USDA’s Early Look at 2019 Farm Income

TOPICS

USDA

photo credit: Alabama Farmers Federation, Used with Permission

John Newton, Ph.D.

Vice President of Public Policy and Economic Analysis

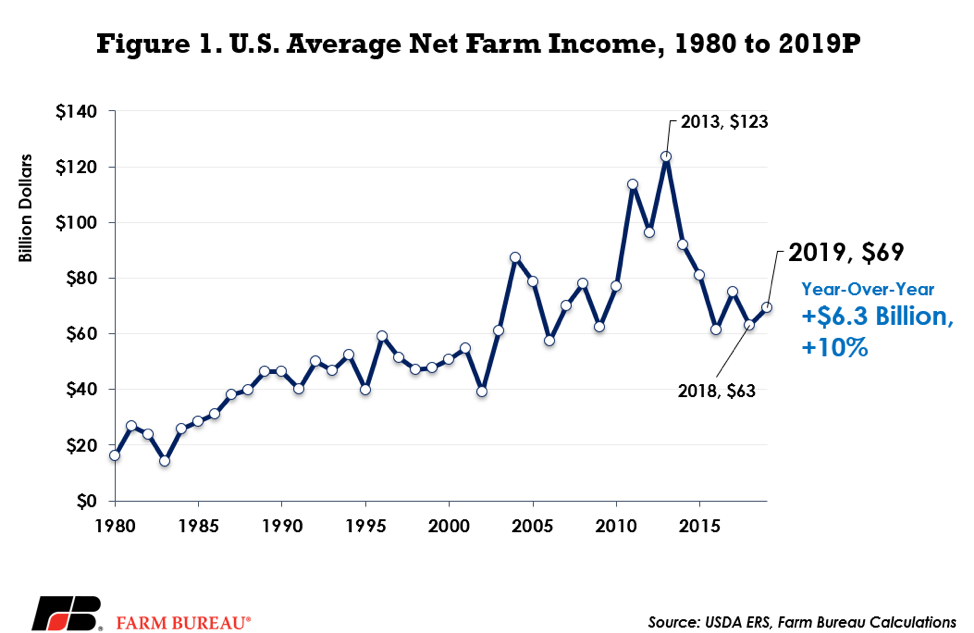

On March 6, USDA released the first projections for farm income and other financial indicators for the 2019 calendar year. According to the Farm Sector Income Forecast, for 2019, net farm income, a broad measure of farm profitability, is projected at $69.4 billion, up $6.3 billion, or 10 percent, from 2018.

The higher net farm income projection comes despite continued retaliatory tariffs on U.S. agricultural products, but largely reflects expectations for trend yields and slightly higher prices for some commodities. This early projection will change as more information on actual acreage, the growing season and, ultimately, demand become known.

The projection for 2019 net farm income includes direct payments from the Market Facilitation Program made to farmers impacted by retaliatory tariffs. Revised net farm income for 2018 was announced at $63.1 billion and was the second lowest over the last decade.

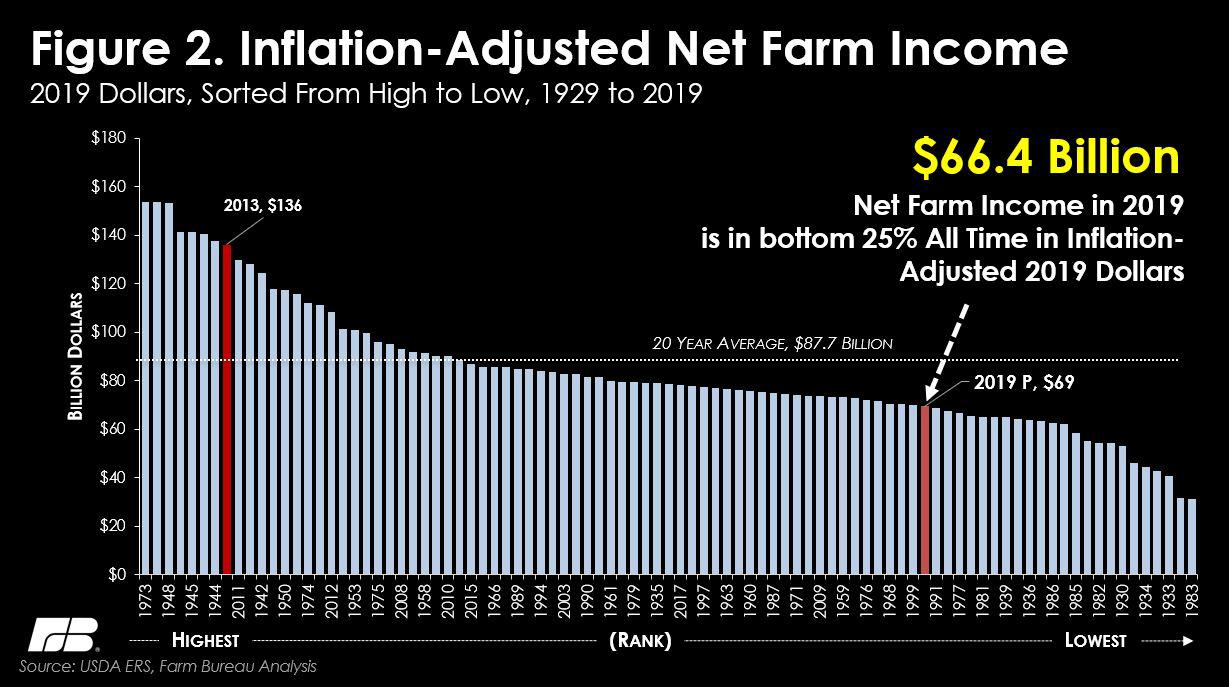

USDA’s first projection for net farm income in 2019 is projected at $69.4 billion, the third-lowest level over the last decade. In 2019-inflation-adjusted dollars, net farm income in 2019 is projected to be 8 percent higher than prior-year levels, representing an increase of $5.2 billion. However, in inflation-adjusted dollars, net farm income in 2019 will remain among the bottom 25 percent of all-time, Figure 2.

