Ethanol Industry Recovery Slowed by Court Decisions

photo credit: Right Eye Digital, Used with Permission

Shelby Myers

Former AFBF Economist

Sixteen months ago, the ethanol industry was facing a demand crisis. COVID-19-related stay-at-home orders reduced ethanol consumption by 44% in four months. Ethanol plants across the country slowed production or shut down completely to conserve overhead costs as businesses, cities, counties and states continued their COVID-19 precautions, which included implementing teleworking and virtual schooling, store and restaurant closures and capacity restrictions and more. Farmers desperately looked for places to sell corn in the 2019/20 marketing year and adjusted plans for marketing 2020/21 marketing year corn. Corn demand, of which ethanol use represents 30-40% annually, suffered and prices plummeted into the fall. Corn prices were saved on the back of unexpected increases in exports, particularly to China. Now, with restrictions softening and car travel returning over the past year, ethanol production is up for its third consecutive month compared to last year and down by single-digit percentage points compared to 2019. Additionally, ethanol production for the 2021/22 marketing year is on track to use 5.2 billion bushels of corn, up from the 4.85 billion-bushel low that was estimated in July 2020 for the 2019/20 marketing year. This, along with 2021/22 exports, is helping drive demand for corn.

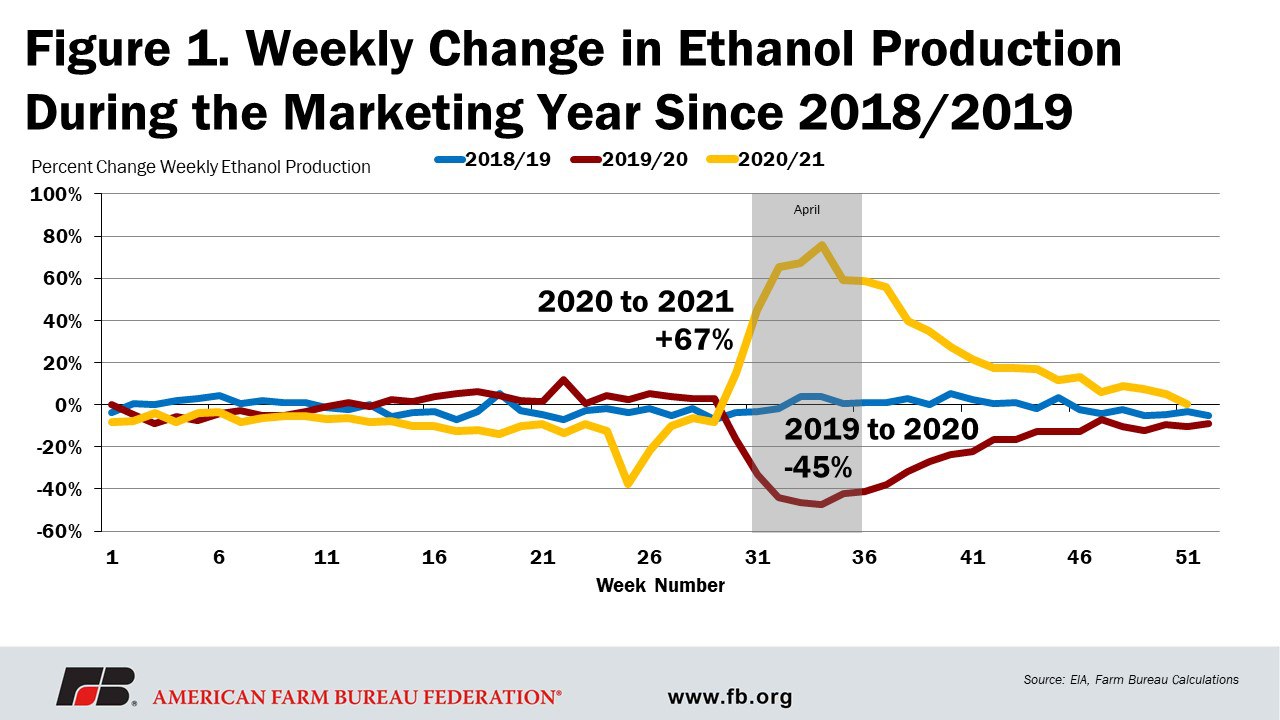

Road to Recovery

The road to pandemic recovery has been a year-long process for the ethanol industry and it continues to hit speed bumps. In April 2019, ethanol production reached 1.3 billion gallons. When COVID-19 restrictions were at their tightest in April 2020, ethanol production bottomed out at 711 million gallons, down 45% compared to 2019. In April 2021, the U.S. Energy Information Administration reported ethanol production was 1.18 billion gallons, up 67% compared to 2020 but still 9% behind 2019 levels.

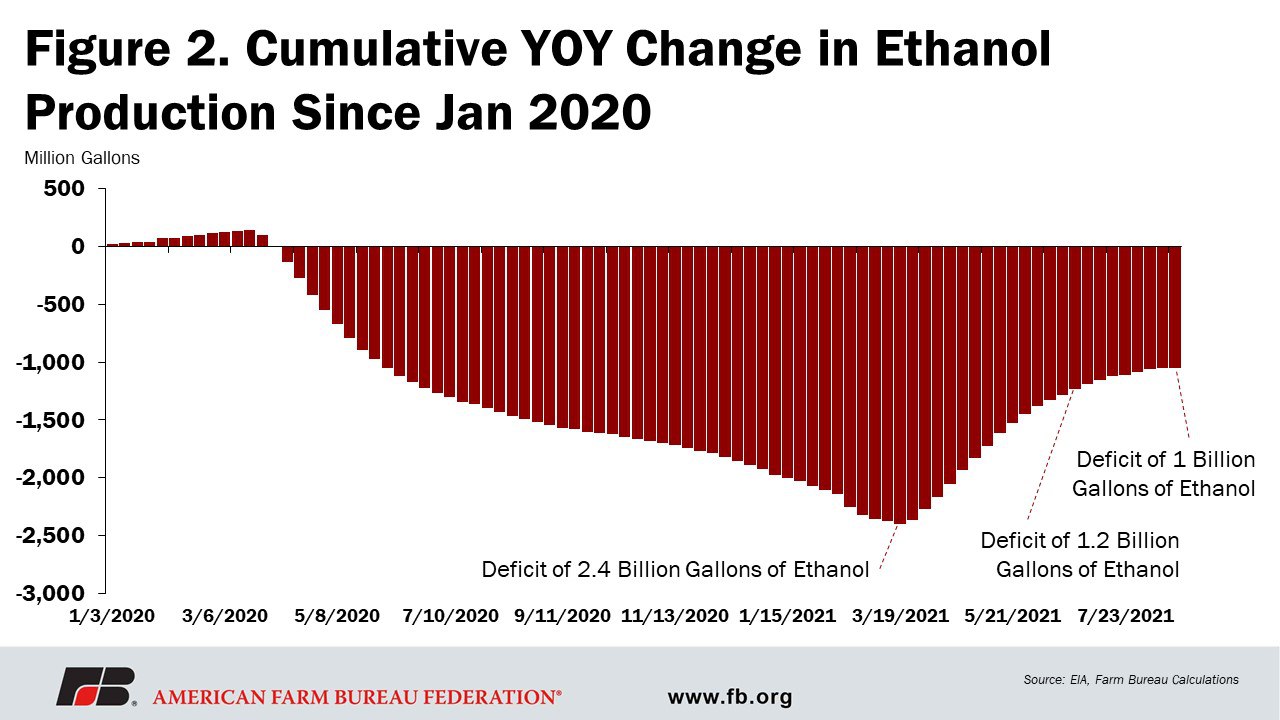

Despite ethanol production rebounding, cumulative ethanol losses indicate a slowed recovery. The lowest point of cumulative losses in ethanol production, a deficit of 2.4 billion gallons of ethanol, occurred during the week of March 19, 2021 – nearly a year after ethanol plants experienced shutdowns and slowed production. Since then, ethanol is only about 1 billion gallons behind in its cumulative ethanol production, but the rate of increased production is slowing, a signal that it may be hard to make up that last billion of lost production.

