New AFBF Survey Shows Drought’s Increasing Toll on Farmers and Ranchers

TOPICS

Water

photo credit: Texas Farm Bureau, Used with Permission

Daniel Munch

Economist

With over 60% of the American West, Southwest and Central Plains categorized as D3 (severe) drought or higher, AFBF conducted a third round of its survey to evaluate drought’s continued impact on farm and ranch businesses. A summary of June 2021 survey results can be found here and October 2021 results here.

The 17 states including and north of Texas, up along the Central Plains to North Dakota and west to California are vital to the U.S. agricultural sector, supporting nearly half of the nation’s $364 billion production by value. This includes 74% of beef cattle, responsible (in total) for 18% of U.S. agricultural production by value; 50% of dairy production, responsible (in total) for 11% of U.S. agricultural production by value, over 80% of wheat production by value and over 70% of vegetable, fruit and tree nut production by value. Drought conditions, which have persisted well into 2022, put production of these commodities at risk, along with the stability of farms, ranches and local economies reliant on crops, livestock and downstream products and services for income.

Assessing Western Drought Conditions Survey

To further quantify some ground-level drought impacts, AFBF distributed a third drought conditions survey between June 8 and July 20 to state and county Farm Bureau leaders, staff, and farmer and rancher members in the affected states. The survey includes several demographic questions to distinguish state affiliation followed by three separate sections: Crop-Specific Factors, Livestock-Specific Factors and General Water Access. Each section consists of a set of issues farmers and ranchers may be facing because of persistent drought conditions (i.e., selling off portions of the flock/herd or reduction in expected harvest yields). On a scale of 0 (not at all prevalent) to 5 (extremely prevalent), respondents were asked to select how prevalent each issue was in their area based on their own experience or outreach with members. Each section also includes a dedicated area for further commentary. Importantly, the geographic footprint of extreme drought has shifted between 2021 and 2022, with states in the Pacific Northwest like Washington and Idaho having relatively better conditions, while states like Texas and Oklahoma have faced widespread drought in the highest, D4, exceptional drought category. This shift is reflected in much of the data collected from producers in these regions.