Expectations for higher farm income were driven partly by a $5.9 billion increase in gross cash income to $428 billion in 2019. Higher cash receipts are expected for corn (+$2.5 billion), wheat (+$500 million), rice (+$200 million), cotton (+$500 million), vegetables and melons (+$200 million), fruits and nuts (+$2.5 billion), milk (+$2.7 billion), cattle and calves (+$2.7 billion), and broilers (+$100 million). Lower cash receipts are projected for hogs (-$700 million) and soybeans (-$2.6 billion) – two commodities significantly impacted by retaliatory tariffs.

These higher cash receipts are partially offset by higher production expenses. Production expenses in 2019 are projected to increase by $2.2 billion to $372 billion. Labor and interest expenses are among the expense categories expected to increase in 2019, with interest expenses increasing by nearly 3 percent to $22.6 billion and labor expenses rising by 6.6 percent to $33 billion.

Rate of Return on Farm Assets

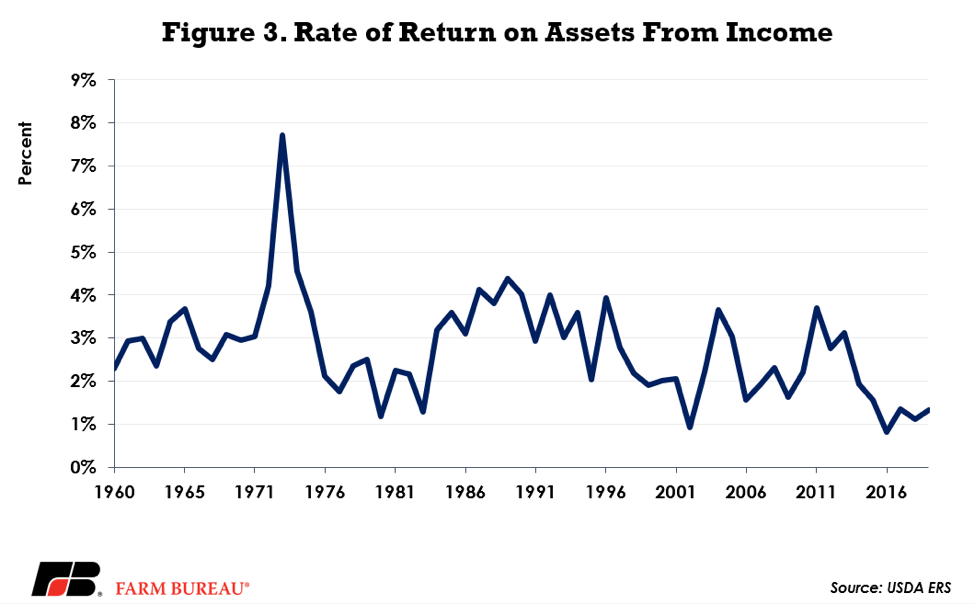

While net farm income is one measure of farm profitability, another important financial ratio is the rate of return on assets from farm income. The rate of return on farm assets from income, i.e., the farm profit margin ratio, provides key insight on farm efficiency and profitability and measures the return on farm sector assets from farm operations.

During 2019, the rate of return on assets from farm income is projected at 1.3 percent, slightly higher than prior-year levels, but far below the levels experienced in 2013 and below the 10-year average of 2 percent. In fact, one concerning statistic is that profit margins during this current downturn in the farm economy are in line with farm profitability ratios experienced in the 1980s, as well as the early 2000s, Figure 3.

Summary

USDA’s first projection for net farm income in 2019 is $69.4 billion and represents an increase of 10 percent from prior-year levels. The higher net farm income projection comes at a time when many farmers are ranchers continue to face headwinds in our primary export markets.

The increase in income is largely based on higher price expectations for many commodities, trend crop yields and higher livestock-product production, as well as trade-related direct payments to farmers. While the slight increase in farm income is expected to lift farm profitability, a projected 1.3 percent return on assets is less than half of other equity instruments and asset returns found in the broader U.S. economy.

While these projections suggest 2019 could be “better” than 2018 for many farmers, much is up in the air. Retaliatory tariffs are still in place, and recently both Mexico and the European Union threatened additional tariffs if 232 tariffs on steel and aluminum are not removed, or if auto tariffs are put in place. Additional tariffs would further erode our competitiveness in key agricultural markets and would weigh on farm income – as they did in 2018.

On the flip side, if markets are fully restored, then demand for U.S.-agricultural products would increase – likely lifting prices and farm income above these early expectations. A supply shock would also have a similar price- and income-boosting effect.

In addition to trade instability, uncertainty remains as to acreage decisions, the growing season and ultimately the demand for U.S. crop, livestock, fruit, vegetable and other horticultural products. USDA will update the farm income projection again in August 2019.

Top Issues

VIEW ALL