Crop Insurance Reduces the Need for Ad-hoc Disaster Payments

TOPICS

Farm Bill

photo credit: Alabama Farmers Federation, Used with Permission

John Newton, Ph.D.

Chief Economist

When agricultural disasters occur, the federal government has traditionally responded in one of two ways: ad-hoc disaster payments or assistance in purchasing federal crop insurance. For nearly two decades the preferred delivery mechanism for a majority of agricultural products has been the federal crop insurance program. Ad-hoc payments do still occur, especially for commodities not widely covered by crop insurance. Such was the case in 2018 following devastating hurricanes, droughts, floods and wildfires across parts of the U.S. in 2017.

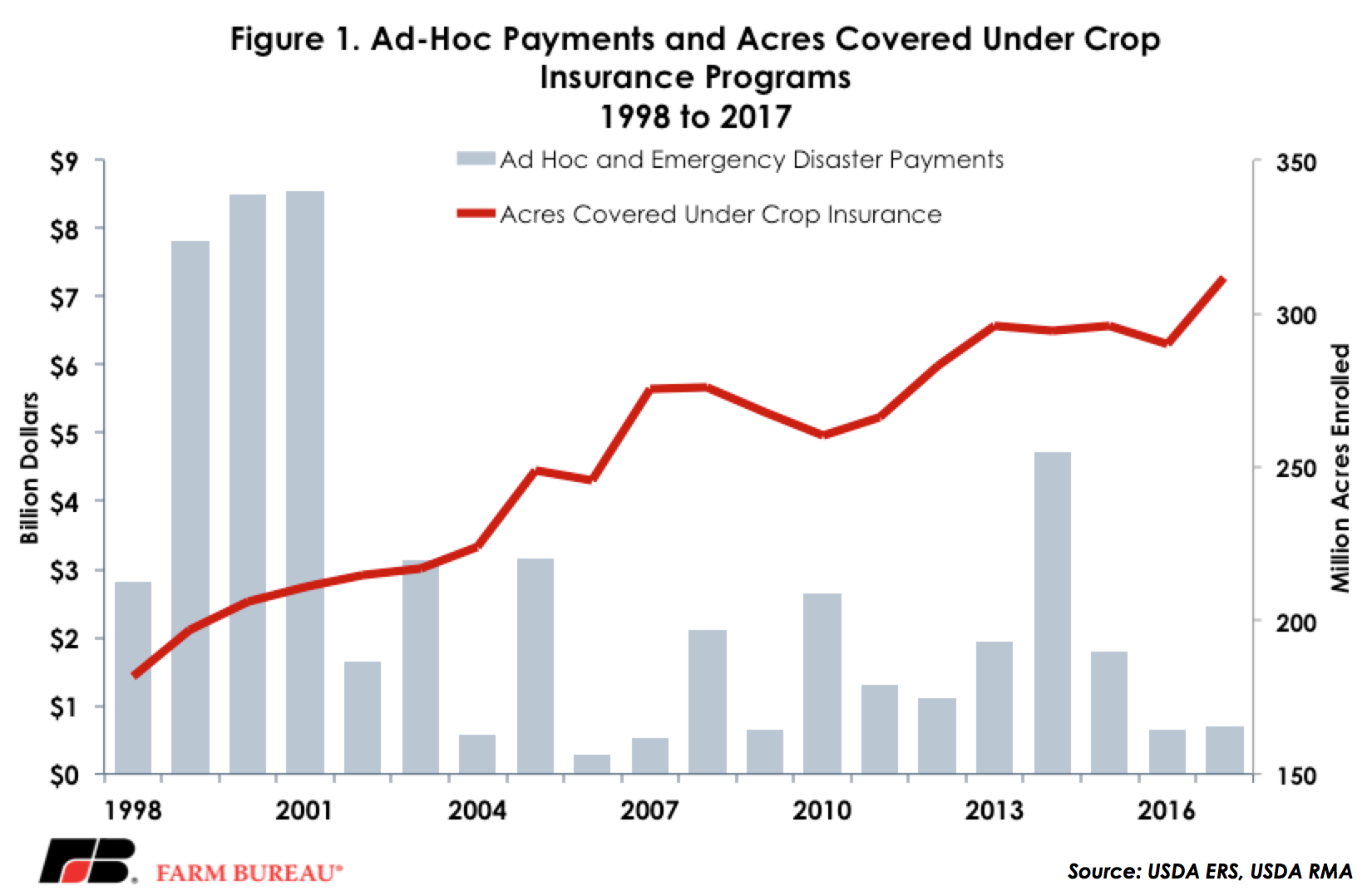

However, as work on the 2018 farm bill ramps up, it’s appropriate to review the benefits of federal crop insurance programs compared to ad-hoc disaster payments. Today’s article compares the farm safety net protection provided by crop insurance to ad-hoc disaster payments, and reveals a negative correlation between the need for ad-hoc disaster assistance and the use of crop insurance tools.

