African Swine Fever Outbreak in China

TOPICS

PorkMichael Nepveux

Former AFBF Economist

photo credit: AFBF Photo, Philip Gerlach

Michael Nepveux

Former AFBF Economist

Since this interview was conducted, there have been multiple outbreaks of ASF increasing the total beyond what was stated in the video.

Over the previous week, China reported several more African Swine Fever (ASF) outbreaks, bringing the total number of outbreaks in the country since early August up to thirteen in six different provinces. ASF is a serious, highly contagious, viral disease affecting pigs that can spread very rapidly in pig populations by direct or indirect contact. Pigs can contract the virus in a variety of ways, including transmission by ticks and direct contact between animals, as well as by contact with contaminated food, animal feed or vehicles. ASF can survive for long periods in uncooked swine products, which can facilitate its introduction into new areas. The virus is extremely hardy and can withstand extreme environmental conditions in fresh and frozen meat. There currently is no vaccine or treatment, and the mortality rate of the virus is near 100 percent for the pigs that become infected. It is very important to note that ASF does not affect humans and poses no food safety implications, particularly when it comes to the U.S. food supply. Humans cannot contract the virus by handeling pork or by coming into contact with pigs as only animals in the pig family can contract it. ASF has already been an issue this year in eastern Europe, but August marks the first time the world’s largest pork producing country has reported a case.

What We Know So Far

Officials in Liaoning Province detected China’s first ASF case on Aug. 1. On Aug. 3, the Ministry of Agriculture and Rural Affairs’ chief veterinary officer reported the outbreak to the World Animal Health Organization. In the following weeks, China reported that over 35.5 million pigs had been screened for ASF, and around 700 pigs deemed susceptible to the outbreak were disposed of by government officials.

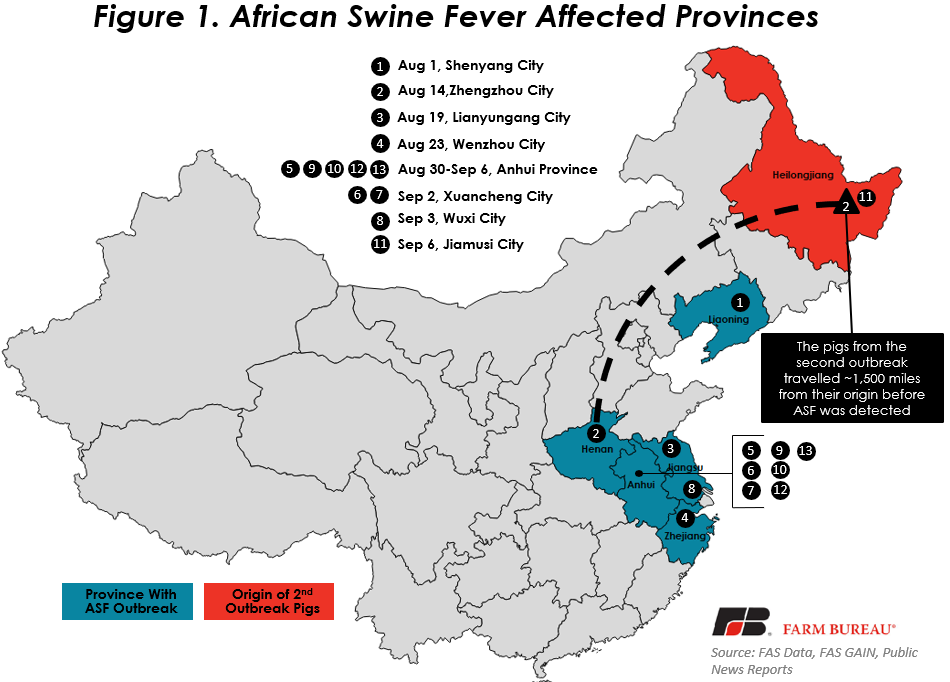

The country would go two weeks before another outbreak was discovered nearly 900 miles away in a harvesting facility in the Henan Province, an area with a significant population of pigs. The facility reported that 30 pigs had died from ASF and another 30 were exhibiting signs of the disease. China reported that the origin of the pigs in the second outbreak had come from roughly 1,500 miles away in the Heilongjiang Province. A reported reason for this long distance of travel is that the northeastern provinces do not have enough animal harvest capacity, and typically will transport the pigs to provinces further south.

