For Some, New MPP Makes Plenty of Cents

TOPICS

Farm Bill

photo credit: Right Eye Digital, Used with Permission

John Newton, Ph.D.

Vice President of Public Policy and Economic Analysis

In February 2018, the Bipartisan Budget Act of 2018 made several modifications to USDA’s Dairy Margin Protection Program and directed the department to reopen signup for the 2018 coverage year. The modifications made to MPP were designed to make it a more attractive risk management tool for small- and medium-sized dairy operations by reducing premium rates, delivering payments monthly, increasing the catastrophic coverage levels, and making more milk eligible for discounted coverage. Farmers have until June 1 to make new MPP coverage elections. MPP coverage will be retroactive to January 2018, and for more than 90 percent of the farmers previously enrolled in the program, coverage during 2018 is guaranteed to be profitable, i.e., program payments will be greater than the insurance premiums.

Bipartisan Budget Act Changes

It’s widely known that despite milk prices falling by more than 50 percent since 2014, MPP offered very little financial support to the struggling dairy industry. Farmers paid nearly $100 million in premiums and administrative fees, and received approximately $12 million in program payments, representing a loss ratio of 12 percent. That all changed in 2018.

The Bipartisan Budget Act of 2018 modified MPP to make the program more affordable and to ensure more timely program payment delivery. The changes to MPP include calculating program benefits monthly instead of bimonthly, reducing the premium rates for Tier 1 coverage by as much as 80 percent, increasing the Tier 1 eligibility to 5 million pounds of covered milk, up from 4 million pounds, increasing the minimum catastrophic coverage level for small- and medium-sized dairy operations.

To best demonstrate these changes, consider that under the old MPP $8 coverage cost 47.5 cents per hundredweight for the first 4 million pounds of covered milk and $1.37 per hundredweight for coverage more than 4 million pounds. For a farm covering 5 million pounds of milk, the old MPP would have cost over $30,000. Now, with the lower premium rate of 14.2 cents per hundredweight for up to 5 million pounds of covered milk, $8 coverage costs slightly more than $7,000 – a reduction of 78 percent.

Covering 5 Million Pounds and Under

The changes to Tier 1 MPP coverage in the Bipartisan Budget Act will provide much needed financial relief to farmers covering no more than 5 million pounds of milk. For farmers electing to cover more than 5 million pounds of milk, the benefits of participation will be lower due to the higher Tier 2 premium rates and should be carefully compared to other risk management options.

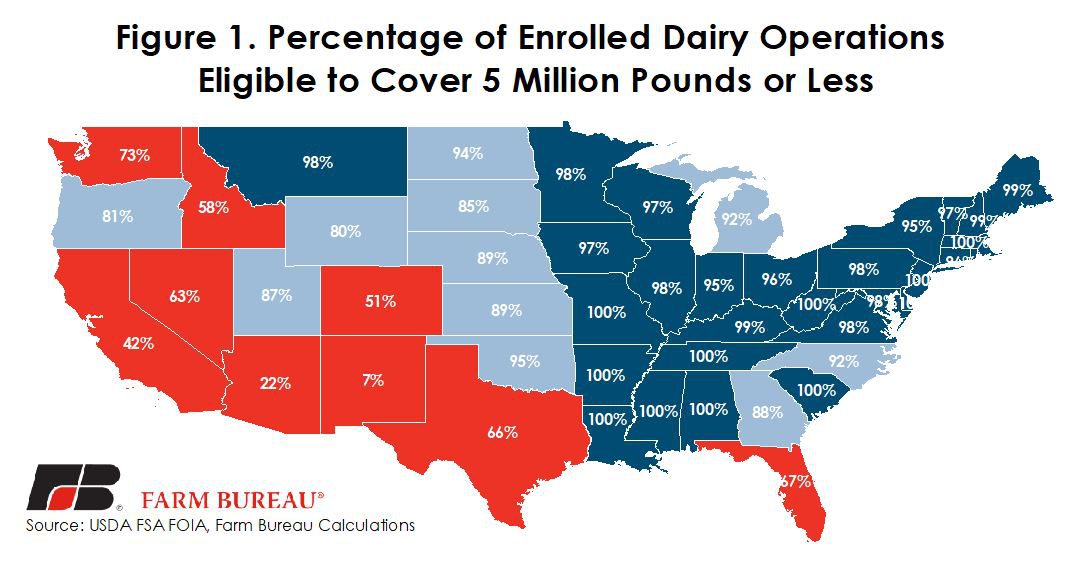

Based on 2017 enrollment data received from USDA’s Farm Service Agency, in 2017, 92 percent of enrolled dairy operations, approximately 20,000 farms, had a production history at or below 20 million pounds of milk. Because the minimum coverage percentage is 25 percent, these farmers would be eligible to elect coverage on up to 5 million pounds of milk and receive the maximum benefits provided by the improved Tier 1 provisions. Figure 1 maps the percentage of enrolled dairy operations eligible to cover 5 million pounds of milk or less based on 2017 enrollment data.