Types of Support

Ad-hoc emergency payments are unanticipated financial outlays delivered to farmers following a natural disaster such as a disease outbreak or adverse weather. USDA also has authority to provide disaster assistance through conservation programs, i.e. emergency grazing, or using Commodity Credit Corporation funds. Not every natural disaster is immediately followed by ad-hoc payments. Many times, these ad-hoc payments are authorized months or years after a natural disaster. For example, 2017 included three major hurricanes, a severe drought in the Upper Midwest and more than 2 million acres of wildfires. Ad-hoc assistance following these disasters first occurred in early 2017, when USDA allowed emergency grazing on Conservation Reserve Program acres and then in early 2018 when the Bipartisan Budget Act appropriated $2.36 billion in disaster assistance.

Federal crop insurance protects farmers from unavoidable risks associated with adverse weather, including crop losses and plant diseases, as well as insect infestations. Hundreds of crops, as well as livestock species, are protected under crop insurance. Policies are designed to insure against a number of risks including revenue declines, yield losses and increased feeding costs for livestock. Federal expenditures related to federal crop insurance programs come primarily in the form of premium subsidies – whereby the farmer and the federal government share in the costs of purchasing insurance. These subsidies do not go to farmers. Insurance premiums reflect the total liability and expected market risk and are highly correlated with the value of the commodities insured.

Crop insurance is delivered through a private-sector delivery system, and in the event of a loss, these private insurance companies are primarily responsible for making the indemnity payments to farmers and ranchers. This consistent use of funds for premium subsidies provides certainty to farmers – and their lenders – that in the event of a crop loss, insurance claims can be distributed immediately following a financial loss.

During the five-year period beginning in 1998 and ending in 2002 – and prior to meaningful crop insurance reform – the federal government made ad-hoc disaster payments of approximately $30 billion. As crop insurance policies improved, and enrollment increased, fewer ad-hoc disaster payments were made, and instead, the federal government provided support through subsidized insurance. By 2017 nearly 317 million acres were covered under a crop insurance policy. The correlation between ad-hoc disaster payments and crop insurance utilization is -54 percent, indicating that as crop insurance coverage has increased the need for ad-hoc disaster assistance has decreased, Figure 1.

Crop Insurance Versus Ad-hoc Payments

There are several benefits of crop insurance over ad-hoc disaster assistance. First, crop insurance provides certainty that in the event of a loss a farmer will be indemnified based on a portion of the value of the crop or livestock. Under crop insurance, farmers know what the losses are and indemnity payments are made directly to the farmer. With ad-hoc disaster packages, the compensation to an eligible farmer or rancher may not reflect the value of the loss. For example, in late 2009 USDA authorized $290 million in Dairy Economic Loss Assistance Payments to support dairy farmers. These ad-hoc payments were made to dairy farmers on up to 6 million pounds of milk and may not have fully covered the amount of milk production on the farm.

Second, under crop insurance, when a farmer experiences a loss, an indemnity payment will be made within 30 days following the signing of the final loss paperwork. These claims are finalized through a private-sector delivery system. With ad-hoc disaster payments, the assistance payments may be delayed by several months or years following a loss. For farmers experiencing a revenue decline or a crop loss, timely indemnification provides an opportunity for growers to meet their financial obligations. Farmers do not have this same payment capacity with unanticipated emergency disaster payments.

Third, under ad-hoc disaster payments, a farmer may not be required to prove a loss on the farm. Rather, farmers growing a specific crop or located in a specific part of the country may be eligible for ad-hoc disaster payments even if a loss was not experienced on the farm. Under crop insurance programs a farmer must suffer a financial loss, relative to the insurance guarantee, to qualify for indemnification – commonly known in insurance principles as a deductible. This ensures that indemnity payments are targeted to areas impacted by a natural disaster such as a drought, hurricane or flood, and that payments are delivered directly to farmers and ranchers impacted by adverse weather.

Summary

The presence of federal crop insurance has significantly reduced the need for unbudgeted and unanticipated agricultural disaster payments. When crop losses occur, and for a variety of crops, the assistance comes primarily from private sector companies, not the federal government. This has proven to be a reliable delivery tool for farm safety net programs, and has significantly reduced the need for ad-hoc disaster payments.

As the 2018 farm bill debate continues, attention will soon turn in earnest to crop insurance programs. The president’s budget in 2017 and 2018 both proposed substantial cuts to crop insurance. At a time when net farm income is at a 12-year low, and after farm programs have already experienced substantial cuts in recent years, now is not the time to turn away from the reliability of the crop insurance program in favor of ad-hoc disaster payments. When Mother Nature is the farmers’ business partner, access to affordable and dependable insurance products remains a critically important component to the financial stability of farmers and the U.S. farm economy.