Reviewing Coronavirus Food Assistance Program Details

TOPICS

USDA

photo credit: AFBF Photo, Philip Gerlach

Shelby Myers

Former AFBF Economist

To provide immediate financial assistance to farmers and ranchers impacted by COVID-19, e.g., Coronavirus Sends Crop and Livestock Prices into a Tailspin and Pandemic Injects Volatility into Cattle and Beef Markets, the Coronavirus Aid, Relief, and Economic Security Act provided the Agriculture secretary with an immediate $9.5 billion and the Commodity Credit Corporation with a $14 billion replenishment, i.e., What’s in the CARES Act for Food and Agriculture. Combining existing CCC funding of $6.5 billion with the $9.5 billion appropriated, the secretary created a $16 billion Coronavirus Food Assistance Program that will provide direct payments to farmers and ranchers to partially offset COVID-19 related losses for livestock and specialty and non-specialty crops. On May 19, USDA unveiled the details of these payments, which are highlighted in this article.

Note: Not all commodities are covered by the newly announced payments because USDA’s Farm Service Agency did not have enough pricing data to determine a payment rate or estimate a loss. For those commodities, there will be a Notice of Availability of Funds and a call for data and information so that proper assistance can be determined.

Direct Payments to Producers

The $16 billion in direct payments will financially assist producers with additional adjustment and marketing costs resulting from lost demand due to COVID-19. To qualify for a payment, a commodity must have declined in price by at least 5% between mid-January to mid-April 2020. The payments will be coupled to actual production and based on actual losses agricultural producers experienced in response to price declines and supply chain disruptions, i.e., sales of commodities impacted by COVID-19. To ensure the availability of funds, producers will receive 80% of their maximum total payment upon approval of their application. The remaining 20% that does not exceed the payment limit will be paid at a later date.

