Importance of NAFTA to Agriculture in Each State for 2016

TOPICS

Trade

photo credit: AFBF Photo, Mike Tomko

John Newton, Ph.D.

Vice President of Public Policy and Economic Analysis

Note: Analysis reflects USDA-published U.S. Census Foreign Trade Division agricultural trade data, and may not be the point of origin for agricultural commodities.

As modernization of the North American Free Trade Agreement, or NAFTA 2.0, continues, concern from the agricultural community over a potential NAFTA withdrawal has intensified. NAFTA supporters point toward the tens of billions of dollars in U.S. agricultural exports delivered to our NAFTA partners each year or point out that exports to Mexico and Canada represent 30 percent of all U.S. agricultural exports. Put simply, Mexico and Canada are among our top three export markets.

Total withdrawal from NAFTA would make U.S. farmers and ranchers less competitive in our top export markets – and could result in billions of dollars of agricultural products accumulating in inventories – further weakening the U.S. farm economy. The integration of the North American agricultural market that has occurred over the last quarter century is at risk. According to the Congressional Research Service, Potential Effects of a U.S. NAFTA Withdrawal: Agricultural Markets:

In general, the application of MFN tariffs on U.S. agricultural imports would likely raise prices both to U.S. consumers and other end users, such as manufacturers of value-added food products. MFN tariffs on U.S. agricultural exports would, in turn, likely make U.S. products in those markets less price-competitive and more costly to foreign buyers, which could result in reduced quantities sold. Given that certain agricultural products dominate U.S. trade with Canada and Mexico—such as meat products, grains and feed, and processed foods—these products could become more costly and less competitive as MFN tariffs are imposed and other trade preferences are removed under a NAFTA withdrawal. This could result in reduced market share for U.S. products in these markets.

Congressional Research Service

A series of Market Intel articles reviews the NAFTA benefits for a variety of commodities. Revisiting NAFTA: Implications for U.S. Agricultural Markets reviewed the free trade agreement as a whole.

Today’s article takes a step back from the commodity-by-commodity approach and instead reviews the importance of NAFTA to the contiguous 48 states during 2016. Data from USDA’s Foreign Agricultural Service are used to estimate the share of total agricultural exports represented by our NAFTA partners. Viewing NAFTA through the lens of what it means in terms of total agricultural exports will help policymakers, industry stakeholders and Farm Bureau members better understand how much our export markets, and U.S. farm income, relies on an integrated North American agricultural market.

Which States Would be Hit Hardest?

During 2016 $38 billion in U.S. agricultural products were delivered to our NAFTA partners, with approximately $20.3 billion going to Canada and $17.8 billion to Mexico. Already, through September 2017, exports to Mexico are up 6 percent over year-ago levels and total NAFTA exports are up 3 percent.

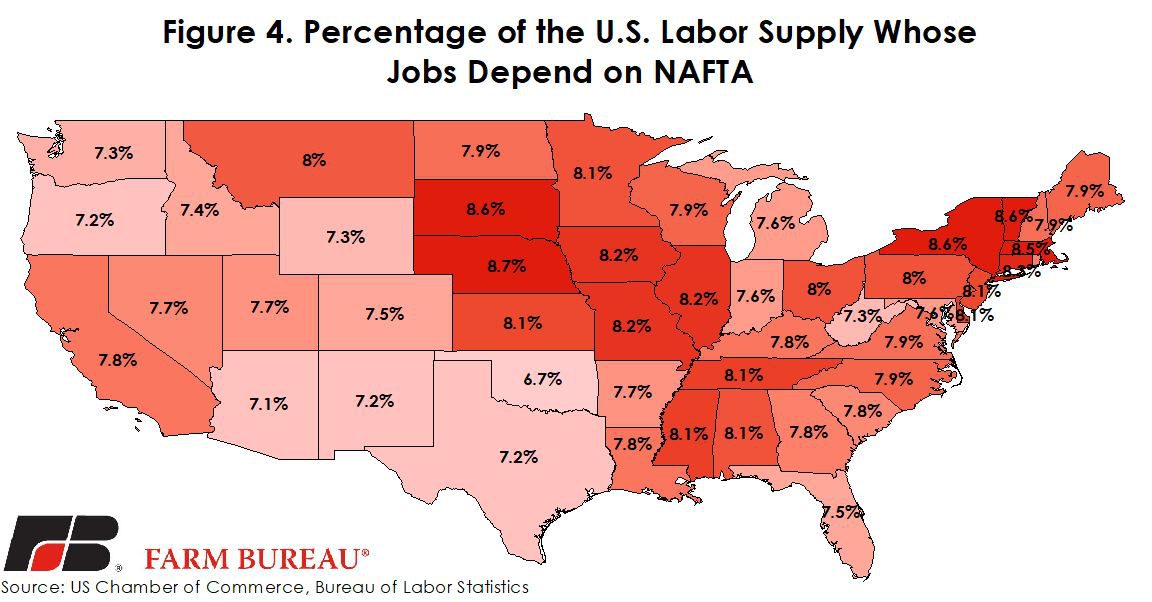

One would expect the value of agricultural exports to be the highest in areas densely concentrated with agricultural production of grains, oilseeds, livestock, dairy and horticultural products. However, the value of agricultural exports does not communicate the relative importance of NAFTA to each state. To determine the importance of NAFTA to each state the ratio of the total NAFTA export value to the value of total agricultural exports was calculated, Figure 1.

