Re-instated July Cattle Inventory Shows Continued Herd Contraction

photo credit: Kansas Farm Bureau, Used with Permission

Bernt Nelson

Economist

Reinstated after its 2024 cancellation, USDA’s July Cattle Inventory report offers a critical midyear snapshot of the U.S. cattle herd, including an estimate of the year’s calf crop. Released alongside the monthly Cattle on Feed report, the two datasets together provide a more comprehensive view of supply trends and herd dynamics — key themes explored in this Market Intel.

The Reports

July Cattle Inventory

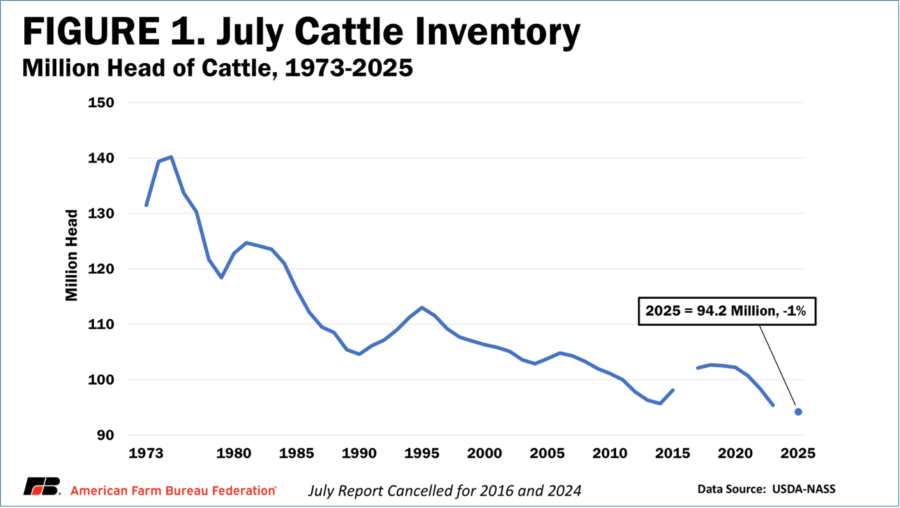

According to the July Cattle Inventory report, the inventory of all cattle and calves in the U.S. on July 1 was 94.2 million head, down 1% from 95.4 million head on July 1, 2023 (Figure 1). All cows and heifers that have calved are estimated at 38.1 million head, down 1% from 2023. The 2025 calf crop is estimated at 33.1 million head, down 1% from last year and the smallest on record. The change in calf crop reflects data reported in the January Cattle Inventory report since the July report was cancelled for 2024. All other changes are compared to 2023. Beef cows were estimated at 28.7 million head, also down 1% from 2023 and a record low since data started being collected in 1973.

*The change in calf crop reflects data reported in the January Cattle Inventory report since the July report was cancelled for 2024. All other changes are compared to 2023.

This Cattle Inventory report also estimates the total number of cattle and calves in all feedlots in the U.S. as opposed to the monthly Cattle on Feed report that only estimates the number of cattle and calves on feed in feedlots with 1,000 or more head capacity. USDA estimates all cattle and calves on feed in the U.S. is 13 million head, down 1% from 2023, and the lowest since 2017. Cattle in feedlots with 1,000-head capacity or more represent 85.6% of all cattle on feed.

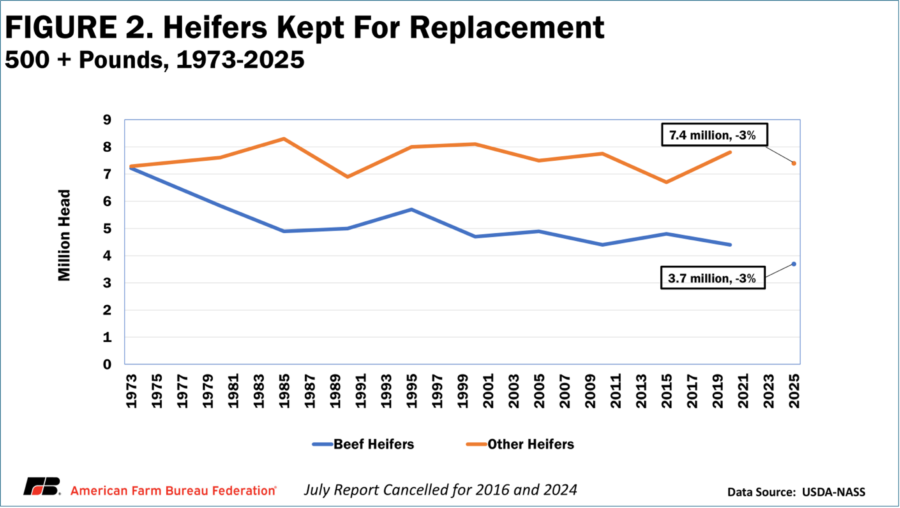

The inventory of beef replacement heifers over 500 pounds was estimated at 3.7 million, down 100,000 head, or 3%, from 2023, while other heifers were estimated at 7.4 million, down 200,000 head or 3%. These heifers are the cattle that could be held back for breeding purposes. This is an indicator that contraction in the U.S. beef herd is continuing.