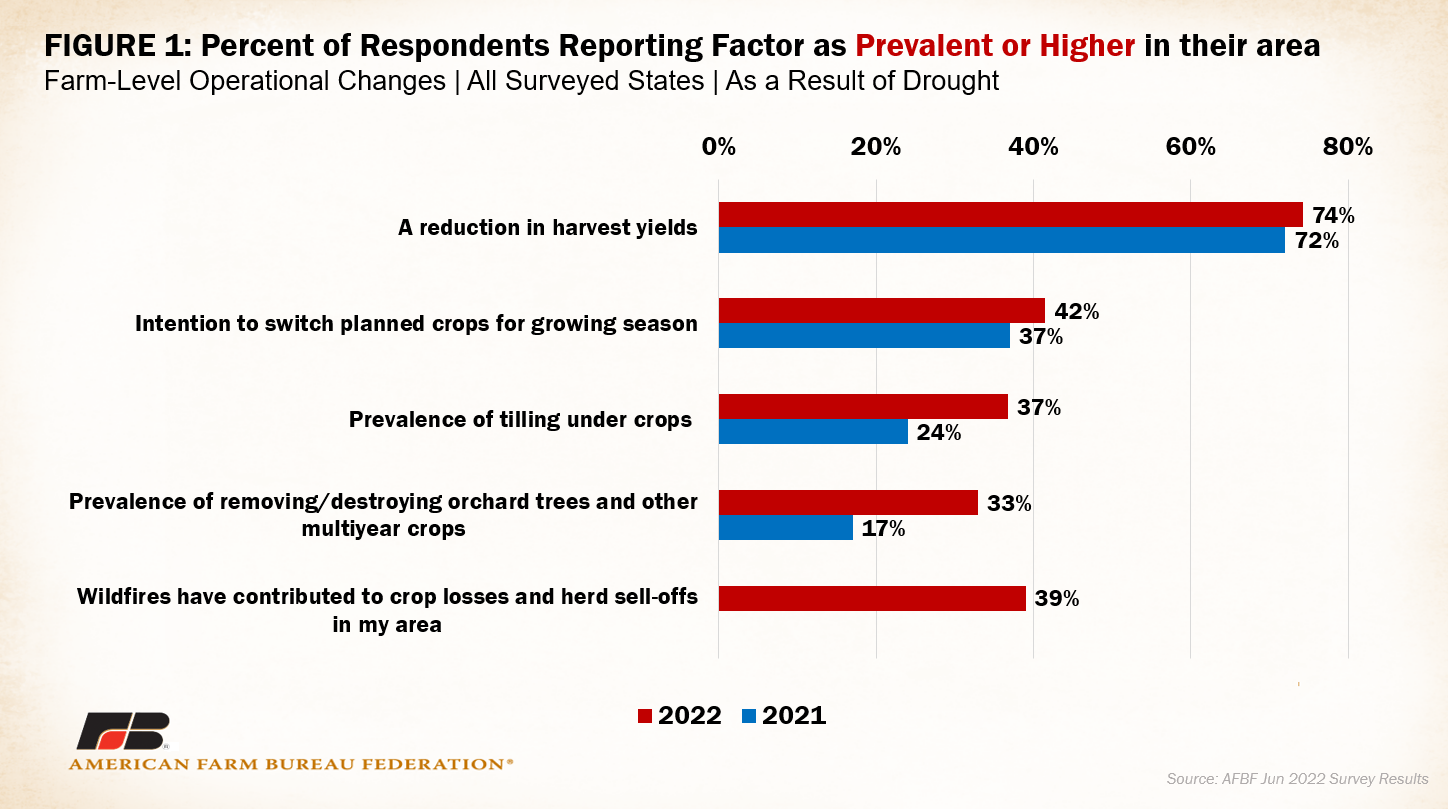

The survey closed with 652 responses from 15 states in the drought-stricken region. Figure 1 summarizes weighted percentages of respondents across all states reporting a certain drought-related operational factor as prevalent or higher in their area; this includes participants who selected prevalent, very prevalent or extremely prevalent for the crop factors section of the survey. The blue bar denotes this percentage from last year’s results while the red line denotes 2022 results.

