Trade and Tariffs Cut Deep into the Hardwood Industry

TOPICS

TradeCary Moon

Policy and PAC Manager

photo credit: AFBF Photo, Mike Tomko

Cary Moon

Policy and PAC Manager

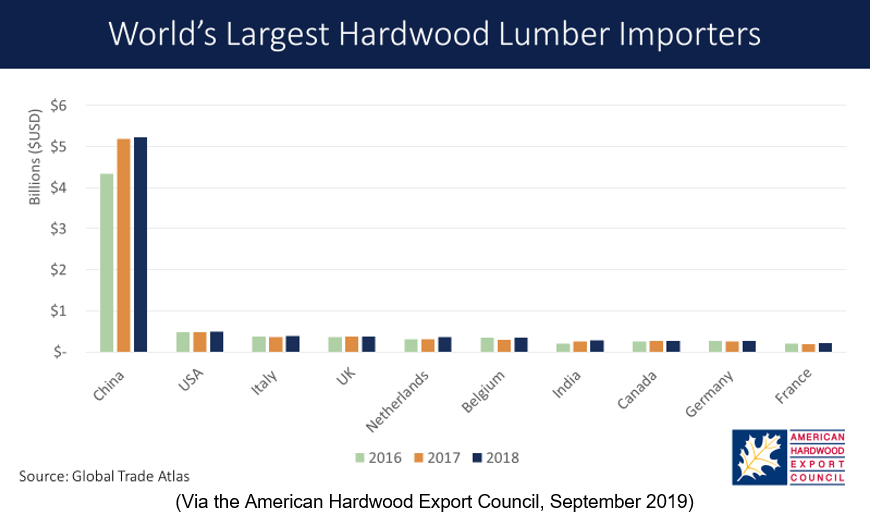

A little more than a year ago, China was by far the largest market for American hardwoods. Prior to the announcement of multiple rounds of tariffs and counter-tariffs between the United States and China in mid-2018, the U.S. hardwood industry was exporting nearly $2 billion worth of product to China annually, accounting for almost 50% of the total U.S. grade lumber produced and nearly 10 percent of total agricultural exports to China.

Beyond its contributions to the U.S. trade balance sheet, the U.S. hardwood industry also provided jobs in areas that are most in need of economic options. A 2018 economic study found that 685,000 people were employed in the hardwood industry, mostly in rural areas where employment opportunities are limited. The total direct economic impact of the industry, including the jobs it provided, was $135 billion.

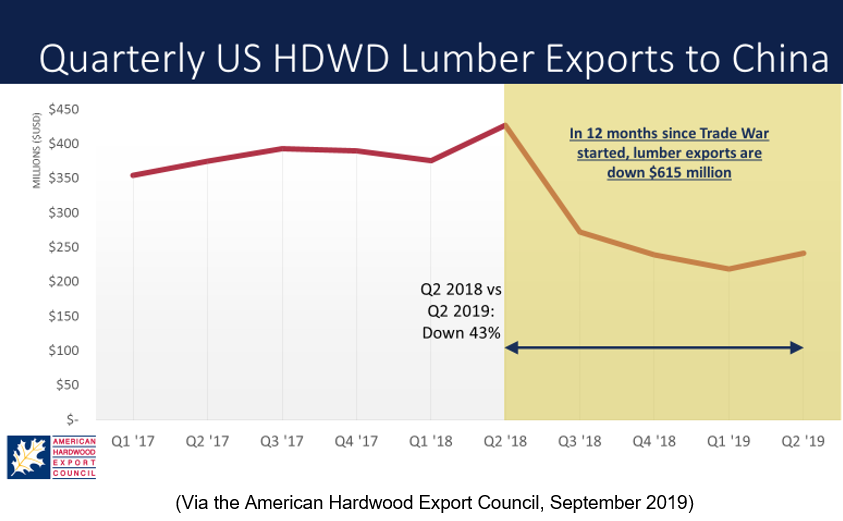

Since the retaliatory action by the Chinese, hardwood exports are down 43% and the value of those exports has fallen by $615 million – or an average of $154 million a quarter. At a time when the administration pays excruciatingly close attention to trade deficits, the U.S. still records a trade surplus with China of nearly $1.3 billion, but this will not last long at the current rate of decline due for the most part to the tariffs designed to ultimately shrink the U.S. trade deficit.

As with many industries with significant economic impact, the U.S. hardwood industry’s relations with our trading partners are complicated. The viability of U.S. hardwood businesses that export depends significantly on their ability to ship their goods and products, including sawn timber and logs, to regions around the world, including Asia, Latin America, Europe and Canada. But no market is even remotely as large as China. To that point, the next closest in size is Vietnam at about 1/10th the size of China.

