Another H-2A Wage? The Prevailing Wage Rate

Samantha Ayoub

Economist

The Immigration and Nationality Act of 1952 requires that foreign workers admitted to the U.S. on work visas “not adversely affect the wages and working condition of U.S. workers similarly employed.” Without a legal definition of what counts as “adverse effects” on wages, the U.S. Department of Labor (DOL) preemptively establishes wage requirements for many temporary worker visas. Prevailing wages reflect the typical wage paid to U.S. workers in a specific occupation and geographic area and apply to certain foreign worker visa programs like H-2A, H-2B, and H-1B.

Prevailing wages are used for both H-2A temporary agricultural workers and H-2B temporary non-agricultural workers, but in different ways. While prevailing wage determinations are required for H-2B applications and are often set through publicly available data, the H-2A program sets mandated Adverse Effect Wage Rates (AEWR) for farm occupations for a state or multi-state region through government sources like the USDA Farm Labor Survey and Bureau of Labor Statistics data. Prevailing wages in the H-2A program are exclusively set using voluntary state workforce agency (SWA) survey submissions and are only mandated for H-2A employees if they are higher than the AEWR, federal or state minimum wage or collective bargaining wage. Broad variation in job activity definitions, timing of responses and geographic area throughout state surveys result in prevailing wages that are not predictable, adding additional uncertainty and administrative hurdles for H-2A employers.

State Surveys

Prevailing wage determinations arise from SWA surveys of employees in their respective states. DOL Wage and Hour Division adjusted prevailing wage survey requirements in 2022 to “provid[e] SWAs with the flexibility to…expand the number and scope of surveys conducted.” The Office of Foreign Labor Certification (OFLC) now accepts prevailing wage survey determinations if they meet nine criteria:

- The SWA submits a wage survey for the agricultural job and the distinct work task(s) performed in that job, as well as the survey methodology.

- The survey was independently conducted by state agencies or universities.

- The survey covers work for a single agricultural activity with distinct work tasks.

- The surveyor either made a reasonable attempt to contact all employers of the occupation in the state or conducted a randomized sampling of the employers.

- The survey provides the mean wage of U.S. workers in the job or performing the distinct work tasks and specifies the geographic area using that unit of pay to compensate the most U.S. workers whose wages are reported.

- The survey covers an appropriate geographic area based on available resources, the size of the agricultural population, and different wage structures (hourly, monthly, piece rate, etc.) for that job within the state.

- Wages from at least 30 workers are reported in the unit of pay most used to compensate U.S. workers.

- At least five employers are represented. If less than five employers exist in the population, wages from all employers must be included.

- Wages paid by a single employer represent no more than 25% of sampled wages. This does not apply if less than four employers exist in the population.

These requirements fall short of typical federal statistics standards. The OFLC can accept survey results based on responses from as few as 30 workers across five employers, meaning data from an extremely small sample size can artificially influence the prevailing wage outcome for an entire area. Depending on the survey sample, the resulting wage rate may apply to just a few counties or, in some cases, impact the entire state.

States also have discretion over what time period to survey, with it being commonplace to survey the “peak week” of activity, when the highest wages are paid for a particular crop activity. For example, a state surveying strawberry harvesters may ask respondents for their wages during the busiest week of picking season, when piece-rate earnings spike, rather than capturing wages averaged across the growing season. This can be especially distorting in cases where agricultural workers receive incentive pay or overtime – leading to the following year’s minimum wage being set by the highest wages paid during the prior year.

Additionally, state prevailing wages may be reported in any common form of pay including hourly, monthly or piece rate. Hourly rates are generally easier to compare to the FLS AEWR, which is also expressed hourly. Kansas had a history of setting monthly prevailing wages that included room and board, going a step further than H-2A regulations that only require housing. And piece rate pay – where workers are paid based on the quantity harvested or tasks completed – is especially common in both crop and livestock production. While piece rates are designed to reward high-performing employees who exceed minimum work requirements, setting a prevailing wage rate for piece rate work can limit employer’s ability to offer additional incentives over the minimum wage requirement, hurting both farmer profits and reducing earning potential for ambitious workers.

Use in the H-2A Program

H-2A employers are required to pay at least the highest of the state or federal minimum wage, the collective bargaining wage, the AEWR or the prevailing wage rate. There is no instance where a prevailing wage determination saves farmers money. Many state prevailing wage surveys do not have a conclusive result and are reported as “no finding,” but they may also find a local wage that is lower than the FLS AEWR. For example, domestic lettuce harvesters in Arizona were found to receive $16.32 per hour in 2024, and the results were posted in May 2025. But the fieldworker AEWR is $17.04 for H-2A workers in Arizona. So, H-2A employers who are unable to find domestic workers to apply for their jobs must pay foreign workers, who also receive housing and transportation, over 70 cents more per hour than the small subsect of similarly employed Americans.

Once prevailing wages are posted that exceed the wage rate listed in a worker’s contract, employers must immediately pay the prevailing wage, even if they are in the middle of a work contract. The prevailing wage stays in effect for one calendar year, or until a higher wage rate is set. There have been legal challenges to the one-year expiration of prevailing wages. Even if the prevailing wage reaches its one-year expiration, if it is listed on a job contract, H-2A employees must receive that wage for the entirety of their work period.

