Farm Loan Delinquencies and Bankruptcies Are Rising

TOPICS

Farm LoansAllison Wilton

Economic Analysis Intern

photo credit: NASA Goddard Space Flight Center / CC BY 2.0

Allison Wilton

Economic Analysis Intern

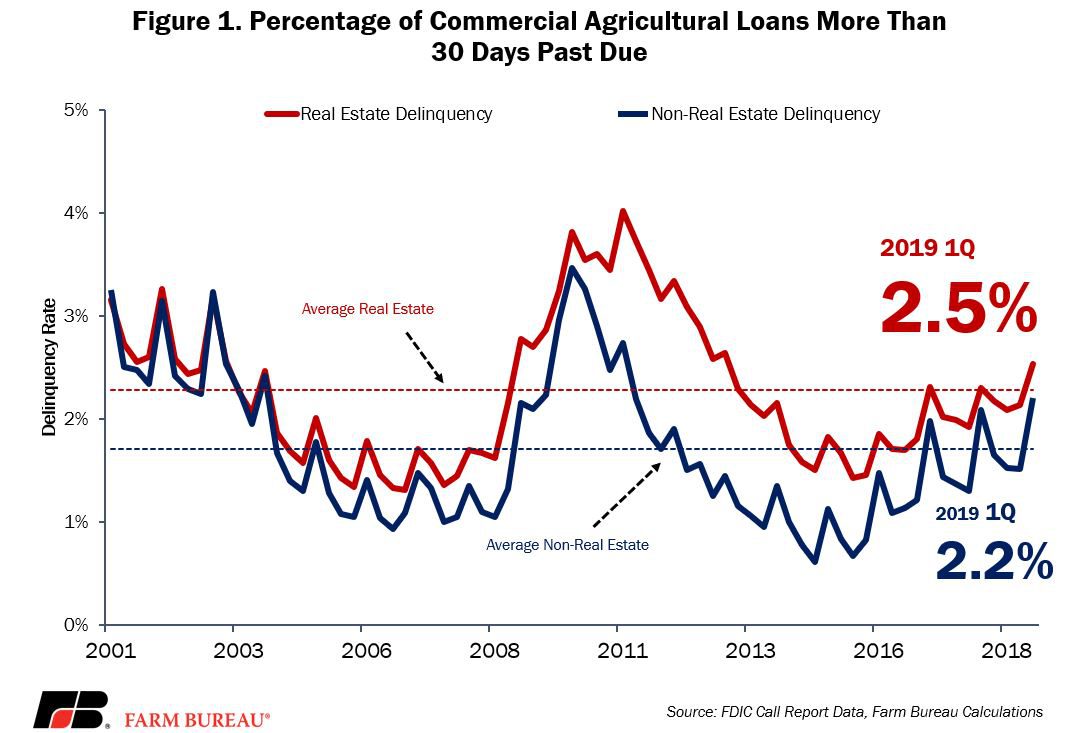

Following several years of low farm income and rising debt levels, a review of Federal Deposit Insurance Corporation quarterly call report data reveals that the delinquency rates for commercial agricultural loans in both the real estate and non-real estate lending sectors are at a six-year high.

For the first quarter of 2019, 2.5% of commercial real estate loans in agriculture were more than 30 days past due, up from 2.1% in the prior quarter and above the historical average of 2.1%. Similarly, 2.3% of non-real estate loans in agriculture held by commercial lenders were more than 30 days past due, up from 1.5% in the prior quarter and above the historical average of 1.7%. The first quarter of 2013 was the last time delinquency rates were this high for commercial lenders. Figure 1 highlights the delinquency rate for both real estate and non-real estate loans held by commercial lenders.

While the delinquency rates are well below the levels experienced following the recession, they are above the historical average and trending in the wrong direction due to several years of poor farm income exasperated by extreme weather events and ongoing trade disruptions (USDA’s Early Look at 2019 Farm Income).

