China’s Insatiable Demand for Soybeans

photo credit: AFBF Photo, Morgan Walker

John Newton, Ph.D.

Vice President of Public Policy and Economic Analysis

Implications

While it is not certain whether the topic of soybeans will be on the agenda this week when President Trump hosts Chinese President Xi Jinping, it is not too difficult to build a compelling case why they should be. Delayed approvals in China for agricultural products derived from biotechnology, including soybeans, has been an issue the last several years. Could this meeting be an opportunity to secure more market access, and grow exports even more?

Exports are the largest consumption category for U.S. soybeans and China imports nearly one-third of every soybean acre harvested. This is equivalent to 25 million acres. The value of U.S. soybean exports to China is over $14 billion per year, and has grown by nearly 250 percent over the last decade. Competition to supply the Chinese market will intensify as more acres around the world are shifted into soybean production. Combined, Brazil and Argentina are projected to have a record soybean harvest in 2017.

Chinese Demand for U.S. Soybeans

This week the Trump administration is formally hosting President Xi Jinping of China. Trade between the two countries is likely to be one of the top policy discussions, along with biotech, job creation and monetary policy. For U.S. agricultural producers, especially soybean growers, trade with China has become critically important. Hong Kong was admitted to the World Trade Organization in 1995 and shortly after China became a member in 2001.

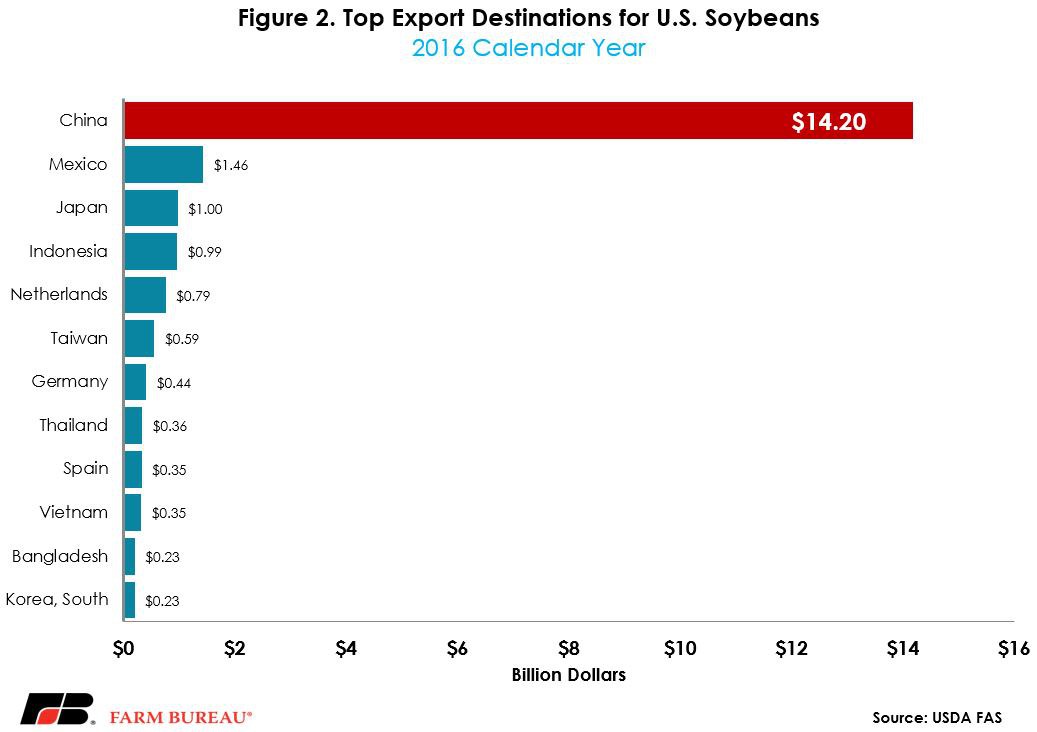

In 2017, U.S. soybean producers are expected to plant a record 89.5 million acres of soybeans, and USDA currently projects a record 2.125 billion bushels will be exported. The primary destination? China. In 2016, U.S. soybean exports totaled $23 billion, with $14.2 billion, or 62 percent of that total represented by Chinese demand, Figure 1. Our second largest trading partner in soybeans? Mexico at $1.5 billion during the 2016 calendar year. Figure 2 highlights the top export destinations for U.S. produced soybeans during the 2016 calendar year.

