Tracking Federal Milk Marketing Order Policy Developments | Part 2

photo credit: Getty

Daniel Munch

Economist

This is the second article in a multipart series following developments in Federal Milk Marketing Orders. The first, released in April 2023, can be accessed here.

If you’re involved in the dairy markets or policy either directly or indirectly, now is a fairly exciting time. After many years of task forces, forums, meetings and discussions, the fruit (or shall we say milk?) of the industry’s labor is the preliminary actions being taken by USDA to consider holding a Federal Milk Marketing Order hearing later this summer.

A quick recap of our last article: on March 28, both the International Dairy Foods Association (IDFA) and Wisconsin Cheesemakers Association (WCMA) submitted formal petitions to USDA for a federal order hearing to increase make allowances. In these original petitions, neither IDFA nor WCMA presented specific desired make allowance values, instead choosing to reference past studies (such as a 2021 Dr. Mark Stephenson cost-of-processing study) and ongoing Dairy Institute of California-based studies to inform future make allowance increases. USDA had 30 days (until April 29) to issue an action plan to complete a hearing within 120 days, request additional information from IDFA and WCMA, or reject their requests. Organizations representing dairy farmers, including the American Farm Bureau Federation, Edge Dairy Cooperative, and the National Milk Producers Federation (NMPF) all wrote letters objecting to the petitions submitted by IDFA and WCMA.

On April 28, USDA responded to IDFA’s and WCMA’s petitions with a request for additional information. Noting that specific make allowance values were not included in their original petitions, USDA requested additional information regarding specific make allowance values to be considered to assist the Secretary in deciding whether to initiate an FMMO rulemaking proceeding on this issue. This action punted the ball back to IDFA and WCMA on a Friday, and on the following Monday, May 1, the National Milk Producers Federation (NMPF) filed their own petition to USDA for a federal order hearing addressing five different pricing formula-related topics. This included increasing make allowances, returning to the “higher of” as the mover for Class I milk prices, updating milk composition factors, removing barrel cheese from the Class III price formula, and updating the Class I price surface. NMPF provided recommended values where applicable in their petition.

As described in the first article, AFBF does not support make allowance updates unless a mandatory survey of processor costs is in place and utilized. In reviewing 7 USC 608d(1) of the Agricultural Marketing Agreement Act, AFBF believes that USDA already has authority to collect and audit – on a mandatory basis – the processing and yield information needed to inform make allowances. AFBF does explicitly support, in principle, the four other recommendations of NMPF’s petition, many of which were consensus items out of AFBF’s October Federal Milk Marketing Order Forum. In a letter, AFBF urged USDA to accept NMPF’s petition for a comprehensive FMMO hearing, asked USDA to solicit additional proposals for that hearing, and emphasized the department’s authority to collect processing cost and yield data from dairy manufacturers. Numerous other state and national dairy organizations and cooperatives also submitted letters in support. Several groups, including Edge Dairy Cooperative, have pushed for a pause to any federal order hearing efforts until a farm bill is passed.

As with IDFA’s and WCMA’s petitions, USDA had 30 days to respond to NMPF’s petition. On June 1 USDA did so by releasing a tentative action plan to hold a hearing pending final decision from the Secretary of Agriculture expected in late July. In the interim, USDA opened a short period for additional proposals to be submitted. This provided an opportunity for other stakeholders to comment on the already proposed changes while also adding additional topics for USDA to consider in a possible hearing. In this decision, USDA also recategorized new versions of IDFA’s and WCMA’s petitions, which were updated with additional numeric values, as additional proposals. USDA held a pre-hearing information session to allow submitters to explain their proposal(s), which were submitted by a June 14 deadline, and provide instructions on appropriate proposal etiquette. Proposals that needed to be updated or edited based on conversations from the virtual pre-hearing information session were due June 20. Secretary Vilsack will then decide whether or not to hold a hearing by late July, with a tentative hearing started by August 23. USDA has assured stakeholders that farmers will be able to participate and testify virtually throughout a possible hearing. USDA has also announced a possible hearing would take place in Carmel, Indiana.

| Pre-Hearing Steps | Anticipated Timeframe |

|---|---|

| Additional Proposals Requested | Additional proposals must be received by 5:00 p.m. (ET), Wednesday, June 14, 2023 |

| Virtual Pre-hearing Information Session | Friday, June 16, 2023 – 10:00 a.m. (ET) |

| Modified Proposals Due | Tuesday, June 20, 2023 – 5:00 p.m. (ET) |

| Hearing Published Federal Register | Late July 2023 |

| Tentative Hearing Start Date | August 23, 2023 |

AFBF policy includes FMMO priorities not included in NMFP’s petition. The following sections outline these additional proposals AFBF submitted for consideration to USDA.

