Trade Aid Round One: A State Perspective

TOPICS

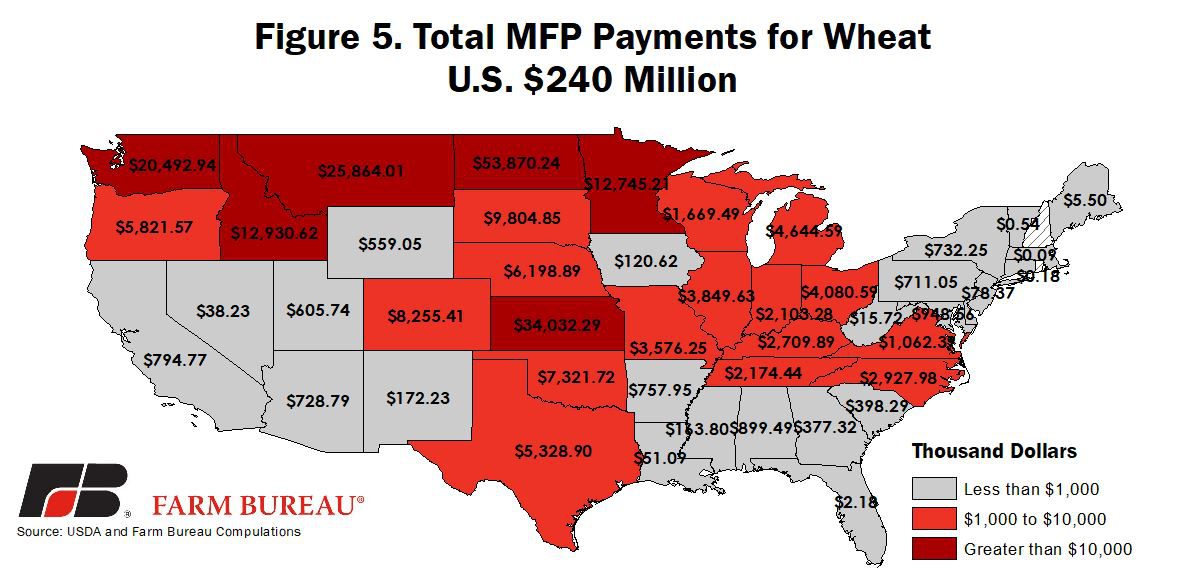

Wheat

photo credit: Getty

Veronica Nigh

Former AFBF Senior Economist

Trade Aid. Trade mitigation package. Assistance for farmers impacted by unjustified retaliation. No matter what you call it, we can all agree that the agricultural community has been eager to learn exactly how USDA would authorize up to $12 billion in trade aid slated to be distributed via three programs beginning after the Labor Day holiday.