Crop Yields

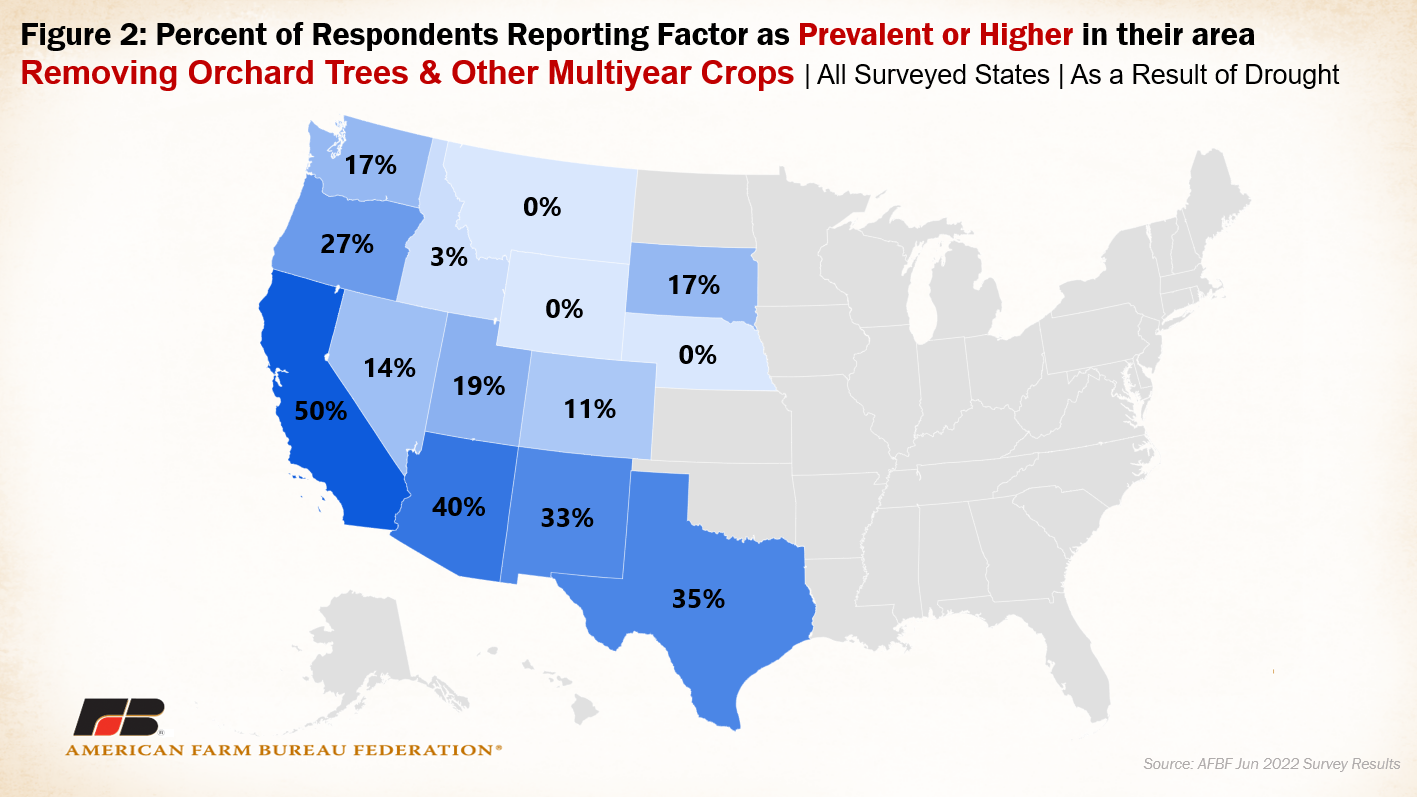

Seventy-four percent of respondents rated a reduction in harvest yields due to drought as prevalent or higher in their area, about the same as last year (72%). Forty-two percent of respondents rated the intention to switch planned crops for the growing season due to drought as prevalent or higher (up from 37% last year). Notably, those who reported tilling under crops because of drought conditions jumped from only 24% of respondents last year to 37% of respondents this year. Similarly, 33% of respondents reported destroying and removing orchard trees and other multiyear crops as prevalent or higher, up from only 17% last year. Producers who experienced significant water usage curtailments last year may have been able to hold on, but ongoing extreme conditions have compelled some of them to make the tough decision to till under or destroy multiyear crops this time around. In one case, a California producer mentioned dropping all fruit on five acres of young Cabernet grapes to help them survive with zero applied water over the last two years, removing all revenue-generating potential for the current year. As expected, prevalence of orchard and multiyear crop removal remains most common in states with high fruit and tree nut crop production such as California and Arizona, where 50% and 40% of respondents, respectively, reported that factor as prevalent or higher.

Across the surveyed region, respondents expected average crop yields to be down 38% this year because of drought conditions, with the biggest drop expected in Texas (yields reported down 68%), followed by Oklahoma (down 60%) and New Mexico (down 54%). Washington farmers are expecting the lowest yield decline (down 8%). One Arizona farmer commented:

“Many of the fields near us are now fallow. Cropland is being converted to housing developments at an alarming rate. Over 10,000 new homes are expected within a 10-mile radius of my house--most within a 5-mile radius, all on cropland or former dairies. It is frustrating and alarming. Where will the food come from if we grow houses instead of food?”

The overwhelming majority of fruits, tree nuts and vegetables are sourced from drought-stricken states where farmers are feeling forced to fallow land and destroy orchards, which will likely result in American consumers paying more for these goods and either partially relying on foreign supplies or shrinking the diversity of items they buy at the store. Drought conditions in the U.S. also risk global access to some items like almonds, since California produces 80% of the world’s supply, greatly limiting buyers’ procurement options. Shifting production to other states is not often feasible given the diversity of crop climate and soil requirements.

