Delta Variant Hinders Job Growth in August

TOPICS

Market IntelBob Young

President

photo credit: Getty Images

Bob Young

President

After revisions to last month’s jobs report, we added just over 1 million new jobs to the economy in July, making the August number of 235,000 a bit of a disappointment. Prior to the pandemic, that would be a pretty good figure. However, with total employment numbers still off more than 5 million from pre-pandemic levels, many were hoping for another 500K-plus figure during this recovery phase.

With the delta variant generating another surge, we have not returned to “all systems go.” On a recent drive from the East Coast to the Midwest and back, we ran into a wide variation in how states and firms approached the problem. In some, it was business as usual. No masks, everything open, have at it. In others, the lobby of the fast-food chain was completely closed, and one could only order via the drive-through.

Let’s discuss two distinct kinds of employment categories. One – food service – has been affected by the recent delta spike, the other – health care – may be moving toward a new “normal”.

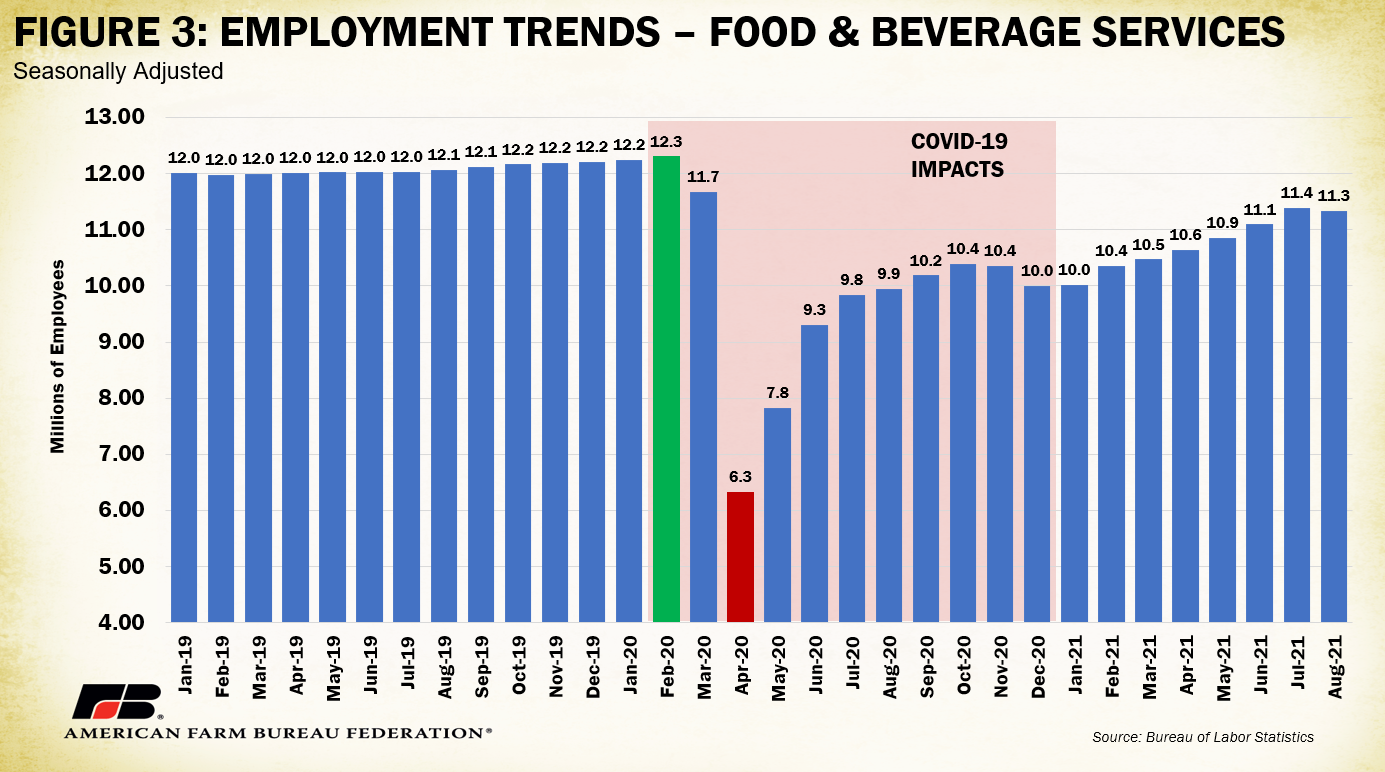

Pre-pandemic, employment in the larger groupings of health care and leisure and hospitality were about on par, with over 16 million employed in each category. Health care rose an average of 30,000 positions through 2019, and one expected the day would come when health care would exceed leisure and hospitality employment. The pandemic obviously changed that whole picture.

