Cow Slaughter Surges

AFBF Staff

photo credit: Colorado Farm Bureau, Used with Permission

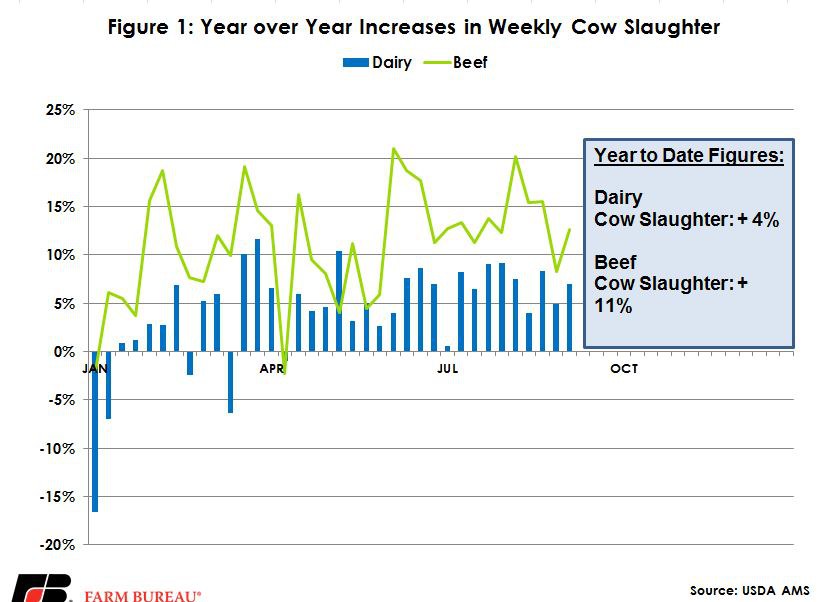

Cow slaughter figures have been running higher this year, showing year-over-year gains all but three weeks of 2017. Year-to-date, the number of total cows moving through the system is about 7 percent higher. Weekly slaughter rates were averaging 5 percent above a year ago through April, and 8 percent above a year ago April to July. Since then, slaughter rates have expanded to 10 percent above a year ago.

Both the beef and dairy herds are sending cows to slaughter at a higher rate than in 2016, and rates across both herds have increased in the later part of the year. Dairy cow slaughter year-to-date is 4 percent higher than 2016 and in recent weeks has averaged 7 percent higher compared to the 1 percent higher seen in the first third of the year. The beef herd, on the other hand, has seen some heavier culling this year. Beef cow slaughter is 11 percent higher through mid-September of this year. Weekly slaughter rates have increased by double-digits nearly every week since mid-June. During that timeframe, beef cow slaughter averaged about 14 percent higher than a year ago. Figure 1 shows the weekly year-over- year increases in 2017.

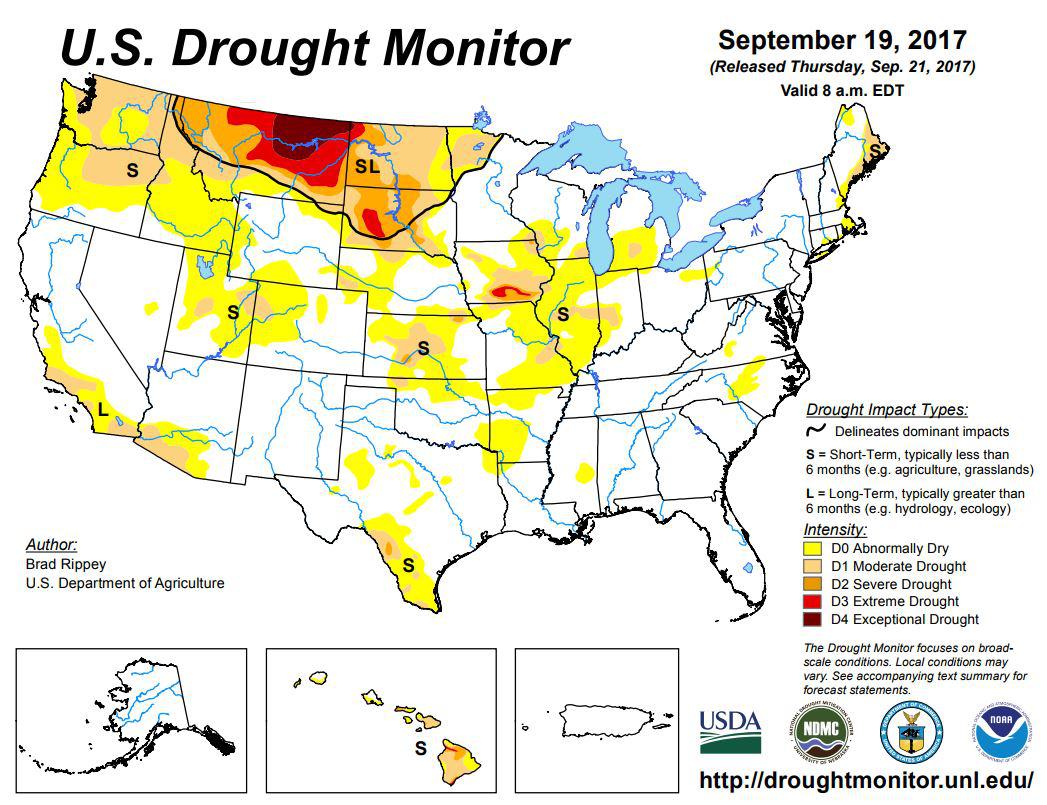

The increase in cow slaughter, particularly on the beef side, comes a little early this year. Many cow-calf operations time weaning in the fall months, skewing the trend of increased cow slaughter until much later in the year. This can be seen in the seasonal decline in cull cow prices, which typically are the lowest in fourth quarter. At least some of the reason behind this early surge in beef cow slaughter is the northern Plains drought, which has been in the background of this cattle market since June, see Figure 2. This not only caused cattle on rangeland to come to market faster, but it also likely shortened the window for when producers pregnancy check and opted to cull cows in a limited feed situation.

This does appear to be aggressive culling on the domestic beef side as Canadian imports of slaughter cows is down significantly this year by 32 percent. The dairy cow herd inventory is holding relatively steady over the summer and has grown since the beginning of the year, adding 43,000 head. Beef cow slaughter, as well as heifer cow slaughter, have been above year-ago levels since the beginning of 2016. Early in this process, the cow herd was refreshing its aging herd after holding onto breeding stock during the price run-up in years before. Older cows were retired and producers were winding down the number of replacements held compared to years past. However, now nearly two years later, those volumes are increasing and the economic incentive today’s cattle prices haschanged the motivations. This culling is more likely a signpost for the transition away from the expansionary phase of the last several years. This means as early as Jan, 1 2018, the cowherd could decline for the first time in four years.

Top Issues

VIEW ALL