African Swine Fever and China: Part II

TOPICS

TradeMichael Nepveux

Former AFBF Economist

photo credit: AFBF Photo, Philip Gerlach

Michael Nepveux

Former AFBF Economist

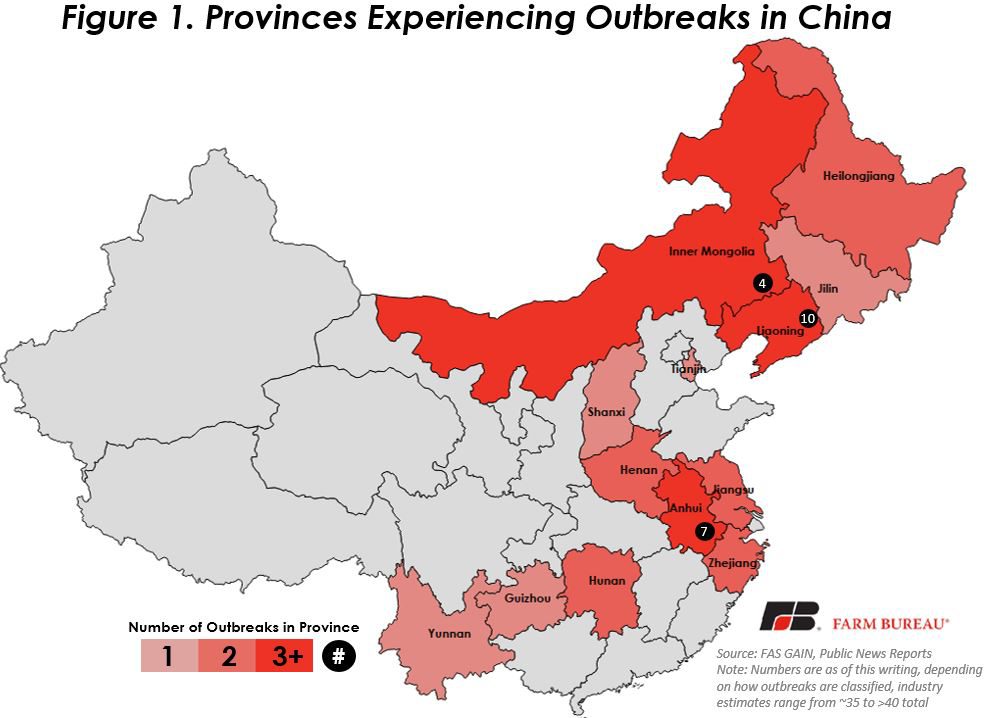

China’s ongoing issues with African Swine Fever continue as the virus spreads further throughout the country. About a month into the outbreak, AFBF examined the ASF situation, and since then the number of outbreaks has grown to approximately 40 cases reported by the government. ASF is a highly contagious viral disease affecting pigs that posts a nearly 100 percent mortality rate in the infected animals. As there is no vaccine or treatment, culling of the infected pigs and those that have been exposed to the virus is the standard protocol. As this virus continues to spread it is critically important to note that the virus does not affect humans. Additionally, while this virus is popping up in many places throughout the world, it has not shown up in the U.S., and U.S. pork producers continue to produce a safe, nutritious and wholesome product for consumers.

The many measures China has implemented to prevent the spread of the disease throughout the country have been less effective than hoped. ASF continues to resurface in provinces that it had already been discovered (Anhui, Liaoning), and has continued to spread to other provinces, reaching some of the southernmost provinces in the country (Hunan, Guizhou, Yunnan). Many in the industry fear that the number of outbreaks may be significantly underreported by the government.

This southern extension has some in the industry particularly worried that this may no longer be only China’s problem. It could develop into a problem throughout Asia as China’s Yunnan Province shares a border with Vietnam, the world’s sixth-largest hog herd.

Another factor to consider is the type of farm impacted, as a substantial share of China’s pork production comes from smallholder farms; estimates vary and can place 40-50 percent of pigs in China on these smallholder, or “backyard,” farms. But one of the recent outbreaks was on a farm with over 20,000 pigs, which, based on its size, would be expected to have more effective biosecurity measures in place to prevent disease compared to the smaller farms. Smallholder farms had been bearing the brunt of the outbreaks, partially due to their practices of feeding kitchen waste to their pigs, which has exacerbated the spread of the disease.