1. Adjusting yield factors if make allowances are updated (based on a mandatory survey)

As discussed, AFBF does not support make allowance adjustments unless data from mandatory and audited USDA surveys is used. As presented in part one, historically, voluntary research efforts have often been utilized to inform adjustments to make allowances. In one of the most recent studies, released in 2021, 80% of butter plants, 76% of cheddar cheese plants, 71% of dry whey plants and 40% of nonfat dry milk plants did not participate – which corresponded to 111 out of the 168 total plants (66%) not providing cost data. This means two-thirds of dairy manufacturing plants did not participate in a survey that could potentially be used to inform binding minimum pricing requirements for farmers.

The conversion of commodity prices into component prices within the FMMO pricing systems includes a yield factor in addition to the make allowance. The yield factor is an estimate of how much product can be produced from a certain quantity of milk components. As production and processing characteristics change both on the farm and in processing facilities, this estimated yield value can also change. Efficiency gains contribute to higher yields that would increase the value of producers’ milk. To maintain fairness within the system, AFBF supports yield factors being adjusted at the same frequency make allowances are adjusted based on mandatory surveys of both costs and processing yields.

2. Paycheck transparency

As noted in part one, each milk handler, whether cooperative or proprietary, presents farmers’ milk check calculations differently. In many cases, the values farmers see for their milk components (butterfat, protein and other solids), producer price differentials (PPDs), assortment of possible premiums, transportation deductions and any other market adjustment are very hard to compare. Farmers within the same county have reported completely opposite PPD values, wide-ranging and undefined market adjustments or vastly different component values. Farmers may also be unable to view whether or not – and how much of – their milk has been pooled. Additionally, there is currently a difference in the requirements of milk check disclosures for proprietary handlers and cooperative handlers. AFBF proposed requiring the same level of transparency across all producers, whether they are a cooperative member or not. AFBF also suggested that the information on milk checks be expanded to include a separation of pooled and non-pooled milk. This would help farmers better understand the relationship between their actual pay price and the price for their milk if they were paid the federal order minimum. If producers had milk pooled on different orders, those quantities of pooled and non-pooled milk on each order would also be reported on milk checks.

3. Reduce de-pooling

Under classified dairy pricing, handlers participating in an order have an obligation to the pooling function of federal orders based on how the milk is used (the Class price). In seven of the 11 federal orders dairy farmers are paid based on the component content of their milk via what is known as multiple component pricing. In this process the producer value of milk is determined monthly based on the cheese milk (Class III) component levels of fat, protein and other solids. The difference between the total pooled revenue from what handlers pay via the set Class price and the component value worth of producer’s milk is denoted as the producer price differential. When the component value of milk in the pool is higher than revenue pooled from paid Class prices, deductions are applied to farmers in the form of a negative producer price differential. Dairy farmers became accustomed to negative PPDs during 2020 and 2021 with average all-market PPDs reaching over -$7 per hundredweight – showing up as a massive deduction on milk checks. This leads to handlers withdrawing milk from the pool. (Handlers of Class II, III and IV can de-pool. Class I handlers cannot.)