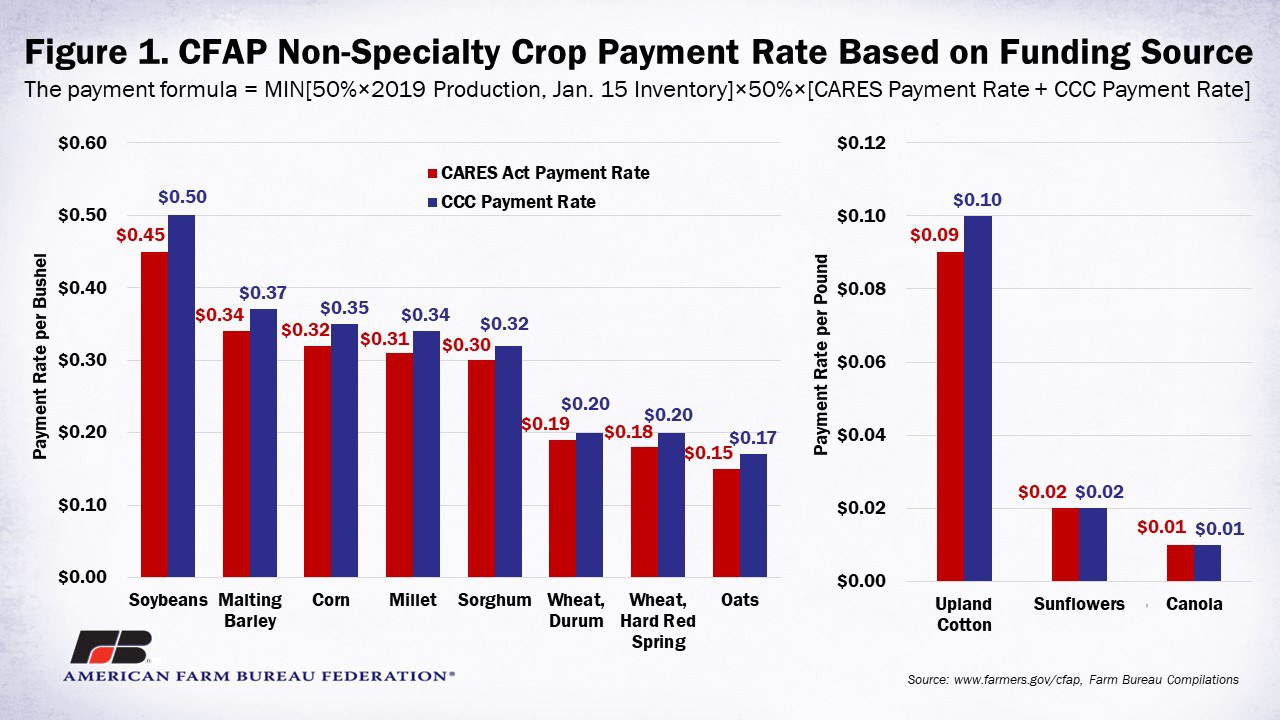

Non-Specialty Crops

For non-specialty crops, e.g., malting barley, canola, corn, upland cotton, millet, oats, soybeans, sorghum, sunflowers, durum wheat and hard red spring wheat, payments will be coupled to actual 2019 production and will be paid based on inventory subject to price risk held as of January 15, 2020. A single payment will be made based on 50 percent of a producer’s 2019 total production or the 2019 inventory as of January 15, 2020, whichever is smaller, multiplied by 50 percent and then multiplied by the commodity’s applicable payment rates.

The payment formula equals: min[50%×2019 Production, Jan. 15 Inventory]×50%×[CARES Payment Rate + CCC Payment Rate]

For example, Corn, a commodity particularly hard hit by COVID-19, will receive 32 cents per bushel from the CARES Act and 35 cents per bushel from the CCC, but will receive an effective payment rate of 33.5 cents per bushel on the minimum of 50% of 2019 production or inventory on January 15.

Producers will be required to provide their total 2019 production for the commodity that suffered a 5%-or-greater price decline, and total 2019 production that was not sold as of Jan. 15, 2020. CFAP payment rates from the CARES Act range from a low of 1 cent per pound of canola to 45 cents per bushel for soybeans. Payment rates from the CCC range from 1 cent per pound of canola to 50 cents per bushel of soybeans. Figure 1 displays the CFAP non-specialty crop payment rates.