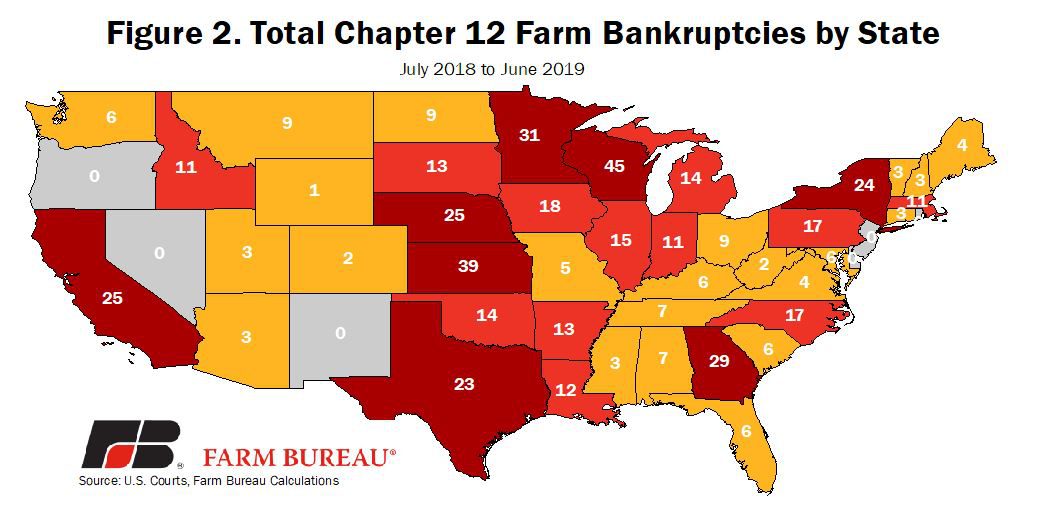

As annual average loan delinquency rates have increased for 24 consecutive quarters, so too have farm bankruptcies over the prior 12 months. Through June 2019, and over the prior 12 months, there were a total of 535 Chapter 12 bankruptcy filings, up 13%, or 60 bankruptcies. The number of Chapter 12 filings over the previous 12 months is the highest level since 2012’s 582 filings. The increase in bankruptcy filings is a noteworthy shift given bankruptcy levels fell during calendar year 2018 compared to 2017, e.g., Farm Bankruptcies in 2018 - The Truth is Out There.

Chapter 12 Bankruptcies by State

Total bankruptcies filed by state vary significantly, from no bankruptcies in some states to as many as 45 filings in others, as shown in Figure 2. Oregon, Nevada, New Mexico, New Jersey, Rhode Island and Delaware had no Chapter 12 bankruptcies filed in the past year, based on data from the U.S. Courts. These states have consistently seen low numbers of bankruptcies in the past decade. In contrast, Wisconsin, Kansas and Minnesota led the nation in Chapter 12 filings; bankruptcy filings in Kansas and Minnesota increased so significantly in the past year that they reached the highest levels of the past decade.

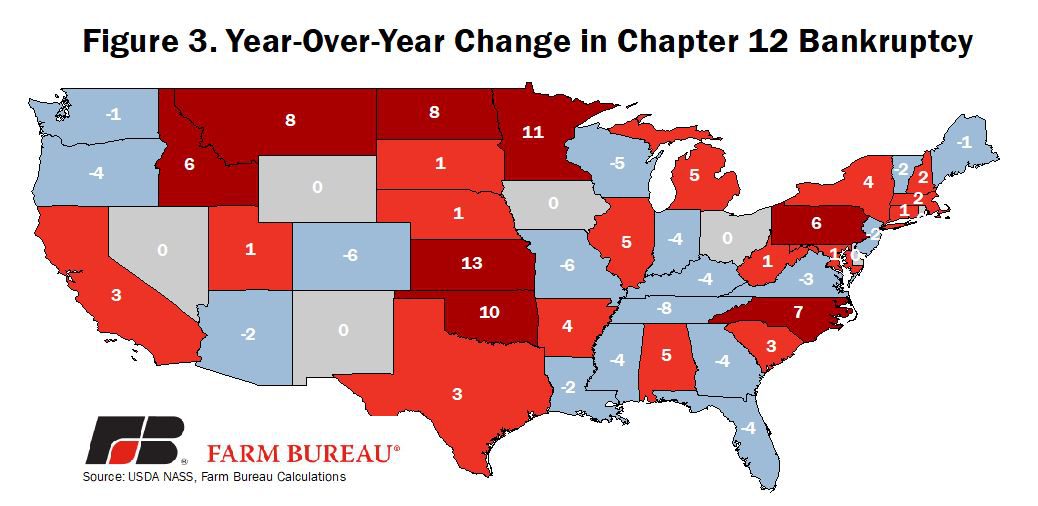

As seen in Figure 3, in some states total bankruptcies filed were down, but those that saw an increase saw a significant increase in the past year. Kansas had 13 more Chapter 12 bankruptcies in the past year, up 50% from the 12-month period ending June 2018. Oklahoma also had a significant rise in farm bankruptcies, with filings more than doubling from the previous year. However, states in the southeast, like Tennessee, Mississippi, Georgia and Florida, had smaller numbers of filings, though those changes weren’t as drastic.

