diesel by 67%.

This expansion is expected to support continued growth in the domestic renewable diesel and biodiesel sectors, which rely heavily on soybean oil as a primary feedstock. Soybean oil use for biomass-based diesel has grown rapidly in recent years, with USDA projecting that over 13 billion pounds of soybean oil will be used for biofuel production in the 2024/2025 marketing year. That figure has more than doubled over the past five years. EPA’s proposal to raise BBD targets aligns more closely with actual supply levels and responds to industry concerns that past RVOs did not keep pace with production capacity. Higher volume targets and reduced RIN generation from imports are expected to strengthen demand for U.S.-grown soybeans and support prices for both oil and whole beans.

Conclusion

Renewable fuels continue to anchor demand for U.S. corn and soybean producers. For the 2025/2026 marketing year, USDA estimates that ethanol producers will use 5.5 billion bushels of corn, making up around 43% of total U.S. corn use. Soybean oil usage for biofuel production is projected at 13.9 billion pounds in 2025/2026 and accounts for approximately 45% of soybean oil usage in the U.S.

Next, the proposal enters a public comment period, allowing stakeholders such as farmers, biofuel producers and industry groups to weigh in. The deadline for public comments is August 8. Comments can be submitted through the Federal Register, and EPA will review all feedback before issuing a final rule.

By raising targets for biomass-based diesel and advanced biofuels, EPA is recognizing the growth and capacity of the domestic biofuels industry. These increased volumes will help drive demand for key agricultural commodities like corn and soybeans, providing stronger market opportunities for American farmers. Aligning the RFS more closely with industry capabilities supports U.S. agriculture and encourages continued investment in domestic renewable energy.