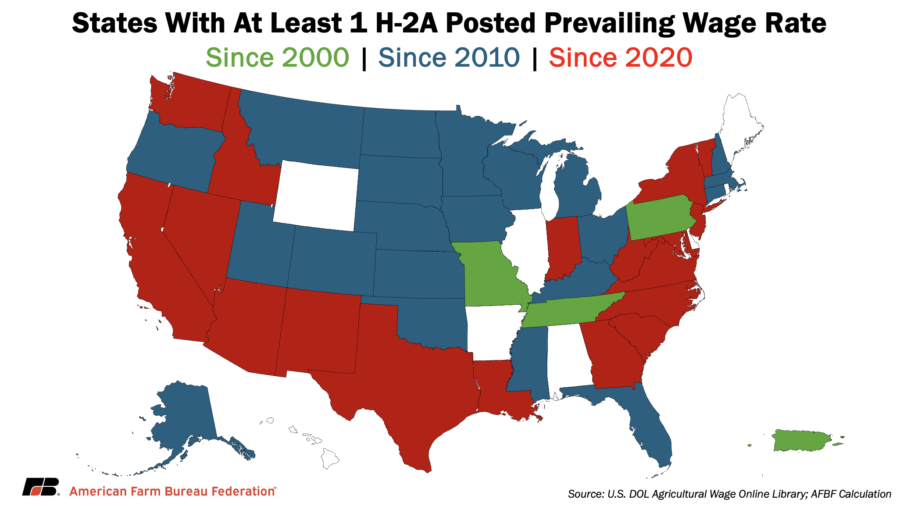

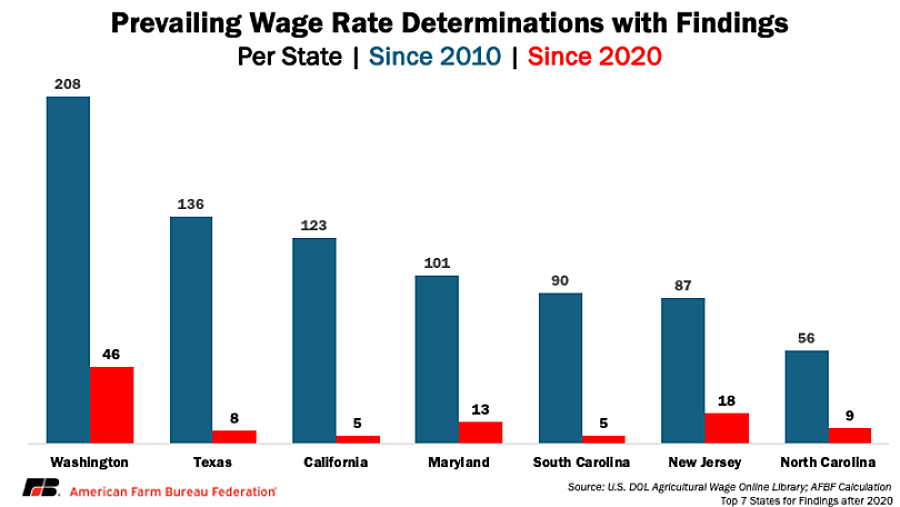

States are not required to perform wage surveys, so prevailing wage determinations can be sporadic and unequal across the U.S. Some states are more active in performing prevailing wage rates surveys, but 40 states and Puerto Rico have implemented at least one prevailing wage in the 21st century. States must sumbit their survey results within one year of receiving wage information, but that does not mean OFLC will post a prevailing wage rate to be paid by employers within the year. There is often no notice that OFLC is going to certify a new prevailing wage, leaving employers scrambling to adjust their budgets and accounting systems to apply their newly regulated wage.

Prevailing wages are also extremely specific. While H-2A already disaggregates wages based on job classification, prevailing wages are even specific to crop or commodity and specific-job task, like harvesting or planting. This could be as specific as different wages in the same year for wool gathering versus packing in Arizona; housing, stripping, cutting or taking down tobacco in Kentucky; the size of the hand line irrigator in Iowa or the variety of oranges in Florida.

Most recently, Washington received posted prevailing wage rates for numerous crop activities, including harvest of both “dark red” cherries – which received a new prevailing wage – and “dark sweet” cherries, which had “no finding” from a survey conducted in 2022 and provided to DOL in August of 2023. This led to significant confusion, as nearly all dark red cherries harvested in the state are sweet cherries. Industry only uses the labels dark red versus dark sweet cherries when referring to stemless or stemmed, respectively. However, the state has contended that the survey was based upon a cherry breeding program fact sheet that was irrelevant to harvest classifications and no longer exists. The state’s interpretation of these crop activity definitions led to a more than 22% increase of the prevailing wage rate in the middle of cherry harvest, with little warning and no opportunity for the growers to budget. This is just one example of the minute nature of prevailing wages, requiring careful consideration and administrative help to know how to implement the wage on the farm.

Conclusion

Without any consistency in the administration or form of prevailing wages across the country, farmers are often left in a lurch, adjusting to sudden and specific wage requirements. Continuing to increase all wage rates included in the H-2A program hurts farmers’ abilities to continue providing employment opportunities or reward high-performing employees beyond the mandated wage. H-2A employers are continuously facing red tape in hiring workers. Prevailing wage determinations add another administrative hurdle, especially when they are posted with no warning and only increase wages – even when state surveys show that other wage rates, particularly the USDA FLS, do not accurately reflect the wages in a more localized area.

Without reforms, the prevailing wage threatens to undermine the very workforce access the H-2A program is intended to provide while pushing U.S. growers further behind global competitors who face fewer labor constraints and lower compliance costs.

Top Issues

VIEW ALL