Few Surprises in Quarterly Hogs Report: U.S. has Plenty of Pork

TOPICS

USDAMichael Nepveux

Former AFBF Economist

photo credit: AFBF Photo, Cole Staudt

Michael Nepveux

Former AFBF Economist

On March 28, USDA’s National Agricultural Statistics Service released its Quarterly Hogs and Pigs report, providing a detailed inventory of breeding and marketing hogs.

Producers use this data to determine production and marketing strategies, while the industry uses it to assess the markets and the future supply of product.

The U.S. inventory of all hogs and pigs on March 1 came in at 74.296 million head, up 2.1 percent from the previous year. This came in right in line with analysts’ expectations of a 2 percent increase from March 1, 2018. In this most recent report, USDA pegged the market hog inventory at 67.95 million, up 2.1 percent from last year but down slightly from last quarter and in line with market expectations of a 2 percent increase. The number of pigs kept back for breeding came in slightly above analysts’ expectations of 1.9 percent, with USDA reporting 6.35 million head, up 2.2 percent from 2018.

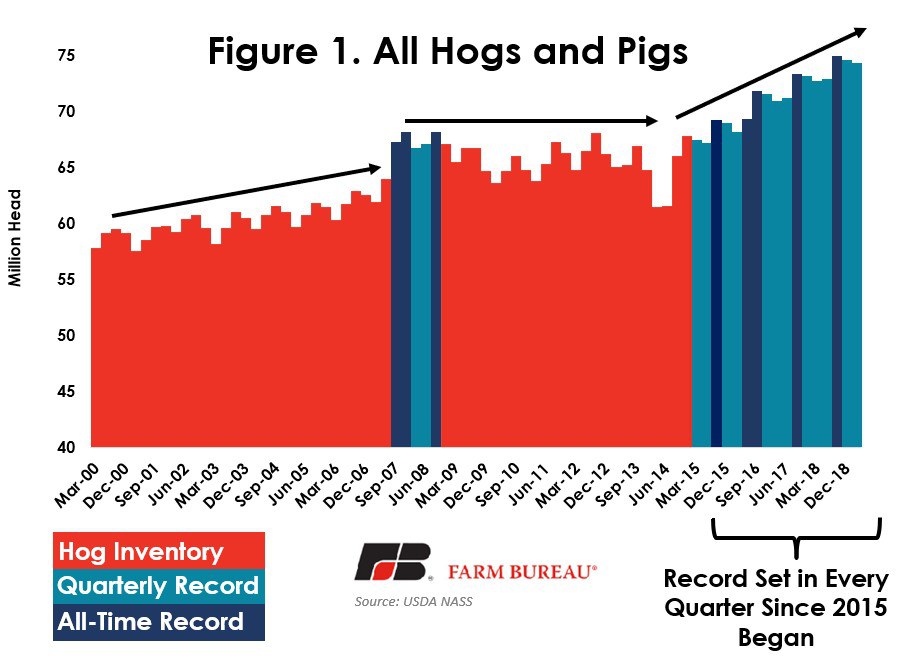

With analysts’ expectations largely in line with USDA’s numbers, this report is very much neutral in tone. It also continued the storyline of record amounts of pork, and even more pork coming down the pipeline with total hogs and pigs, the breeding herd and the market herd all making records for the March report.

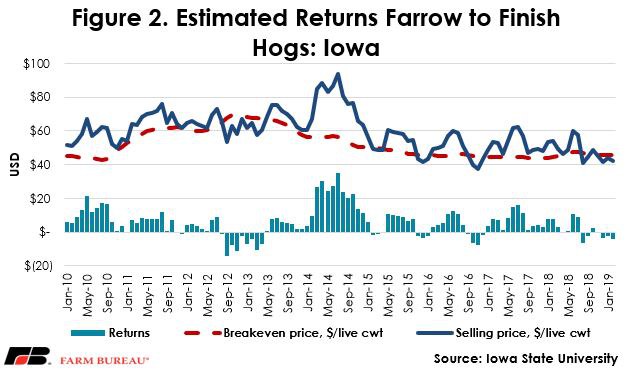

Every single report over the last four years has hit a quarterly record in terms of the total hogs and pigs inventory, with five of those quarterly reports hitting an all-time record number across all quarters and record pork production expected in 2019 as well. When the boom period of grain prices slowed after 2013, pork producers experienced a drop in their feeding costs as grain prices receded. Since then, there has been a steady increase in production as producers expanded capacity. The current trade situation has kept feed input costs low, relieving some of the pressure caused by lower pork prices, also a result of the trade issues.

As far as the future supply of pigs, the report shows producers intend to increase farrowings from this time last year. The report showed producers intend to have 3.12 million sows farrow in the March-May quarter, resulting in an increase of 1 percent from actual farrowings in 2018 if those numbers are realized. One discrepancy between the report and analysts’ expectations is in the farrowing intentions reported for June-August this year. The report shows intentions down slightly from 2018 at 3.19 million sows, while analysts were expecting an increase of over 2 percent from 2018. Analysts are somewhat split on whether or not the rate of expansion is changing, with some considering the potential for a slowdown in light of a tough financial environment for producers. However, many analysts do not see a slowdown in the rate of expansion moving forward. One major wild card is leaving many analysts without a solid prediction: How will the African Swine Fever outbreak in China ultimately affect the U.S. and global pork markets?

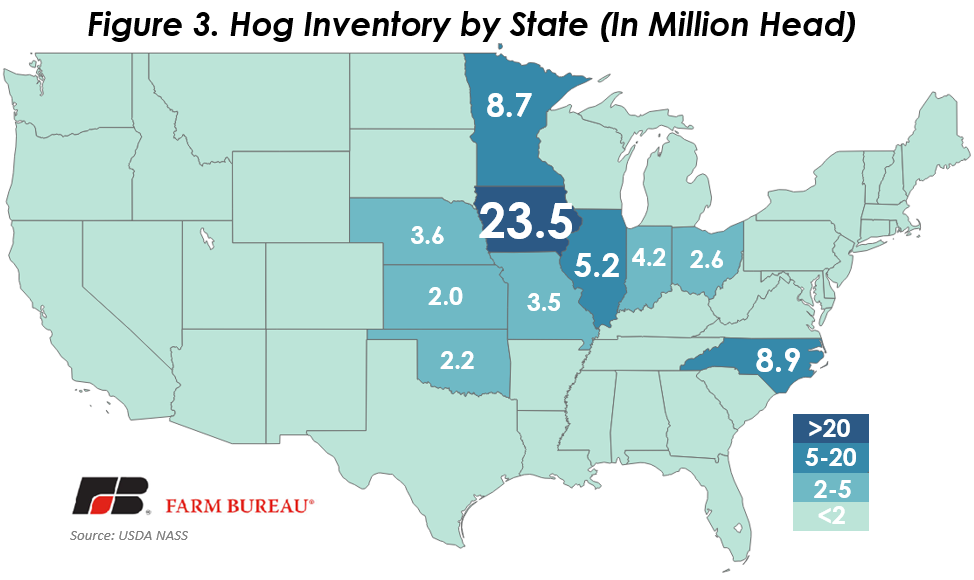

Iowa is once again top in the nation for pork production, accounting for 32 percent of the nation’s hogs and pigs in inventory. As usual, following Iowa are North Carolina and Minnesota, accounting for 8.9 million and 8.7 million pigs each, respectively. Together, these three states account for 55 percent of the nation’s hog supply.