While the virus appeared to have a slow start and was somewhat geographically dispersed, it has picked up steam. As of this writing, there have been thirteen outbreaks in China (Figure 1), with the last four occurring on a single day (Sept. 6). To date, several hundred pigs have been identified with the virus. Given the rapid spread across thousands of miles of the country, there is also fear of the virus jumping the border and spreading outside of China. The Food and Agricultural Organization of the UN called an emergency three-day meeting to examine the outbreak and discuss strategies to curb the spread of ASF to neighboring countries. The FAO stated that ASF is almost certain to spread in Asia. South Korea has already identified the first instance of the virus being transported out of China in pork products. USDA’s Animal and Plant Health Inspection Service increased border screening checks to avoid entry of swine products from the contaminated areas.

What has been the Impact in China?

China is aggressively trying to put the brakes on the spread of ASF. Officials have designated this as an Emergency Response Level II incident, which involves local police in the investigation process. Officials are culling herds that could be susceptible to contracting the virus in affected areas. It is currently reported that approximately 40,000 hogs have been culled. While this is just a fraction of a percentage of the overall hog population, estimated to be nearly 450 million, thousands more hogs potentially could be culled as the virus spreads.

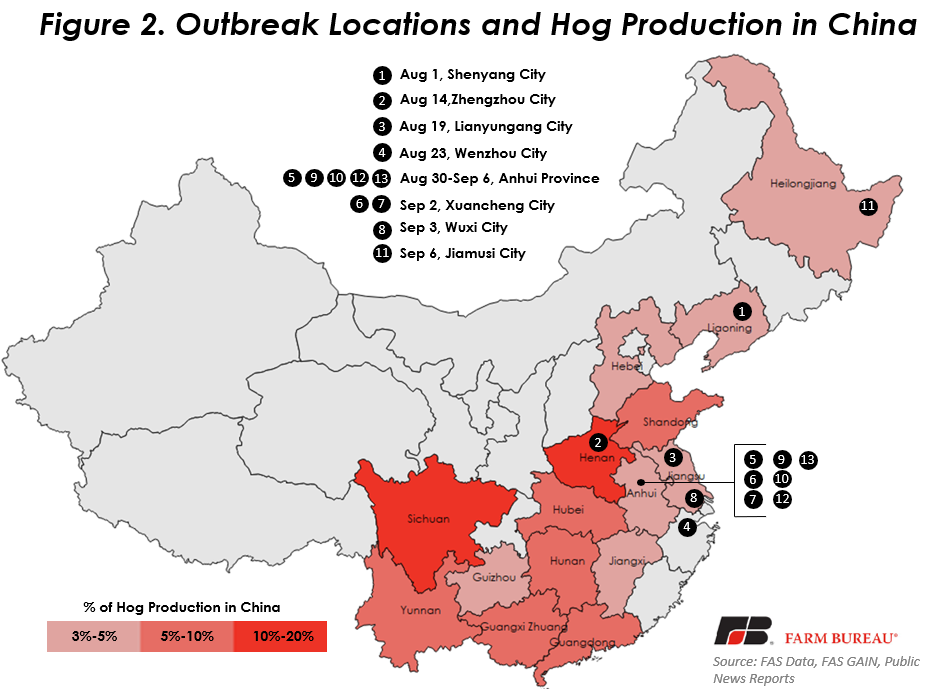

The government also announced the closure of live hog markets in the affected provinces. China has introduced a ban on transporting pigs and pork products from, as well as through, the affected provinces, which has the potential to significantly disrupt the country’s pork supply chain. This ban has already affected price to an extent due to an imbalance of supply and demand between provinces, and the inability to get the pigs and the pork to where they are demanded. Further compounding this issue is a potential scramble by producers to sell off their herds to processors in order to avoid being caught up in a potential forced cull of their herd. Preventing the disease from spreading from the coastal areas, where most of the recent outbreaks have been, further into the central areas of the country, where much of the country’s pork production is concentrated, is critically important (Figure 2).