Livestock Production

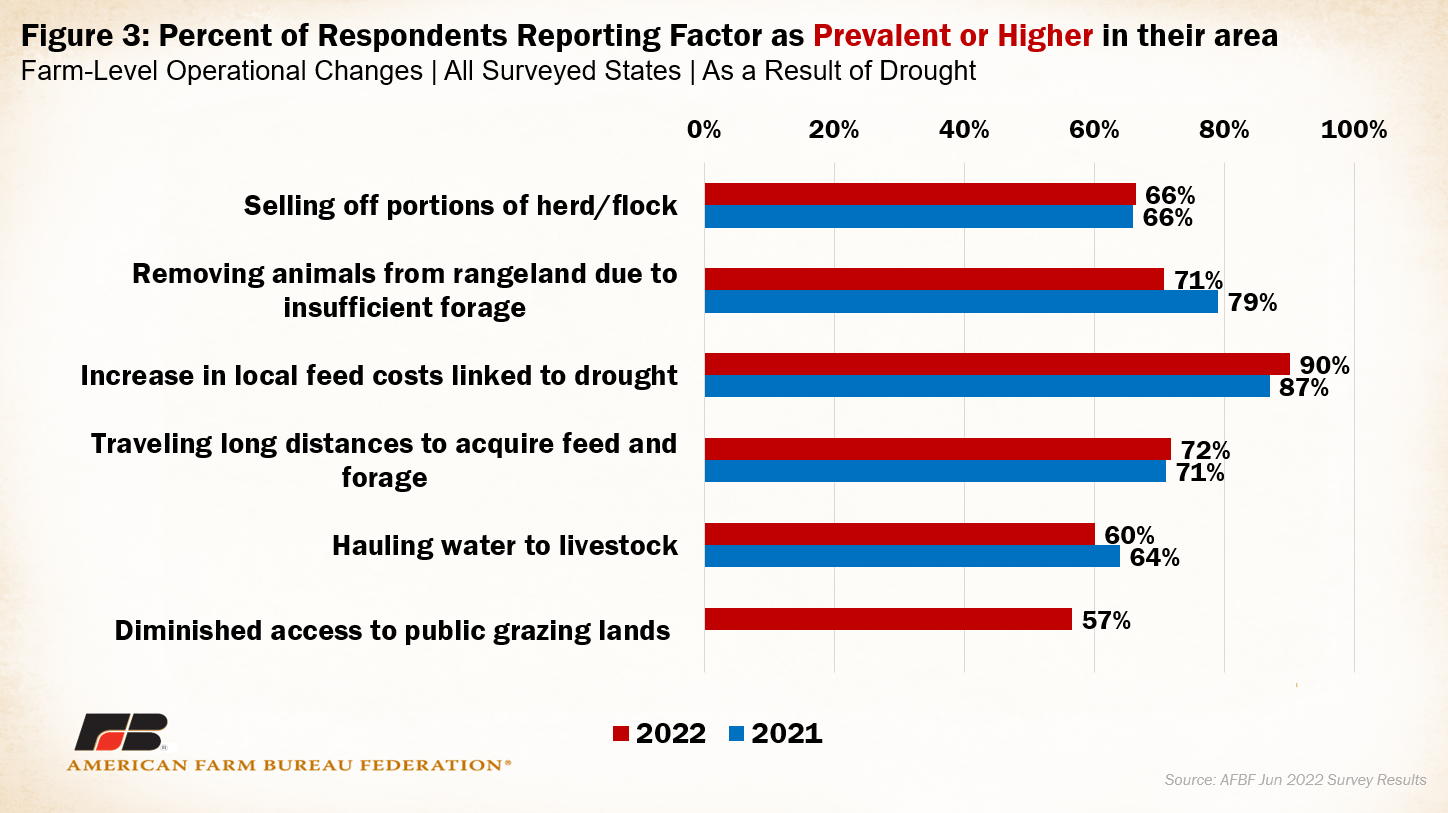

Figure 3 summarizes results from the livestock factor section of the survey. Ninety percent of respondents reported an increase in local feed costs as prevalent or higher in their area, up from 87% last year. As the region provides over 70% of the nation’s hay, widespread low-quality or insufficient forage means farmers and ranchers must look elsewhere for a smaller supply of feed at exorbitant prices, and often located a long distance from the farm or ranch. One Utah producer who trucked in hay from Nebraska last year now faces the costly barrier of fuel prices to access hay in 2022.

Two-thirds of respondents reported prevalence of selling off portions of the herd or flock, with average herd sizes expected to be down 36% in the surveyed region. The largest herd decline is in Texas (herds reported down 50%), followed by New Mexico (down 43%) and Oregon (down 41%). Washington expected to have the smallest average herd size decline (down 14%). Insufficient and poor quality forage forces liquidations, which cut into operational income. In Texas, one producer reports, “We have sold half our herd and may not be able to feed the remaining. The ones we sold only brought 60-70% of what we bought them for in 2021.” Scarce and lower quality forage also impacts feed conversion ratios necessary to reach desired market weights. Cattle inventories have continued to decline, with the number of heifers capable of producing next year’s calf crop dropping due to increased feedlot placements. In New Mexico a rancher somberly writes:

“Trying to help my daughter and her husband build their herd up to take over operations fully but with drought conditions, it is not looking like they will be able to hang on to their cattle either. Meantime, our costs keep going up - gasoline - feed - medicine - tax requirements - making it hard for older ranchers to turn over the reins to young couples starting off.”

In many Western states, where the federal government owns the majority of land, drought has diminished any usable forage, with 57% of respondents reporting impaired use of public lands as prevalent or higher and 71% reporting removing animals from rangeland due to insufficient forage as prevalent or higher. Ranchers reliant on these lands have few or no alternative options to purchasing food elsewhere and may lose out on funds paid for grazing permits. Eighty percent of Nevada’s area and 63% of Utah’s is federally owned, creating particular hardships for ranchers in these areas. One Utah sheep rancher writes:

“For the past two years we have gotten only about 25% of the normal amount of feed out of our desert permit. In each of the last two years our sheep have been fed hay for an additional 40-50 days, compared to normal, at a cost of about $600 per day. It appears that we may need even more hay this year at an even higher cost.”