Cattle on Feed

The Cattle on Feed report for this month was bullish. Cattle and calves in feedlots with capacity of 1,000 head or more were 11.1 million head, down 2% from July 1, 2024. The inventory included 6.88 million steers and steer calves, up 1% or about 60,000 head from 2024. Heifers and heifer calves on feed were estimated at 4.24 million head, down 5% or 240,000 head from last year.

The steep reduction in heifers and heifer calves on feed could be an indicator that farmers and ranchers have begun holding back a larger number of females for breeding rather than placing them on feed for market. However, the Cattle Inventory report presented that both beef heifers and other heifers being held back for replacements are down about 3%. This is counter to the narrative that farmers have begun holding back beef cattle to grow the herd (Figure 2).

The Cattle Cycle

The cattle cycle refers to expansion and contraction in the cattle inventory in response to perceived profitability. One full cycle typically takes about 10 years. The current cycle is in year 12 and has been contracting for seven years, making it a “hypercycle.”

Since it takes almost two years from the time a calf is born before it can have a calf of its own, the current calf crop is the first generation of cattle that could increase the herd size in this cattle cycle. Many farmers and ranchers make decisions in the fall about whether to keep cattle for breeding or to sell them at market. This means that if female cattle from this calf crop are kept for breeding, they will be able to produce their first calf in 2027, making 2027 the first possible chance of meaningful herd expansion.

Obstacles

According to USDA’s most recent census of agriculture, the average age of a farmer has risen to 58.1 years old. Imagine being in this person’s shoes, approaching retirement age while prices are near-record profit levels. Supply and input costs, such as labor, fuel and equipment, remain elevated from factors such as inflation. Interest rates also remain high, driving up the cost of borrowing money to purchase cattle or pay for business expenses. These are serious obstacles to expansion in this cattle cycle for both the retirement-aged farmers and ranchers and new and beginning farmers. It’s a good time to get out, and a hard time to get in, a big reason the “hypercycle” continues.

New World Screwworm

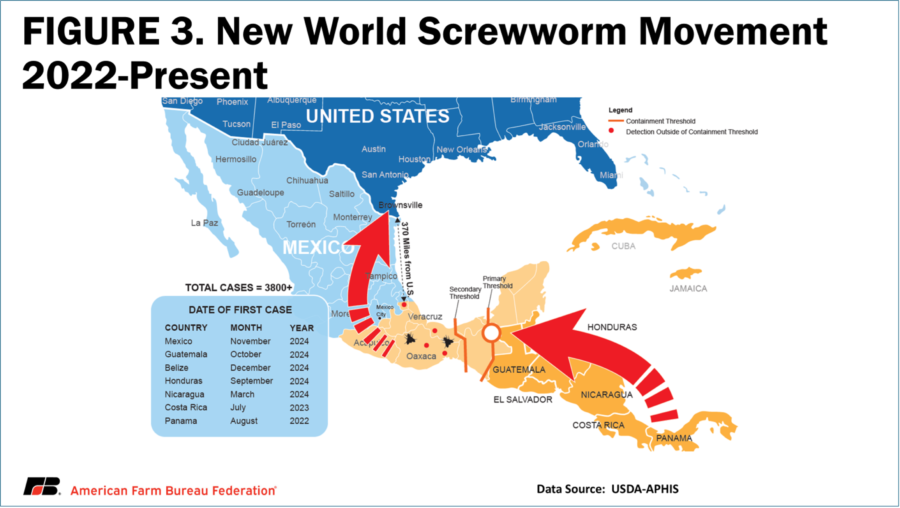

New World screwworm (NWS) is a fly endemic to Cuba, Haiti, the Dominican Republic and countries in South America. The fly lays eggs on a warm-blooded animal, typically on or near a wound. When the eggs hatch, the larva feed on the surrounding flesh as they burrow into the wound, which is how the pest got its name. NWS can infest any warm-blooded animal including livestock, poultry, wildlife, domestic animals, and, though rarely, humans.

NWS has spread northward to Costa Rica, Guatemala, Nicaragua, Belize, El Salvador and, more recently, Mexico. USDA estimates there have been 3,800 detections of NWS since it was first detected in Mexico in November 2022 (Figure 3). USDA announced the closure of southern border ports to livestock trade on July 9 after new detections indicated northward movement of the pest to toward the U.S.-Mexico border. This closure came after an announcement to open ports starting July 7.

Approximately 1.2 million-1.5 million head of cattle are imported into the U.S. from Mexico every year. When ports are open, cattle imported from Mexico are typically a significant portion of U.S. beef cattle, representing about 4-5% of all cattle marketed for U.S. beef production. If NWS reached the U.S., it would cost billions in economic losses. Closing ports further restricts already tight beef cattle supplies, but it helps protect the United States from the massive economic fallout if NWS ever crossed the border.

Summary and Conclusions

USDA revived the July cattle report after cancelling it in 2024. This report is one of two reports that provides detailed estimates of the inventory of all cattle and calves in the United States. When combined with USDA’s monthly Cattle on Feed report, there is evidence of continued contraction in the U.S. beef herd. If female cattle from this year’s calf crop are kept this fall, they would be capable of producing their first calf in 2027. This would provide an opportunity for the first meaningful growth in the U.S. cattle herd in 14 years and signal the start of a new cattle cycle.