Corn is King Again as Soybean Acres Fall in 2019

TOPICS

USDA

photo credit: Arkansas Farm Bureau, used with permission.

John Newton, Ph.D.

Chief Economist

On March 29, USDA released the much-anticipated Prospective Plantings report revealing farmers’ intentions for planted acreage for principal crops in 2019. Based on responses to a survey conducted during the first two weeks of March, the report provides the first glimpse into how farmers are likely to allocate corn and soybean acreage following retaliatory tariffs placed on U.S. agriculture beginning in 2018.

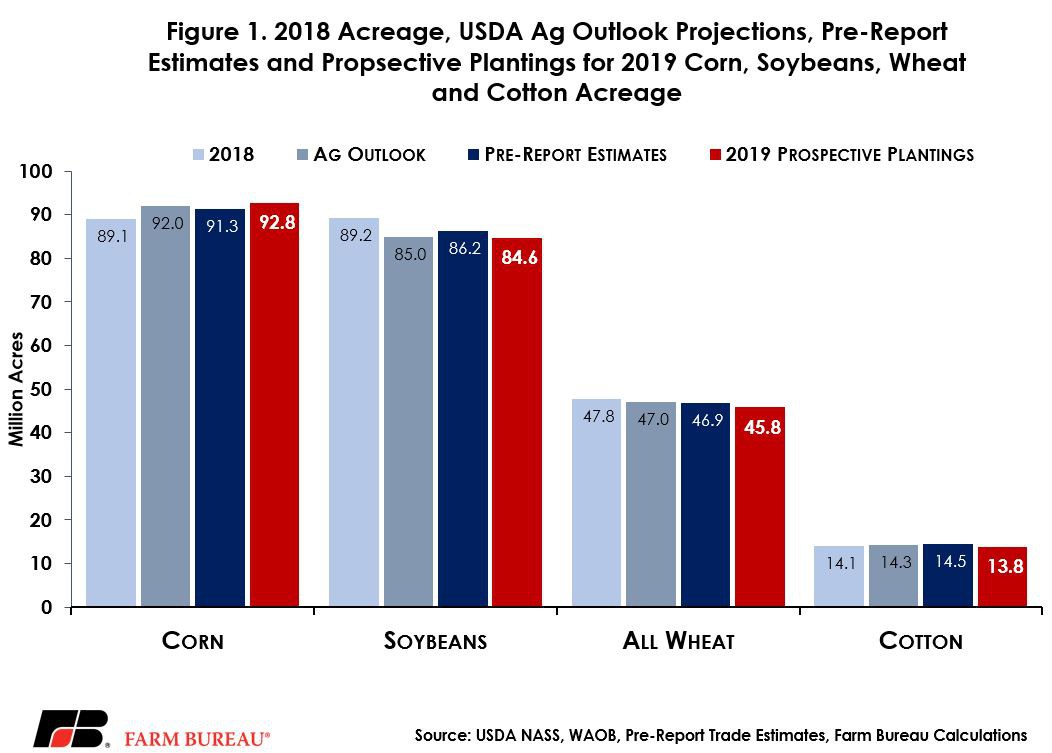

At USDA’s February 2019 Agricultural Outlook Forum, the department estimated farmers would plant 92 million acres of corn and 85 million acres of soybeans in 2019. Pre-report survey estimates put corn between 89.5 million and 92.7 million acres and soybeans between 84.3 million and 88 million acres. The average of the analysts’ estimates was 91.3 million acres of corn and 86.2 million acres of soybeans.

The prospective plantings survey results revealed farmers are planning to plant 92.8 million acres of corn and 84.6 million acres of soybeans. For corn, USDA’s acreage estimate was above prior-year levels, above USDA’s February projections and above the average trade estimate. For soybeans, USDA’s estimate was below prior-year levels, below USDA’s February forecast and below the average trade estimate. Figure 1 highlights 2018 acreage and the estimates for 2019 acreage from USDA and the pre-report estimates from traders.

