Total Cheese in Cold Storage Hits Record-High for April

TOPICS

Milk

photo credit: Getty

John Newton, Ph.D.

Vice President of Public Policy and Economic Analysis

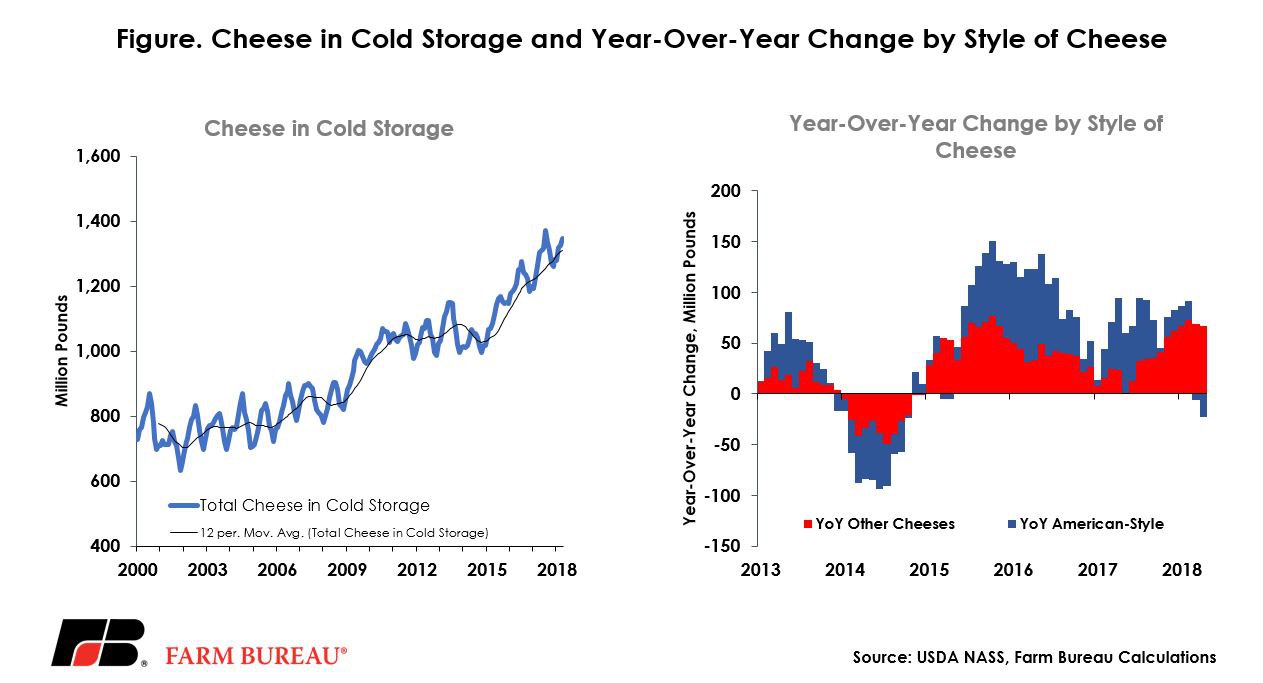

U.S. dairy farmers are expected to produce 218.7 billion pounds of milk this year. With total fluid milk sales in the first quarter of 2018 down nearly 2 percent compared to prior-year levels, more and more milk is finding its way into manufactured dairy products such as cheese. Cheese in cold storage totaled 1.35 billion pounds at the end of April 2018, the second-highest total on record since the series began in 1917 and the highest April total ever.

American-style cheese stocks totaled 781.5 million pounds, down 55 million pounds or 2.8 percent from prior-year levels. March and April 2018 mark the first time since April 2015 that American-style cheese inventories have been below the previous year’s levels. Inventory of other cheeses, including Italian-style and Swiss, climbed to a record 565 million pounds, up 66 million pounds, or 13 percent, from 2017.

Cheese inventories generally climb during the spring flush and peak in July prior to the summer grilling season, so it is anticipated that cheese inventories will continue to increase over the next two-to-three months, possibly eclipsing the record of 1.37 billion pounds set in July 2017.

Top Issues

VIEW ALL