Decent Growth in First Quarter GDP, But Lagging Consumer Spending a Concern

TOPICS

MacroeconomyBob Young

President

photo credit: AFBF Photo, Morgan Walker

Bob Young

President

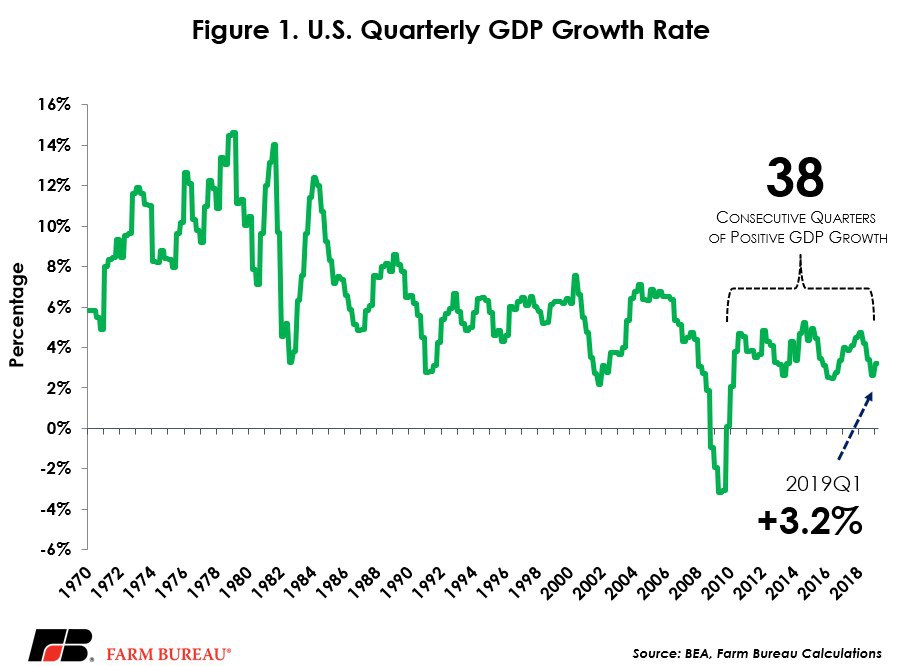

First quarter gross domestic product growth of 3.2% is positive news if taken at face value, but there’s a dark cast to these seemingly bright numbers. If you only want the good news, it’s probably best to leave now.

If you’re still with us, keep in mind the look-back nature of the fed’s GDP report; the advance estimate for the first quarter of 2019 was released April 26. This report is for economic activity that has already occurred. It is like knowing what your blood pressure was this morning. It provides no real information as to how your spouse’s actions will affect those numbers tomorrow.

Overall, the economy grew by $147 billion (real) from fourth quarter 2018. Recall the GDP is made up of four – maybe five – things: personal consumption expenditures, gross private domestic investments, net exports – or imports and exports – and government consumption expenditures.

One of the better ways to assess the health of our economy is to look specifically at the things reflecting our economic behavior. Imports are not part of our economic behavior. Yes, they can plug holes in our demand versus our domestic supplies of specific goods, but imports don’t reflect our work. Government expenditures are also, to a large degree, independent of the economy as they are driven by federal, state and local political decisions.

That leaves personal consumption expenditures, private investment and exports as the three core components of the economy. The largest of all components is personal consumption expenditures. While the GDP number was over 3%, personal consumption added only 0.82% to GDP growth. A dive below the surface here is also revealing. These expenditures divide into goods and services, with goods split between durable and nondurable products. Overall spending on goods contracted to the point that it reduced the GDP by 0.14%. Durable goods were a 0.4%, or $23 billion (real), drag on the GDP, with motor vehicles and parts sliding 0.5%, or $26 billion (real), from the last quarter of 2018. Nondurable goods contributed 0.2% to the overall growth. The services sector, on the other hand, showed a 1% contribution to GDP growth. Health care services are a driving juggernaut in employment growth, and that carries through in GDP numbers. Health care services alone contributed 0.4% growth in GDP. Converting these percentages into real money, spending on health care expenses went up $21 billion on an annualized basis in the first quarter of 2019. This was the largest single category growth in all consumer spending.

Gross private domestic investment contributed just under 1% growth to GDP at 0.92%. The big story here, however, was not any real growth in spending, but rather a 0.67% contribution from higher nonfarm private inventories. A positive bump in GDP from growing inventories is a somewhat perverse signal. Inventories going up may help GDP figures this quarter, but they indicate shelves are filling, so there will be less need for production in future quarters.

One of the big stories of the report related to the trade picture. Exports provided a solid 0.45% contribution to growth, with goods exports a firm 0.37% increase. Imports also contributed to the GDP growth – .58% – by falling; higher imports mean we consumed things we did not produce here at home and thus show as a drag to overall GDP. A $33 billion (annualized basis) drop in imports actually bumps GDP growth.

We’re left now with government consumption and investment. While the federal government shutdown was underway for part of this reporting period, there is little detail in the report as to the effect of that action. The data for federal consumption came in at precisely zero percent. Defense spending contributed a 0.16% growth with nondefense spending down an exact 0.16%. The story is more focused on state and local government actions. These contributed 0.41% to growth, the highest level since the first quarter of 2016. The majority of this added spending appears to be on structures as opposed to consumables.

Overall, the report tells a good story. Any quarter with GDP growing over 3% is considered good. But there are a couple of reasons for concern. Personal expenditures have now been declining for the last three quarters. There has been only one quarter since 2015 with lower growth in consumer spending than the first quarter of 2019, and that was the first quarter of 2018. Is this a new annual pattern or is this year-long trend of declining growth in consumer spending a darker sign?

The investment figures are also worrisome. With the biggest contributor to the growth of that component coming from inventory build, weakness is showing in a second component of core GDP. The export data is helpful; the import side of the picture is probably driven more by tariffs than any real shift.