Cattle on Feed Back to 2012 Levels

TOPICS

Livestock

photo credit: North Carolina Farm Bureau, Used with Permission

John Newton, Ph.D.

Vice President of Public Policy and Economic Analysis

USDA’s Jan. 26 Cattle on Feed report revealed Jan. 1 cattle and calves on feed for the slaughter market reached 11.5 million head, up 8 percent over prior-year levels and in line with the average trade estimate of an 8-percent increase. For three consecutive months U.S. cattle on feed has been above 11 million head, suggesting that cattle inventory levels are now back to 2012 levels.

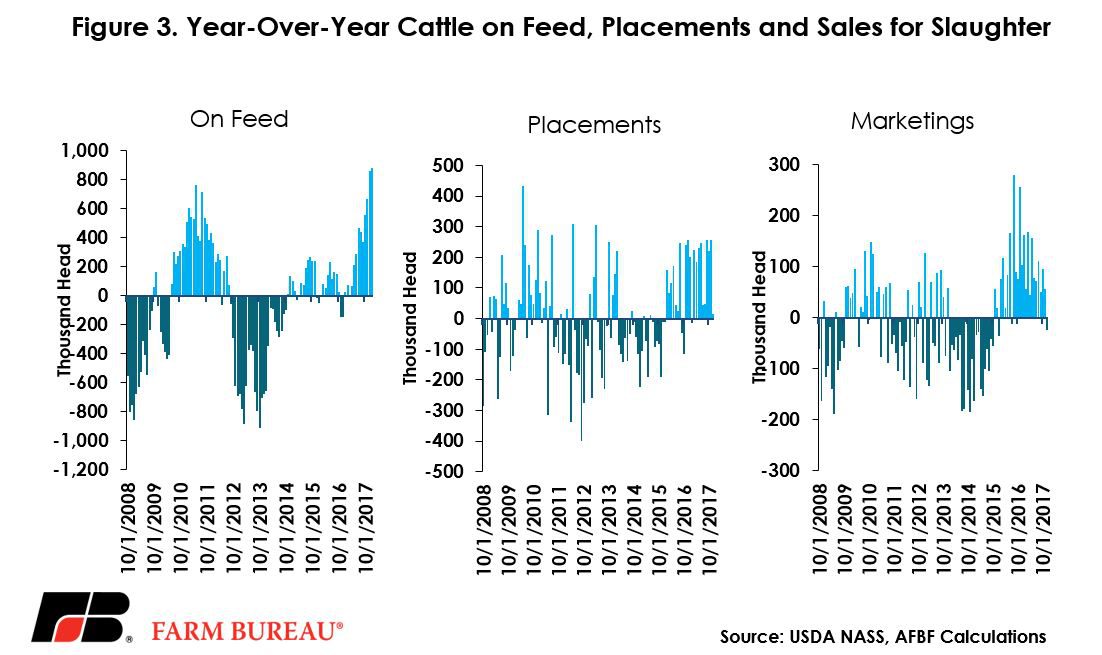

On a volume basis, the number of cattle on feed on Jan. 1 surged by 884,000 head above year-ago levels, representing the largest volume increase in more than a decade. December’s increase in cattle on feed continues the growth experienced in the sector during each month of 2017. In fact, the number of cattle on feed has been above prior-year levels in 21 out of the last 24 months.

