FDA’s Orange Juice Rule Could Boost U.S. Growers

Daniel Munch

Economist

For many Americans, a cold, crisp glass of orange juice is a morning ritual. Yet behind that simple pleasure lies a U.S. orange industry fighting formidable challenges like invasive diseases and extreme weather. Now, a small regulatory change may offer some much-needed relief. The Food and Drug Administration (FDA) has proposed updates to a 60-year-old standard of identity for pasteurized orange juice, lowering the required minimum sugar content (measured in degrees Brix, a standard measure of natural sweetness) from 10.5° to 10.0°. This tweak could deliver significant benefits to U.S. citrus growers, without changing the taste or price for consumers.

Shrinking Orange Harvests, Growing Challenges

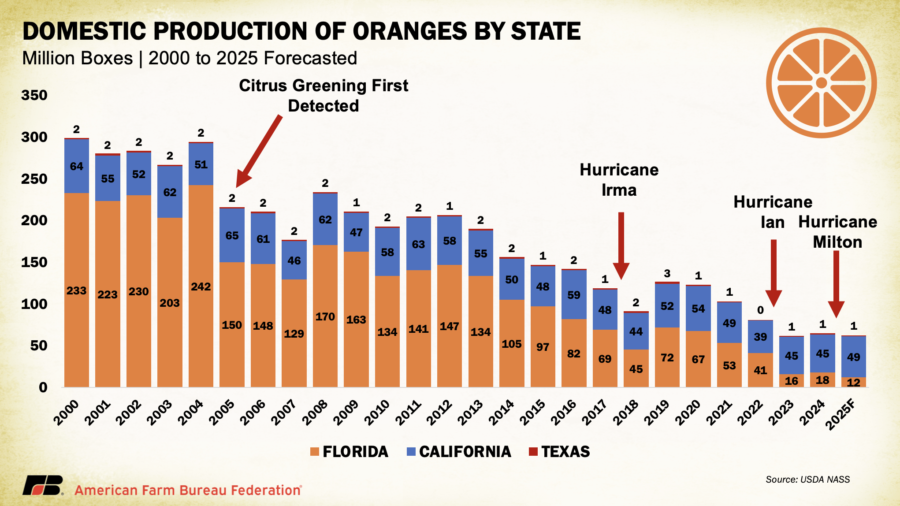

The twin blows of Huanglongbing (HLB, or citrus greening disease) and frequent hurricanes have led to sharply lower orange yields and fruit sugar levels. Citrus greening, an incurable disease first detected in Florida in 2005, causes trees to drop fruit prematurely and produce oranges that are smaller and less sweet. As a result, Florida’s orange production has plummeted by about 92% since 2005 – from 150 million boxes to just 12 million expected in 2025. The 2024/25 Florida orange crop is projected to be the smallest since 1930, 33% below last season and a stark reminder of the devastating toll disease and extreme weather have taken on the industry. This collapse has shrunk farmers’ incomes and rippled through local economies. Florida’s citrus sector supported over 32,000 jobs and nearly $7 billion in economic output as of 2021, making its survival critical for rural communities. While Florida’s output has collapsed, California has grown from supplying just 20–30% of U.S. oranges to nearly 80% today, managing modest gains since 2022 even as overall national production remains historically low.

One subtle consequence of HLB disease is a decline in the natural sugar content, known as Brix, which measures the percentage of soluble solids (mostly sugars) in juice. In the 1960s, when FDA first set quality standards for orange juice through what is called a standard of identity, essentially a legal recipe that defines what a product must contain to be sold under a certain name, Florida oranges were high in sugar, averaging about 11.8° Brix. The 1963 standard of identity for pasteurized orange juice (POJ) required at least 10.5% soluble solids in the finished juice. For decades this was not a problem, as Florida was the dominant orange juice supplier and typically met that benchmark. But since 2010, average Brix levels have steadily fallen as HLB infection spread, and hurricanes battered groves. By the 2022–23 season, the average Florida orange tested around 9.7° Brix, below the current legal minimum for pasteurized OJ. In short, changing growing conditions have made it increasingly difficult to meet the minimum requirements under the old rules.