China is the Biggest Player in the Pork World

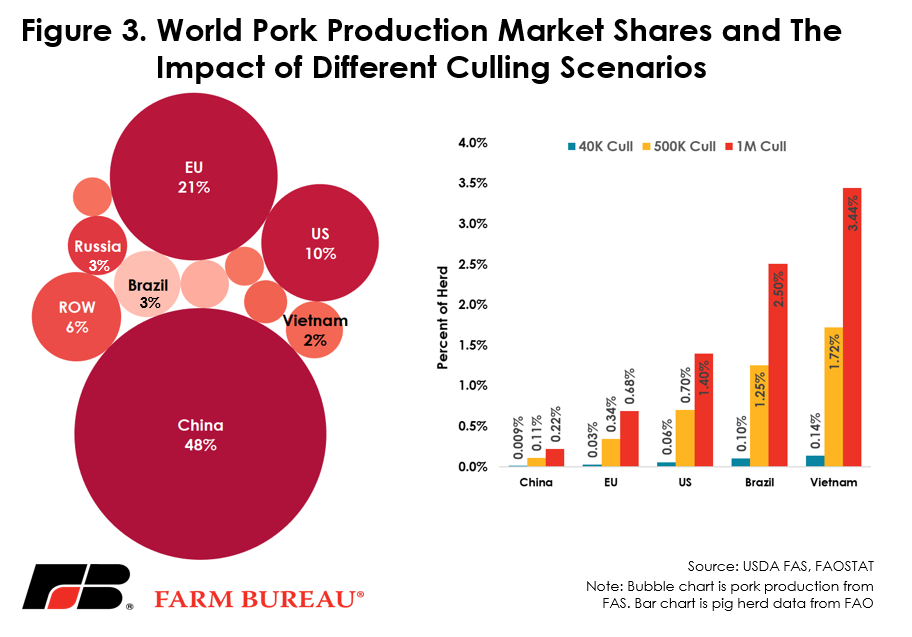

China is by far the world’s largest producer and consumer of pork. Therefore, any significant disruption in that supply chain has the potential to dramatically impact world supply and demand. Figure 3 highlights the drastic differences in scale between China and the next-largest pork producers. Reports are that China has already disposed of approximately 40,000 animals. That number may not be large enough to materially impact the herds of the five largest pork producing countries, but the number is expected to grow. The sheer size of China’s pig herd means that even materially larger animal disposal numbers would still be a fraction of the Chinese herd, but significant shares of other countries’.

Key Takeaways

The word “potential” has been used frequently in this article. This is because it is still too early to say definitively what the overall impact will be. The impact is also contingent on several “it depends if” variables. Primarily, it depends on how effective China is in controlling the spread of the virus. If their measures are largely successful, then the impact to the world pork supply and demand equilibrium is unlikely to amount to much. Additionally, it depends on what percentage of the pigs that get infected are utilized for raising more animals. If this virus hits the sow population hard, the forward production curve of pork in China could be dramatically affected.

Is There an Opportunity Here for U.S. Pork Exports?

At this point, it is unlikely that U.S. pork exports to China would significantly increase. This is partially because it is still too early to tell what the overall impact is, but also because of other forces at play. We are in the middle of the trade spat with China, facing steep tariffs on U.S. pork imports into the country. Even if a significant disruption were to happen, it would take quite a bit to overcome the 70 percent tariff that U.S. hams and shoulder cuts are facing. Additionally, China is ractopamine-free, and while the U.S. produces some “racto-free” pork, it is not a sizable amount. China would be more likely to turn to another racto-free country such as the European Union or Canada before turning to the U.S. or Brazil.

Top Issues

VIEW ALL