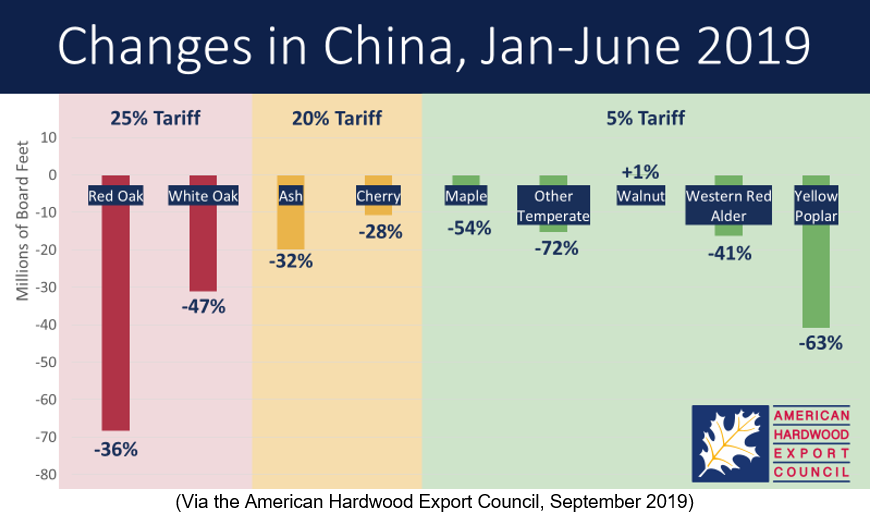

China has traditionally been a purchaser of notable wood varieties like red oak and cherry, which are not as in demand domestically, so there are no other markets that can meet the current production levels. We must also consider those who produce value-added hardwood products, such as engineered flooring or plywood. They face significant challenges from the influx of products from countries, particularly China, that do not abide by international rules regarding free and fair trade.

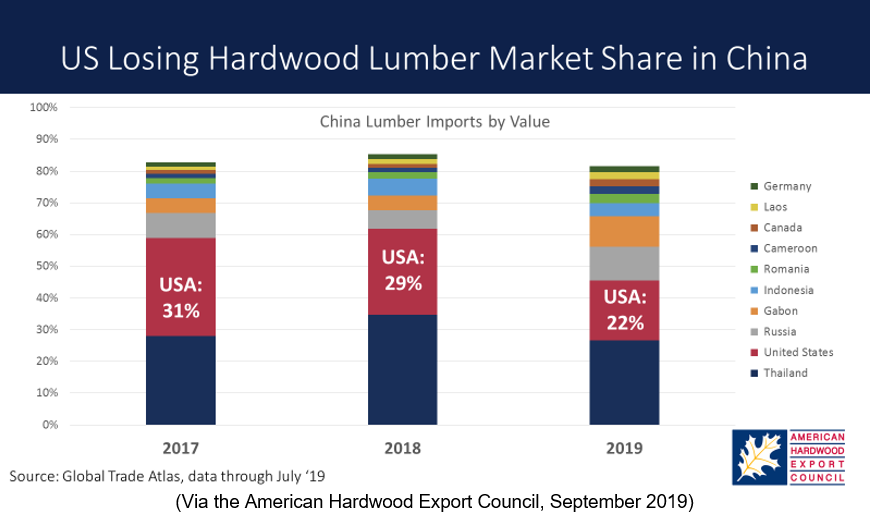

Additionally, other countries have taken advantage of the decrease in U.S. wood making it into China. Countries like Russia and Gabon have flourished and almost doubled their market shares in China since the same time last year. It is also unclear if the Chinese hardwood market will still be available to U.S. producers should the trade war end – and if they are, will domestic mills and operations have a way to catch back up after some sort of resolution is reached?

As yet, there is no mechanism for the U.S. government to provide any relief to the hardwood industry as they have with other agricultural products. Trees grow the same way as many other row crops, they just have to be left alone for 30-100 years and not harvested seasonally. Tree farmers also cannot switch their products year-to-year to take advantage of current markets due to the extremely long growth periods.

These are real life consequences being felt by hardwood lumber mills, producers and the entire supply chain– often in rural communities with low incomes where these are the largest employers. Lumber prices have hit all-time lows for many species. Mills are reducing hours of operation, laying off employees and, with increasing frequency, closing their doors. If the current situation is not addressed, either by a trade deal or some sort of relief program, there is serious concern that the American hardwood industry will disappear…and with it all the related value-added production and spin-off jobs it supports.

The U.S. hardwood industry is filled with tough, smart and resilient people who are doing everything they can to hang on and continue to provide well-paying jobs to those in rural parts of the country. But time is running out and options are limited for this bedrock American industry.

The Hardwood Federation is the largest DC-based hardwood industry trade association, representing thousands of hardwood businesses in every state in the U.S. and acting as the industry’s advocacy voice on Capitol Hill. It is an umbrella organization made up of 28 national, regional and state hardwood associations engaged in the manufacturing, wholesaling, or distribution of North American hardwood lumber, logs, veneer, plywood, flooring and related products.

Top Issues

VIEW ALL