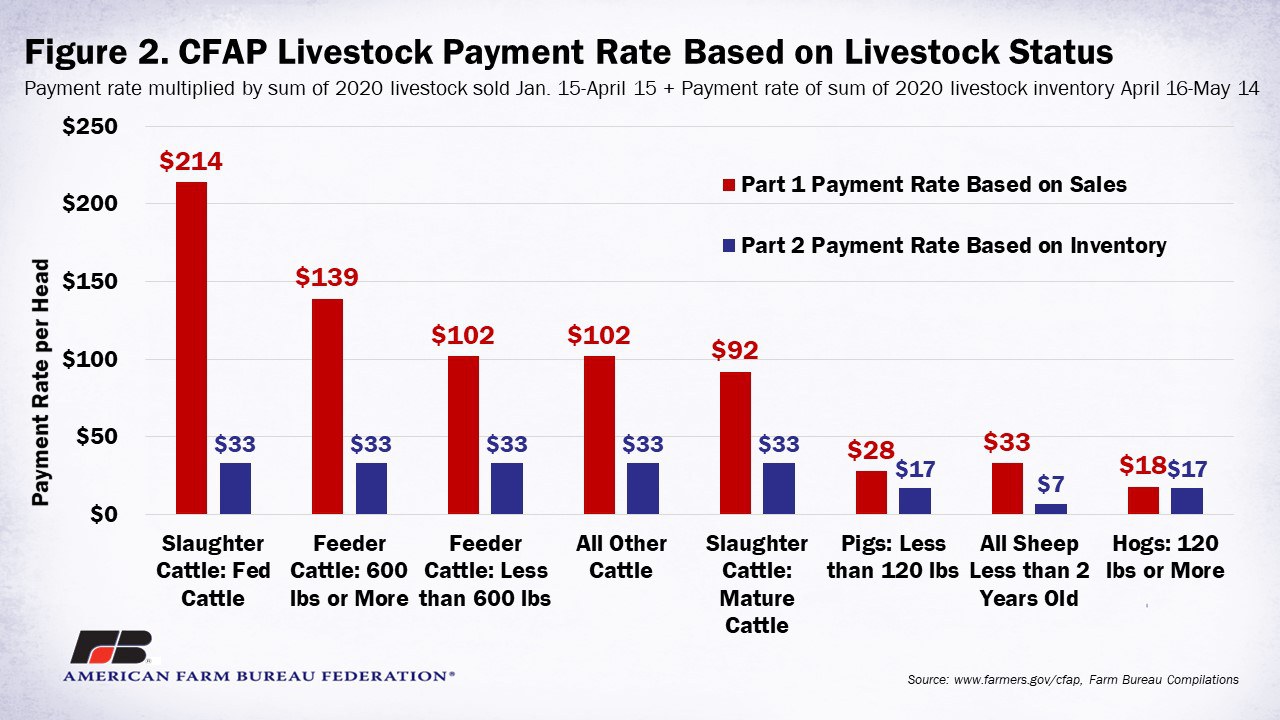

Livestock

Livestock producers are eligible for a CFAP payment if they have an ownership interest in cattle, hogs and sheep with a 5%-or-greater price decline as a result of the COVID-19 pandemic and face significant costs in marketing their inventories due to unexpected surplus and disrupted markets between mid-January and mid-April 2020.

Producers of eligible livestock, i.e., cattle, hogs and sheep, will receive a single payment for livestock will be calculated using the sum of the producer’s number of livestock sold between January 15 and April 15, 2020, multiplied by the payment rates per head, and the highest inventory number of livestock between April 16 and May 14, 2020, multiplied by the payment rate per head.

The payment formula equals: [Number of Livestock Sold Jan. 15 to Apr. 15]×[CARES Act Part 1 Payment Rate] + [Inventory Apr. 16 and May 14]×[CCC Part 2 Payment Rate]

For example, fed cattle sold between Jan. 15 and Apr. 15 will receive $214 per head, and the maximum number of fed cattle in inventory between Apr. 16 and May 14 will receive $33 per head. The payment rates are not additive and are paid on different sets of cattle. Producers will be required to provide the total sales of eligible livestock, by species and class, between Jan. 15, 2020 and April 15, 2020, of owned inventory as of Jan. 15, 2020, including any offspring from that inventory; and highest inventory of eligible livestock, by species and class, between April 16, 2020, and May 14, 2020. For livestock in inventory, payment rates range from $7 per head for sheep less than two-years-old to $33 per head for all cattle. For livestock sold, payment rates range from $18 per head of hogs 120 pounds or less to $214 per head for fed cattle. Figure 2 displays the CFAP livestock payment rates.

Dairy

Dairy producers are eligible for a CFAP payment if milk production occurred in January 2020, February 2020 and/or March 2020. Any dumped milk production during those months qualifies for assistance. A single payment is available for dairy producers based on a producer’s certification of milk production for the first quarter of the calendar year 2020 multiplied by $4.71 per hundredweight. The second part of the payment is based on a national adjustment to each producer’s production in the first quarter, e.g., 1.014 multiplied by $1.47 per hundredweight. Effectively, the payment rate is $6.20 per hundredweight on milk produced in the first quarter.

Wool

CFAP payments are eligible to wool producers who have suffered a five percent-or-greater price decline over a specified time as a result of the COVID-19 pandemic, and who face increased marketing costs for inventories.

Producers will be paid based on inventory subject to price risk held as of January 15, 2020. A single payment will be made based on 50 percent of a producer’s 2019 total production or the 2019 inventory as of January 15, 2020, whichever is smaller, multiplied by the commodity’s applicable payment rate.

The CARES payment rate for wool are 71 cents per pound for graded wool and 36 cents per pound for non-graded wool. The CCC payment rates are 78 cents per pound for graded wool and 39 cents per pound for non-graded wool.

