Argentina’s Woes Expected to Lead to Smaller Global Soybean Crop in 2018

TOPICS

USDA

photo credit: Arkansas Farm Bureau, used with permission.

John Newton, Ph.D.

Vice President of Public Policy and Economic Analysis

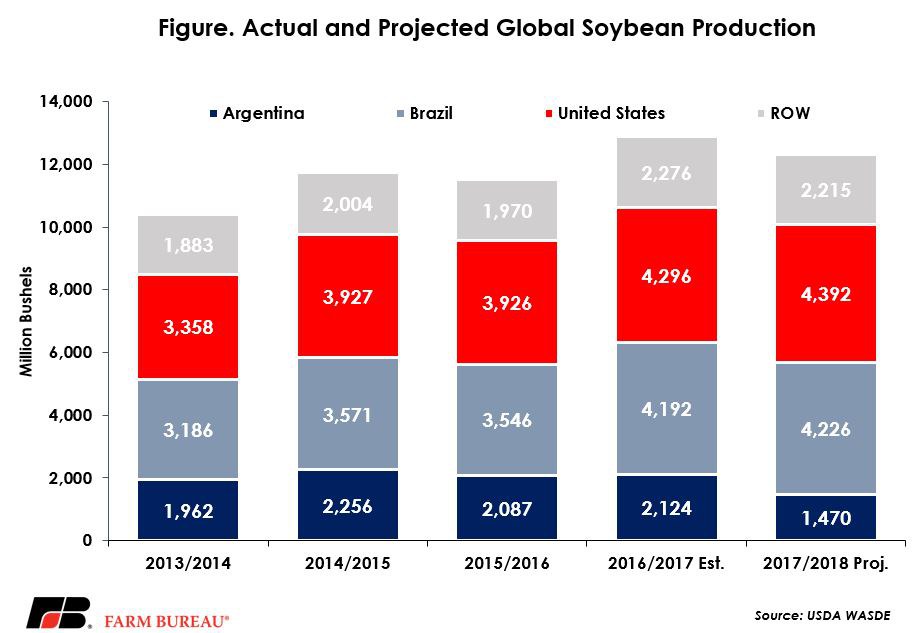

USDA’s April 10 World Agricultural Supply and Demand Estimates provided an updated projection for the global supply and demand for soybeans in 2018. Driven by adverse growing conditions in Argentina, harvested soybean area and yields are anticipated to be lower in 2018. For the 2017/18 marketing year, soybean production in Argentina is expected to fall 31 percent from the 2016/17 marketing year to 1.4 billion bushels. If realized, Argentina’s 2018 soybean production volume would be the lowest in a decade.

The small crop in Argentina is partially offset by larger soybean crops in both the U.S. (4.4 billion bushels) and Brazil (4.2 billion bushels), up 2 percent and 1 percent, respectively, from the prior year’s production volume. Combined, the U.S., Brazil and Argentina are expected to represent 82 percent of global soybean production in 2017/18 – in line with their historical market share.

2017/18 global soybean production is now projected at 12.3 billion bushels, down 1.8 percent from last month’s estimate. If realized, 2017/18 global soybean production would be down 5 percent from 2016/17’s record-high production volume of 12.9 billion bushels. With 2017/18 global production projected to be lower, and USDA leaving consumption mostly unchanged from the prior month’s estimate, global ending stocks are now projected at 3.3 billion bushels, down 6 percent from prior-year levels. The global stocks-to-use ratio is projected at 18 percent, down 2 percentage points from the prior marketing year.

Importantly, in the face of China’s announcement of a soybean tariff of 25 percent, USDA left unchanged projected import demand from China at 3.6 billion bushels and left unchanged the projected U.S. export volume of 2.1 billion bushels. These projections will continue to change throughout the marketing year, with the next update coming in the May 10 WASDE.

Top Issues

VIEW ALL