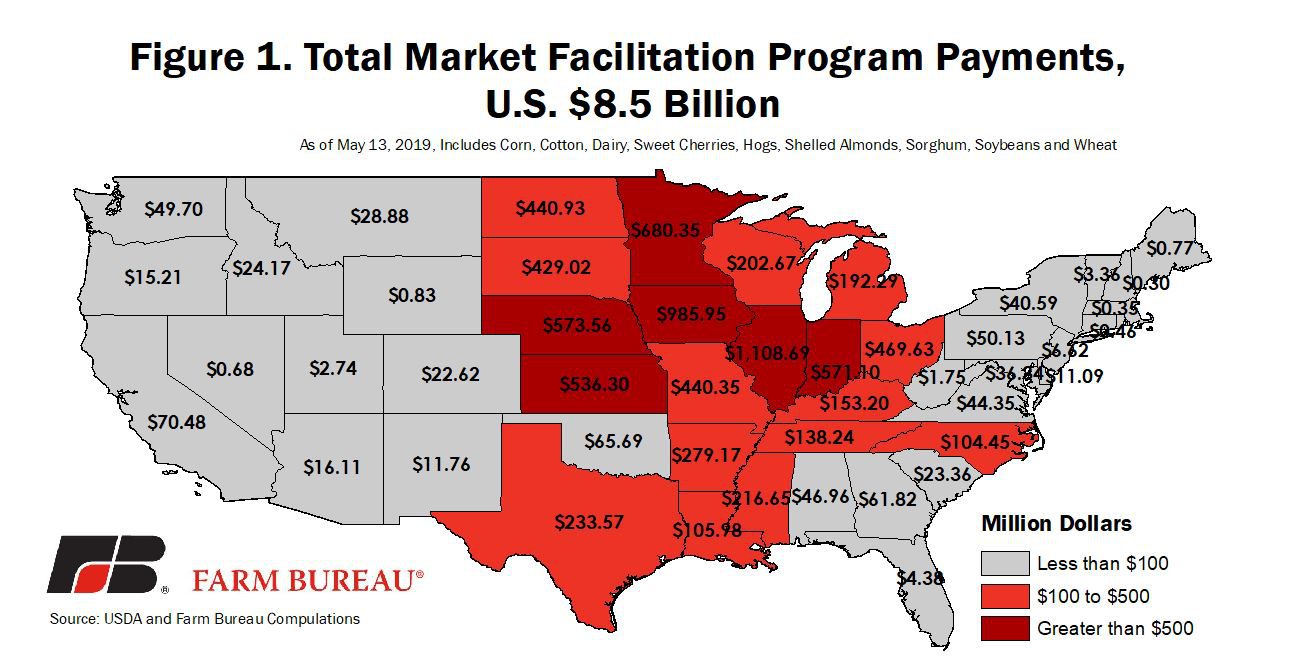

On August 27, USDA released details about how those payments will be allocated across those three programs and across affected commodities. Here we explore the state-level impact of the largest program, the Market Facilitation Program. As details are made available from USDA, future MI articles will delve into the Food Purchase and Distribution Program and the Agricultural Trade Promotion Program.