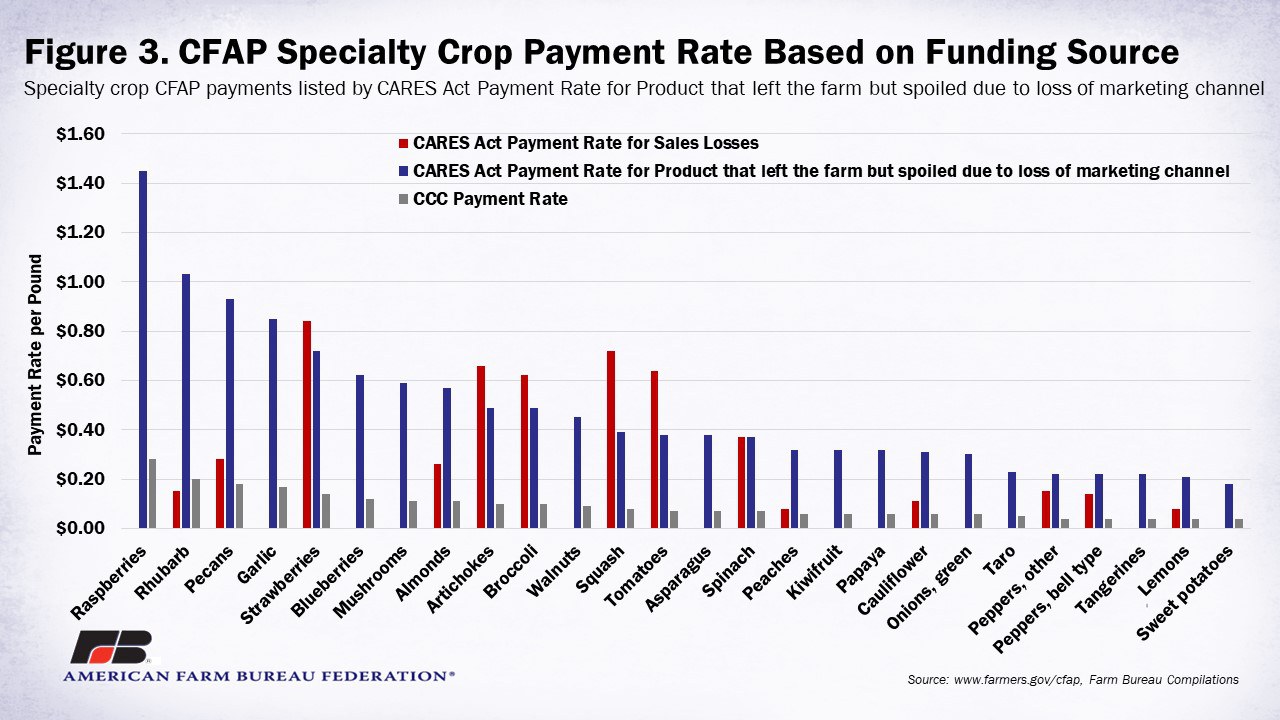

Specialty Crops

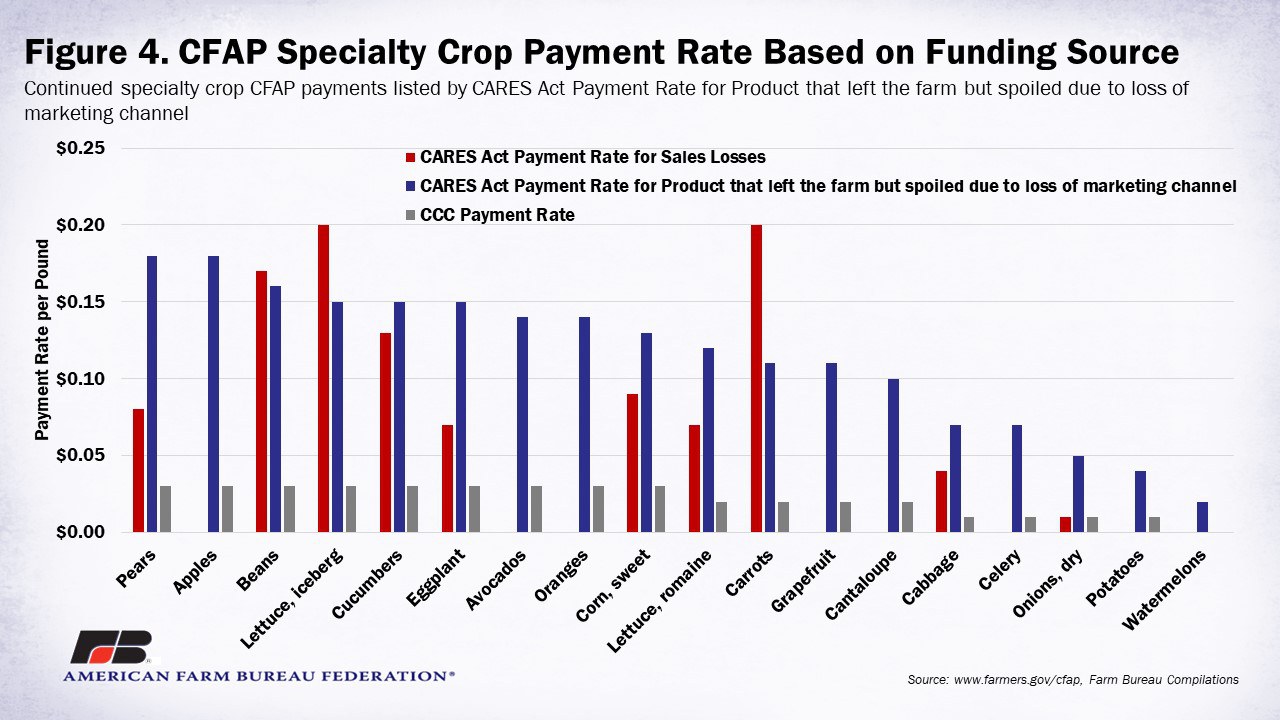

Specialty crop producers are eligible for CFAP payments if they 1) had crops that suffered a 5%-or-greater price decline between mid-January and mid-April as a result of the COVID-19 pandemic; 2) had produce shipped but subsequently spoiled due to loss of marketing channel, and 3) had shipments that did not leave the farm or mature crops that remained unharvested.

Depending on the crop and loss type, payment rates range from 1 cent per pound for crops like dry onions, cabbage, celery and potatoes to $1.45 per pound for raspberries. For more information, consult the CFAP Payments for Specialty Crops page provided by USDA to determine each eligible specialty crop and qualified loss type payment rate. Figure 3 and 4 display the CFAP payment rates for eligible speciatly crops.

Payment Limitations

Payment limits still apply but are unlike other FSA programs. A payment limitation of $250,000 is applied to the total amount of CFAP payments made for all eligible commodities. Also, entities structured as corporations, limited liability companies and limited partnerships may receive $250,000 per shareholder up to $750,000 for those who contribute at least 400 hours of active person management or personal active labor. Participation in other farm programs such as Agriculture Risk Coverage, Price Loss Coverage, Dairy Margin Coverage and Dairy Revenue Protection is complementary to CFAP and will not lower a recipient’s CFAP payments.

Summary

The Coronavirus Food Assistance Program helps producers offset COVID-19-related price declines for livestock, dairy and specialty non-specialty crops. Sign-up for the $16 billion in direct support to farmers will open May 26th and payments are expected to be distributed within seven to 10 days. Producers interested in signing up to participate in this program should know that USDA Service Centers will be open for business by phone appointment only. Additional details about requirements for program participation can be found on USDA’s CFAP website. This program is an important down payment in helping farmers and ranchers deal with the unprecedented and unexpected economic fallout related to COVID-19.

However, more help will likely be needed as the full extent of the crisis becomes known. To that end, USDA will see the Commodity Credit Corporation replenished by $14 billion in July, and lawmakers are currently considering what additional support may be needed to assist other sectors of agriculture not included in the current CFAP authority. Expanding the Commodity Credit Corporation’s borrowing authority to $68 billion would be a step in the right direction, i.e., Reviewing the Commodity Credit Corporation’s Borrowing Authority, as would several of the provisions in the HEROES act, e.g., Food and Agriculture in the HEROES Act.