August Trade Data Shows Strong Exports Continue

TOPICS

TradeAFBF Staff

photo credit: Getty

August trade data showed exports continued at a double-digit pace, increasing 15 percent over August 2016. This marks the third straight month of double-digit export increases and extends the year-to-date lead to 15 percent over last year. Leading the way in the month of August were increases to Vietnam (113 percent), Japan (+9 percent), followed by Hong Kong (28 percent), and Canada (18 percent). Mexico and other countries showed single digit increases, while China and South Korea posted year-over-year declines.

Imports also increased in August, up 8 percent compared to 2016. Several countries had double-digit increases in imports to the U.S., starting with New Zealand (19 percent), Australia (15 percent), Mexico (14 percent) and Uruguay (14 percent). Brazil and Nicaragua posted year-over-year declines this month. Year-to-date imports are still hovering just below a year ago, down 3 percent, although the last three months have shown rather strong increases.

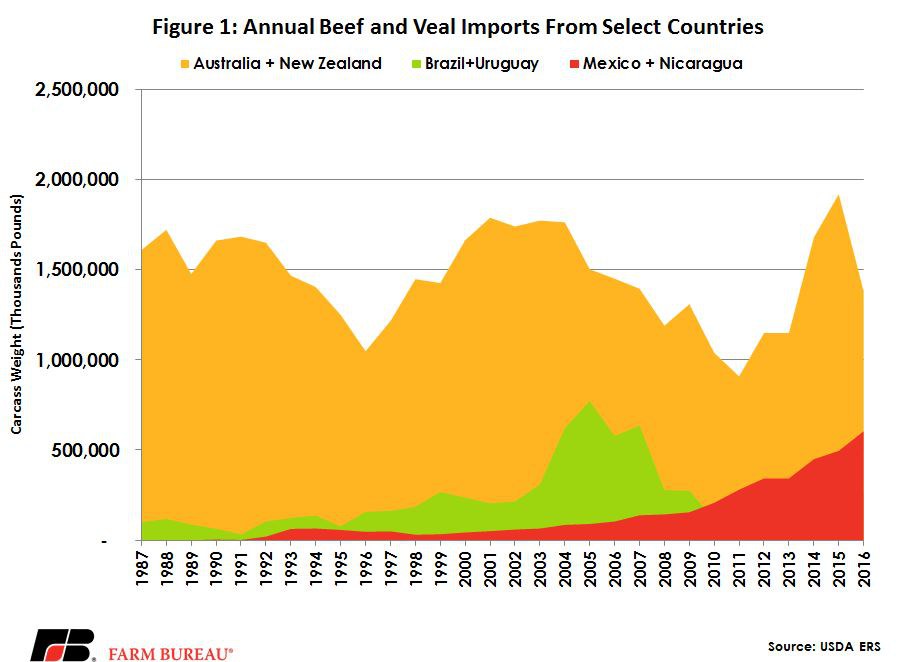

Imports have regionally shifted this year. While Australia and New Zealand still supply the lion’s share of imported beef, about 1 billion to 1.5 billion pounds annually (carcass weight), Central and South America have been increasing shipments this year. Brazil and Uruguay over the last five years have supplied on average about 215 million pounds per year. This year those two countries have nearly hit 200 million pounds through the first eight months of 2017. Year-to-date Brazil is up 19 percent and Uruguay follows with a 12 percent increase. However, the big news is the growth from Mexico and Nicaragua, which combined have shipped almost half a billion pounds of beef to the U.S. this year, already more beef than they've sold in any single year before 2015. Mexico alone is up 31 percent on a year-to-date basis and Nicaragua is up 26 percent. Figure 1 shows the increase in imports from these regional pairs.

Mexico and Nicaragua have been gaining ground in the U.S. import market since about 1998. Imports from these two countries surpassed annual imports from Brazil and Uruguay in 2010 and have not looked back, posting double-digit increases in seven out of the last 10 years. This trend will be an interesting one to watch as markets shift and new trade agreements unfold. Canada is still a large player shipping beef to the U.S. and ranked 2nd in 2016 on a tonnage basis, larger than Mexico and Nicaragua combined. However, this month those numbers fail to make the highlight reel, coming in only 3 percent higher year-to-date than 2016 and even in the month of August.

A version of this article first appeared in In the Cattle Markets and is reprinted by permission from Livestock Market Information Center (LMIC). AFBF is a member of LMIC. In the Cattle Markets is an extension newsletter featuring content from a group of rotating agricultural economists. AFBF’s Katelyn McCullock is a regular contributor and wrote this week’s “In the Cattle Markets” highlighting the the U.S. trade data. To subscribe to future “In the Cattle Markets” newsletters visit www.lmic.info.

Top Issues

VIEW ALL