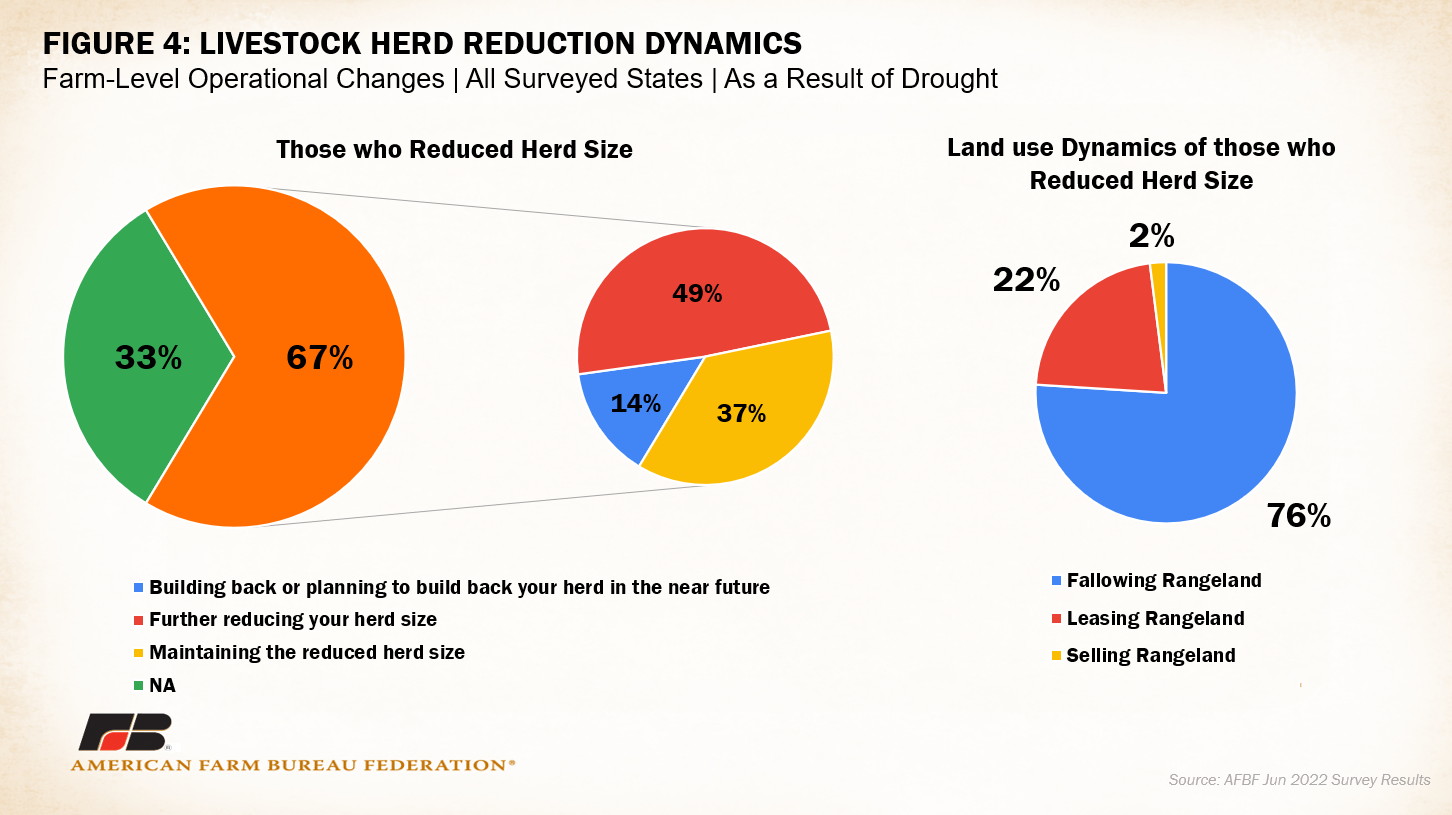

In this iteration of the survey, respondents were also asked about land fallowing and herd management behavior if they had reduced or liquidated their inventories last year. Of the surprising 67% of respondents who reported reducing herd sizes in 2021, nearly 50% were further reducing their herd or flock this year, 37% were maintaining the reduced herd size and only 14% were building their headcount back up. Thirty-three percent of the total respondents did not reduce herd sizes last year or did not raise livestock. Additionally, of those 67% who reduced their herd sizes, 76% fallowed the rangeland that was no longer in use, 22% leased the land to another rancher and only 2% sold the land. Even with dire conditions, ranchers reported holding onto their land, indeed a primary hold of producer equity. Smaller inventories of livestock across a region that supports over 70% of domestic beef production by value decreases production and drives up prices for consumers. Lower volumes of marketable product also translate to reduced payoffs for producers.