With shutdowns, leisure and hospitality employment dropped by almost half. Leisure and hospitality employment recovered well from mid-2020 until the fall outbreaks, then returned to steady growth. The question is whether or not the August flattening suggests another reduction in hospitality and leisure employment or just a pause. This sector seems to be more closely related to outbreak numbers than most other components of the economy.

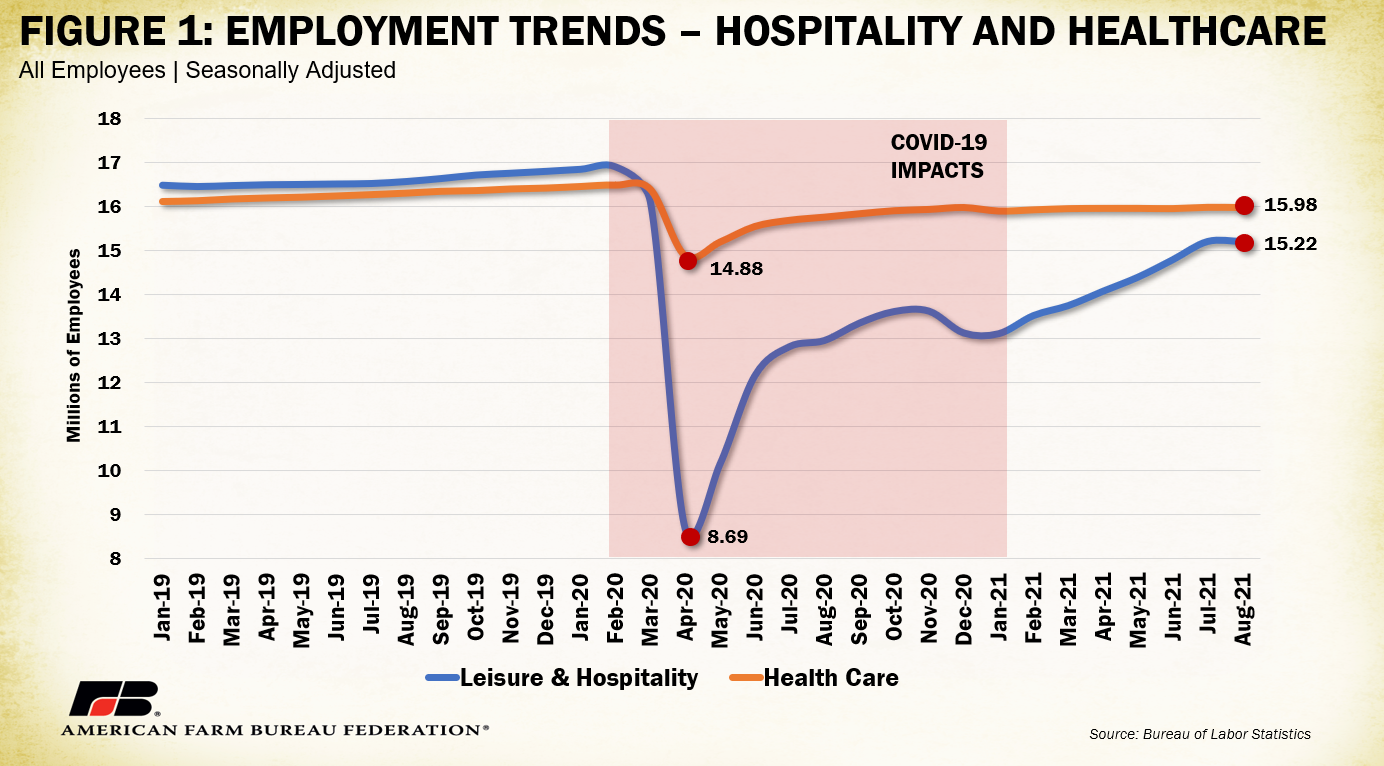

Let’s go a little deeper into both of these categories and look specifically at hospitals. Before the pandemic, hospital employment grew an average of 5,000 jobs a month. For 2021, the growth has been only 2,000 jobs a month. While many hospitals stopped performing elective surgeries in the early days of the pandemic, several have restarted. Comparing the pace of job growth pre-pandemic to how the sector has performed over the last several months raises the question of whether this flat level of hospital employment is a slight detour, or have we found a new normal?

