Ethanol Plants Pushed Toward Unprofitability

TOPICS

Renewable Energy

photo credit: Mark Stebnicki, North Carolina Farm Bureau

John Newton, Ph.D.

Vice President of Public Policy and Economic Analysis

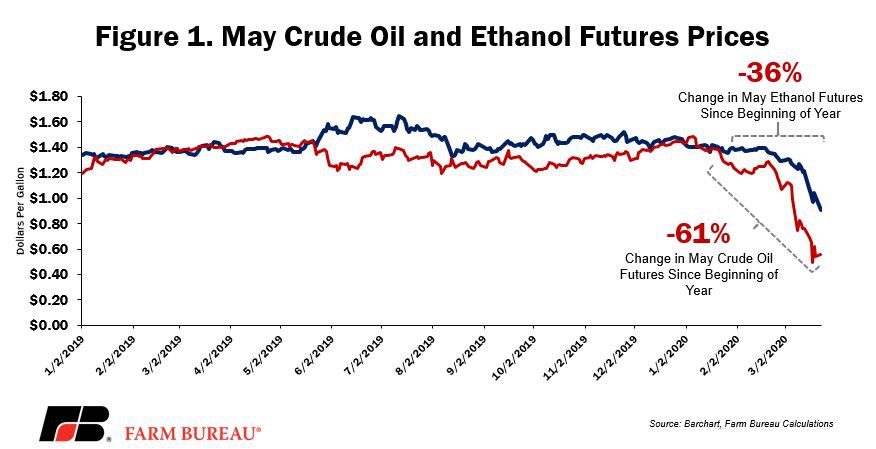

In recent years, Saudi Arabia and Russia have supported global oil prices by aligning to strategically limit oil production. The recent collapse of this strategic agreement has driven up oil production capacity. At the same time, the self-distancing and quarantine protocols put in place in many countries to slow the spread of COVID-19 have reduced economic growth and stymied the demand for crude oil. The dramatic effect of these dual black swan events is a 61% drop in the May crude oil futures value, which has fallen from more than $60 a barrel to $23 a barrel. The lower price of oil contributed to a 36% decline in the May ethanol futures price, from $1.41 per gallon to 90 cents per gallon as of the writing of this article. Figure 1 highlights the May crude oil and ethanol futures values.

Lower prices at the pump mean smaller profits for ethanol plants. While measuring the profitability of ethanol plants is difficult, the industry-trusted benchmark is Iowa State University’s Ethanol Plant Model. Based on the ISU model, the returns over variable costs (not returns over all costs) was -4 cents per gallon in January 2020 and averaged 6 cents per gallon during 2019. Importantly, using this same model with a 90 cents per gallon ethanol price, the returns over variable costs drops to -39 cents per gallon, and returns over all costs drop to -60 cents per gallon – holding everything else constant.

These deteriorating economic conditions led POET, one of the largest producers of ethanol in the U.S., to suspend corn purchases at some facilities. Given that approximately 40% of the nation’s corn production is grinded for ethanol, cash prices of corn are likely to face pressure until demand improves.

What is a Break-Even Corn Price?

One of the obvious questions that follows then is, what corn price will allow these plants to stay open, i.e., the break-even price? The shutdown point occurs when a firm can no longer cover variable operating costs – which in the case of an ethanol plant includes but is not limited to the price of corn, natural gas, chemicals, electricity, transportation and water.

Based on the ISU ethanol plant model, these non-corn variable costs averaged 37 cents per gallon, ranging from 34 cents per gallon to 41 cents per gallon over the last two years. The total revenue is defined as the value of ethanol plus the value of dried distillers grains. For this analysis, the value of DDGs is set at $142 per ton and is in line with prices reported in USDA’s Daily Ethanol Report.

