Can Monster Crop Yields Continue?

TOPICS

USDA

photo credit: AFBF Photo/Terri Moore

John Newton, Ph.D.

Vice President of Public Policy and Economic Analysis

USDA’s Jan. 12 Crop Production report confirmed what we’ve known all along: The U.S. produced several monster crops in 2017. For the 2017/18 marketing year production of corn is the second highest on record at 14.6 billion bushels, soybean production is record-high at 4.4 billion bushels, and cotton production is the fourth highest on record at 21.3 million bales.

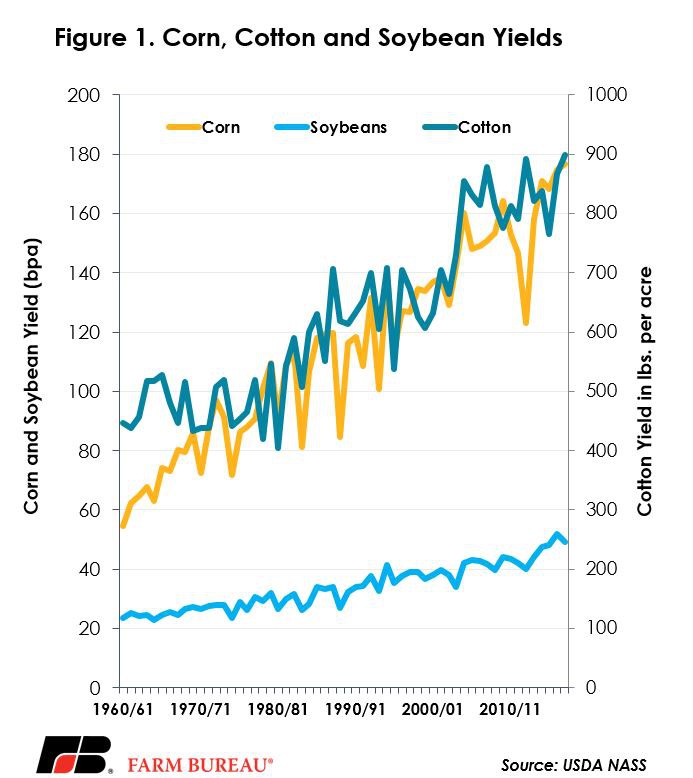

Record Crop Yields

While the production of these crops was at or near record highs, crop yields were record-high for corn and cotton, and the second highest on record for soybeans. For corn, the U.S. average yield in 2017 was 176.6 bushels per acre, 2 bushels above last year’s record and 9.8 bushels per acre above the linear trend yield. For soybeans, the U.S. average yield was 49.1 bushels per acre, down 2.9 bushels from last year’s record and 3.2 bushels above the linear trend yield. Finally, for cotton, the U.S. average yield was 899 pounds per acre, 32 pounds above prior-year levels and 54 pounds above trend. Figure 1 details U.S. average corn, soybean and cotton yields from 1960 to 2017.

For corn and soybeans, 2017 makes the fifth consecutive year of crop yields above a linear trend. For cotton, crop yields have been above trend for two consecutive years. One impact of multiple years of larger than anticipated yields is that carryout stocks for corn, soybeans and cotton continue to expand. Since the drought year of 2012, corn ending stocks have increased more than 200 percent, and are projected at 2.5 billion bushels – the highest level since 1988. Soybean ending stocks have increased 234 percent over this span, and are projected at 470 million bushels – the highest level since 2007. Finally, cotton stocks are projected at 5.7 million bales, 50 percent higher than in 2012. For corn and soybeans, in particular, these monster crops have led to significantly lower crop prices. The 2017/18 marketing year average prices for corn and soybeans are projected at $3.25 and $9.30 per bushel, respectively. The corn price is down more than 50 percent and the soybean price is down 35 percent since the record-high prices of 2012. For the time being, several monster crops in a row have delayed recovery in the new era of grain prices.

Can This Trend Continue?

