Restaurant Performance Index Increases; Expectations Remain Strong

AFBF Staff

photo credit: Alabama Farmers Federation, Used with Permission

The restaurant industry accounts for $799 billion in sales, according to the National Restaurant Association. It’s an important piece of the food business, debuting food trends, shaping how we eat and employing 14.7 million people. The restaurant industry is also highly cyclical and exposed to the economic winds of the overall economy. To capture restaurant owner sentiment, the National Restaurant Association surveys owners on a monthly basis, asking them to evaluate the current situation of the restaurant industry and what the expectations are for the next six months. That data is released as an index value in what is known as the Restaurant Performance Index.

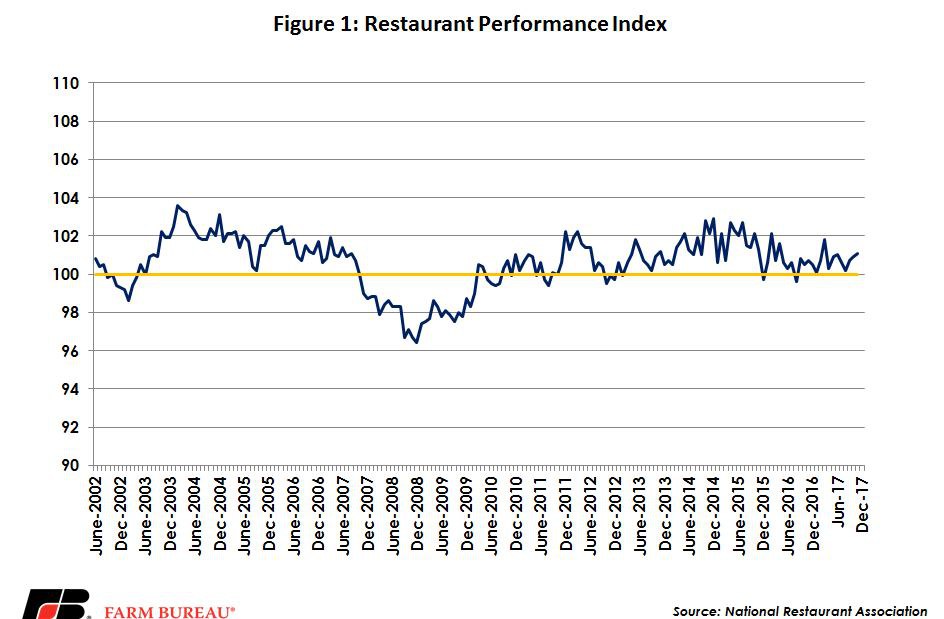

The most recent data, released at the end of December, looked at November through the beginning of 2018. The overall index increased compared to the previous month to 101.1. A value of 100 is recognized as a stable state of the industry—neither expansion nor contraction. Values above 100 indicate expansion, while values below 100 indicate contraction. November marks the 15th consecutive month the index has been over 100.

The index is divided into two categories: the current situation and the expectations index. This is designed to indicate strength or weakness in specific areas such as same-store sales, capital expenditures, labor, and customer traffic. In November, the current situation also improved, showing stronger same-store sales, customer traffic and labor. However, the current index value was still slightly below the 100 mark, indicating some current weakness. In an interesting contrast, a separate National Restaurant Association survey showed that in 2017 one in 10 adults planned on eating Thanksgiving at a restaurant.

On the expectations side of the index, restaurant owners are expecting the next six months to continue to improve. The November expectations index is the highest it has been in nine months. Business conditions were expected to gain the most ground, up 0.8 percent from last month, followed by same-store sales. Capital expenditures declined relative to a month ago, but still posted a value over 100.

In the last three months the gap between the current situation and the expectations index has widened. Expectations indicate strong growth in the future, but the current situation indicates that the last several months of positive expectations have yet to come to fruition. Capital expenditures declined relative to October in both the current and expectations index, which are longer term investments and could point to hesitation to commit to large upgrades, although both values were still at 100 or above. For the full report visit National Restaurant Association.

Top Issues

VIEW ALL