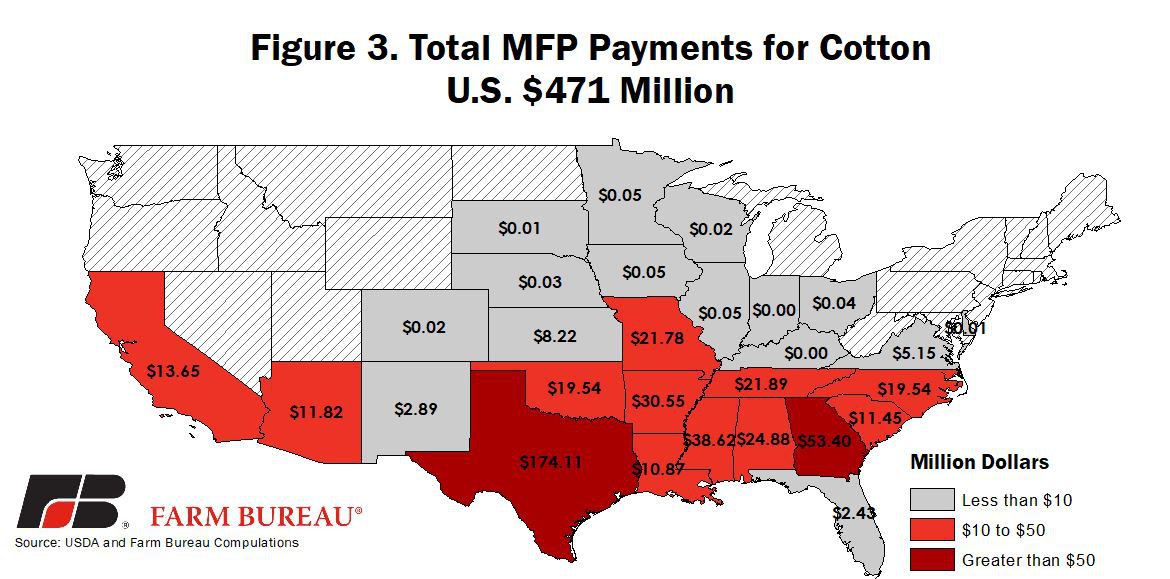

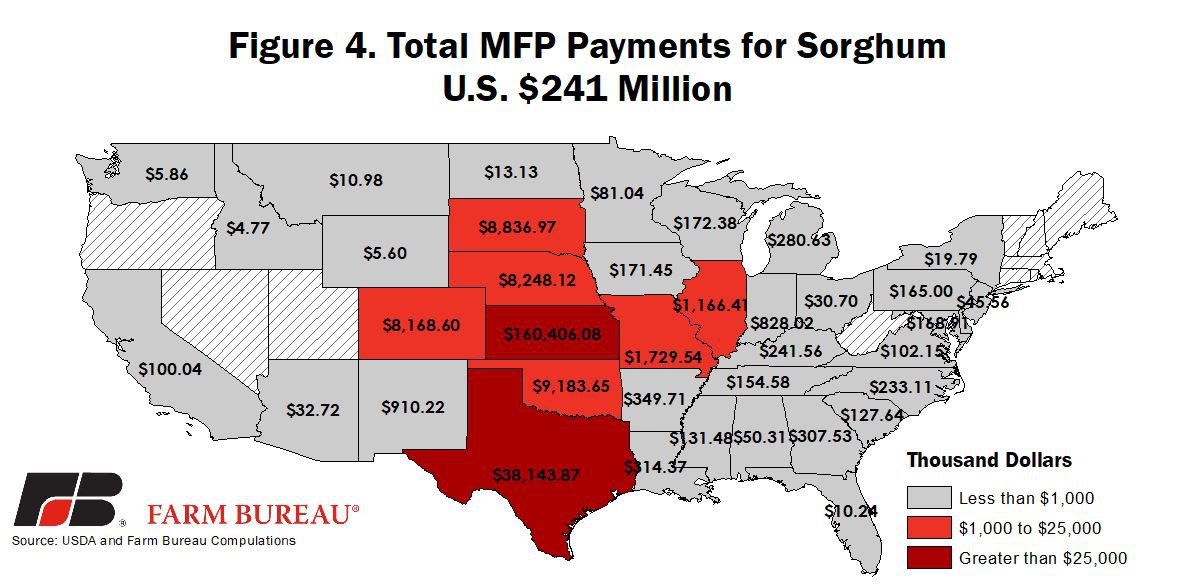

The Market Facilitation Program is intended to aid corn, cotton, dairy, hogs, soybeans, sorghum and wheat producers who have been impacted by retaliatory tariffs enacted by trading partners. Each commodity on the list has faced tariffs of various severity in different and sometimes multiple markets, which has resulted in a wide range of trade and price disruption.