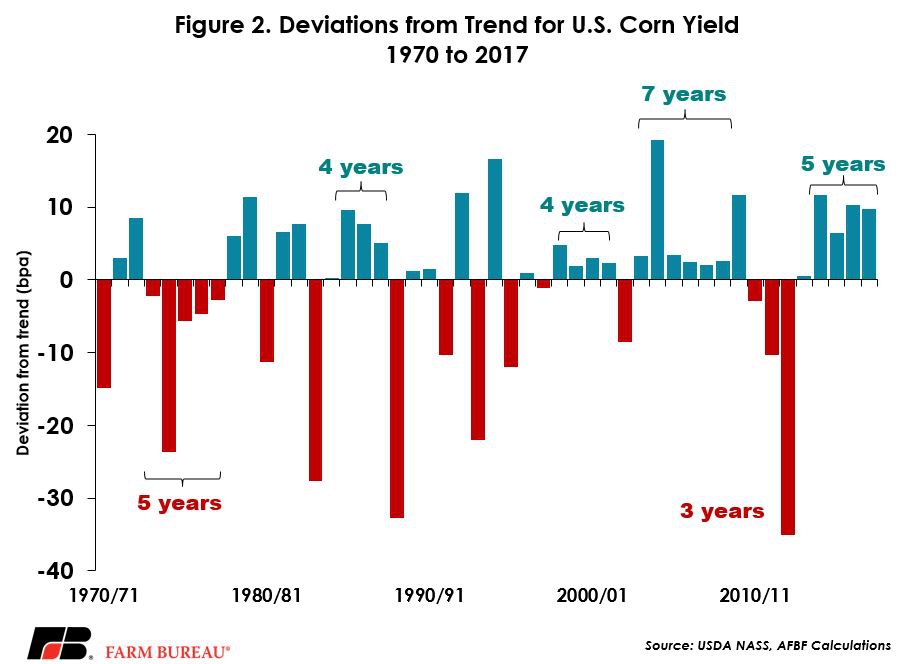

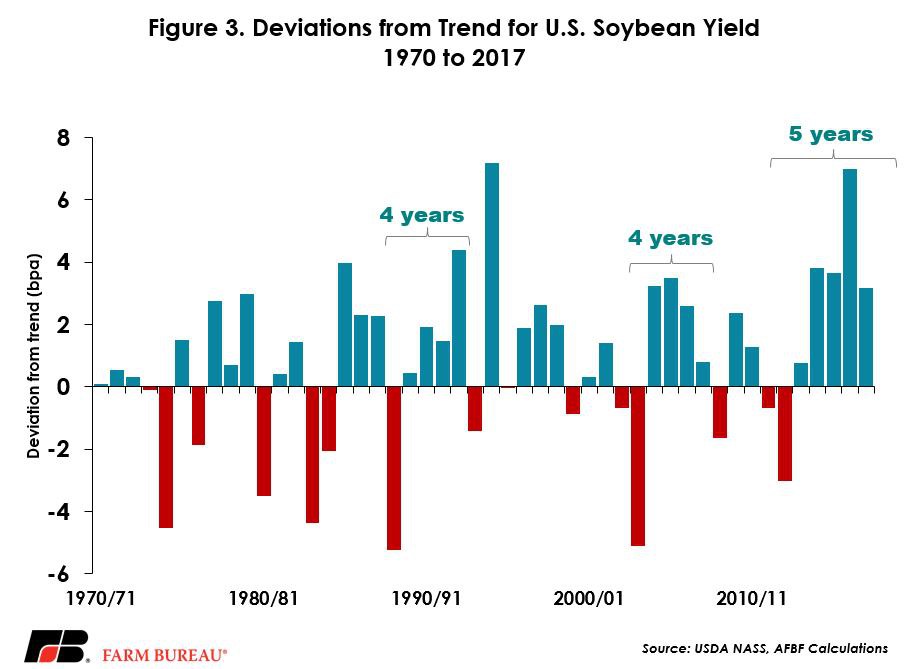

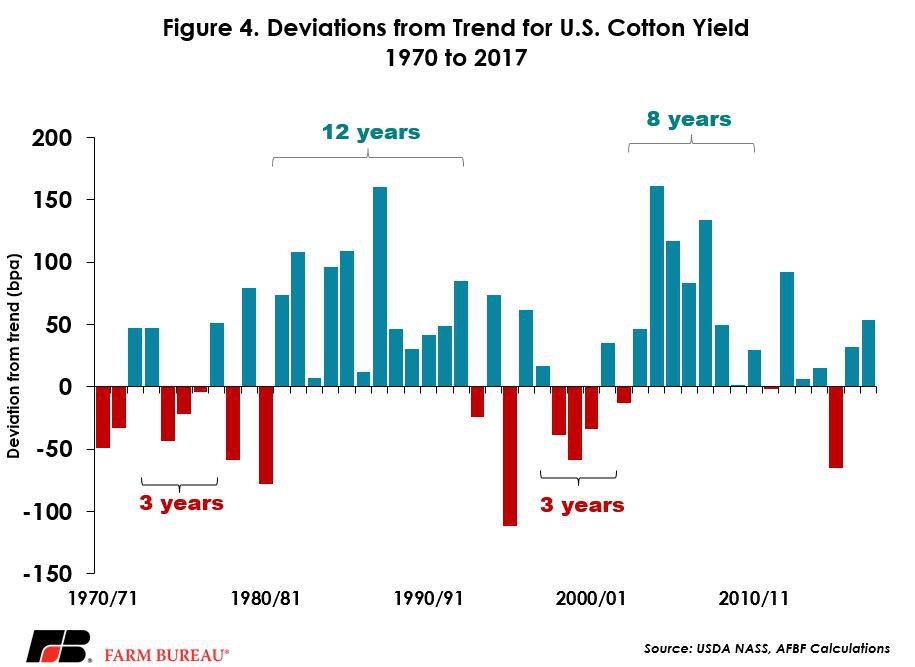

The million-dollar question facing growers going into 2018 is: “Can this pattern of above-trend crop yields continue?” In short, yes, it can. However, the law of averages should catch up eventually, right?

Since 1970, corn, soybean and cotton yields have been above trend more than 65 percent of the years. For corn, the longest period of above-trend crop yields was 2003 to 2009, i.e. seven consecutive years. The current streak of five consecutive years is the second longest on record. The longest period of below-trend corn yields was 1973 to 1977, five years, followed by 2010 to 2012, three years, Figure 2.

For soybeans, the current streak of 5 consecutive years of above-trend crop yields is the longest on record, followed by 4-year streaks from 2004 to 2007 and from 1989 to 1992. There has never been a period where soybean yields have been below trend for more than two consecutive years, Figure 3.

Finally, for cotton, the current streak of two consecutive years of above-trend crop yields is well below the pattern witnessed from 1981 to 1992 when 12 years of yields above trend were experienced, and from 2003 to 2010 when eight years of above trend yields were experienced. In fact, had it not been for 2010 and 2015, the current period of cotton yields above trend would be 15 years, Figure 4.

Implications

For many years crop yields in corn, soybeans and cotton have been above linear-trend estimates. Higher than anticipated crop yields have led to a significant expansion in ending inventory levels, lower crop prices, and, ultimately, lower net farm income. While the frequency of historical crop yield deviations has no bearing on future crop yields, the law of averages should eventually hold. Should the law of averages not hold, it may be prudent for the industry to reevaluate the impact technological innovations have had on crop yield predictability – or the lack thereof.

Follow Market Intel on Twitter: @FBMarketIntel

Top Issues

VIEW ALL