The most common of the many factors that contribute to the existence of negative PPDs are: Class III milk value rising above the butter-powder (Class IV) milk value, changes in utilization rates of milk due to production changes in an order, the advanced prices for Class II skim and Class I milk lagging behind rising Class III component prices, and changes in utilization due to de-pooling by handlers deciding to not pool milk in an order for one or more months by which de-pooling leads to more de-pooling.

a. Eliminate advanced pricing of Class I milk and Class II skim milk

One possible way to disincentivize de-pooling is removing the current use of advanced prices in Class I and II products. In the current regimen, weighted average prices from the first two weeks of each month are used to calculate advanced prices for the following month used to price Class I and Class II products. Advanced prices are announced by the 23rd of the month for the following month, while Class III and IV prices are not final until the fifth of the following month. For example, advanced prices are announced on June 22 for Class II skim milk and Class I milk delivered this July, while Class III and IV prices will not be final until August 2. This arrangement creates a long lag between when the advanced prices and current prices are announced for that same month and means that the advanced prices (Class II skim milk and components and Class I skim milk and butterfat) can be based on weekly data that is 25 to 40 days older, on average, than the basis for the “current” prices (Class II butterfat and all Class III and IV prices).

This means when market prices rally, announced prices are higher than advanced prices, and the PPD will be lower, and vice versa. For handlers tracking markets closely, this lag time creates an opportunity to de-pool milk from the order to benefit from the non-pooled value of possible rallied prices. When handlers de-pool as a result of comparatively high manufactured product prices, the resulting deficit in the order from lost pool value results in generally lower or negative PPDs for producers.

