Corn and Soybean Harvest Nearly One-Quarter Complete

TOPICS

SoybeansMegan Nelson

Economic Analyst

photo credit: Arkansas Farm Bureau, used with permission.

Megan Nelson

Economic Analyst

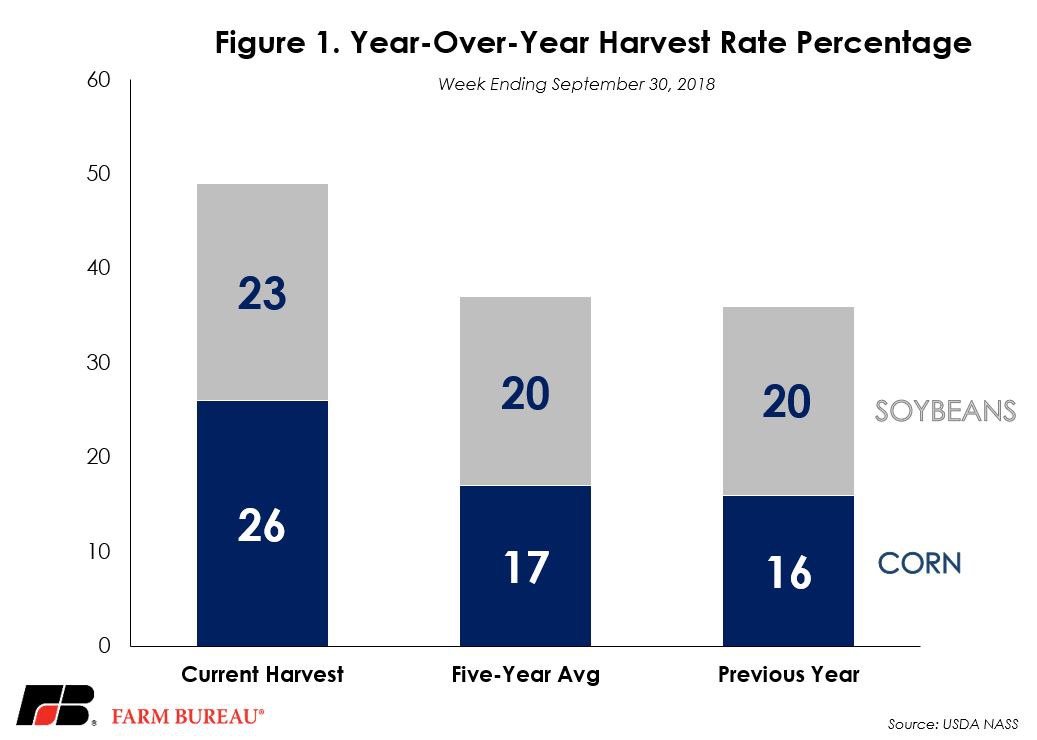

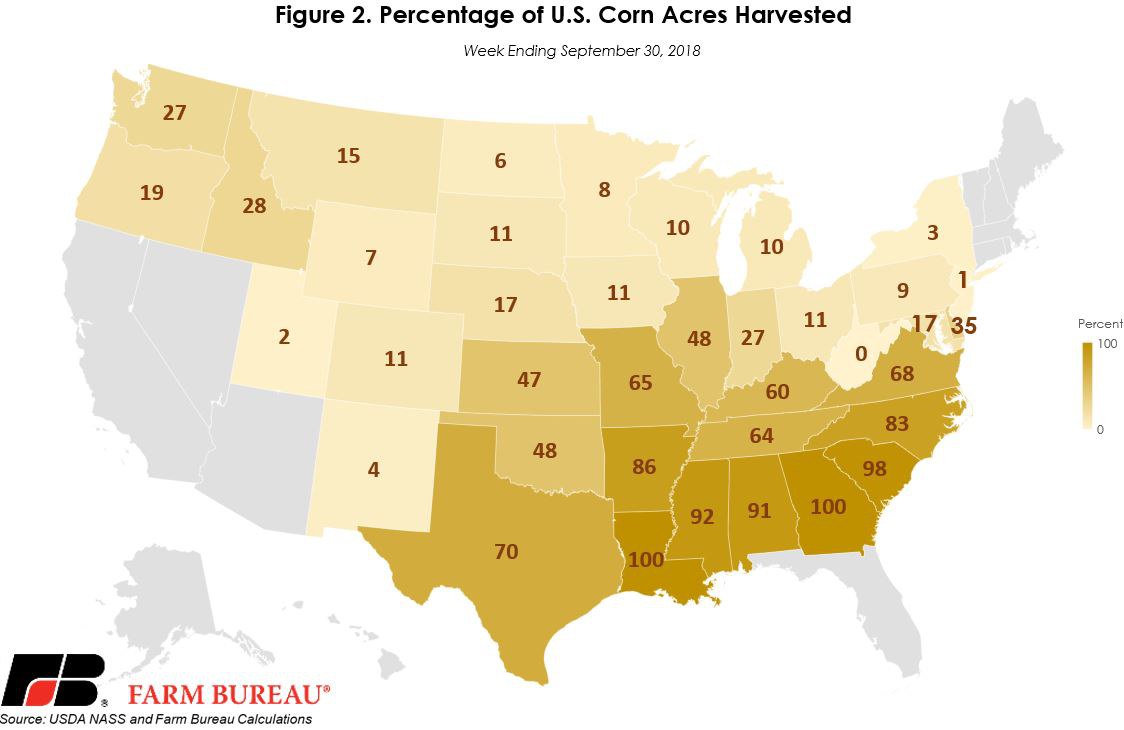

As reported in USDA’s October 1 Crop Progress report, the U.S. corn harvest pace increased by 10 percentage points from last year and is currently 26 percent complete. The pace of harvest is 9 percentage points higher than the five-year average, Figure 1. So far, U.S. corn producers have harvested 3.9 billion bushels of corn, with Illinois corn producers, who have harvested 1.1 billion of those bushels, leading the way. Kansas and Nebraska producers have harvested 314 million bushels of corn each, representing 47 percent and 17 percent of harvest completion, respectively. Figure 2 shows the percent of U.S. corn acres that have been harvested for the week ending Sept. 30.

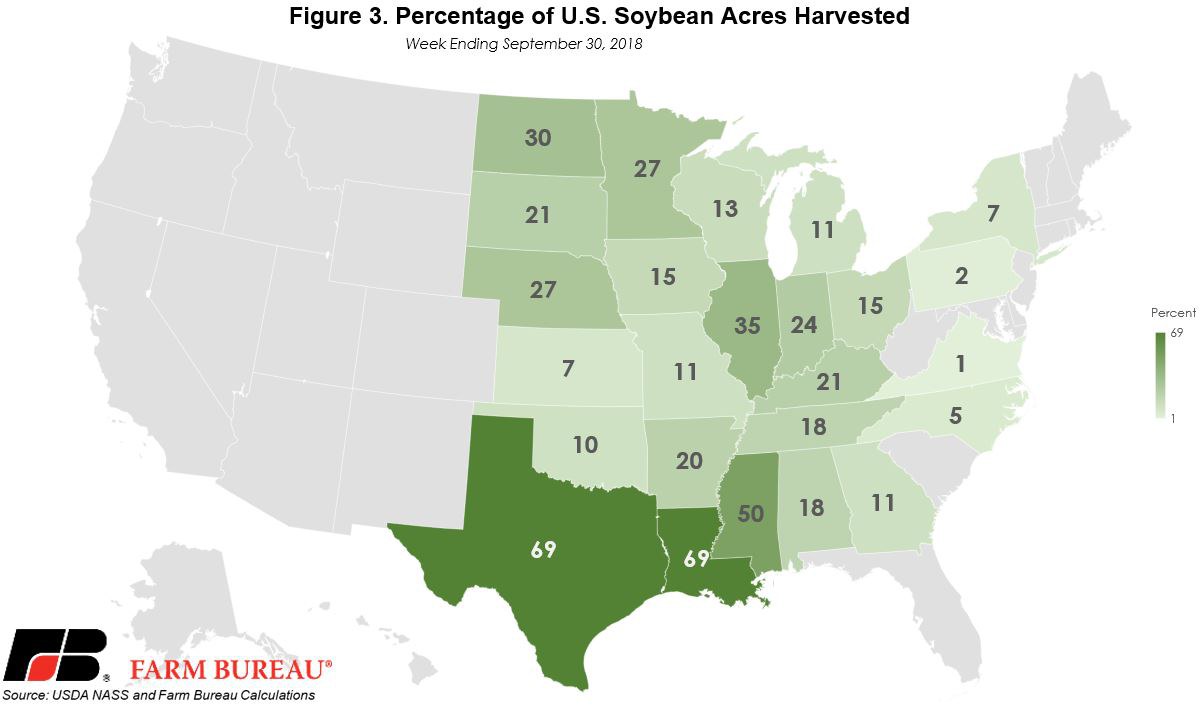

U.S. soybean producers have harvested 1.2 billion bushels already, representing 23 percent of the soybean harvest. The current harvest rate for U.S. soybeans is slightly higher than both the five-year average and prior-year levels. Figure 3 shows the percent of U.S. soybean acres that have been harvested for the week ending Sept. 30.

For the week ending Sept. 30, U.S. corn crop conditions have remained the same at 69 percent in good-to-excellent condition, according to USDA. Current conditions remain improved over the five-year average of 66 percent good-to-excellent. Corn crops in poor-to-very-poor condition continue their now six-week stretch at 12 percent. USDA’s estimates are slightly improved over analysts’ predictions of no change in corn or soybean crop conditions over the last week.

The U.S. soybean crop is also holding strong at 68 percent of crops in good-to-excellent condition, unchanged from last week. Current conditions remain up 8 percentage points from last year and 4 percentage points from the five-year average of 64 percent in good-to-excellent condition. Soybean crops in poor-to-very-poor condition have also remained steady at 10 percent.

Top Issues

VIEW ALL