Water Access

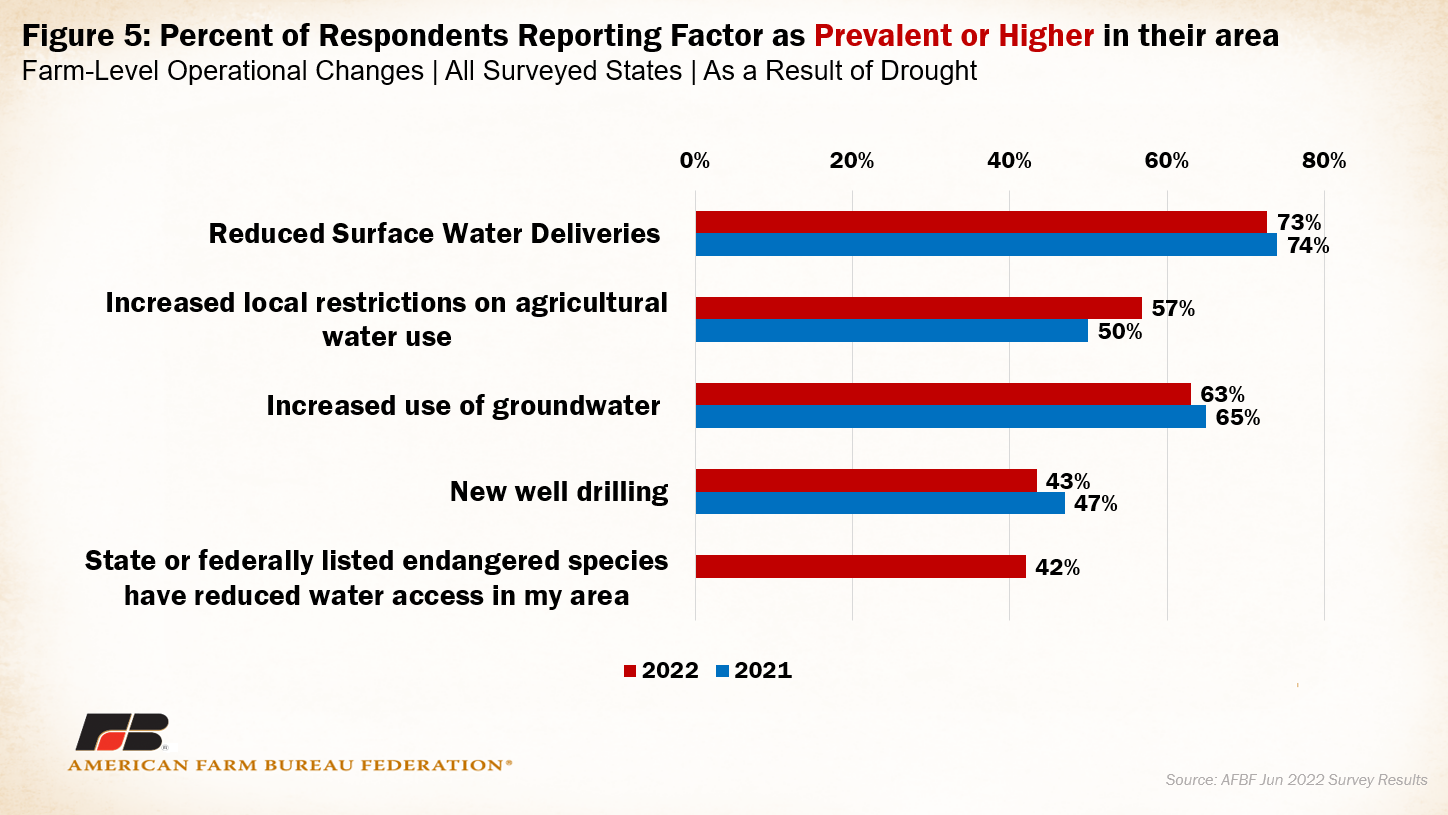

Reduced surface water deliveries and increased reliance on groundwater are widespread, with regional surface water delivery expectations down a whopping 50% from normal. These factors were highest in New Mexico (reported down 67%), Texas (down 59%) and Oregon (down 57%) and lowest in Nebraska (down 4%), which is expected as Nebraska is more reliant on groundwater sources. Figure 5 summarizes results from the general water access factor section of the survey.

