From WHIP+ to ERP: A New Name for 2020-2021 Ad Hoc Disaster Assistance

TOPICS

Wildfires

photo credit: Alabama Farmers Federation, Used with Permission

Daniel Munch

Economist

On May 16, USDA announced that some commodity and specialty crop producers impacted by natural disasters in 2020 and 2021 will soon be eligible to receive emergency relief payments totaling about $6 billion to offset crop yield and value losses through the Farm Service Agency’s (FSA) new Emergency Relief Program (ERP), previously known as the the Wildfire and Hurricane Indemnity Program + (WHIP+). The long-awaited news comes after farmers and ranchers over the past two years faced billions of dollars in losses associated with wildfire, extreme drought, hurricanes, tornados and other major weather events. Those who had losses in early 2020 have waited over two years to hear program specifics. Today we dive into what we know so far about how the rebranded disaster assistance program will work and what farmers should expect when trying to determine their qualification status.

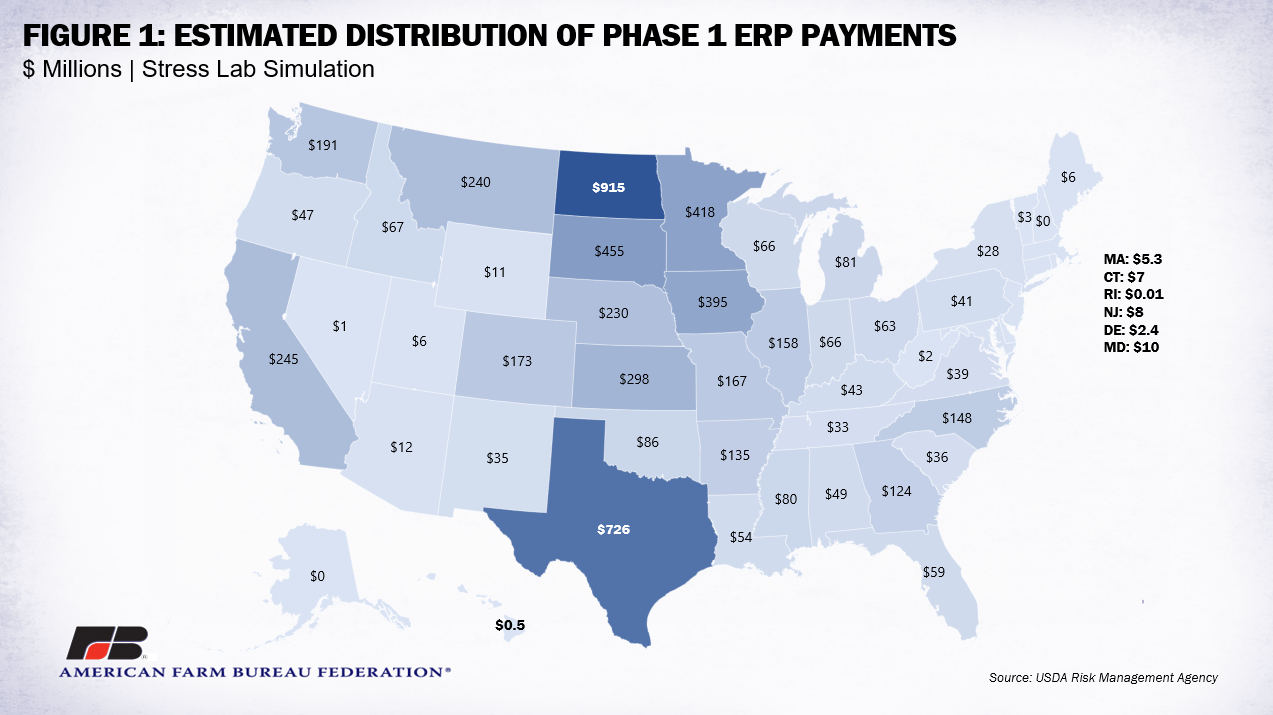

Ad hoc disaster assistance programs have been discussed in previous Market Intels including: Reviewing WHIP+ and Other Disaster Assistance Programs, 2020 Disaster Estimations Reveal at Least $3.6 Billion in Uncovered Losses, 2020 Disasters Reveal Gaps in Ad Hoc Aid Legislation , Continuing Resolution Extends Disaster Coverage for Most 2020 and 2021 Losses, Kentucky, Arkansas Tornadoes, Midwest Derecho Renew Calls for Timely Disaster Assistance and 2021 Disaster Estimations Reveal at Least $12.5 Billion in Crop and Forage Losses. Established under the Additional Supplemental Appropriations for Disaster Relief Act of 2019 with $3.005 billion in funds alongside On-Farm Storage Loss, Milk Loss, and Tree Assistance programs, WHIP+ had its origins in the 2017 WHIP. On Sept. 30, 2021, President Biden signed a continuing resolution into law with a retroactive extension of disaster assistance programs, including WHIP+ (or a WHIP+-like program, like ERP), the On-Farm Storage Loss Program, Milk Loss Program and Tree Assistance Program, through 2020 and 2021. The law appropriates $10 billion out of the Treasury to the office of the secretary of Agriculture for these programs and expands ad hoc disaster coverage for additional causes of loss including derechos, winter storms, polar vortexes, freeze, smoke exposure and quality losses for crops. The first phase of ERP will provide $6 billion of these funds to eligible farmers and ranchers. Estimated state-by-state distributions are displayed in Figure 1.

