A Clancy-esque View of the Economy

Bob Young

President

photo credit: AFBF Photo, Mike Tomko

Bob Young

President

Like a good Tom Clancy novel, there are a lot of storylines unfolding in the economy. Any one of these narratives may be the one to cause the collapse of the world as we know it – or it may save the day. Some of these storylines are international, some domestic, but they are all linked through the general economy.

China is a Strong Storyline

One of the strongest story lines is related to the Chinese government’s actions. Roiling markets early this week, China, which has regularly managed the value of its currency, announced it would allow the value of the yuan to drop to the point that $1 would buy more than 7 yuan, Figure 1. This prompted the Trump administration to notify China it was considered a “currency manipulator.” And of particular concern to the agricultural sector, the Chinese announced it would halt imports of U.S. agricultural products.

Equities tanked. A thousand-point drop in the Dow in a single trading session is a bad day. A thousand-point drop given where we are in the economic cycle is somewhere to the worse side of bad. The Chinese government stated later in the week they would not let the yuan devalue to the more than the 7-yuan level and our equities showed some – but not full – recovery.

A Second Storyline

The U.S. jobs report for July had headline numbers that looked okay, but underneath the numbers, weaknesses are showing. Eight major economic sectors account for over 50 percent of the nation’s employment. Leisure and hospitality, for example, make up 11% of total jobs. After an anomalous January, this sector added an average of less than 10,000 new slots a month, a meager showing for a sector employing nearly 17 million.

Health care, the next largest sector, keeps on trucking. It has added an average of more than 32,000 new jobs each month in 2019 and will likely become the largest employment category in the next few years.

Retail trade employment has been sluffing off jobs every month this year but January. The retail sales sector is still trying to sort out what the future looks like. Manufacturing job numbers ticked up in July, but again, other than anomalous January, every month in 2019 has shown lower job growth numbers than the same month in 2018. Some months have been down markedly.

Construction employment, which accounts for nearly 5% of all jobs, has shown positive but very slow growth in 2019. Construction jobs are not going to be a major economic driver.

Wholesale trade – 4% of the overall jobs market – has shown positive growth for all but one month of the year.

The temporary help services sector dropped more than 25,000 positions in January and has been essentially flat for the last four months. One could view this in a positive light and suggest employers are going straight to full-time employment, or you could view it as companies don’t need to expand, even temporarily, at this stage.

Truck transportation employment is the last of the ”big eight,” accounting for 1% of non-farm jobs. It also has been demonstrating a somewhat “meh” performance this year, with numbers well under the same time last year and much below where we were in the last six months of 2018. Take out the health care sector employment numbers, and the other seven sectors are positive, but only just so.

Another Storyline

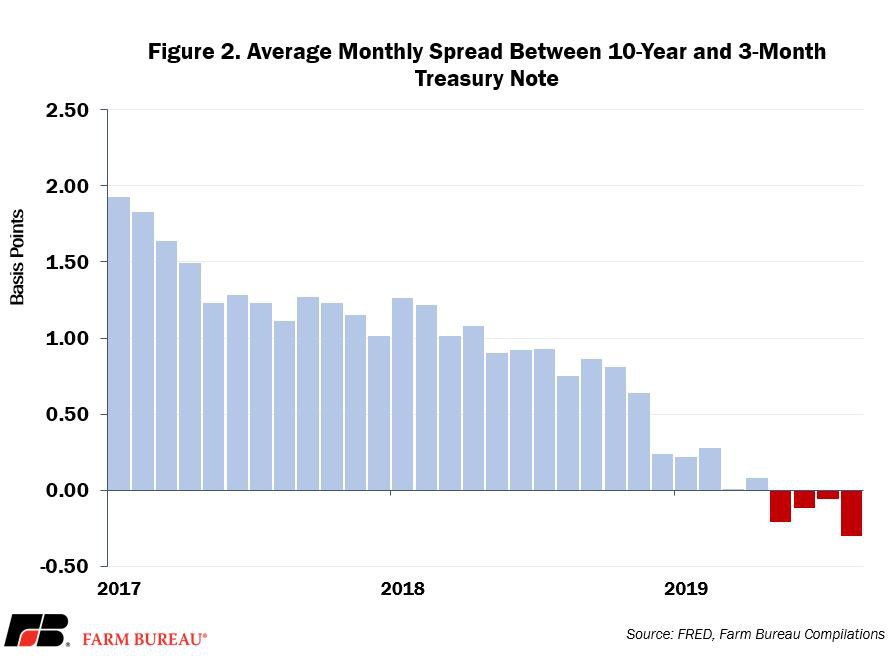

Tom Clancy seemed to always have at least six storylines running in his books at any one point – another storyline here is the yield curve. The 10-year Treasury note was lower than the Federal Funds rate by 31 basis points in June, Figure 2. It was a full one basis point higher than the Fed Funds rate in May, so technically not inverted until the June figures. A yield rate inversion, which occurs when long term rates are lower than short term rates, has historically been an indicator of an economy poised to turn down. Just because an inversion has occurred does not suggest a recession will show up tomorrow. It has been anywhere from 12 to 24 months downstream, but it is a key marker.

Storylines Come Together

One of the interesting features of a Clancy novel is the way all these storylines come together by the end of the book. We have a long way to go in this tale, but the links between these three are already starting to show.

The trade war alone was driving some investors to the haven of government bonds, and China’s currency tactics are sending even more investors in that direction. Greater demand for bonds raises the price of those bonds, which pushes the interest rate downward. Investors tend to look toward the longer-term notes, thus pulling down the long end of the yield curve. Retaliatory tariffs have certainly hurt the agricultural sector, and overall manufacturing sector employment growth – while not bad – has certainly backed off last year’s pace.

We are probably only two-thirds of the way through this book. Heck, given the size of a good Clancy novel, we may only be a third of the way through. We are in the midst of what will likely become the longest economic growth period in the history of the country. However, there are storm clouds gathering, although clouds do not necessarily mean rain.

Top Issues

VIEW ALL