Already, for the first half of the 2016/17 marketing year, U.S. soybean exports have totaled $18 billion, with exports to China representing 72 percent or $13 billion dollars. The pace of U.S. exports to China will slow for the second half of the marketing year as the record-large South American crop becomes available for export. However, of the 1.658 billion bushels already exported during the first half of the marketing year, 1.175 billion bushels were exported to China. This first-half total is greater than the entire marketing year soybean production for Illinois and Iowa combined (1.164 billion bushels).

Assuming China has imported 90 percent of their U.S. soybean demand through the first half of the marketing year, total soybean exports to China could approach 1.3 billion bushels during the 2016/17 marketing year. This total would represent 30 percent of U.S. soybean production, or nearly one-third of every U.S. acre harvested. Using the average soybean yield of 52.1 bushels per acre, Chinese demand is equivalent to 25 million U.S. acres.

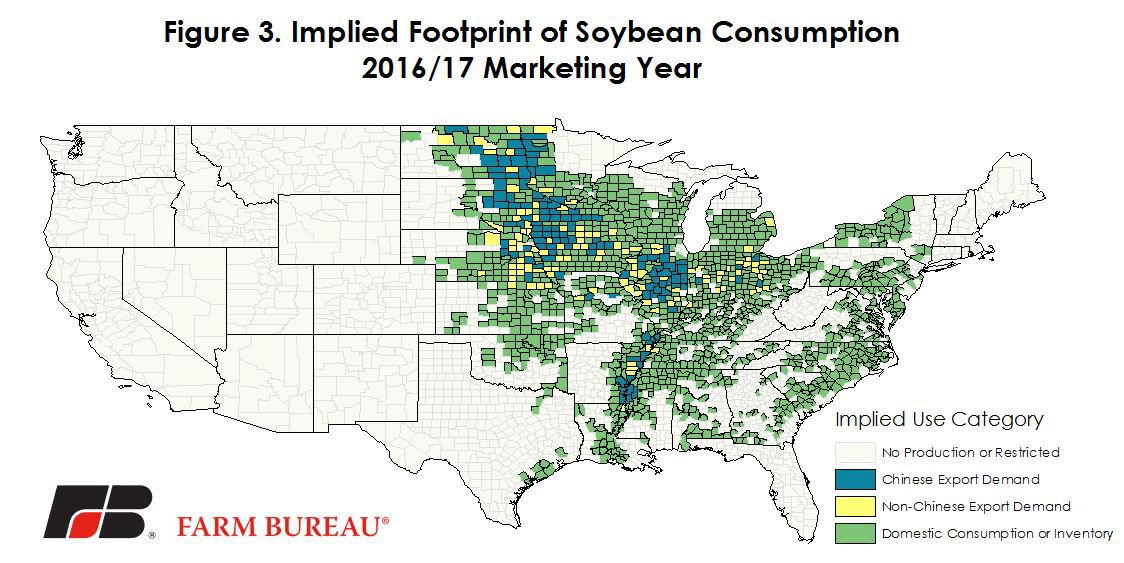

To put the footprint of Chinese soybean demand into perspective Figure 3 maps all soybean production categories, and then allocates the soybean consumption categories to each county in descending order. The categories mapped are: Chinese export demand, non-Chinese export demand, and domestic use and inventory. As identified in Figure 3, for the 2016/17 marketing year, soybean production from the top 131 soybean-producing counties are needed to meet the Chinese export demand. Then, the next 113 counties are needed to meet non-Chinese export demand. Finally, soybean production from the remaining 1,241 counties is needed to meet domestic demand (crushing, seed and residual use) and inventory.

There’s no question that U.S. growers are betting big on Chinese demand for soybeans.

Since China joined the World Trade Organization the value of U.S. soybean exports has tripled and U.S. producers have responded to this demand by planting record levels of soybeans in both 2016 and in 2017. During this time, soybean acreage has grown by nearly 15.4 million acres, yields have reached new record highs, increasing by 32 percent, and production has increased by 1.4 billion bushels. Additionally, the marketing year average price received for soybeans has climbed by more than 100 percent, or $5.12, to $9.50 per bushel.

Note: A version of this article first appeared in Newton, J., and T. Kuethe. "The Footprint of Chinese Demand for U.S. Soybeans." farmdoc daily (5):57, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, March 27, 2015.

Top Issues

VIEW ALL