The ERP announcement breaks the program down into two phases., Phase 1 focuses on streamlining payments to producers whose crop insurance and/or Noninsured Crop Disaster Assistance Program (NAP) data are already on file. Phase 2 focuses on filling payment gaps to cover producers who did not participate or receive payments through existing programs or with other special cases (see payment calculation examples). Under Phase 1, eligible crops include all crops for which federal crop insurance or NAP coverage was available and a crop insurance indemnity or NAP payment was received, except for crops intended for grazing. Qualifying natural disaster events include “wildfires, hurricanes, floods, derechos, excessive heat, winter storms, freeze (including a polar vortex), smoke exposure, excessive moisture, qualifying drought, and related conditions.” Related conditions under ERP include “weather and adverse natural occurrences that occurred concurrently with and as a direct result of a specified disaster event.” Examples include excessive wind that occurred with a derecho or silt and debris that occurred as a result of flooding. Losses due to drought are also eligible if they occurred in areas rated by the U.S. drought monitor as D2 (severe) for eight consecutive weeks or D3 (extreme drought) or higher at any time during the applicable calendar year. Phase 2 details are expected later this summer.

Applying

Under ERP Phase 1, over the next week FSA will send pre-filled applications to producers with existing crop insurance or NAP information on file. The form will include eligibility requirements, outline the application process and provide ERP payment information. A separate application form will be sent for each program year (2020 and 2021). USDA clarified that receiving a pre-filled application does not necessarily guarantee payment under Phase 1 ERP. Producers will have to return completed and signed ERP Phase 1 applications to their local FSA office.

In addition, USDA is requiring the following forms, which should already be on file for those with prior FSA program participation, for ERP eligibility:

- Form AD-2047, Customer Data Worksheet.

- Form CCC-902, Farm Operating Plan for an individual or legal entity.

- Form CCC-901, Member Information for Legal Entities (if applicable).

- Form FSA-510, Request for an Exception to the $125,000 Payment Limitation for Certain Programs (if applicable).

- Form CCC-860, Socially Disadvantaged, Limited Resource, Beginning and Veteran Farmer or Rancher Certification, if applicable, for the 2021 program year.

- A highly erodible land conservation (sometimes referred to as HELC) and wetland conservation certification (Form AD-1026 Highly Erodible Land Conservation (HELC) and Wetland Conservation (WC) Certification) for the ERP producer and applicable affiliates.