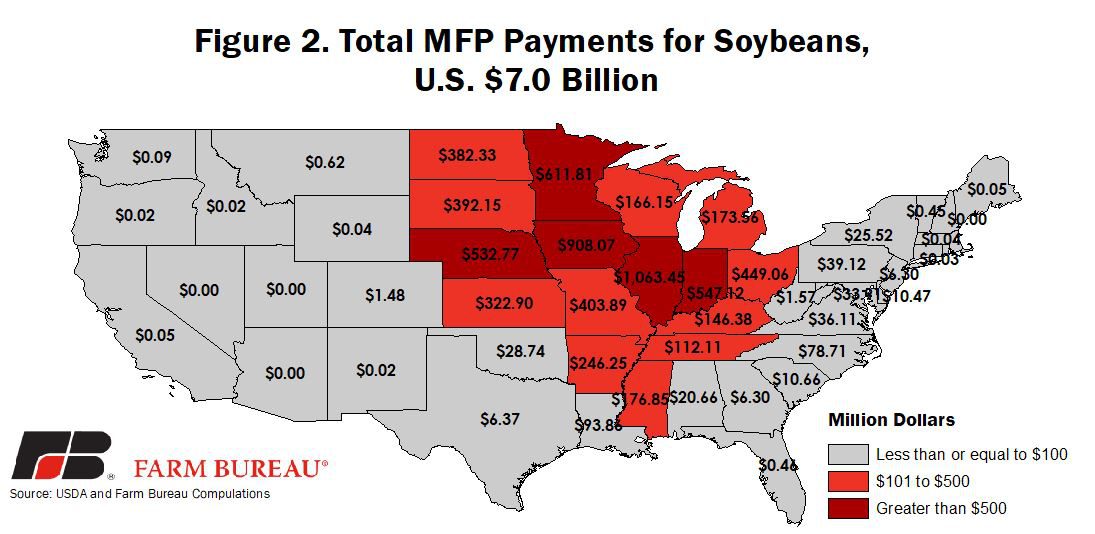

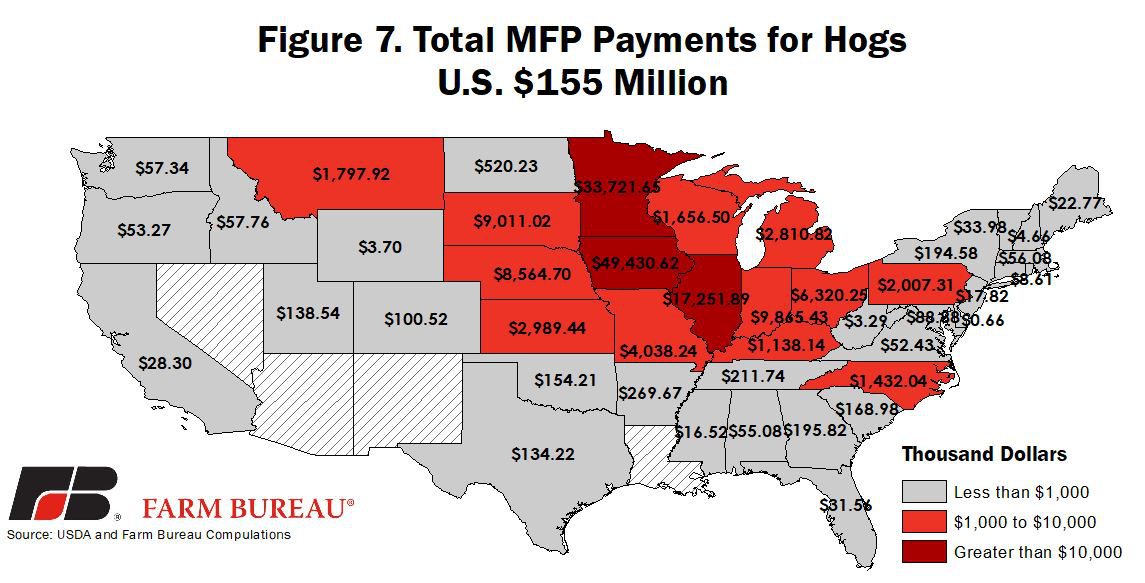

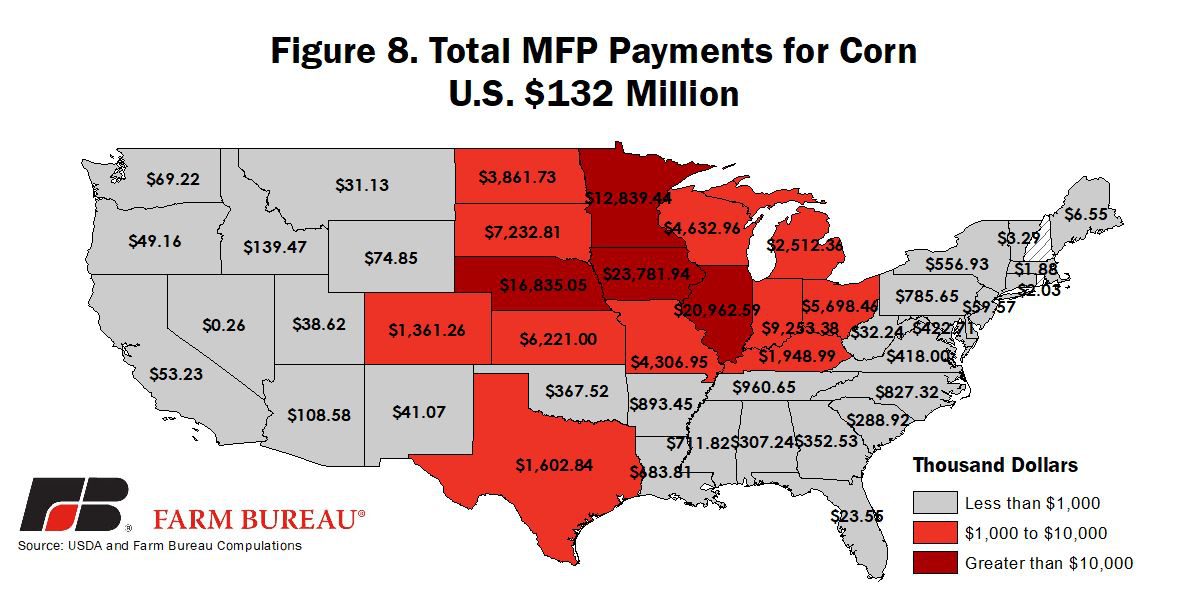

For example, several U.S. pork products face additional tariffs of 20 percent in Mexico (our #2 market for U.S. pork) and additional duties of 50 percent in China (our #4 market for U.S. pork). Combined, these two markets accounted for 36 percent of U.S. pork exports in 2017. While soybeans are only on one retaliation list, China’s, the additional 25 percent duty has led to a significant disruption given the large share of U.S. soybean exports destined for that market. In 2017, 57 percent of U.S. soybean exports went to China. U.S. corn, another product on the list, is now subject to additional tariffs in both the European Union and China, but those markets combined for a mere 3 percent of U.S. corn exports in 2017. USDA’s job of isolating the impact on these commodities during a summer of volatile prices was far from enviable.

Producers of commodities covered under the MFP will be eligible to submit applications for support on Sept. 4, or after harvest is 100 percent complete and they can report their total 2018 production, whichever comes first. Payments will be made in two parts, with the first payment guaranteed to occur. USDA will have the discretion to determine if a second payment period is warranted by trade conditions. The initial MFP payment will be calculated by multiplying 50 percent of the producer’s total 2018 actual production by the applicable MFP rate. If Commodity Credit Corporation announces a second MFP payment period, the remaining 50 percent of the producer’s total 2018 actual production will be subject to the second MFP payment rate.

USDA estimates that CCC will distribute nearly $4.7 billion in MFP trade assistance in the first round, based on 50 percent of production. If 2018 production is exactly the same as 2017 and the market disruption that has been experienced through August continues at the same level through the end of harvest, USDA MFP assistance would total $9.392 billion. When combined with the targeted spending of $1.413 billion via Food Purchase and Distribution Program and an estimated spending of $200 million via the Agricultural Trade Promotion Program, the trade aid total will come to slightly more than $11 billion. USDA has clearly given themselves some room, about $1 billion worth, to make changes to the programs as they unfold.