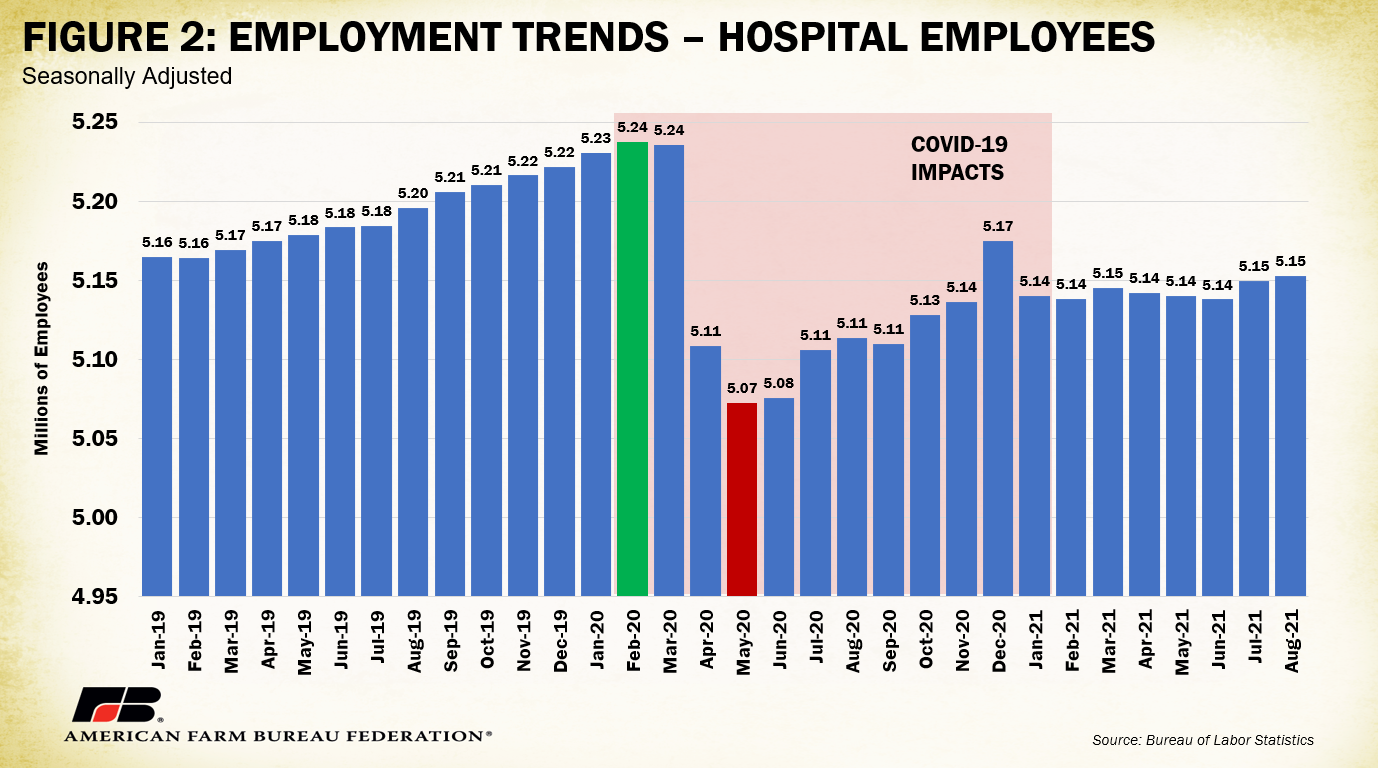

Food and beverage employment makes up the majority of leisure and hospitality jobs. This sector has come back well from before the pandemic, but job growth here was essentially flat before the shutdowns. Once things began to reopen after the spring 2020 collapse, numbers recovered and have continued apace for much of the year, albeit at a slightly slower pace than early 2020. But unlike hospital employment, the sector has continued to hire up until the latest flattening of the curve.

Different parts of the economy are going to come out of this in their unique way. Hospital employment, for example, may see growth surge again as we go back to more elective surgeries, and staff is not all tied up dealing with COVID-related illnesses. Talking to care staff, dealing with this illness is getting very wearing.

There are probably another million or so slots to be filled in food and beverage. The delta surge is a short-term factor, and once it’s passed, expect those growth trends to return, although much growth above 12 million jobs is unlikely.

Overall, the report shows the effects of the latest surge, but it’s not a bad report. The household survey indicated we added 190,000 to the labor force, and the unemployment rate dipped two-tenths of a percent, so a good message, all things considered.