EPA Proposes New Renewable Fuel and Biomass-Based Diesel Volume Standards

TOPICS

RFSMichael Nepveux

Former AFBF Economist

photo credit: North Carolina Farm Bureau, Used with Permission

Michael Nepveux

Former AFBF Economist

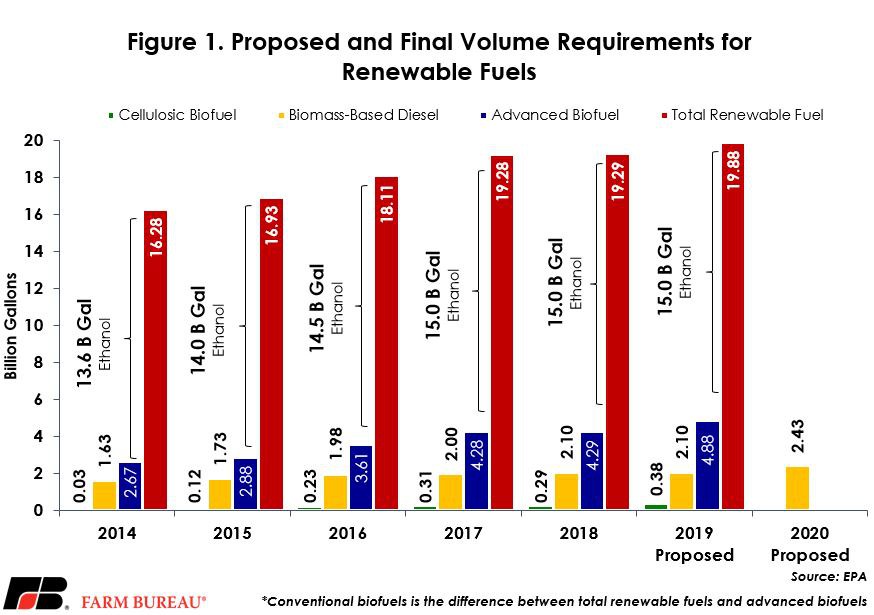

On June 26, the Environmental Protection Agency released its proposed volume standards for total renewable fuel, total advanced biofuel and cellulosic biofuel for 2019, as well as the proposed biomass-based diesel volume for 2020. The proposed rule would increase volumes in all four categories.

Background:

The Renewable Fuel Standard program is a national policy that requires a certain volume of renewable fuel to replace conventional petroleum-based fuel. The RFS contains four renewable fuel categories: total renewable fuel, advanced biofuel, cellulosic biofuel and biomass-based diesel. Under section 211 of the Clean Air Act, EPA is required to set renewable fuel percentage standards every year. EPA has historically released its proposed volume requirements for each of the categories in June or July. This proposed rule is subject to public comments and, potentially, revision based on those comments. EPA is required to release its final version of the rule by November 30.

What is in the Proposed Rule?

The proposed rule would increase total renewable fuel volumes to 19.88 billion gallons, an increase of 590 million gallons from the 2018 final volumes of 19.29 billion gallons. This is somewhat of a contrast from the 2018 increase of 100 million gallons over 2017 volumes. The total advanced biofuel volume would be increased by the same amount, from 4.29 billion gallons in 2018 to 4.88 billion gallons in the proposed rule.

Corn-based ethanol is considered a conventional biofuel, and is counted toward the total renewable fuel category volumes. Due to the way different biofuel categories are nested under each other, total conventional biofuel volumes, i.e. corn-based ethanol, is the difference between total renewable fuels and total advanced biofuels. This proposed rule would set conventional biofuels at 15 billion gallons for the third year in a row.

Biomass-based diesel is getting a substantial increase of 330 million gallons, up to 2.43 billion gallons from 2.1 billion gallons in 2019. Biomass-based diesel volumes must be finalized a year before the other biofuel categories, meaning this proposed rule is setting volumes for 2020. This is the second-largest increase for biomass-based diesel ever and the largest increase since 2014.

Another significant development is within the cellulosic biofuel sector; the new proposed cellulosic volumes represent an increase of 93 million gallons, increasing to 381 million gallons from 288 million gallons in 2018. This is a change of direction from last year, when EPA lowered the 2018 volume to 288 million gallons from 311 million gallons in 2017. This proposed increase could indicate that EPA believes the capacity for producing cellulosic biofuels is expanding at a greater pace than it believed last year.

What Are the Key Takeaways?

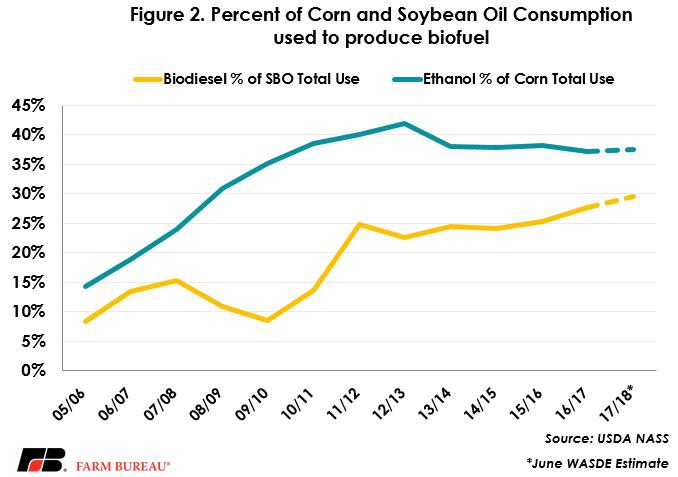

Renewable fuels provide a significant and steady market for American growers. In the 2016/17 marketing year, 5.4 billion bushels of corn, or 37 percent of total consumption, were used by ethanol producers. In the 2016/17 marketing year, 6.2 billion pounds of soybean oil, the oil from nearly 550 million bushels of soybeans, were used in biodiesel production (Figure 2).

While increases in the proposed volumes are certainly a step in the right direction, reaction is still somewhat mixed among stakeholders. Some stakeholders and producers indicated that these increases do not amount to much if issues such as the overuse of small refining waivers essentially limit the amount of renewable fuel blending required.

It is critical to American agriculture that a robust RFS remains in place and continues to serve as an important market for farmers.

Top Issues

VIEW ALL