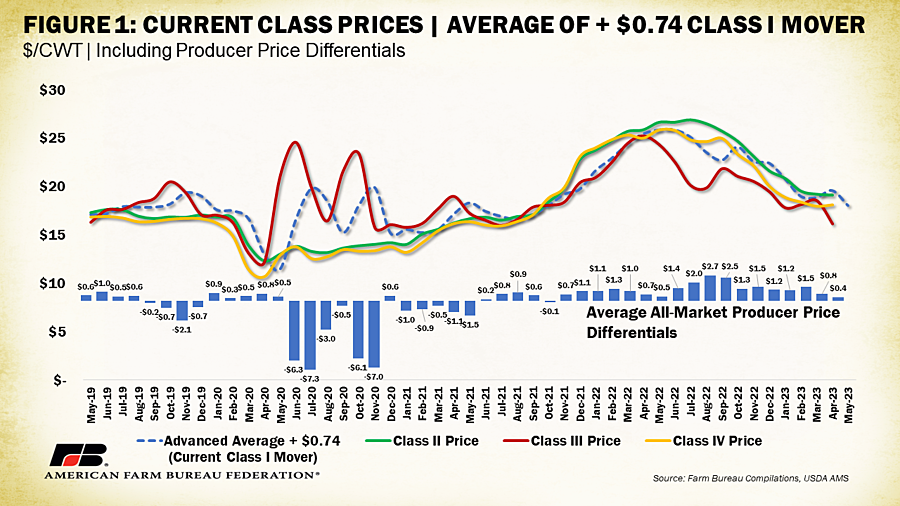

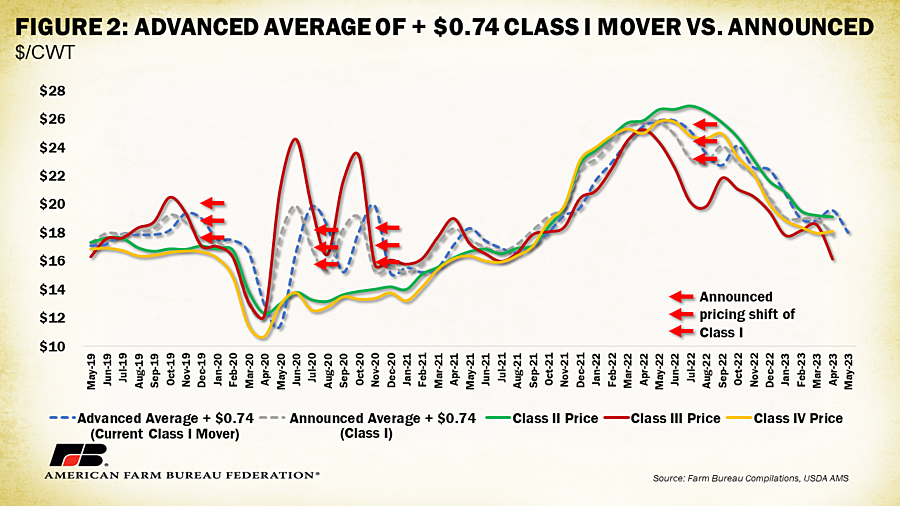

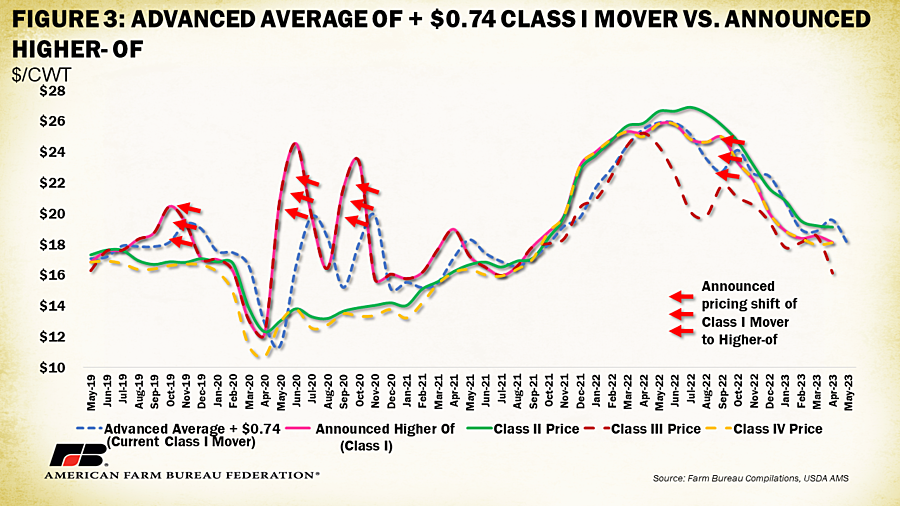

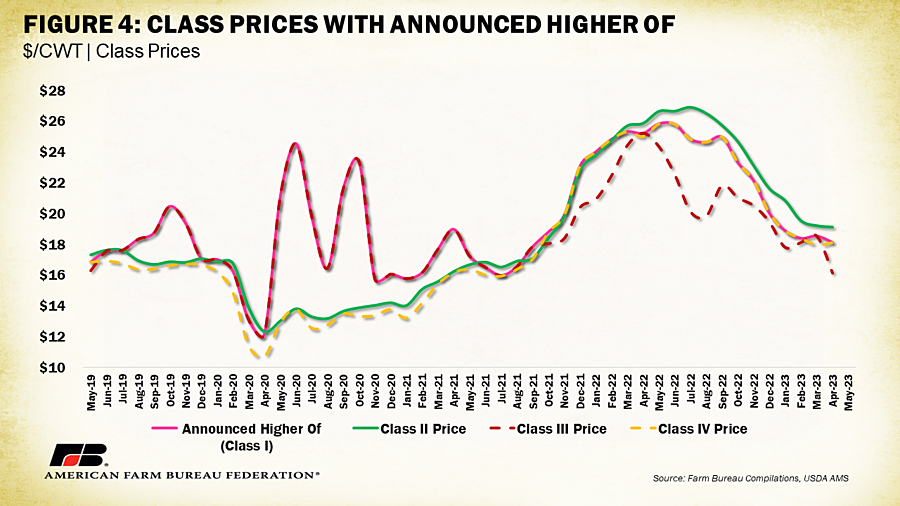

By removing advanced pricing, all commodity prices would be announced during the same month, removing any lag time within the pricing system. Combining this adjustment with a return to the “higher-of” Class I mover could further reduce price spreads that contribute to a higher probability of handlers de-pooling from the marketplace. Figures 1- 4 illustrate the current class price system, the current class price system including a shift to an announced Class I base pricing, the current class price system including a shift to announced Class I base pricing and a switch to the higher-of Class I mover, and what the class price system would have looked like with announced pricing and a switch to the higher-of Class I mover, respectively (all else held equal). Notably with both adjustments made, the Class I base price moves in tandem with the higher-of price between Class III and Class IV with no lag present.