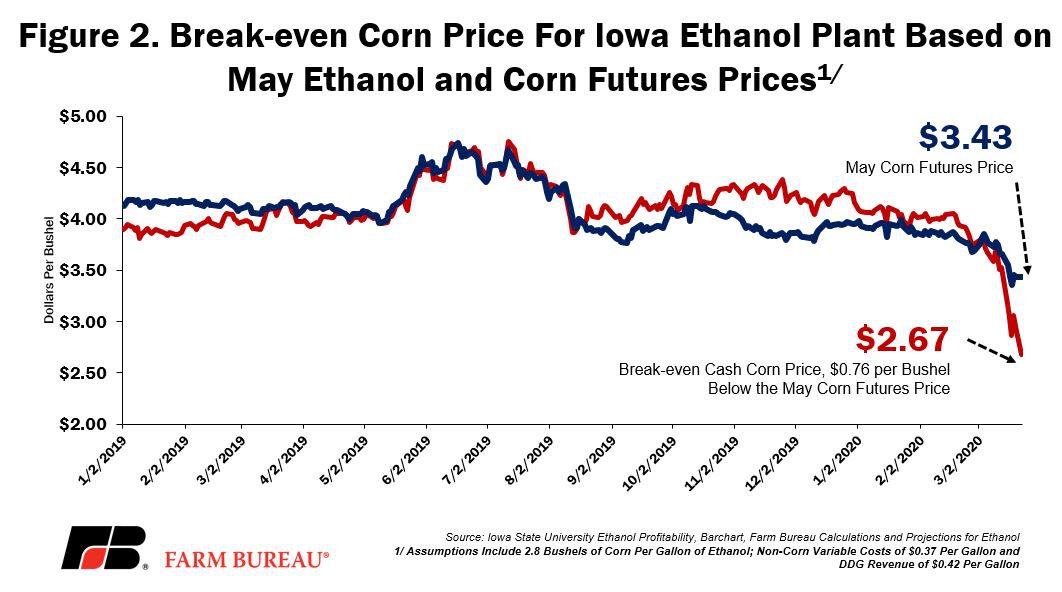

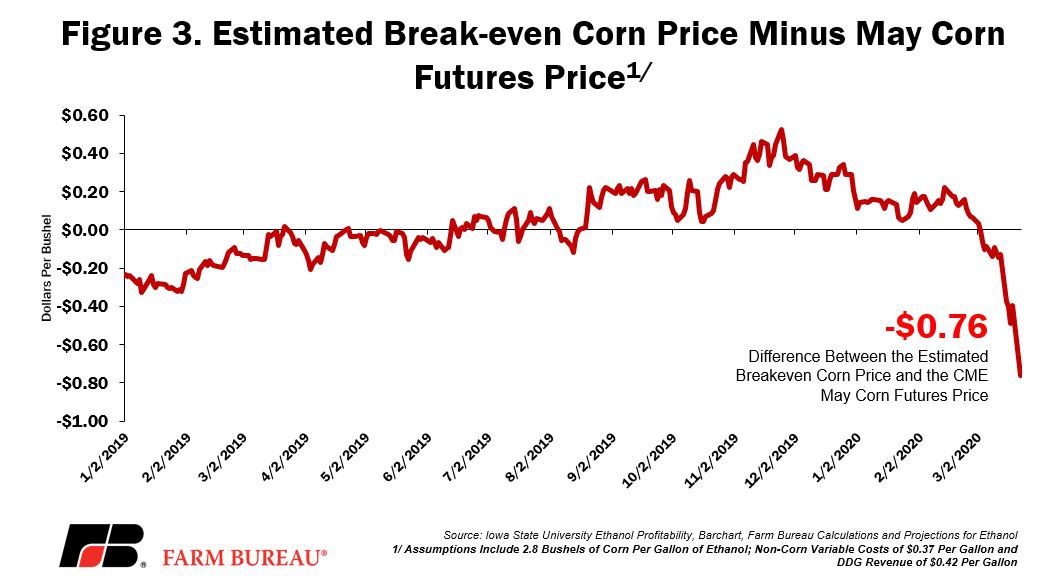

Subtracting the variable costs from the total revenue – based on the DDG value and the May ethanol futures value – and then assuming a conversion rate of 2.8 gallons per bushel, the break-even value of corn is approximately $2.67 per bushel – down sharply from two weeks ago when the break-even corn price was $3.79 per bushel. This is likely a conservative estimate given the wide range of operating costs across ethanol facilities. Using this estimate, the difference between the corn futures price and the estimated break-even price now stands at -76 cents per bushel – and explains the reduction in cash corn prices in portions of the Midwest. Figure 2 identifies the May corn futures prices and the estimated break-even price of corn. Figure 3 highlights the divergence between the corn price and the estimated break-even price.

Summary

The ethanol industry is facing two black swan events, the Saudi-Russian oil war and the COVID-19 pandemic. Global economic uncertainty has pushed the price of crude oil down by more than 60% and the price of ethanol by nearly 40%. The lower ethanol price is pushing ethanol production into the unprofitable column, compelling many plants to scale back. Reduced corn demand for ethanol is being met with corn already in inventory – impacting spot market corn prices.

This estimated – and simplistic – break-even analysis based on the Iowa State University Ethanol Model suggests the purchase price for corn should be $2.67 per bushel – well below the May futures value of $3.43 per bushel. Other ethanol plants obviously will have different cost structures and different corn prices that will allow those plants to stay open. However, as a result of these challenges, across much of the Midwest local grain bids are now well below the Chicago futures price. Additionally, for farmers feeding livestock, the availability of DDGs and wet cake will be impacted by lower ethanol processing capacity.

Once global economies emerge from self-distancing and oil production realigns with demand, the profitability of ethanol production facilities should improve. Declining gasoline consumption in the U.S. remains a long-term challenge, but the industry has put an emphasis on building demand in export markets. Given these factors, the administration should provide certainty that small refinery exemptions will be limited and that ethanol production facilities – along with other essential agricultural production facilities – will have ample access to lines of credit or commodity credit corporation resources to provide economic stability to these ethanol plants.

Top Issues

VIEW ALL