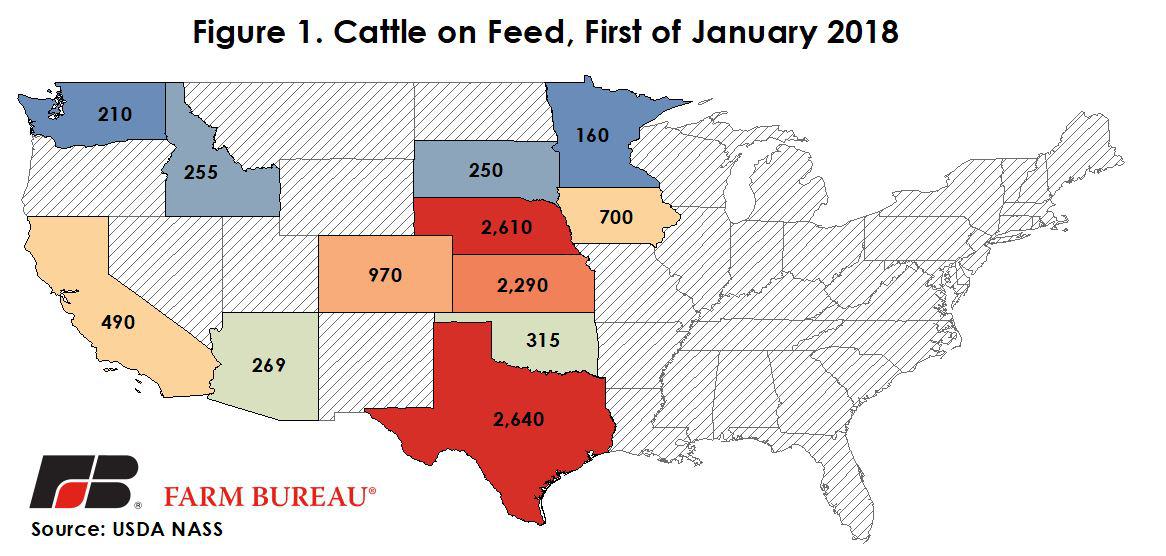

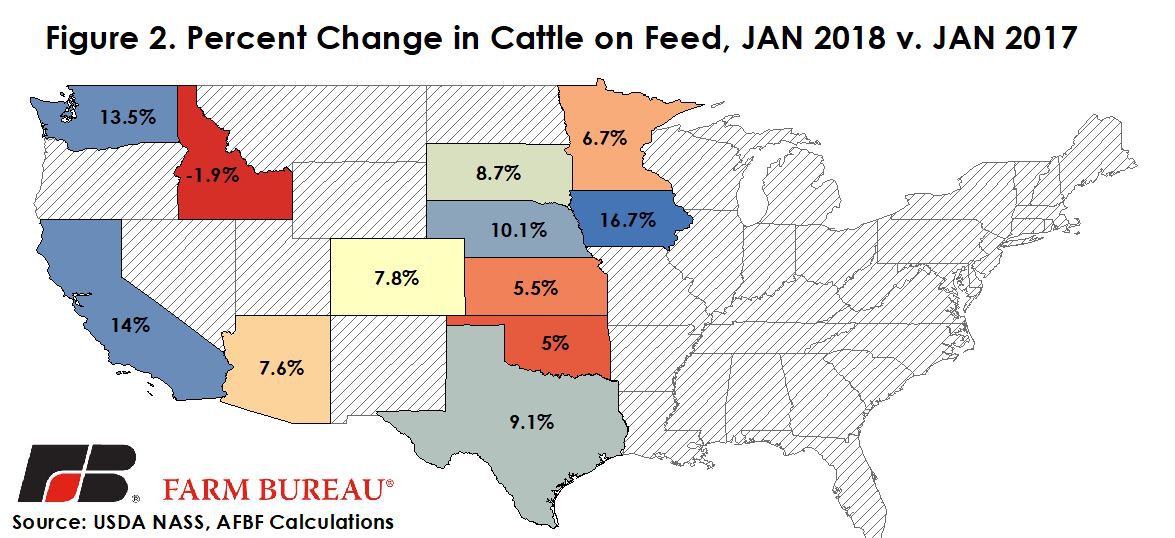

The number of cattle on feed was the highest in Texas, Nebraska and Kansas, where a combined 7.5 million cattle were on feed, Figure 1. States with the largest increases during December included Texas, Nebraska, Kansas and Iowa, which added a combined 680,000 head, i.e. placements minus marketings, i.e. sales for slaughter, and other uses. Of the major states reported, only Idaho saw a reduction in the number of cattle on feed compared to a year ago. On a percentage basis, states with the largest increase in cattle on feed were Iowa, California, Washington and Nebraska, Figure 2.

The high levels of cattle on feed are the result of more animals being placed on feedlots due to widespread drought and limited forage across the U.S. Marketings, however, have remained current and the number of cattle on feed is not a concern, but marketing will need to continue to keep pace. The number of head placed in feedlots during December 2017 totaled 1.8 million head, an increase of less than 1 percent over year-ago levels. This was above the average trade estimate of a 3-percent decline in placements. On a volume basis, placements were up 14,000 head. December saw a decline in the number of marketings, the first year-over-year figure to drop since July -2016. Marketings of fed cattle during December 2017 were 1.75 million head, down 1.4 percent or 25,000 head from prior-year levels and in line with the average trade estimate. Finally, other disappearance came in at 74,000 head, up sharply from prior-year levels. Year-over-year changes in cattle on feed, placements and marketings are found in Figure 3.

Implications

What the weather holds for 2018 has yet to be seen, but given the dryness and reduction in hay yields, forage is expected to be tight at the very least until late spring (Read: Drought Expands Across the U.S.). With larger supplies already on feed, cattle prices are expected to be lower this year. Strong demand in 2017 left the cattle industry pleasantly surprised, with cattle prices remaining firm late in the year. This could very well happen again, but for now, expect annual average prices to be down about 5 percent on the fed side and 3 percent for feeder weights.

USDA recently raised 2018 beef production due to increased cattle placements in late 2017 and expected heavier marketings and weights early in 2018. Beef production in 2018 is projected to increase 6 percent, to 27.8 billion pounds on a carcass weight equivalent. If realized, this would be record-high U.S. beef production. With additional supplies coming online in 2018, USDA projects exports will increase marginally and domestic consumption will increase by nearly 3 pounds per capita to 59.4 pounds per capita, the highest beef consumption figure since 2010.

Top Issues

VIEW ALL