Guaranteed Benefits at $8 Coverage

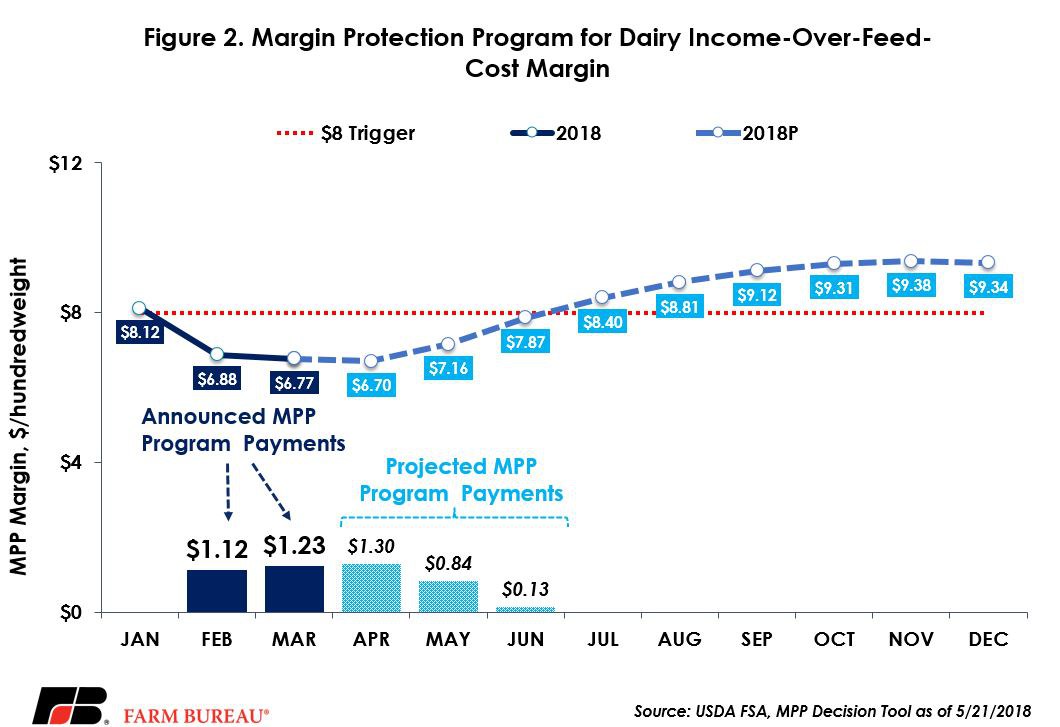

While the enrollment period for the improved MPP runs from April to June 1, the coverage for 2018 will be retroactive to January. Based on the data released by USDA, the February and March MPP margins were $6.88 and $6.77 per hundredweight, triggering program payments of $1.12 and $1.23 per hundredweight for $8 coverage, respectively, and excluding sequestration of 6.6 percent. With a Tier 1 premium rate of 14.2 cents for $8 coverage – which is less than the dairy checkoff assessment – the net benefit of participation for February and March is $0.98 and $1.09 per hundredweight, respectively.

Importantly, even if MPP isn’t triggered for the rest of 2018, farmers covering no more than 5 million pounds under the $8 coverage level will have a positive return of 3.9 cents per hundredweight, or $1,950 for a farm covering 5 million pounds (including premiums, administrative fees and sequestration). For these farmers, the 3.9 cents per hundredweight is guaranteed and can only get larger. For example, if April triggers a payment of $1.30 per hundredweight, as projected, the net benefit of participation jumps to 14 cents per hundredweight, or $7,000, for a farm covering 5 million pounds of milk.

As of mid-May, USDA’s MPP decision tool forecasts MPP margins to remain below $8 per hundredweight through June 2018. Potential program payments of $1.30 in April, $0.84 in May and $0.13 in June are currently projected for $8 coverage, Figure 2. If realized, $8 MPP coverage would have a net benefit of 21.6 cents per hundredweight, or nearly $11,000, for a farm covering 5 million pounds. Benefits of MPP participation would only increase if feed prices continue to rise or if milk prices falter going into the fall.

Summary

During 2018, milk prices and MPP margins reached the lowest levels since 2016. Due to the multi-year downturn in milk prices and financial hardships faced by dairy farmers, as well as the poor historical performance of MPP, Congress made several modifications to the program in the Bipartisan Budget Act of 2018. Following the congressional action, USDA reopened signup and made the benefits retroactive. Farmers have until June 1 to finalize their coverage elections for 2018.

Anecdotal reports suggest that as of mid-May fewer than 8,000 dairy operations had signed up for the improved MPP. Similar patterns were observed in years past, whereby dairy operators would finalize their coverage options in the final week prior to the enrollment deadline. However, for the improved MPP, there is no need to wait as the benefits of participation are guaranteed to be positive for 92 percent of the dairy farmers previously enrolled in the program.

With so much uncertainty around milk and feed prices in 2018, one certainty many dairy farmers have is that the improved MPP will provide some financial assistance. With little more than a week remaining until the signup deadline, farmers should take a second look at MPP for 2018 and make sure they are not leaving money on the table.

Top Issues

VIEW ALL