Cattle on Feed Lower Than Pre-Report Estimates

AFBF Staff

photo credit: Alabama Farmers Federation, Used with Permission

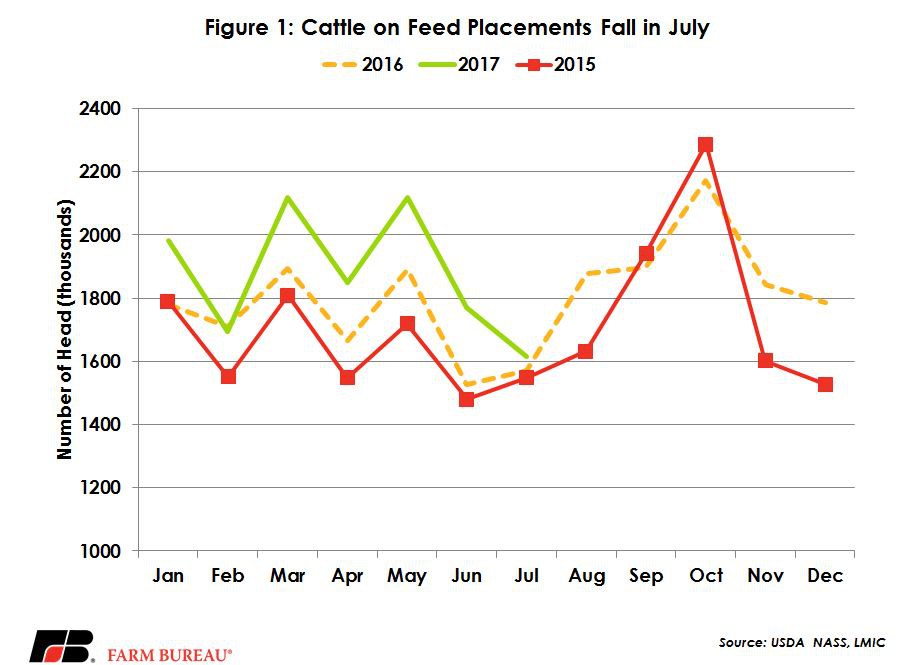

On August 1, there were 10.6 million head of cattle on feed, up 4 percent from the previous year. The rate of cattle placed onto feed has slowed noticeably, coming in only 3 percent up from 2016. August is the first month in 2017 without double digit placements since February, as February’s numbers dropped 1 percent without the extra calendar day of the 2016 leap year. In every other month in 2017 placements have been between 11 percent and 16 percent above a year ago. Figure 1 has the replacements for 2015-2017.

As pointed out in last week’s In the Cattle Markets feedlot returns have eroded rather sharply over the last couple of weeks, largely driven by a decline in fed steer prices. The five market slaughter steer prices have fallen $34.92 per cwt since its peak in early May. However, feedlot returns did hold strong for most of the summer. July feedlot returns fell significantly and are expected to turn negative in August. June to July feeder prices fell about $12 per hundredweight, and weekly prices continue to slide, making feedlots more cautious about bidding aggressively for cattle. Marketings remained strong in July -- up 4 percent-- but with the deterioration in feeding returns, it’s clear feedlots are thinking twice about filling pens with negative returns projected. Across the board, pre-report estimates were slightly higher than actuals, and had some rather wide ranges.

Cattle on feed weight breakdown reflected smaller placements. Last month all three categories under 800 pounds showed increases in the neighborhood of 25 percent above a year ago. Comparatively at the extremes in June, cattle under 600 pounds and over 800 pounds were up 2 percent each: 700-799 pound cattle had the higher increase over a year ago, up 7 percent. Nebraska continued to show high placements of cattle under 600 pounds and in the 700-799 pound weight category. Texas noticeably had less placements, even with a year ago compared to the 18 percent jump seen in June. Colorado also was even with last year, showing only a gain in the heavy weight category of over 800 pounds. Last month, Colorado placements were up 19 percent over a year ago.

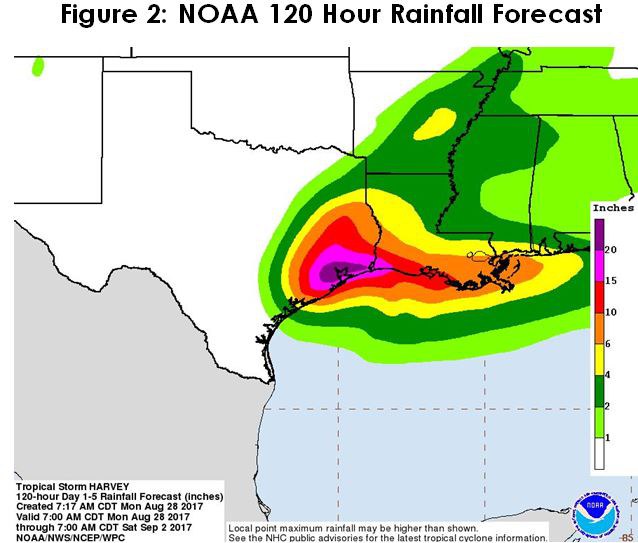

Hurricane Harvey hammered the coast of Texas last weekend. Texas A&M’s Dr. David Anderson estimated that there are 54 counties in declared disaster areas affecting 1.2 million beef cows based on the USDA county estimates. Dr. Anderson also noted there are a large number of livestock auction barns in this area as well and Sam Kane beef packers near Corpus Christi. Dr. Anderson’s newsletter can be found here. The next several days is expected to show continued heavy rainfall. Figure 2 is the 120 hour forecast by NOAA.

A version of this article first appeared in In the Cattle Markets and is reprinted by permission from Livestock Market Information Center (LMIC). AFBF is a member of LMIC. In the Cattle Markets is an extension newsletter featuring content from a group of rotating agricultural economists. AFBF’s Katelyn McCullock is a regular contributor and wrote this week’s “In the Cattle Markets” highlighting the USDA NASS Cattle on Feed report. To subscribe to future “In the Cattle Markets” newsletters visit www.lmic.info.

Top Issues

VIEW ALL