As identified in Figure 1, several states depend heavily on NAFTA as a share of their total export volume. On average, 30 percent of U.S. agricultural exports are delivered to our NAFTA partners. However, during 2016 two-thirds of states had a higher export percentage to NAFTA than the U.S. average. An additional 13 states had more than 50 percent of their agricultural exports go to NAFTA partners.

During 2016, 80 percent of all agricultural exports from Vermont went to NAFTA partners. The top five states in terms of percentage of agricultural exports to NAFTA partners were Vermont, North Dakota, South Dakota, Delaware and Missouri. These states would be hit the hardest in the event of a NAFTA withdrawal. Of the contiguous 48 states, the least reliant on NAFTA for agricultural exports was Washington at 10 percent.

Share of All Exports to Mexico and Canada

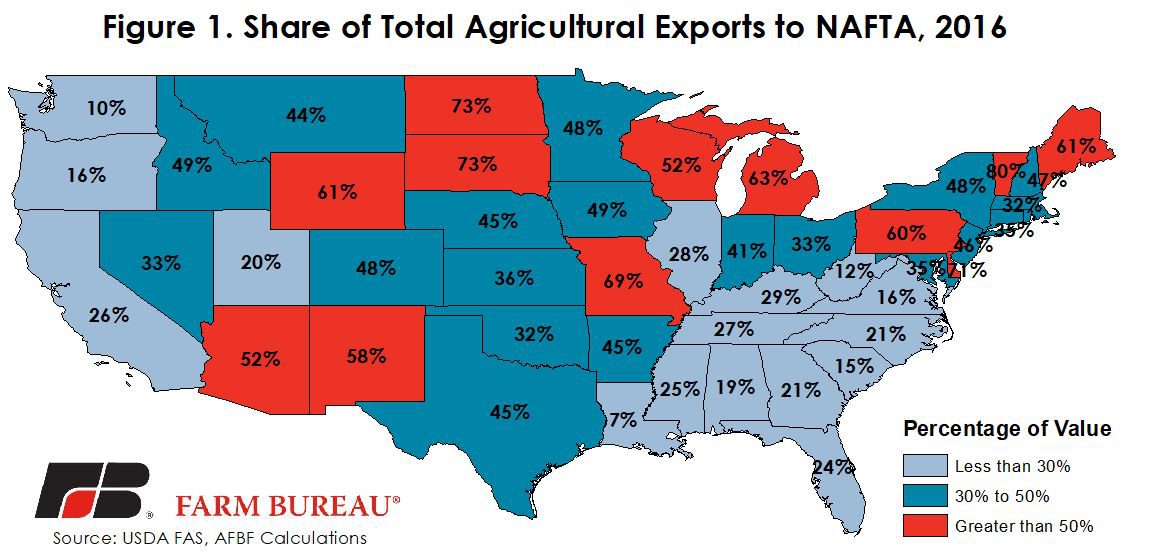

The dependence on Mexico and Canada individually for agricultural exports has an interesting spatial and product-specific disposition. For example, the top exported agricultural products to Mexico are grains and feeds, oilseeds, and livestock products. So it follows then that states with high concentrations of grains and oilseeds and livestock production and in close proximity to shipping routes would rely heavily on Mexico as a trade destination.

As identified in Figure 2, several states depend heavily on Mexico as a destination for the agricultural exports. During 2016, 51 percent of all agricultural exports from Missouri went to Mexico. The top five states in terms of percentage of agricultural exports to Mexico were Missouri, New Mexico, South Dakota, Texas and Nebraska. Of the contiguous 48 states, the least reliant on Mexico for agricultural exports was Oregon at 2 percent.