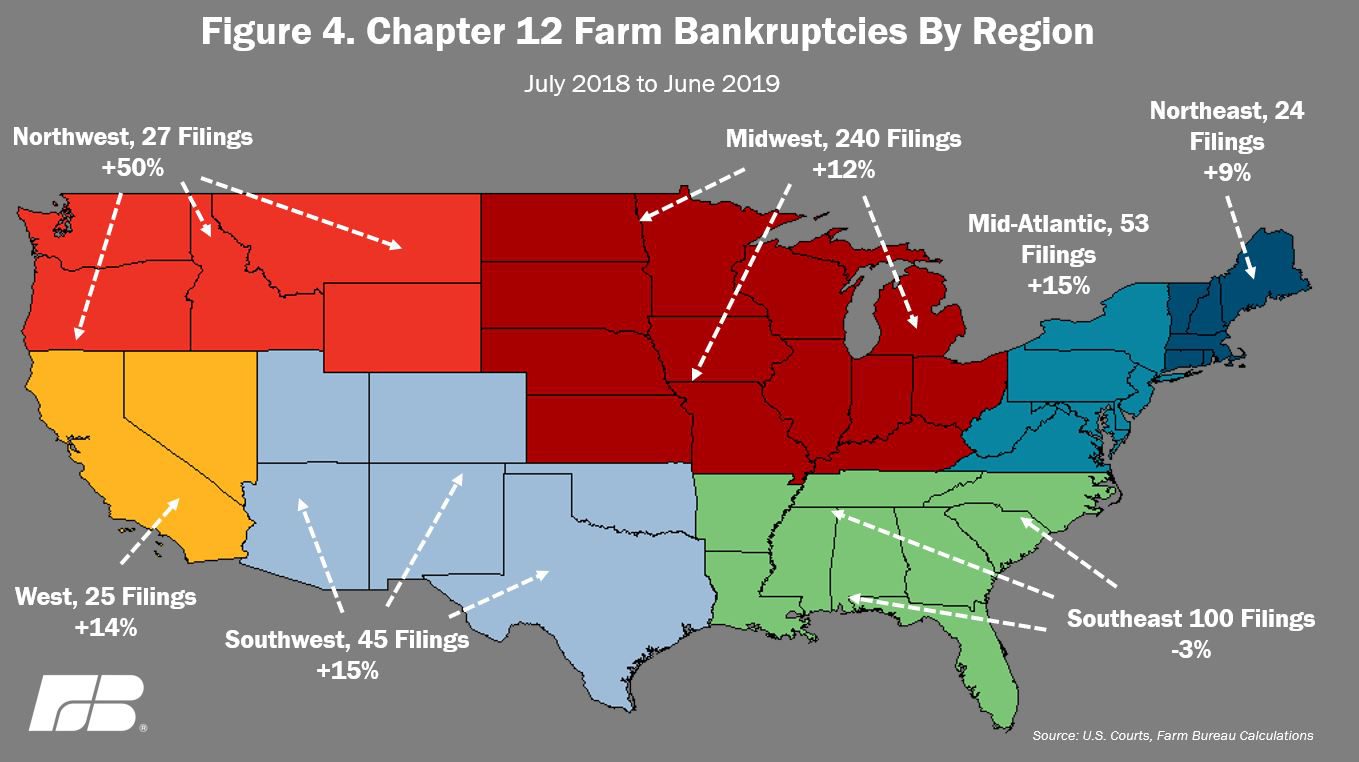

Chapter 12 Bankruptcies by Region

In the year ending June 2019, Chapter 12 farm bankruptcies increased in every region in the United States, except for the Southeast. However, there were still a significant number of bankruptcies filed in that region (Figure 4). The Midwest and Southeast had the highest number of filings, 240 and 100 bankruptcies in the past year, respectively. The Midwest is up from 215 filings from the previous year to 240 filings, an increase of 12%. The biggest increase in bankruptcies, 50%, occurred in the Northwest, which includes Washington, Oregon, Idaho, Montana and Wyoming.

Summary

Across the U.S., farm loan delinquencies and Chapter 12 bankruptcies are rising. The deteriorating financial conditions for farmers and ranchers are a direct result of several years of low farm income, a low return on farm assets, mounting debt, more natural disasters and the second year of retaliatory tariffs on many U.S. agricultural products.

The administration and Congress have done a good deal to assist farmers and ranchers, including passing the 2018 farm bill, as well as a disaster aid package, and providing a second round of Market Facilitation Program trade assistance payments, e.g., What to Expect in the New Disaster Aid Package, USDA Announces Details Behind the New Trade Aid Package and Estimating Dairy Trade Aid Payments.

In addition to these financial assistance packages, the House of Representatives recently passed the Family Farmer Relief Act, which updates Chapter 12 bankruptcy eligibility. Chapter 12 bankruptcies provide a seasonal repayment schedule over a three- to five-year period and lower costs relative to other chapters.

Currently, there is a debt limit of $4.1 million, preventing many family farmers from filing Chapter 12 bankruptcies. The Family Farmer Relief Act raises that cap to $10 million, allowing more farmers the opportunity to qualify under Chapter 12. This also gives producers and their creditors a better chance to reorganize and avoid mass liquidation, ultimately preventing further consolidation in the agriculture industry.

Combined, these administration and congressional efforts, along with the approval of the U.S.-Mexico-Canada Agreement and the opening of new markets around the world, will help U.S. agriculture reverse the negative trend of rising bankruptcies, low farm income and increasing difficulty servicing record-high agricultural debt.

Top Issues

VIEW ALL