With new outbreaks come new culls, and some of the most recent estimates put the total ASF cull numbers in China at over 200,000 animals. Bear in mind, this number is a drop in the bucket for China’s estimated pig herd of 430 million head. Additionally, most in the industry caution that any of these reported numbers are likely underreported by a significant factor.

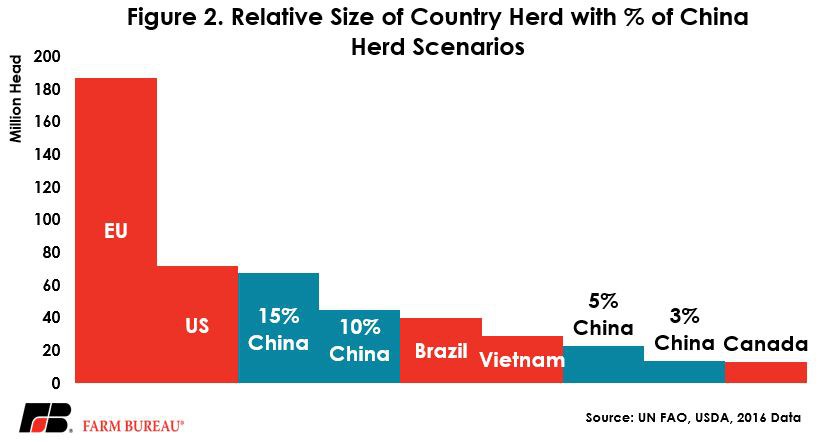

A key, and quite frankly, impossible, question to answer is how many pigs will ultimately be impacted by ASF in China. This is where the industry’s crystal ball experts have come in with a wide range of potential impacts. A reasonable “very high” scenario seems to be around 15 percent of the herd being impacted. In order to put that in terms relative to other countries, Figure 2 shows several scenarios of impacts to the Chinese herd alongside total herd numbers for other top producers. The overall size of China’s pork production means that 15 percent of China’s pig herd is nearly as large as the U.S. pig herd (but due to the efficiency of U.S. production, they produce less product per animal).

