CME Introduces Pork Cutout Contract Amid Strengthening Pork Market

TOPICS

Risk ManagementMichael Nepveux

Former AFBF Economist

photo credit: AFBF Photo, Cole Staudt

Michael Nepveux

Former AFBF Economist

On Tuesday, the CME Group announced it will be launching a new pork cutout-based contract. The new pork cutout futures and options are intended to be complementary to existing lean hog contracts and aim to provide market participants the ability to manage risk from the live animal through the meat case. CME Group cited an increasing share of animals’ prices tied to the pork cutout through formula pricing as a key reason for the introduction of the product.

What Comprises the Pork Cutout?

The pork carcass cutout is an estimate of the value of a 53-54% lean, 205 lb. hog carcass using wholesale prices that are paid for sub-primal pork cuts. A composite value is derived each day for each of the pork primals, which are calculated from the sub-primal values. Those composite values are then used to represent a single composite value of the pork carcass. There are six primals for the pork carcass that are used to calculate the cutout: loin, butt, picnic, rib, ham and belly. The cutout is a series of mathematical calculations through which current pork sub-primal prices and typical industry yields are used to calculate primal values. The calculated primal values are factored against their typical yield from the carcass and combined into the final cutout value. As a result of the calculated nature of the cutout, various primal values can significantly impact the final value of the cutout.

Figure 1 shows the overall cutout value, as well as the values of the various primal cuts used to determine the cutout value. This figure illustrates how both the primal value as well as carcass yields impact the final value of the cutout. For instance, at $127 for the month of September, the rib primal is one of the most expensive primal cuts in the carcass. However, due to it comprising such a small share of the overall carcass, its contribution to the overall cutout is much smaller than one would expect from just looking at the price of the primal. The ham and loin primals were priced much lower than the rib this past month, but due to their larger percentage shares of the carcass, they contribute more to the overall value of the cutout. Because of how the cutout is calculated, it increases the level of complexity in developing a risk management plan, especially when trying to plan around seasonality in different primals for market participants looking to reduce exposure for specific cuts.

CME’s Pork Cutout Contract

The new contracts will be quoted in U.S. cents per pound, will have a contract size of 40,000 lbs. and will mirror the lean hog contract months of February, April, May, June, July, August, October and December. Pork cutout futures and options will be financially settled to the CME Pork Cutout Index, which is a five-business-day weighted average of prices reported by USDA and published in its "National Daily Pork Report FOB Plant - Negotiated Sales – Afternoon" report. Both meat processors and meat buyers could utilize this contract in managing their risk and for hedging in the marketplace. Pork cutout futures and options will be centrally cleared, meaning that the CME Clearing House will be the central counterparty to all trades, protecting customers from default risk. The contract will also offer the opportunity for spread trading. Calendar spread trading and inter-commodity spread trading between the pork cutout and lean hog contracts will be available to participants. The pork cutout futures and options contracts will launch on Nov. 9, 2020, assuming there are no issues raised during the relevant regulatory review periods.

Current Pork Cutout Exhibiting Strength

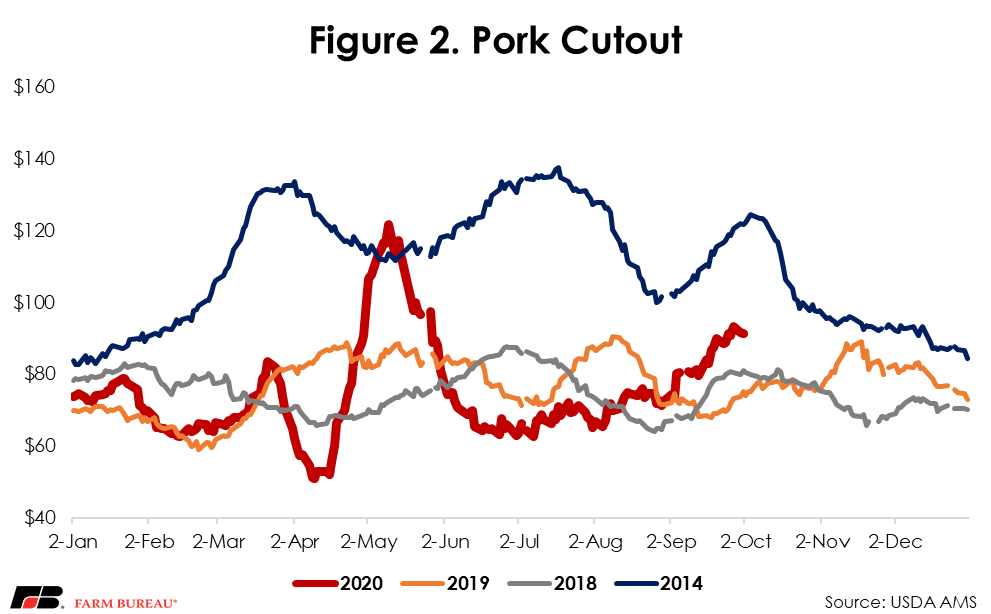

The month of September was a very strong month for U.S. pork markets, a development that seemed to catch many market participants off guard. Much of the strength is a result of the demand picture, with supply relatively in line with year-ago levels. Even with a normal supply picture, the cutout ended roughly $20/cwt above this time last year (Figure 2).

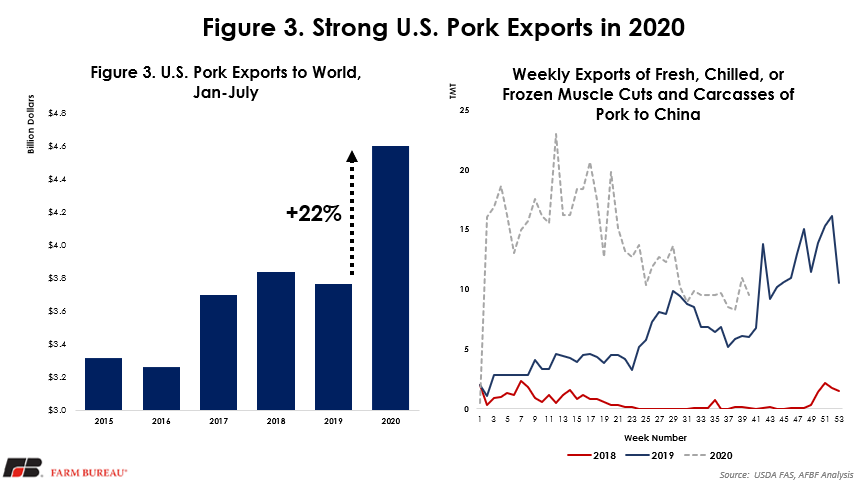

Strong export demand has been a key development for much of 2020, with U.S. global exports of pork products increasing by 22% YTD over 2019. China’s continuing shortage of animal protein due to African Swine Fever’s decimation of its hog herd has accounted for a strong increase in U.S. pork exports to that country. If Chinese demand is driving the current strength in the pork cutout, that strength may hold in the coming months as the country historically ramps up pork purchases in anticipation of the Chinese New Year.

Summary

This week, the CME Group announced the launch of a new cash-settled pork cutout contract. The new contract is intended to be complementary to existing lean hog contracts and aims to provide market participants with the ability to manage risk from the live animal through the meat case. With the increasing number of hog transactions utilizing the pork cutout as part of a formula transaction, these contracts have the potential to develop into an important risk management tool for industry participants. The timing of this announcement coincides with a rising pork cutout value and offers an opportunity to revisit what exactly the pork cutout is and how it is calculated.

Top Issues

VIEW ALL