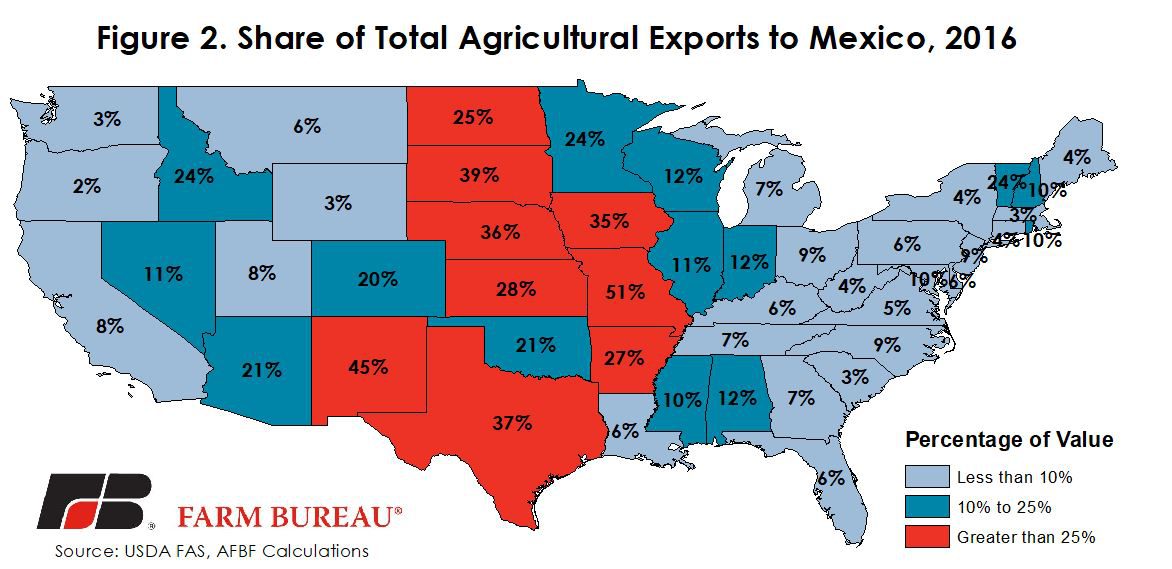

The top exported agricultural products to Canada are horticultural products, grains and feeds, livestock and sugar. States with high concentrations of these products and those located along the northern U.S. border rely heavily on Canada as a trade destination.

As identified in Figure 3, several states depend heavily on Canada as a market for their farm exports. During 2016, 65 percent of all agricultural exports from Delaware went to Canada. The top five states in terms of percentage of agricultural exports to Canada were Delaware, Wyoming, Maine, Vermont and Michigan. Of the contiguous 48 states, the least reliant on Canada for agricultural exports was Louisiana at 1 percent.

Implications

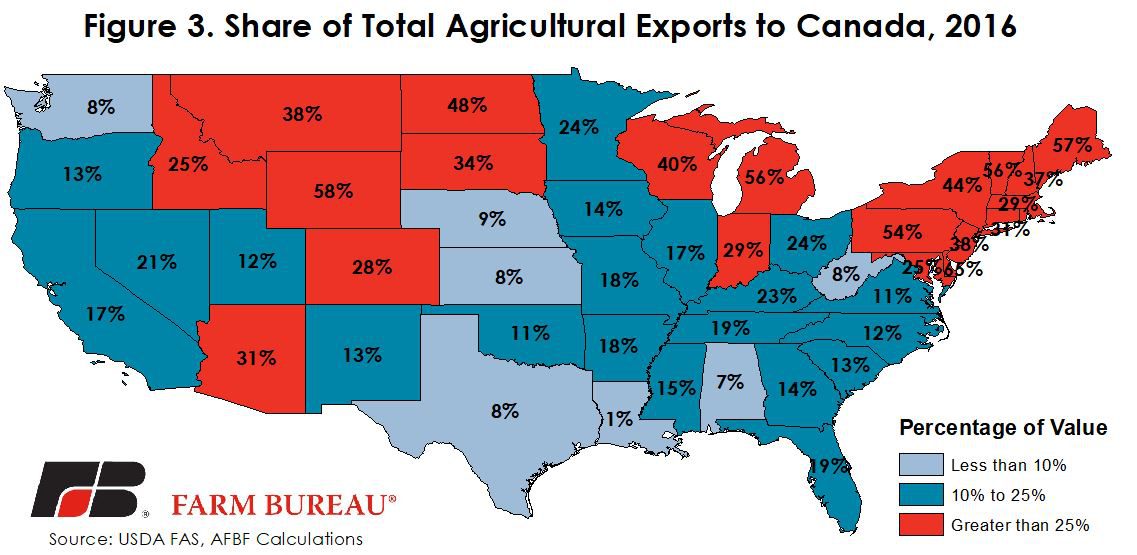

The drumbeat of a NAFTA withdrawal has become louder – despite resistance from U.S. farmers and ranchers and agricultural industry stakeholders. As the rhetoric increases it’s important for policymakers, industry stakeholders and farmers and ranchers to know that every single state in the U.S. benefits from exporting agricultural products to our NAFTA partners. Agriculture is not the only beneficiary. The U.S. Chamber of Commerce estimates that nearly 13 million jobs depend on NAFTA, representing approximately 8 percent of the U.S. labor force. As evidenced in Figure 4, jobs that depend on NAFTA are all across rural America.