As Deadline Approaches, DMC Enrollments Low, Despite Expected Benefits

TOPICS

USDAMichael Nepveux

Economist

photo credit: Mark Stebnicki, North Carolina Farm Bureau

Michael Nepveux

Economist

As we near the end of a historic and unexpected year, many dairy farmers are giving much thought to how to best manage the unexpected. With a looming sign-up deadline of December 11, the Dairy Margin Coverage program is a voluntary risk management program that makes payments when the national average income-over-feed-cost margin falls below a farmer-selected coverage level. The margin is the difference between the national average U.S. all milk price and the estimated cost of feeding a dairy cow with corn, soybean meal and high-quality alfalfa hay.

Coverage is available from as low as $4 per hundredweight to as high as $9.50 per hundredweight. Dairy producers pay premiums for coverage with lower premium rates for the first 5 million pounds of milk covered. Under DMC, program payments, which may be triggered monthly, are made if the margin falls below the farmer’s elected coverage level. Program payments are based on the amount of milk covered in the program and may range from 5% to 95% of a farm’s milk production history in 5% increments. Market Intel has published a number of articles delving into the revamped dairy program and its potential benefits.

DMC Enrollment

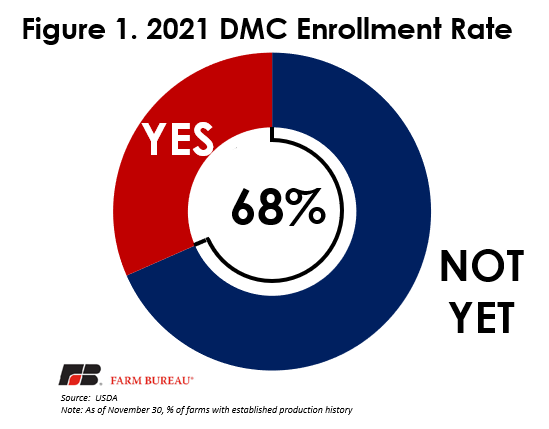

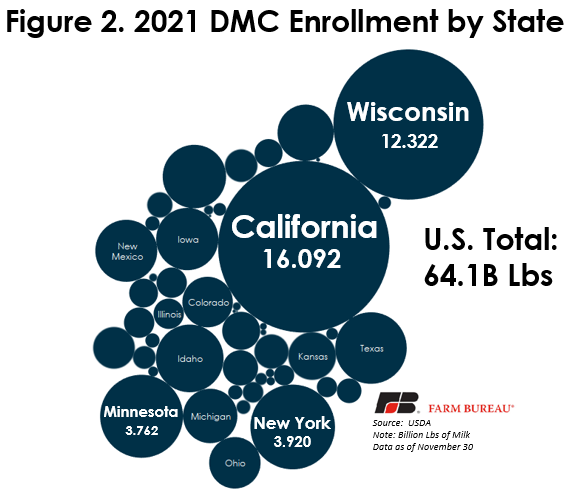

DMC enrollment coverage for 2021 opened on October 13 and closes on December 11. For 2021, 7,846 dairy operations have enrolled in DMC so far, covering approximately 64 billion pounds of milk, and accounting for just under one-third of the number of operations and total volume of milk. Approximately 68% of the licensed operations with established production history have not yet signed up for the program. California, Wisconsin, Minnesota and New York led the way in pounds of milk covered (Figure 2). We are very likely going to see the number of enrollments for next year increase before the deadline because a decent share of producers opted for a one-time enrollment for the 2019 year, which committed them to multiple years of program participation.

Next year’s 7,846 operations enrolled compares to 13,468 operations enrolled in 2020, which was a decline from the 23,417 operations enrolled in 2019. The drop in 2020’s enrollments was partially due to fairly rosy expectations for the dairy industry for 2020. In 2019, no one imagined the impact that COVID-19 would have on the U.S. economy or the roller coaster ride it would put dairy prices on throughout the summer. As a result, enrollments for 2020 declined as most people expected dairy prices to recover and feed prices to hold steady, which would have resulted in little-to-no program payouts. While it is natural to hope for a best-case scenario, risk management exists to protect producers from the opposite.

