A Goldilocks June Employment Report

TOPICS

MacroeconomyBob Young

President

Bob Young

President

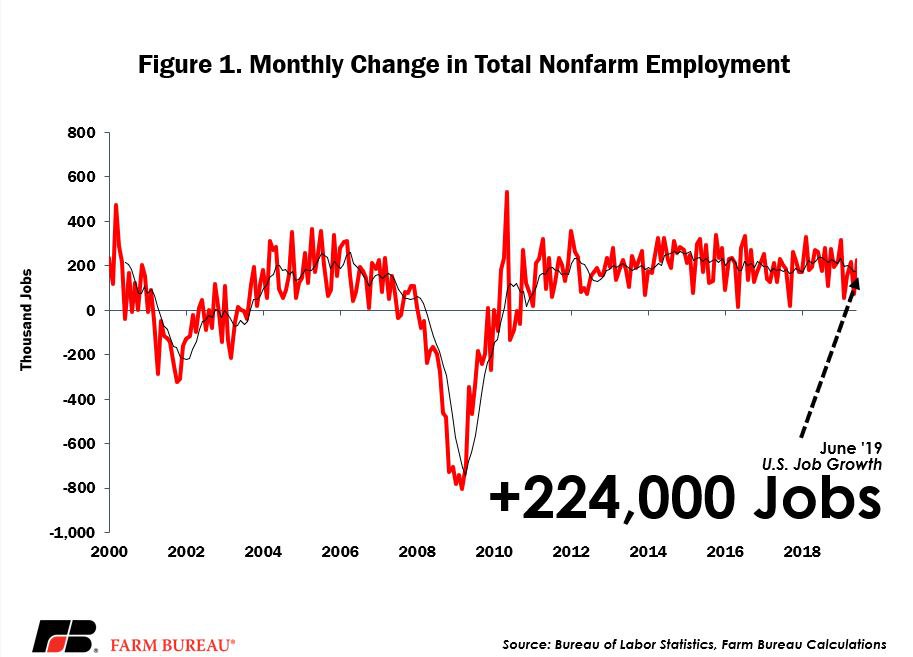

With a headline number of 224,000 new jobs, the June jobs report could not have hit the sweet spot any better. Had it come in over 250,000, market anticipation of future Federal Reserve interest rate increases could have pulled hundreds off the Dow Jones Index. Had it come in under 150,000, fears of a slowdown would have had the talking heads ranting. But 224,000 is just about right to maintain people’s confidence in a fairly robust economy, especially when combining that number with the 3.1% annual rate of increase in average hourly earnings.

Construction jobs were up by 21,000 slots; nonresidential specialty trade employees made up 12,000 of that figure, with residential building construction jobs adding another 4,600. June’s manufacturing figures were much better than last month’s, adding 17,000 positions, as opposed to only 3,000 last month. Computers and electronic products contributed 6,500 new jobs. Out of the 17,000 total jobs added in manufacturing, nondurable jobs grew by 5,000 positions. Jobs in plastics and rubber product production were the biggest gainers.

The service sector showed the most significant growth, coming up with 154,000 new slots. The two big adds in that category came from professional and business services as well as education and health services. Health care continues to be the engine that always performs, adding 35,000 new jobs this month. In something of a change from past months, hospitals added 11,200 jobs, in addition to 18,500 in the ambulatory health care services category.

Also in the service sector, the professional and business services add of 51,000 positions more than doubled last month’s gain of 24,000 new slots. Breaking that number down into a few of the parts, computer systems design added 7,200 of that total, with management and technical consulting another 7,100. Administrative support services were another 14,000 jobs, 4,300 in temporary help services.

One would think by this time in the summer, those leisure and hospitality jobs should already be identified, making the growth of only 8,000 jobs in that category not surprising. Employment in the amusements, gambling and recreation category dipped by 4,200 positions. Even food service and drinking establishments shed a few jobs.

One interesting component of the report this month was in the government jobs category. While the federal government only boosted its numbers by 2,000 slots, posting the same increase as state governments, local government numbers rose by 29,000, with 26,400 of those positions outside of education.

As for the previously mentioned compensation increases, while the bump was only 6 cents an hour for the month taken over the last 12 months, hourly wage rates have grown by 3.1%. Although this is higher than the general inflation rate, it is only modestly so.

Again, a Goldilocks report. Not too hot, not too cold, just right for the Federal Reserve to leave things alone for another month, even though the bond markets sure seem to think there is a rate cut coming soon.