Another impact would be the likely demand for bottlers and retailers to find opportunities to forward price. These opportunities exist in the marketplace, including off-exchange swaps, the use of derivatives based on Class III and IV futures and options, and the likely development of a Class I futures and options complex at the CME Group, based on an expected call for such from the industry.

b. Increase the Class II differential with drying/rewetting cost update; base on cost/yield survey

AFBF also proposed an increase in Class II differentials as a way to increase the minimum order value of Class II milk, increasing the average pool value in every order and reducing the likelihood of negative PPDs and attendant de-pooling. The Class II differential was initially developed during order reform to reflect the cost of drying and rewetting milk, to reflect the higher value of Class II milk without incenting processors to dry and rewet (Class IV) milk for Class II uses. The current differential sits at 70 cents and is added to the advanced Class IV skim milk pricing factor in the calculation of Class II milk. This value is out of date and no longer meets the purpose of incenting the availability of Class II milk.

Since many processors argue that powder is not rewetted for most uses, the minimum cost of rewetting is not an appropriate consideration for this calculation. For that reason, and for simplification, AFBF proposed adopting only the cost of drying in setting the Class II differential. This would ideally be based on a recent mandatory and audited cost and yield survey; in the interim, however, this could be updated using the current make allowance for nonfat dry milk (NDM), together with the current nonfat solids (NFS) yield factor and updated butterfat and nonfat solids tests for milk in the FMMOs. The cost of drying skim milk can be calculated then as:

$0.1678 x 0.99 x 9.4121 = $1.56

or

NDM make allowance x lbs. NDM/lb. NFS x avg. lbs. NFS/cwt. skim milk = cost of drying

The impact of this hypothetical change would increase the minimum order value of Class II milk by 86 cents per hundredweight, increasing the average pool value in every market and reducing the likelihood of negative PPDs and attendant de-pooling. There were 14.2 billion pounds of Class II milk pooled in 2022; in a static analysis, the value of pooled milk would be increased by $122 million. The $1.56 differential is lower than the lowest Class I differential ($1.60) so, combined with a return to the “higher-of” Class I price formula, it maintains Class I prices above Class II in every month.

4. Add 640-pound blocks to the Class III protein calculation and NDPSR survey

Per dairy mandatory price reporting regulations, USDA collects and releases sales information only for products used in Federal Milk Marketing Order milk pricing formulas via the National Dairy Products Sales Report (NDPSR). Each week USDA surveys dairy product manufacturers selling 1 million pounds or more of cheddar cheese, butter, dry whey and nonfat dry milk to determine the sales price and volume of dairy products sold.

The specific products and specifications are below:

- Salted butter (80% butterfat), fresh or storage, in 25-kilogram and 68-pound boxes meeting USDA Grade AA standards.

- Cheddar cheese in 40-pound blocks, colored between 6 and 8 on the National Cheese Institute color chart, meeting Wisconsin State Brand, USDA Grade A or better standards. Sales of cheddar cheese 4 to 30 days of age.

- Cheddar cheese in 500-pound barrels, white, meeting Wisconsin State Brand, USDA Grade A or better standards. Sales of cheddar cheese 4 to 30 days of age.

- Edible non-hygroscopic dry whey in 25-kilogram bags, 50-pound bags, totes and tankers meeting USDA Extra Grade standards. Dry whey must be less than 180 days old and must not be certified organic.

- Non-fortified, nonfat dry milk in 25-kilogram bags, 50-pound bags, totes and tankers meeting USDA Extra Grade or USPHS Grade A standards. Nonfat dry milk must be less than 180 days old.

Notably, many dairy products sold are not included in the survey. One such product AFBF supports adding is 640-pound cheddar cheese blocks. There has been a pronounced shift from 40-pound blocks to 640-pound blocks in the marketplace. AFBF expects the addition of 640-pound blocks to the survey would strengthen price discovery, avoid the potential for block manufacturers to switch between sizes to avoid and re-enter the price survey, and avoid a possible data quality crisis of dwindling small block volume in the future.

5. Add unsalted butter to the butterfat and protein calculation and NDPSR survey

Adding unsalted butter to the butterfat and protein calculations and NDPSR survey parallels, in reasoning, the request to include 640-pound cheddar blocks. Previous analysis has demonstrated butter has the lowest representation in the NDPSR survey compared to total U.S. production, with under 15% of butter production captured in the survey between 2019 and 2021. The current survey excludes unsalted butter explicitly, likely because at the time of that decision unsalted butter was a low volume product. Currently, estimations place unsalted butter at about 40% of all butter sales, partially linked to increases in retail demand from bakery product manufacturers. AFBF believes including unsalted butter in the NDPSR would increase the survey price, making it more representative of the market value of all butter and likely increasing the price of butterfat for dairy farmers through its effect in the butterfat formula.