Corn Acres in 2019

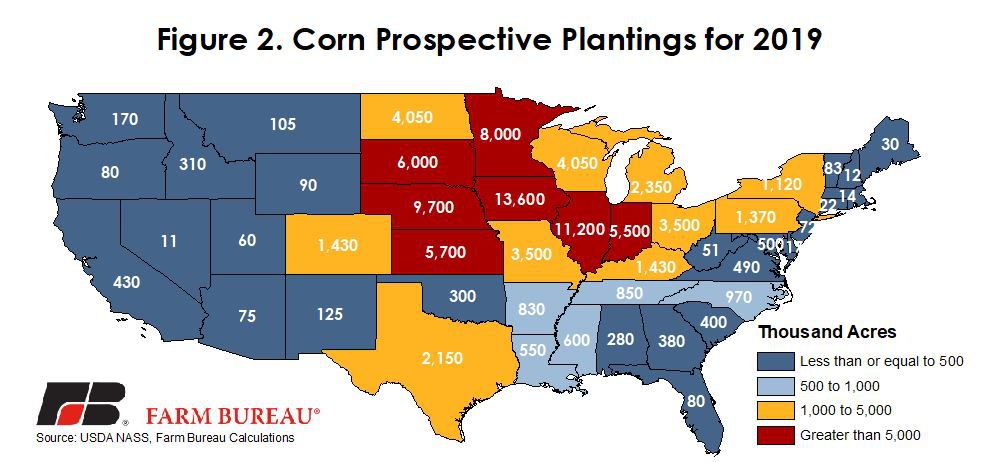

For the 2019/20 marketing year, U.S. producers intend to plant 92.8 million acres of corn, up 4 percent, or 3.66 million acres, from the prior year. Corn acreage is expected to be the highest in Iowa at 13.6 million acres, followed by Illinois at 11.2 million acres and Nebraska at 9.7 million acres. Figure 2 highlights planting intentions for corn for the 2019 growing season.

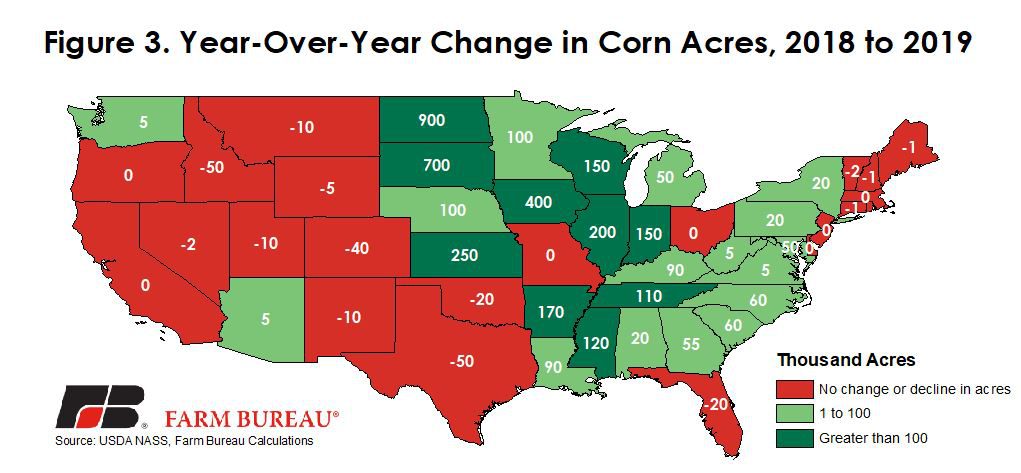

Compared with last year, planted corn acreage is expected to be in line with or higher than prior-year levels in 34 of 48 corn-producing states. The largest change in planted acreage was in the Dakotas, where growers intend to plant 1.6 million additional corn acres in 2019. Iowa farmers plan to increase corn acreage by 400 thousand acres in 2019. Figure 3 highlights state-level year-over-year changes in corn acres.