Phase 1 Payment Calculations

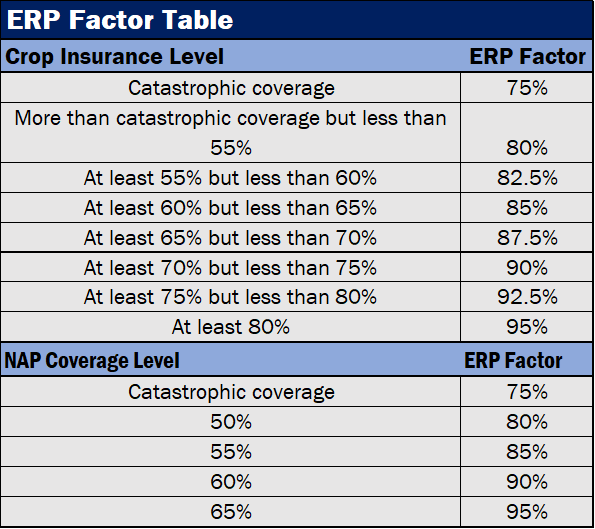

USDA has reported that ERP Phase 1 payments for crops covered by crop insurance will be reduced to 75% of the calculated total payment to ensure payments under both phases do not exceed available program funding. Phase 1 payments for NAP-covered crops will not be prorated due to the much smaller portfolio of participating producers. ERP Phase I payment calculations for a crop will depend on the existing coverage obtained by a producer. Calculations will parallel the formula of the existing coverage but use an ERP factor in place of the producer-selected coverage level. Paid indemnities or NAP payments through existing coverage (after also subtracting service fees and premiums) will be subtracted from the final ERP payment. In other words, producers will be indirectly reimbursed for premium and fee costs for 2020 and 2021 program years. ERP factor tables for crop insurance and NAP are provided below.

Payments under ERP Phase 1 will be calculated based on the producer’s loss due to all eligible causes of loss. Producers who are defined as beginning, limited resource, socially disadvantaged and/or are veterans will have payments under ERP raised by 15% from the base ERP payment. Payment limitations for Phase 1 ERP are dependent on farm-related adjusted gross income (AGI). Payment limitations are addressed by USDA as follows:

- A person or legal entity, other than a joint venture or general partnership, cannot receive, directly or indirectly, more than $125,000 in payments for specialty crops and $125,000 in payment for all other crops under ERP (for Phase 1 and Phase 2 combined) for a program year if their average AGI farm income is less than 75% of their average AGI the three taxable years preceding the most immediately preceding complete tax year.

- If at least 75% of the person or legal entity’s average AGI is derived from farming, ranching or forestry-related activities and the participant provides the required certification and documentation, as discussed below, the person or legal entity, other than a joint venture or general partnership, is eligible to receive, directly or indirectly, up to:

- $900,000 for each program year for specialty crops; and

- $250,000 for each program year for all other crops

- The relevant tax years for establishing a producer’s AGI and percentage derived from farming, ranching, or forestry related activities are:

- 2016, 2017, and 2018 for program year 2020; and

- 2017, 2018, and 2019 for program year 2021

Similar to WHIP+, ERP retains future insurance coverage requirements for participating producers. All producers who receive payments are required to purchase crop insurance or NAP coverage where crop insurance is not available for the next two available crop years. Insurable crops must be covered at greater than or equal to 60% or at the catastrophic level for NAP crops. USDA has reported Phase 1 payments for qualifying producers with submitted applications should reach bank accounts in June.

Payment Calculation Examples

The following examples provide a general framework for how Phase 1 ERP is expected to compensate qualifying producers.