Ethanol Outlook

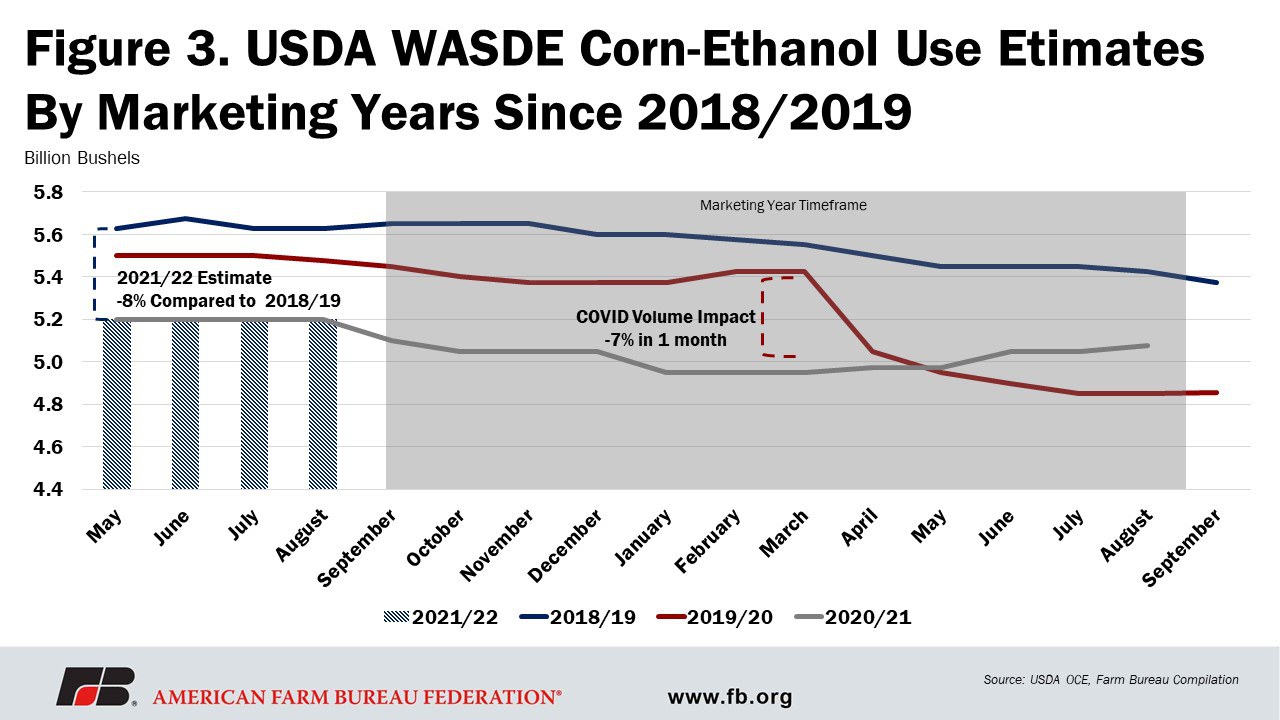

Ethanol use represents a large portion of U.S. corn demand, and the industry’s rebound has been evident in USDA’s World Agricultural Supply and Demand Estimates. USDA has historically estimated peak corn ethanol use for June ahead of the marketing year. For the 2018/19 marketing year, USDA estimated 5.6 billion bushels would go to corn ethanol demand. While the number remained high, the actual volume of corn was closer to 5.3 billion bushels that went to corn ethanol use, estimated at the end of the marketing year in September 2019. For the 2019/20 marketing year, the June 2019 WASDE reported corn ethanol use would be close to 5.5 billion bushels. But when COVID-19 stay-at-home precautions were implemented nearly a year later, the April 2020 WASDE lowered the estimate to just above 5 billion bushels and ended the marketing year at 4.8 billion bushels of corn used for ethanol, a 10% reduction from the previous marketing year. The 2020/21 marketing year started 8% lower than the 2018/19 marketing year at 5.2 billion bushels estimated for corn ethanol use. As we’ve moved through COVID-19 precautions, that number was lowered to below 5 billion bushels, but has recovered since January 2021 and sits at 5.075 billion bushels. The next WASDE report, which will be released on Sept. 10, will have the most updated number for ethanol use in the latest marketing year. As for the 2021/22 marketing year, USDA has stuck with its initial estimate of 5.2 billion bushels. Looking to the official start of the new marketing year, tight supplies through harvest and other corn use categories like export demand could cause that estimate to lower further, like in 2020/21. The current outlook for ethanol use has the industry trajectory staying depressed, despite the productivity gains in recent months.

Ethanol in the Courts

While ethanol production is moving toward recovery to pre-COVID-19 levels, the industry is facing additional setbacks in the courts. At the end of June, the Supreme Court of the United States held that the Trump administration EPA was permitted to grant small refinery waivers under the RFS even if the refiners had not previously been granted a waiver. The decision reversed the Tenth Circuit Court of Appeals, which previously held that waivers could only be granted to refiners that had a waiver in all previous years since the program began.