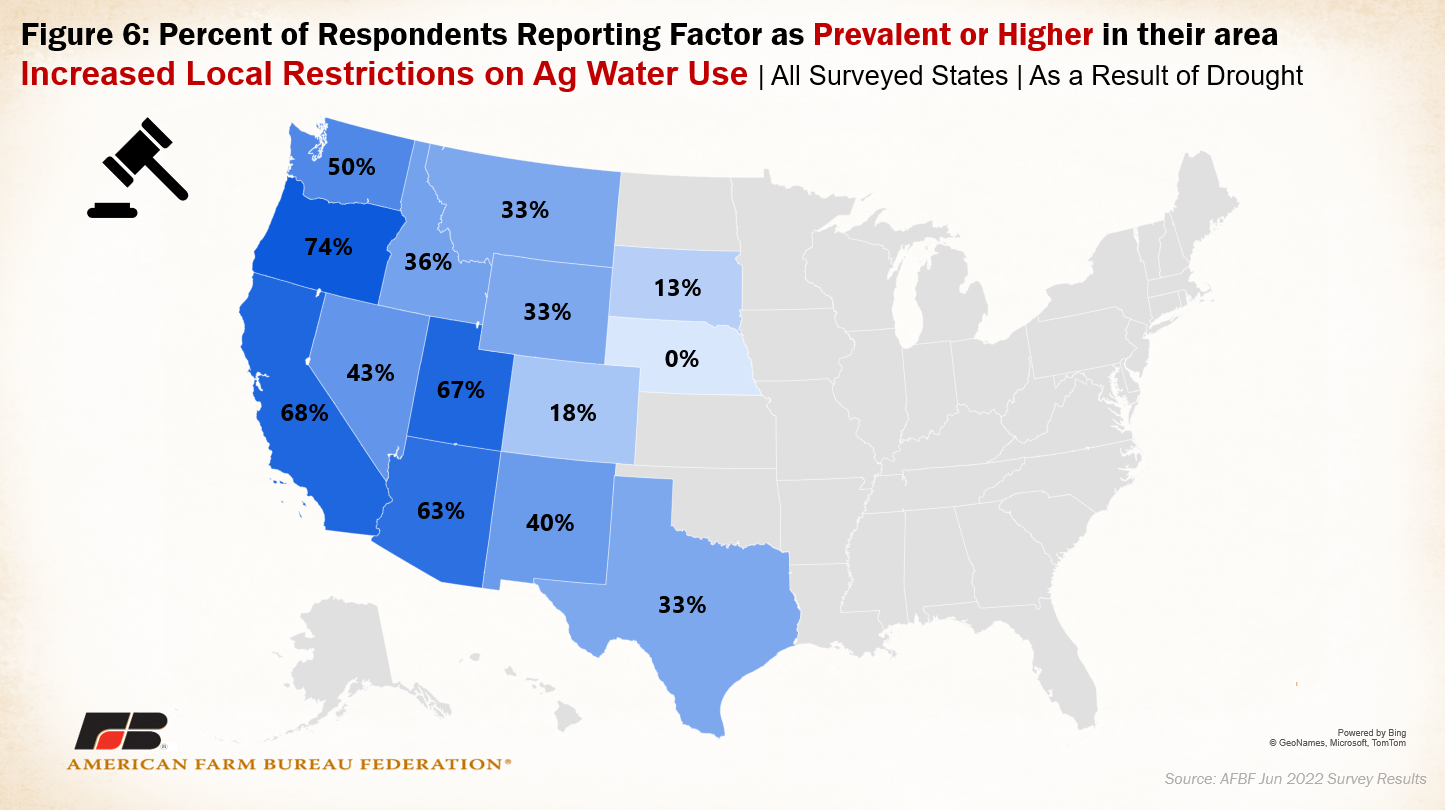

It is not surprising to see a jump in the percent of respondents reporting increased restrictions on agricultural water use in their area as prevalent or higher (50% last year vs. 57% this year). As reservoir levels decline, water management organizations such as irrigation districts often make cuts to allocations. In the Colorado River Basin, for example, both Lake Mead and Lake Powell, which provide surface water across 5.5 million acres of land in seven Western states, are below 30% of their total capacity. Drought contingency plans in the lower Colorado River Basin place surface water allocation curtailments on states as the water level drops. Recently, water levels in Lake Mead have dropped to 1,041 feet, further exacerbating concerns about the health of the Colorado River system and potential impacts to productive agricultural regions.

Producers also reported additional regulations on well drilling that have stunted access to groundwater, which dropped marginally in prevalence from 47% of respondents last year to 43% this year. One California producer noted that drilling a new well would be over a year and a half away. Still, over 60% of respondents continue to report increased use of groundwater, with the highest uses in California (63%) and Arizona (62%). In some cases, wells do not guarantee reliable water access, as another producer in California explained: “Discussing with adjacent landowner use of his well by agreement for a source of groundwater to replace anticipated loss of my well because of dropping groundwater levels and no source of surface water.” Others face salinity and additional mineral contamination barriers.

