Harvest Climbs North

TOPICS

Winter WheatMegan Nelson

Economic Analyst

photo credit: Right Eye Digital, Used with Permission

Megan Nelson

Economic Analyst

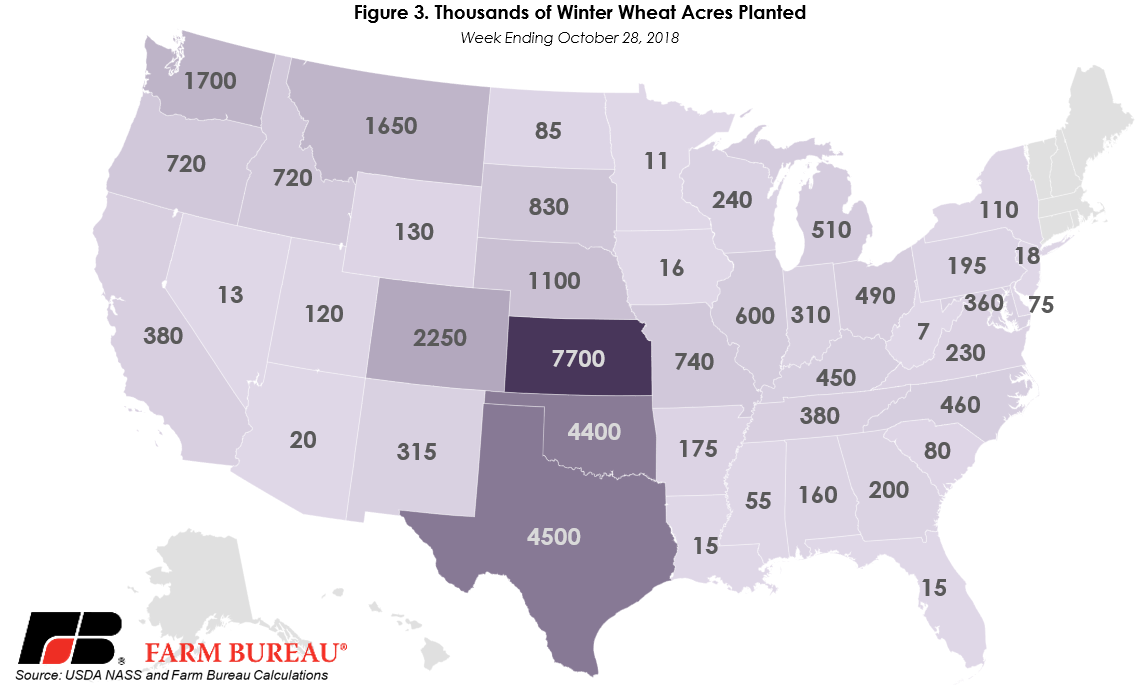

The harvest continues to climb north as USDA’s October 29 Crop Progress report revealed the U.S. corn harvest is 63 percent complete. Slowing slightly from its expeditious start, the corn harvest pace remains up from the previous year, representing an 11-percentage point increase. The current pace is right on track for the five-year average of 63 percent complete and down slightly from analysts’ estimates of 64 percent complete. U.S. corn growers have harvested 9.3 billion bushels so far this year. Iowa and Illinois growers are leading the charge, harvesting 2 billion and 1.3 billion, respectively. Figure 1 shows the state-by-state outlook for percent of corn acres harvested on the left and the number of corn bushels harvested for the week ending Oct. 28.