6. Consider make allowance adjustments for plants that balance the market

In dairy markets, balancing refers to efforts to offset excess supply during flush or high production times of year and buffer against shortages during short production months. Often this is partially accomplished by processing plants building large enough facilities to process higher quantities of milk in flush months and running at lower capacities during other parts of the year. During those lower supply short months these processors lack the benefits of economies of scale since much of their capacity goes unutilized. This includes less-than-fully utilized staff and a greater cost per pound of product manufactured under the same fixed overhead costs of full capacity. To help compensate plants for this effort important to promoting orderly marketing, AFBF has requested the exploration of variable make allowances for cooperatives and plants that balance the market.

In short, having make allowances that increase for plants that run less full would partially compensate seasonal balancing efforts. One potential concern, however, with this request is that plants could be incentivized to process less to benefit from higher make allowances, but this can be offset by basing calculations off of the true Class III and IV utilized volume in each plant.

7. Consider seasonal Class I differentials

Class I location differentials, fixed values ranging from $1.60/cwt to $6/cwt, are an important element of the Class I beverage milk price formula. Currently, every U.S. county is assigned a fixed Class I location differential based on the supply and demand characteristics of the region. To support production and marketing in milk-deficit regions, location differentials are added to the base value of Class I milk to determine the total class value. The current Class I differentials were established in 1998 with only a minor update in 2008. Many of the factors used to estimate differentials effectively have since changed, to the point that current differentials no longer ensure an adequate supply of milk to many plants. In addition to AFBF’s support for increasing Class I differentials, as outlined in NMPF’s petition, AFBF also proposed exploration of seasonal Class I differentials.

Milk supply and demand changes daily while milk prices and location adjustments are fixed on both a monthly and annual basis. For example, daily milk receipts at bottling plants fluctuate during the week with peak receipts early in the week and less milk received as the weekend approaches. Additionally, on a monthly basis milk supplies and demand are not always aligned. For example, in the Southeast marketing order, milk supplies exceed Class I demand during the first half of the year, but in the second half of the year milk supplies are not enough to meet local demand. Milk supplies can be like an ocean, ebbing and flowing in opposite directions depending on the month. Class I prices that are too high for the flush season can draw too much milk into a high Class I pool, without necessarily serving the market at all. Similarly, Class I prices that are too low in the late summer or early spring can fail to attract the basic needs of a market without balancing cooperatives bearing an undue burden. Seasonal Class I differentials can incent milk movement when and where it is appropriate, reduce pool riding and better supply short markets by setting the right price in the right place at the right time.

8. Extend 30-day limit to 45 days for nonfat dry milk in NDPSR

Currently, the NDPSR survey excludes products sold under the terms of a forward contract negotiated 30 or more days prior to the transaction, as well as any product sold for export. Today, a large share of nonfat dry milk and comparable skim milk powders manufactured in the U.S. are exported, and most of the product ships more than 30 days after the price is set by the buyer and seller. Some exporters believe that this is an unfair exclusion that leads them to face undue variation between the Class IV skim milk and nonfat solids price and their selling prices.

AFBF proposes that the limit of 30 days between setting a price and shipping out the product be lifted to 45 days for nonfat dry milk in the NDPSR in order to capture a wider array of prices. This change may be best handled through the notice and comment rulemaking to amend existing regulations in 7 CFR 1170 to conform to FMMO changes made in a hearing. However, AFBF believes that discussion of these topics during a tentative hearing would establish a sounder basis for future rulemaking.

Conclusion

USDA is in the process of making a final decision on whether or not to hold the first national Federal Milk Marketing Order hearing in over a decade. The proposals above outline the priorities of AFBF going into this rulemaking process and are aimed at ensuring farmers are paid fairly and accurately, minimizing de-pooling and promoting orderly marketing of milk.

Top Issues

VIEW ALL