How DMC Performed In 2020 So Far

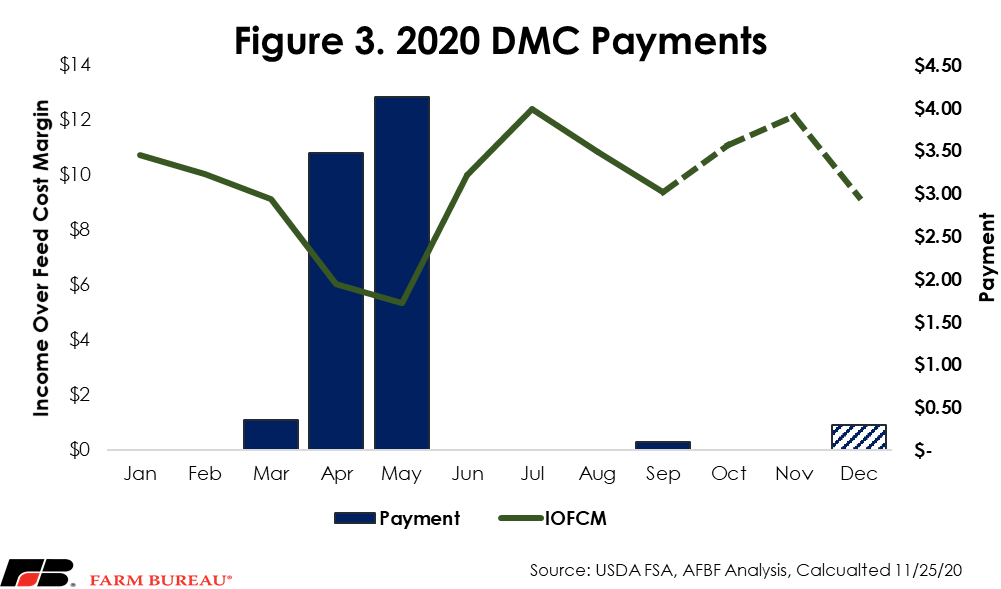

Producers who elected to enroll in DMC for 2020 received some protection at the onset of the COVID-19 crisis. Margins during April and May were $6.03 and $5.37, respectively, meaning that producers who enrolled at $9.50 coverage would have received payments equal to $3.47 (April) and $4.13 (May) per hundredweight. A producer who covered 5 million pounds at this coverage level would have received more than $30,000 in total payments for 2020, compared to a premium $7,500.

Expected Payout in 2021

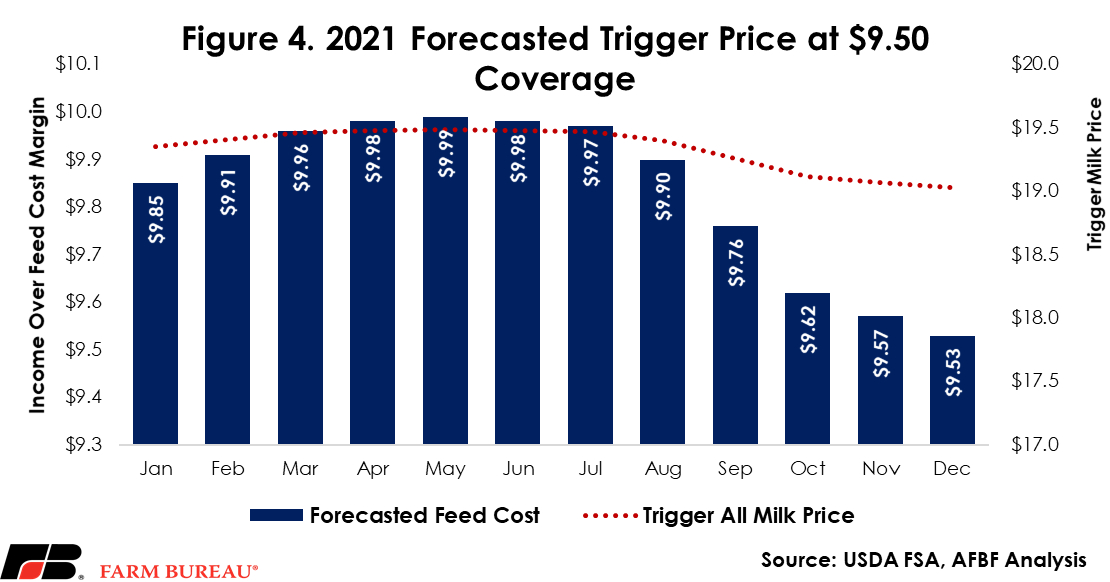

This low level of enrollment with less than two weeks until the deadline is somewhat surprising given the expected benefits of enrolling in the program in 2021. While a rally in crop markets may be a boon for those farmers, it results in increased feed costs for dairy producers. Increased feed costs squeeze dairy farmers’ margins, making participation in programs like DMC more attractive.

Rising feed costs push up the milk price that it takes to trigger payments under the program, making it easier for producers to receive payments under the program. One can think of the milk price that triggers a payment as the summation of the forecasted feed costs and the elected coverage level. Figure 3 shows the 2021 forecasted feed costs as well as the resulting trigger price at a $9.50 coverage level. As of now, all of 2021 is expected to see a trigger price above $19/cwt, resulting in a relatively decent chance of payments at this coverage level. Current Class III and Class IV milk futures, and milk price forecasts indicate the all milk price used to calculate margins will likely remain under the trigger price throughout the year, resulting in payments. It would make sense for producers to at least enroll their first 5 million pounds under Tier I at a $9.50 coverage level given the expected net benefit.

Summary

The deadline for enrollment in DMC for 2021 is December 11, and so far, enrollments are very low. This is somewhat perplexing to observers given the potential of payments exceeding premiums seems relatively likely. The income-over-feed-cost margin is expected to decline throughout the year due to rising projected feeding costs, pushing the projected price needed to trigger payments above $19/cwt for the entire year. Producers who are interested taking advantage of these potential benefits should sign up soon.