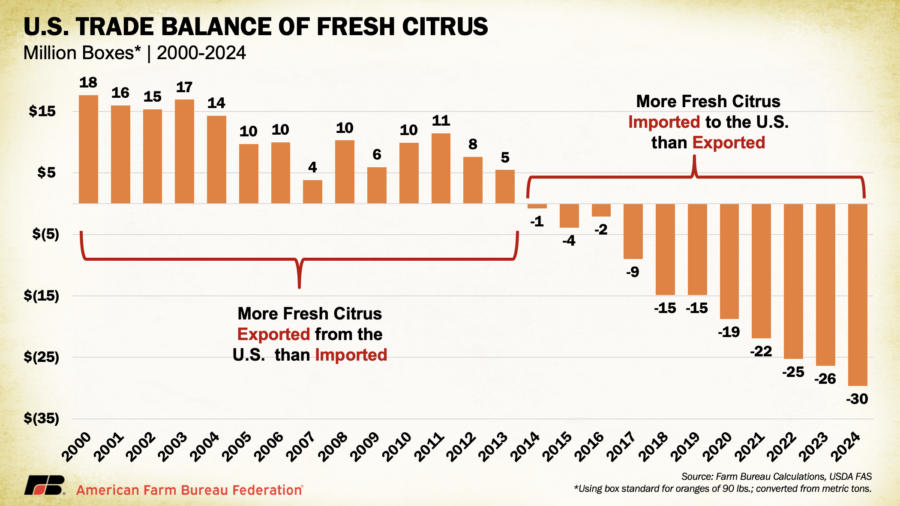

In recent years, meeting the 10.5° Brix standard has often required U.S. processors to blend in imported high-sugar juice or concentrate from countries like Brazil and Mexico. While this keeps products legally compliant, it reduces the share of U.S.-grown fruit in the final product, further shrinking the market presence of domestic oranges at a time when production is already at historic lows. This reliance on foreign inputs not only raises costs for processors but also accelerates the shift in supply and market share toward foreign competitors, making the U.S. more dependent on imports and less competitive globally.

Lowering the Brix standard would reduce the need for these high-Brix imports, helping to slow the widening orange juice trade deficit and retain more value within the domestic supply chain. For some processors, particularly grower-owned cooperatives, avoiding the expense of imported concentrate could mean the difference between operating at a loss or remaining viable to preserve jobs and processing capacity in rural areas.