Payments to producers will be limited in three ways. First, MFP payments are capped per person or legal entity at a combined $125,000 for dairy production or hogs. Second, MFP payments are also capped per person or legal entity at a combined $125,000 for corn, cotton, sorghum, soybeans and wheat. Payment limitations are separate for livestock and crops, so a person or legal entity with dairy or hogs and a crop operation could potentially receive as much as $250,000 in market facilitation program payments. Third, eligible applicants must have an ownership interest in the commodity, be actively engaged in farming and have an average adjusted gross income for tax years 2014, 2015 and 2016 of less than $900,000. USDA’s estimates for the first round of MFP payments do not seem to take into account that some operators will see payments limited by either the commodity caps or AGI. Instead, the payment estimates are based on a simple calculation of total production multiplied by the MFP payment rate.

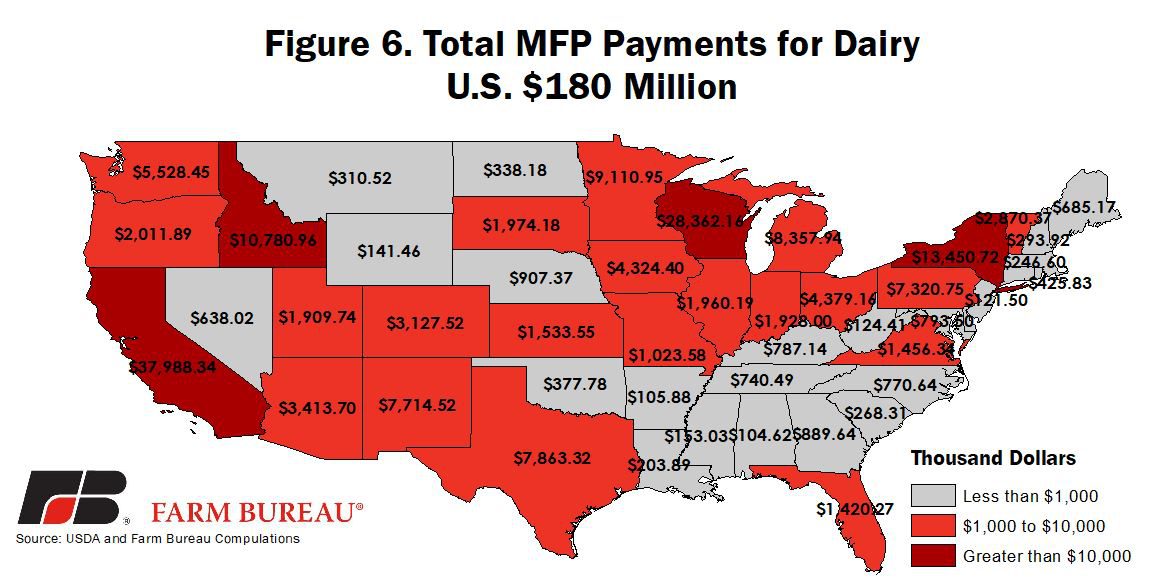

Below, we estimate the impact to each state based on USDA’s August 2018 Crop Production report using state-level production estimates for corn, cotton, grain sorghum, soybeans and wheat. Dairy payments are based on January-June 2018 state-by-state production reports. Finally, the estimated payments for hogs are based up a June 1, 2018 pig inventory, since the August 1 inventory is not yet available. In all cases, the state-level payment is the product of the state’s share of U.S. production and the MFP payment rate. We follow USDA’s methodology, assuming no payment limitations based on the payment cap or AGI limit. We acknowledge that some producers will likely be impacted by these limitations and as a result, these numbers should be viewed as an upper limit.

Given the impact retaliatory tariffs have had on soybean and pork prices, it should come as no surprise that the top three MFP payment states are top-producing soybean and hog states. Combined, Illinois, Iowa, Minnesota, Indiana and Nebraska are estimated to receive more than $2.1 billion, or 45 percent, of the first round of MFP payments. The top 10 states, which include some of the largest wheat and grain sorghum producing states, are expected to account for 71 percent of all of the first round of MFP payments.