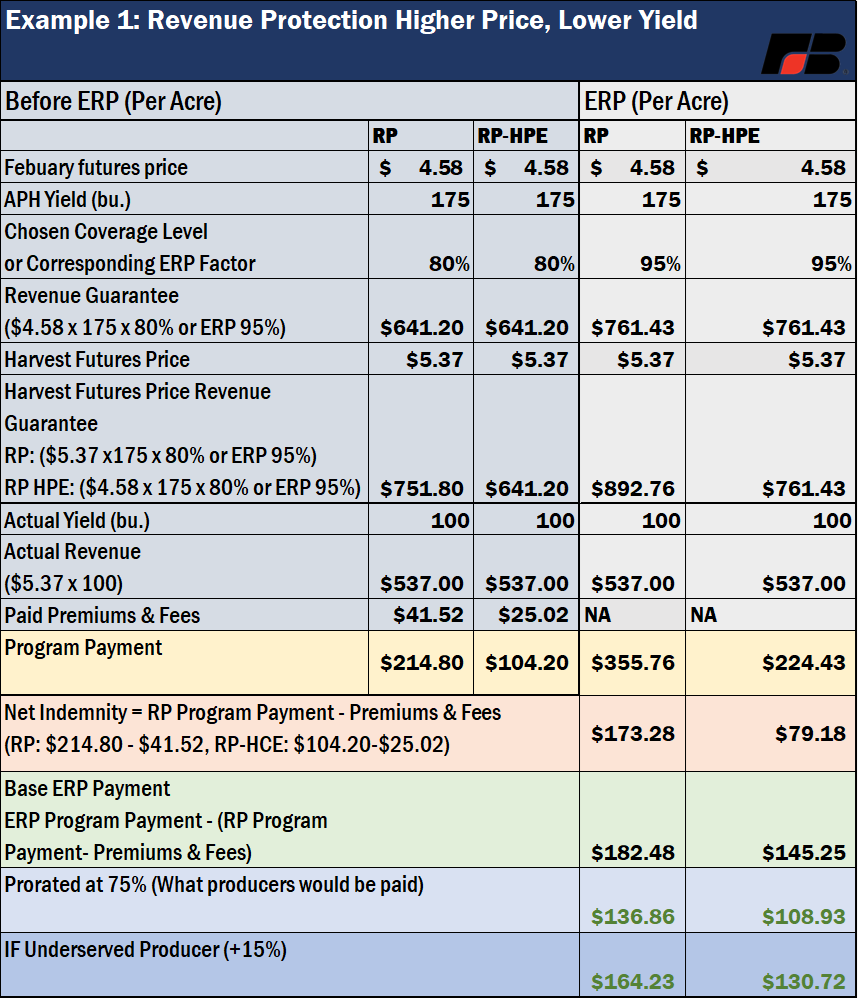

In this first example we use a corn producer in Iowa who had an active revenue protection (RP) or RP with the harvest price exclusion (HPE) policy in place during a program year (2020 or 2021) when the harvest price moved higher than the February reference price but yields dropped due to a qualifying weather disaster. The left, “Before ERP,” columns display the variables and elections of the plan without ERP assistance. The producer purchased an 80% coverage level, which resulted in an indemnity of $214.80/acre under the RP example and $104.20/acre indemnity under the RP-HPE example (yellow, left). With ERP in place, the coverage level is swapped with the associated ERP factor (in this case, 80% is increased to 95%) and the resulting base ERP payment becomes $355.76/acre under the RP example and $224.43/acre under the RP-HPE example (yellow, right). After service fees and premiums are subtracted from the base RP/RP-HPE indemnity payment that value (red) is then subtracted from the base ERP payments (yellow, right) to become $182.48/acre for RP and $145.25/acre for RP-HPE (green). Prorating 75% then drops these down to $136.86/acre and $108.93/acre, respectively (light blue), which is what a producer should expect to receive. Underserved producers, as defined by USDA, would receive an additional 15% on top of the base ERP payment, resulting in a payment of $164.23/acre under the RP example and $130.72/acre under RP-HPE (dark blue).