Market Trends Underscore Urgency of Action

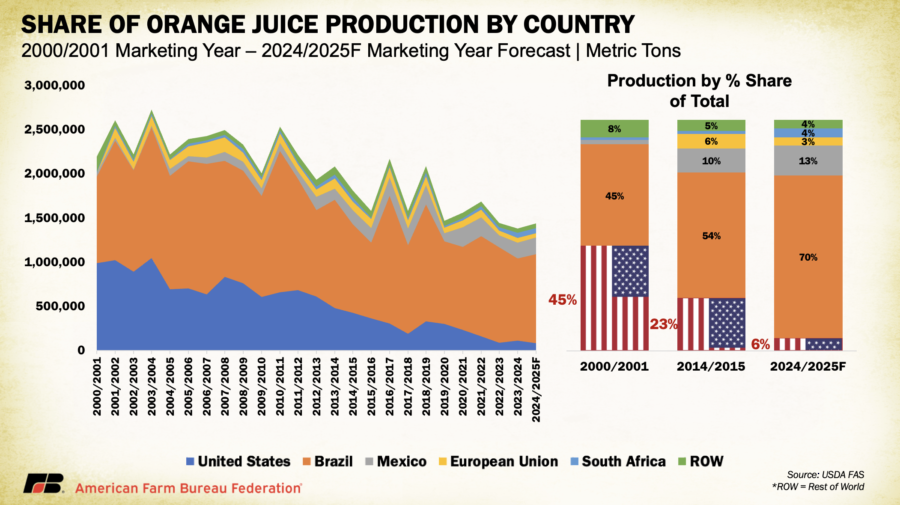

In 2000, the U.S. produced 45% of the world’s orange juice; today, that share has withered to just 6%. Fresh citrus trade has followed the same downward path: the U.S. remained a net exporter until 2014, when the trade balance had its first deficit of about 770,000 boxes. That gap has since ballooned, with 2025 imports projected to exceed exports by more than 30 million boxes. In orange juice alone, domestic production supplied nearly 75% of U.S. consumption in 2005 but now meets only 16%. In an era when every drop of U.S.-grown juice matters, the current standard effectively sidelines part of the crop, deepening production losses and shrinking the industry’s economic footprint.

Modernizing a 60-Year-Old Orange Juice Standard

The FDA is proposing to lower the minimum Brix requirement for pasteurized orange juice from 10.5% to 10.0%, updating a standard set in 1963 when U.S. production was far higher and average sugar content easily exceeded the threshold. According to FDA’s analysis, the change would have no measurable impact on taste or nutritional value for consumers, amounting to about 1 gram less natural sugar in an 8-ounce serving. Notably, however, because the proposed 10.0° standard remains slightly above Florida’s most recent average of 9.7°, some fruit would likely still fall short.

The proposed change does not impose any new requirements on juice makers; it simply expands the range of juice that can be marketed as pasteurized orange juice. Processors that choose to maintain higher Brix levels for branding or flavor reasons can continue to do so, but if a season’s crop averages around 10.2° (for example), they would no longer need to blend in additional high-sugar imports or discard fruit to meet the 10.5° cutoff. FDA projects annual industry savings of over $50 million, primarily from reduced blending costs and greater use of fruit that might otherwise go unused. Based on USDA Foreign Agricultural Service projections for 2024/25, U.S. orange juice consumption is expected to total about roughly 128 million gallons, which equates to savings of about 39 cents per gallon.

By enabling more domestic oranges to qualify for higher-value juice markets, the change could also reduce the diversion of fruit into lower-paying outlets (such as animal feed, industrial byproducts or discounted bulk juice blends) in low-sugar years. Less reliance on imported concentrate may help also preserve U.S. processing capacity and market share, providing long-term benefits to growers. While Florida’s industry stands to gain the most from this change, other citrus growers throughout the country have also expressed support, recognizing that a stronger national juice market benefits all growers and helps maintain competitiveness against foreign suppliers. Additionally, FDA does not anticipate measurable changes in retail prices from the rule, meaning consumers could continue to see price stability even as processors and growers increase efficiency.

Next Steps in the Rulemaking Process

FDA’s proposal is open for public comment until Nov. 4, with submissions accepted through Regulations.gov or by mail. After reviewing comments, the agency will issue a final rule to take effect 30 days after publication in the Federal Register.

The proposal also invites input on other changes to orange juice identity requirements, such as removing the Brix minimum entirely or raising the allowable mandarin/tangerine content in pasteurized orange juice from 10% to 15%. For growers and processors, this is a chance to share data on how regulatory updates could affect crop use, processing costs and market competitiveness, ensuring the final rule reflects on-the-ground realities.

Looking Ahead

While the proposed Brix adjustment is modest in scale, it directly addresses a requirement that has sidelined U.S.-grown fruit during years of lower sugar content. By aligning quality standards more closely with current growing conditions, the rule could help keep more domestic juice in American cartons, slow the erosion of market share, and improve processor efficiency without affecting taste or nutrition for consumers. For an industry facing historic production lows, extreme weather and growing import dependence, even incremental changes can play a meaningful role in stabilizing the market and preserving economic activity in citrus-growing regions.

Top Issues

VIEW ALL