Then, in the following week, the United States Circuit Court of Appeals for the District of Columbia struck down a 2019 rule change that allowed for expanded summertime ethanol sales. The court found that the Trump administration overreached its authority when it lifted the ban on gasoline with higher ethanol content by authorizing the sale of 15% ethanol-blended gasoline in the summer months. Provisions of the Clean Air Act have prohibited the sale of certain fuels with a higher volatility from June 1 through Sept. 15 to limit smog. Congress has allowed 10% ethanol, and the EPA in its 2019 ruling revised the interpretation of the exemption to federal law to include the 15% ethanol blend.

Both rulings have the potential to hold ethanol demand back, despite the fuel option being key to helping reduce greenhouse gas emissions. A recent study by Harvard University, Tufts University and Environmental Health and Engineering Inc. estimated that the use of corn ethanol blended in fuels reduced greenhouse gas emissions by 980 million metric tons between 2008 and 2020, which is the equivalent of annually removing 18 million cars from the road.

EPA is in the process of setting the renewable volume obligations for 2020, 2021 and 2022. The current proposed RFS rule was sent to the Office of Management and Budget on August 26, marking the first step in the process. The EPA annually reviews biofuel blending requirements set by Congress, then issues a rule that sets renewable volume obligations that align with market conditions. The Trump administration did not issue the rules before leaving office and the Biden administration’s EPA extended compliance deadlines for the 2019 renewable volume obligations to Nov. 30, 2021, and for the 2020 renewable volume obligations compliance deadline to Jan. 31, 2022.

For the ethanol industry to continue on its trajectory of recovered ethanol demand and to encourage increased ethanol use, AFBF urges Congress and EPA to act to ensure demand is not lost for this important renewable, homegrown fuel.

Summary

It has been a tumultuous 16 months for the ethanol industry and corn growers. After a brief celebration of rebounded demand after COVID-19 impacts, a series of court decisions could hold the industry back from its growing role in greenhouse gas emission reductions. And without congressional action directing the future of the RFS, EPA is left to decide whether or not to increase ethanol demand beyond current outlook levels that peg industry demand at its lowest level since 2014. Boosting corn ethanol demand and increasing blending levels can help the industry make a full recovery and push overall corn demand higher, boosting prices for farmers.