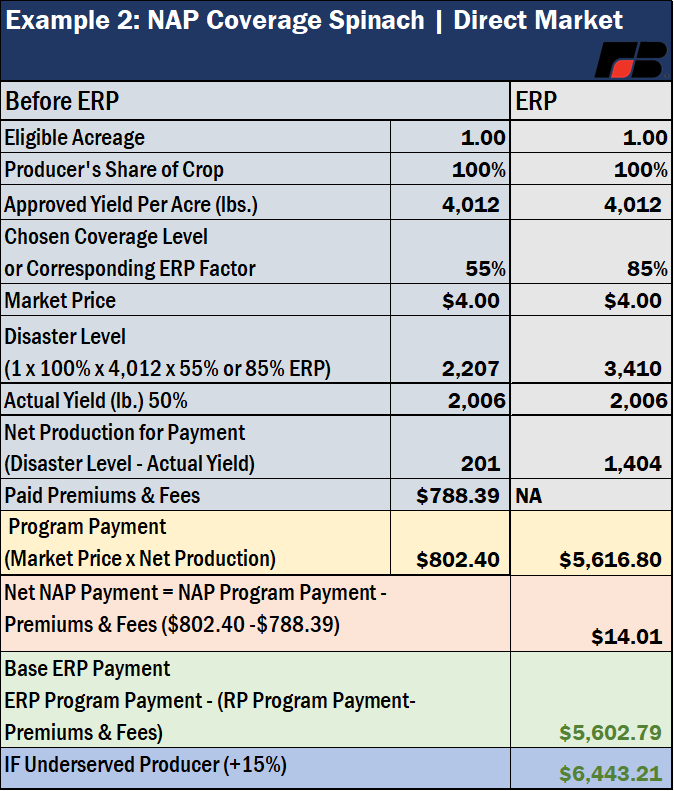

In the second example we use a specialty crop producer in Oregon who had active NAP coverage in place during a program year (2020 or 2021) when a loss in their spinach crop (50% of their volume) took place because of a qualifying disaster. They had chosen the direct market option. Before ERP their chosen NAP coverage level was 55%, which resulted in a payment of $802.40 (yellow, left) for their lost spinach crop under the market per pound price. With Phase 1 of ERP in place, the 55% level is swapped for the ERP factor of 85% and the resulting base indemnity becomes $5,616.80 (yellow, right). After service fees and premiums are subtracted from the base NAP indemnity payment that value (red) is then subtracted from the base ERP payment (yellow, right) to become $5,602.79 (green). ERP payments for those with NAP coverage are not prorated at 75%. Underserved producers, as defined by USDA, would receive an additional 15% on top of the base ERP payment, resulting in a payment of $6,443.21 (blue).

USDA has reported that producers who had a shallow loss but were not able to collect an indemnity from crop insurance or NAP and producers with area-based policies (Supplemental Coverage Option, Stacked Income Protection Plan, Area Risk Protection Insurance, Enhanced Coverage Option, etc.) will be compensated under Phase 2 of the ERP program, which has not yet been released because indemnities for those policies have not yet been calculated. Producers who received no indemnity would also fall under Phase 2 since there is no data record through RMA. USDA expects details to become available this summer after the availability of funds is confirmed. This could leave a large swath of producers, including specialty crop producers who do not use NAP, without assistance. If enough funding is available, payments of 100% or a difference between 75% and 100% of Phase 1 payments may be made rather than the prorated base of 75%.

Conclusion

After over two years of waiting, the ERP announcement presents an opportunity for some producers to receive assistance for crop losses from major weather disasters in 2020 and 2021. The program, similar to WHIP+, will provide an expected $6 billion in funds to producers with prior crop insurance or NAP coverage under Phase 1 and address all other producers under Phase 2. As pre-filled applications are mailed and farmers begin to receive payments, whether or not gaps in prior disaster assistance programs have been addressed will be revealed. Emphasis on timeliness and efficiency should be of highest importance to USDA, especially as thousands of producers who fit into the Phase 2 category continue to wait for information. Ensuring ERP and other disaster assistance extensions provide adequate support is vital – not only for farm-level stability but for a safe and secure domestic food supply.

Top Issues

VIEW ALL