Soybean Acres in 2019

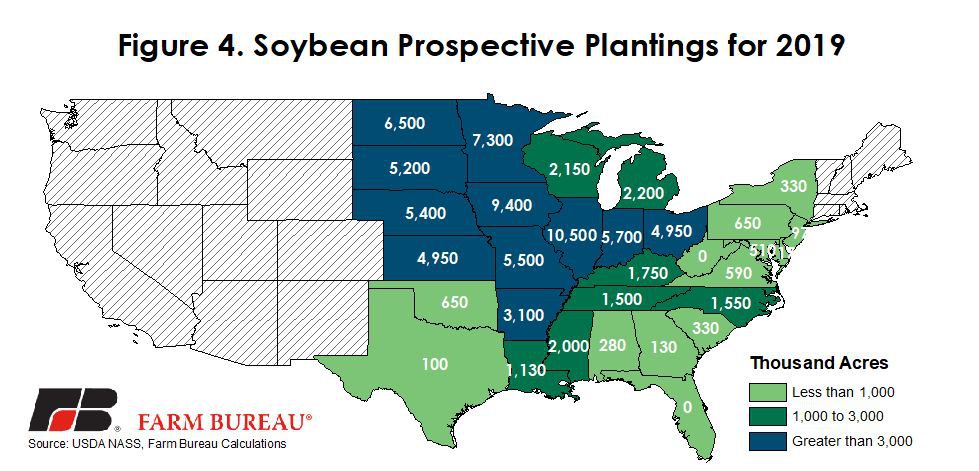

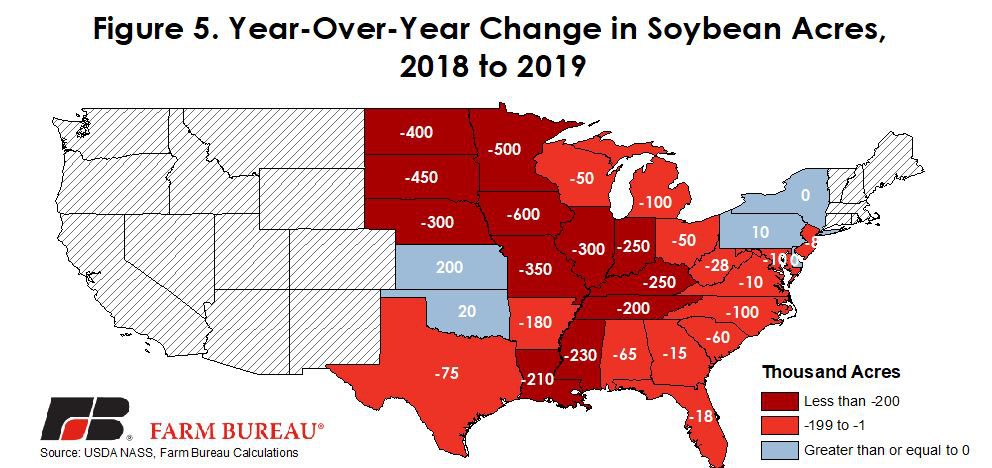

For the 2019/20 marketing year, USDA estimates soybean planted area at 84.6 million acres, down 5 percent, or 4.6 million acres, from the previous year. The reduction in soybean acreage was expected as old-crop soybean demand has been adversely impacted by retaliatory tariffs from China -- reducing the export volume and ultimately the prices for soybeans. With lower expected returns on new-crop soybeans, farmers in 26 out of 29 soybean-producing states are expected to reduce plantings in 2019.

Soybean acres are expected to be the highest in Illinois at 10.5 million acres, followed by Iowa at 9.4 million acres. The decline in soybean acres is expected to be the greatest in Iowa, where producers will plant 600,000 fewer acres in 2019. Following Iowa are Minnesota with 500,000 fewer soybean acres and the Dakotas with 850,000 fewer acres. Figures 4 and 5 highlight soybean acreage intentions for 2019 and the year-over-year change in soybean acres, respectively.

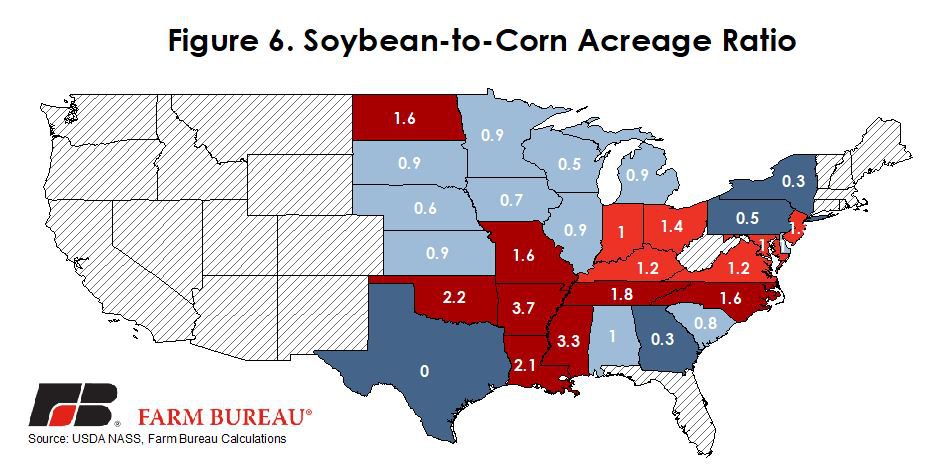

In 14 out of 29 soybean-producing states soybean acres will top corn acres in 2019. The states with the largest soybean-to-corn acreage ratio, Figure 6, include Arkansas, Mississippi, Oklahoma and Louisiana. Growers in all those states will plant at least twice as many soybean acres as corn acres.

Implications

Given the trade headwinds soybean producers have experienced, analysts were anticipating a decline in U.S. soybean acres in 2019. Industry expectations were for 84 million to 88 million acres planted in 2019, and current projections are on the low-end of that range.

USDA’s Prospective Plantings report provides the first survey-based estimate of acreage for the upcoming crop year, but a variety of factors could change what growers plant this year. For example, the devastating floods experienced in the Midwest, along with the high flooding risk forecasted for this spring, may delay corn plantings and ultimately lead more growers to plant soybeans due to the later planting date.

Second, the administration has worked to restore normal trading flows between the U.S. and China for agricultural commodities. Purchases of corn, soybeans and pork, for example, have been announced in recent weeks. Restoration of the Chinese market could shore up expectations for soybean demand in 2019 and lead to slightly more soybean acres in 2019.

Given these uncertainties, markets will now turn their attention to the pace of old-crop demand and U.S. trade negotiations, specifically the U.S.-Mexico-Canada Agreement, U.S.-China and potential bilaterals with both Japan and the European Union. The next opportunity to evaluate actual acreage decisions will be USDA’s June 28 Acreage report.