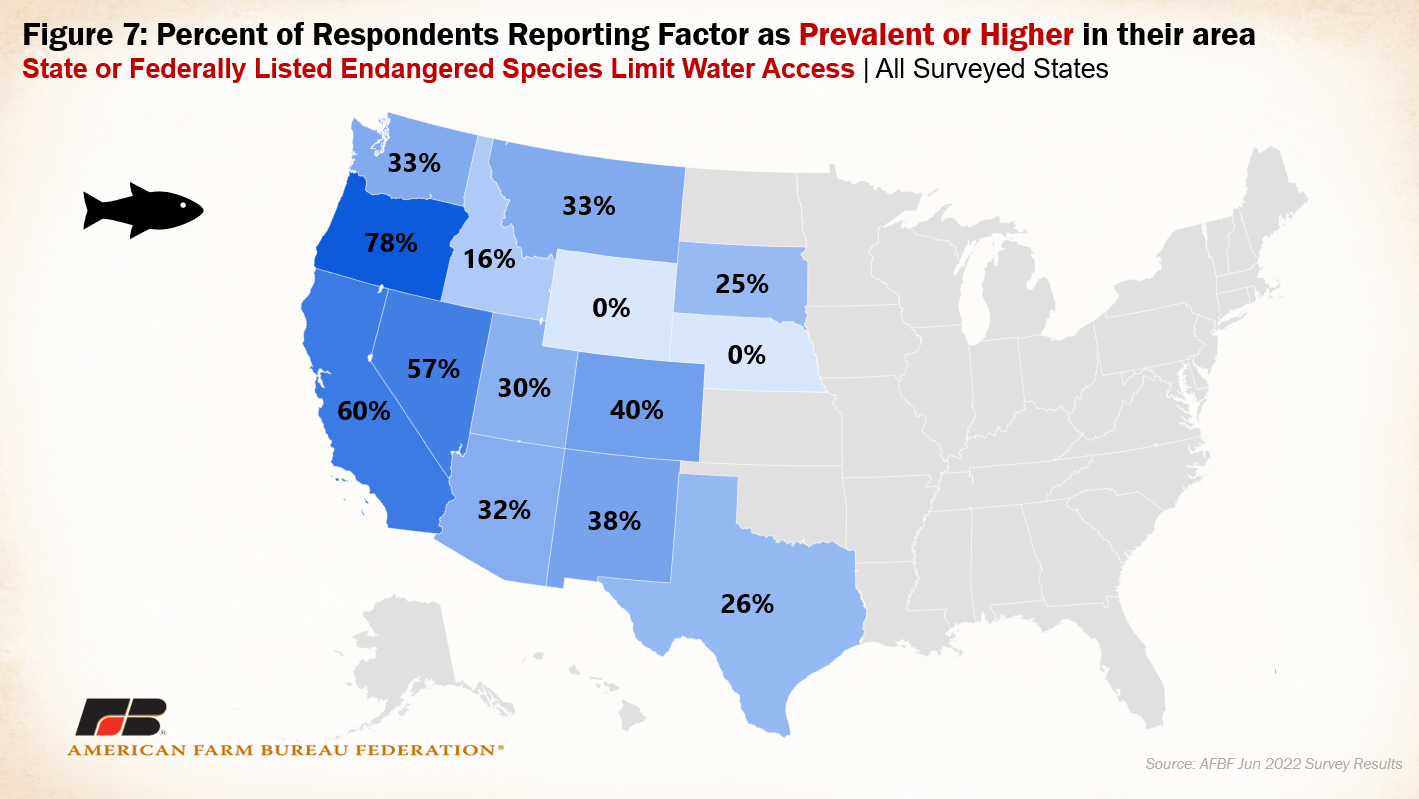

Endangered Species

Notably, drought isn’t the only cause of regulated water use. Over 40% of respondents reported that state or federally listed endangered species have reduced water access in their area. The Endangered Species Act prohibits the “take” of a species listed as endangered which, under the Act, is defined as, “to harass, harm, pursue, hunt, shoot, wound, kill, trap, capture, or collect, or attempt to engage in such conduct.” The act also defines “harm” to include significant habitat modifications or degradation that “kill or injure wildlife by significantly impairing essential behavioral patterns including breeding, spawning, rearing, migrating, feeding or sheltering.” This means many human, crop or livestock interactions with a listed species could be defined as harm if the U.S. Fish and Wildlife Service determines that natural behaviors have been disrupted, including by irrigation draws from rivers. One Oregon farmer comments:

“The Klamath Basin has water even in dry years. But because of ESA regulations and rival water calls, agriculture cannot access water that is available. Because of dam infrastructure, more water is released for environmental purposes than would have flowed under natural conditions. Single species regulation comes at a detrimental cost to both agriculture and other species. An example is the wildlife refuges are dried up with no water, putting the Pacific flyway in jeopardy.”

Regulatory implications of listed endangered species on water access compounds the effects of drought on agriculture across the West.

Even with the stark conditions, many producers have relied on good ol’ American ingenuity, transitioning acreage to more drought-resistant crop varieties such as Sudan grass, dry beans and rye. Others have invested in new production technologies to support their farms and ranches, hoping the risk brings reward. As one Utah rancher described it:

“We have purchased two HydroGreen fodder systems to sustain feed to cattle. Water usage is much less with it, but it was a lot of money up front. We have been able to increase our herd, but it is still with a lot of risk to our operation.”

Unfortunately, not all operations can afford to make these investments or are not as flexible in their ability to try new crop types, such as those grown on trees or vines. Overall, respondents expect their farm-related revenue to be down 38% from the average year due to drought, with the highest expected declines in Texas (-54%) and New Mexico (-50%). This magnitude in revenue losses ripples through local rural economies that support vital jobs, tax revenue and food security.

Conclusion

Farmers and ranchers across the Western half of the country continue to battle severe drought conditions. The ability to illustrate the severity of these conditions and their impact on agriculture with existing data is greatly limited. The results of AFBF’s 2022 Assessing Western Drought Conditions survey offer a window into operational-level hurdles farmers and ranchers face in coping with persisting water shortages. Most of these issues and adjustments negatively impact business income, putting the solvency of many farms and ranches at risk. For consumers, drought brings higher prices and scarcity of goods not grown in other regions. Given the region’s vital role in providing nearly half of American agricultural production by value, discussing and undertaking effective drought mitigation efforts is key to a secure domestic food supply and to protecting our farm and ranch families.

Top Issues

VIEW ALL