A Tale of Two Commodities: Soybeans and Steel

TOPICS

Trade

photo credit: North Carolina Farm Bureau, Used with Permission

Veronica Nigh

Former AFBF Senior Economist

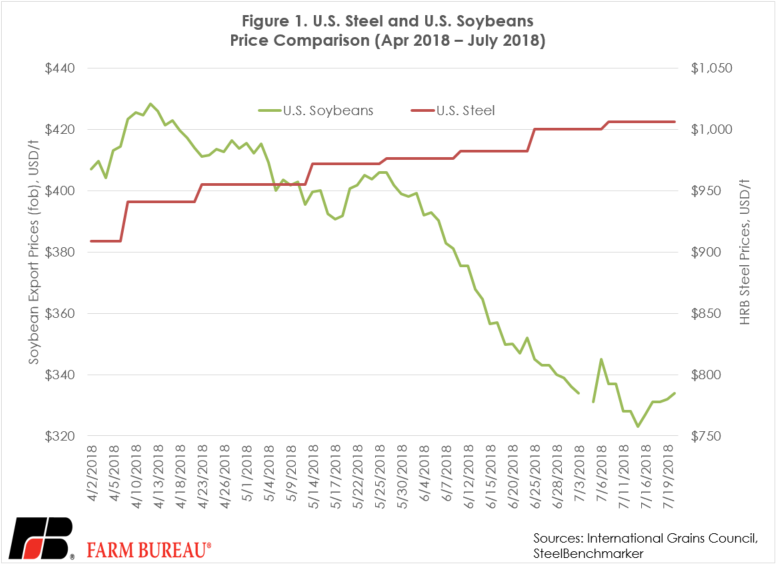

For several months now, the U.S. has been abuzz about all things steel and aluminum. At the end of May, the White House released a press statement that “The Section 232 steel and aluminum tariffs have already had major, positive effects on steel and aluminum workers and jobs and will continue to do so long into the future.” The effect of the 25 percent tariff on steel has continued to build since they were enacted in the spring, contributing to higher prices for U.S. steel.

But for every action, science tells us there is a reaction. The reaction has come in the form of retaliatory tariffs from our trading partners. Chief among those partners is China, which has been impacted by both the 232 tariffs as well as the tariffs that resulted from the U.S. 301 investigation related to intellectual property theft. As has been well reported, China has targeted U.S. agricultural products in its retaliation efforts. To date, approximately 90 percent of U.S. agricultural exports to China face some sort of additional tariff.

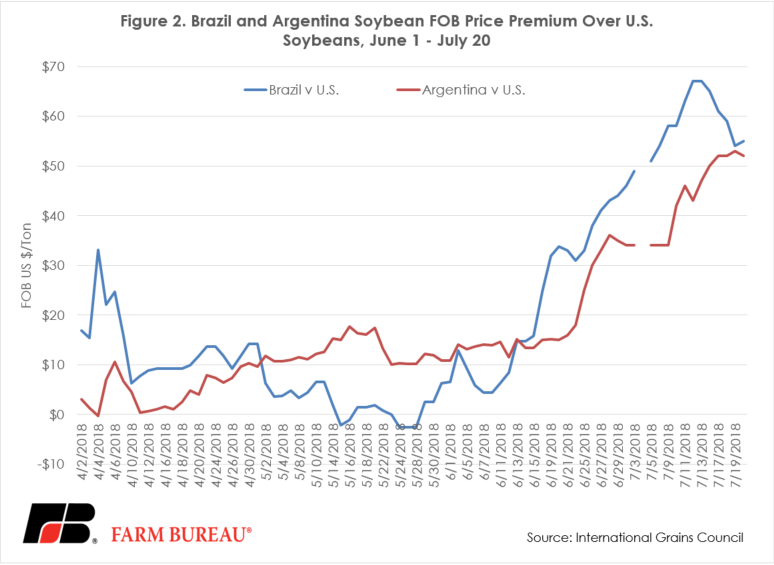

The tariffs on U.S. imports of steel and aluminum and the additional tariffs applied on U.S. agricultural products by our partners are both having the intended effect. Since the beginning of April, U.S. HRB steel futures prices have risen 11 percent. U.S. soybean FOB prices have fallen 18 percent over the same time period. Meanwhile, U.S. soybean growers' loss are Brazilian and Argentinian soybean growers gain. Brazilian and Argentinian soybean FOB prices have gained significant premium over U.S. soybeans since Chinese tariffs on U.S. soybeans went into effect. At close of business July 20, the premium was $55 per MT for Brazilian soybeans and $52 per MT for Argentinian soybeans.

Top Issues

VIEW ALL