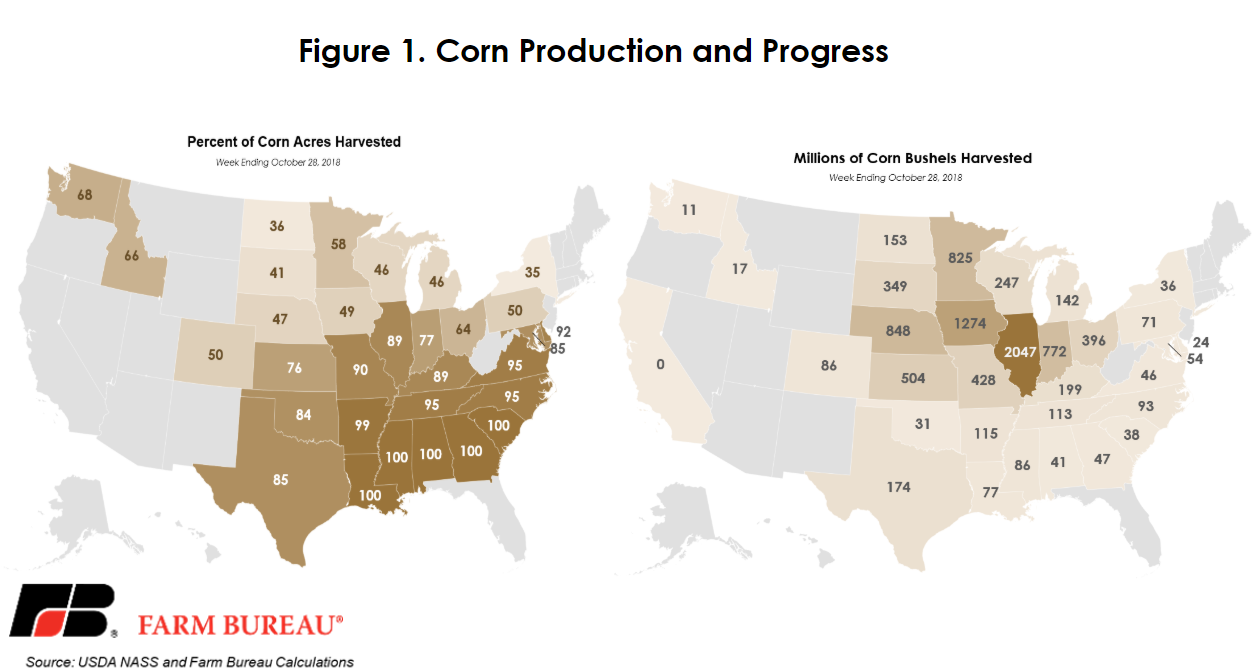

The Crop Progress report also indicates that the U.S. soybean crop is steadily moving, with 72 percent of harvest complete. In contrast to the U.S. corn crop, the U.S. soybean crop had a sluggish start due to rain delays and is currently down 9 percentage points from last year’s rate and below the five-year average of 81 percent complete. The current harvest rate is slightly outpacing analysts’ estimations of 70 percent complete for this week. Figure 2 outlines the state-by-state outlook for percent of soybean acres harvested on the left and the number of soybean bushels harvested for the week ending Oct. 28.

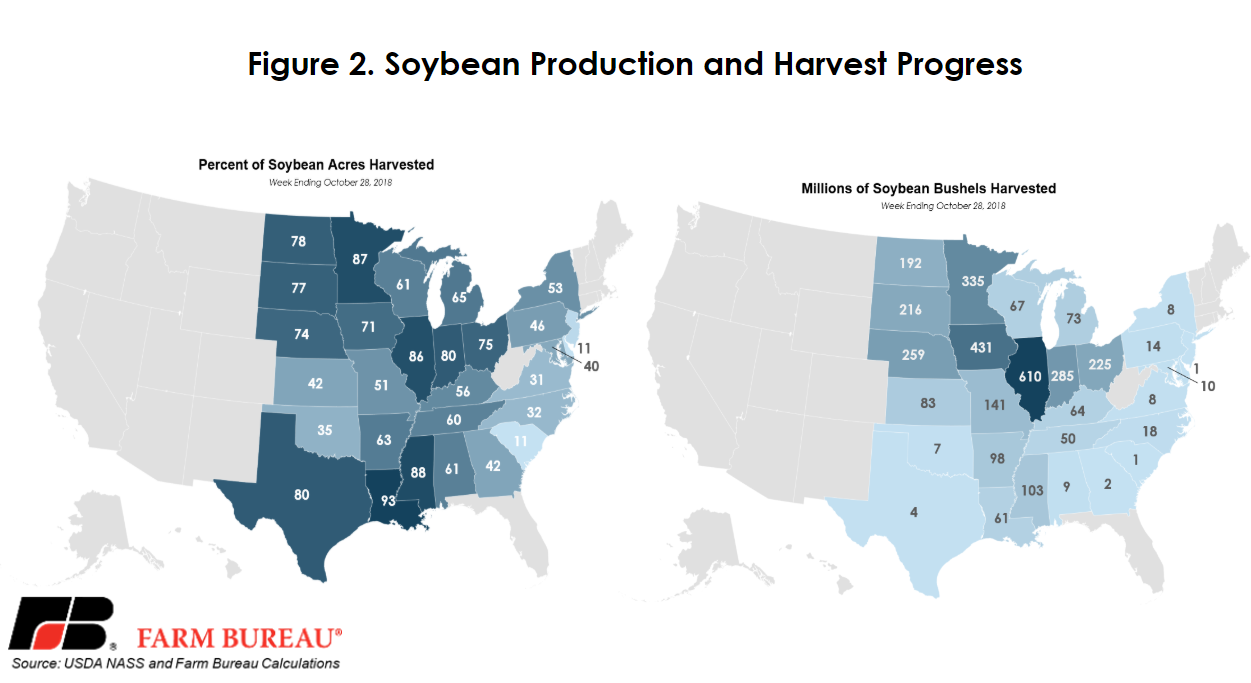

For the week ending Oct. 28, USDA reports that 32.5 million acres of winter wheat has been planted so far, with 22 percent of the U.S. winter wheat crop yet to be planted. The current planting rate is slightly lagging from last year’s planting pace of 83 percent planted. The bread basket of the U.S., Kansas, has planted 7.7 million acres of winter wheat so far. Oklahoma and Texas follow with 4.4 million acres and 4.5 million acres, respectively. Figure 3 illustrates the state-by-state look at the number of winter wheat acres planted as of the week ending Oct. 28.