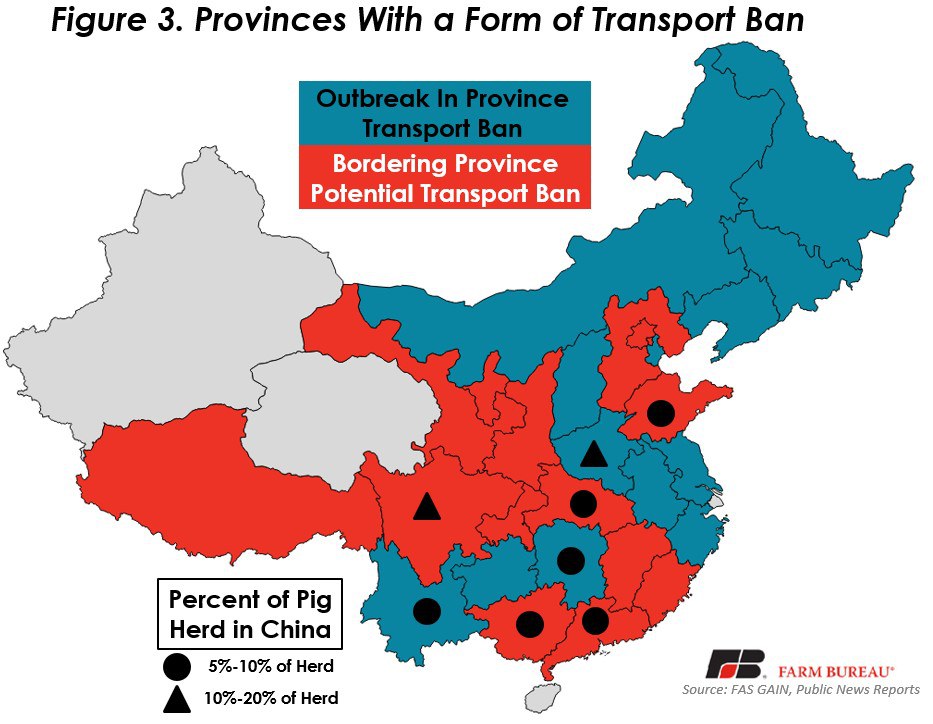

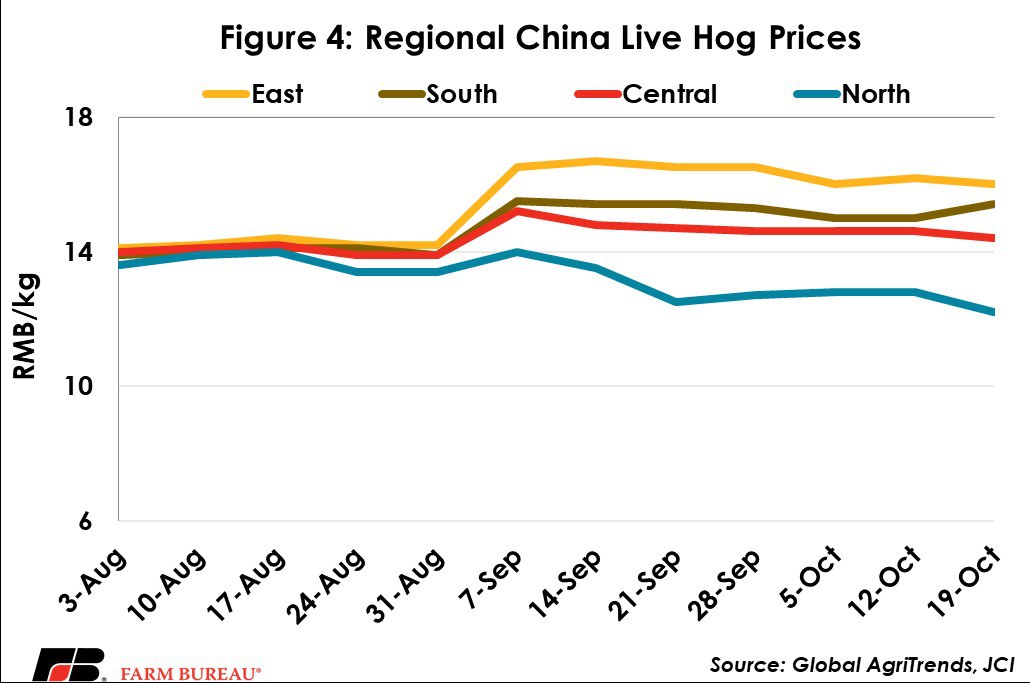

One measure taken by the Chinese government is to prohibit the transport of pigs from any provinces that have reported African Swine Fever cases, as well as from neighboring regions. Since this measure was announced, the number of infected provinces has grown and if this policy is enforced, almost the entire country would fall under a transportation ban. A side effect of this ban has been to create a supply and demand imbalance regionally within the country. Key supply regions are now unable to transport their product to where they are needed, and as a result regional price spreads have widened since the announcement of travel bans. With these transport restrictions expected to continue, smaller farmers in affected regions may look to liquidate pigs to get out of the market.

Impact to the U.S.

Again, it should be noted that the ultimate impact of ASF in China is still very much a hypothetical, with no one knowing for sure how badly the pig herd will be impacted. However, if it is indeed severe, would China turn to the U.S. to supply their pork? Of course, as a two-handed economist we must conclude that it depends. It would take a very large deficit in pork for U.S. producers to overcome tariffs as high as 70 percent on some pork products, but it is technically possible. China would likely turn to the European Union, Canada Brazil and others first, depending how much excess pork those countries have. The bright side on this is that U.S. pork could help backfill where these other countries have been exporting. However, if the Administration were to find a path forward with China that removed the retaliatory tariffs on U.S. agricultural products, U.S. producers could potentially service the Chinese market.

What About the Potential for ASF in the U.S.?

The U.S. does not currently import pork products from China, with the majority of U.S. pork imports making their way from Canada (Figure 5). USDA’s Animal and Plant Health Inspection Service has import restrictions that prohibit the entry of untreated animal products from countries or regions impacted by a variety of diseases, including ASF. For instance, USDA suspended imports of pork from Poland for several weeks in October due to concerns about export protocols and ASF. Now it allows pork to come in from the unaffected regions of the country.

Both USDA and the U.S. pork industry are taking protective measures to prevent the disease and preparing responses in the event of an outbreak. For decades APHIS has had controls in place on food waste from international sources. States have the authority to ban the feeding of plate waste containing meat in order to prevent the spread of diseases. One potential threat is humans, specifically people traveling abroad and returning to the U.S. with infected products and not giving them up at the border. USDA and Customs & Border Protection are the line of defense against this avenue, employing some of the most beloved agents known as the Beagle Brigade.