Heavy Meat Inventories Set New September Highs in 2017

TOPICS

LivestockAFBF Staff

photo credit: Getty

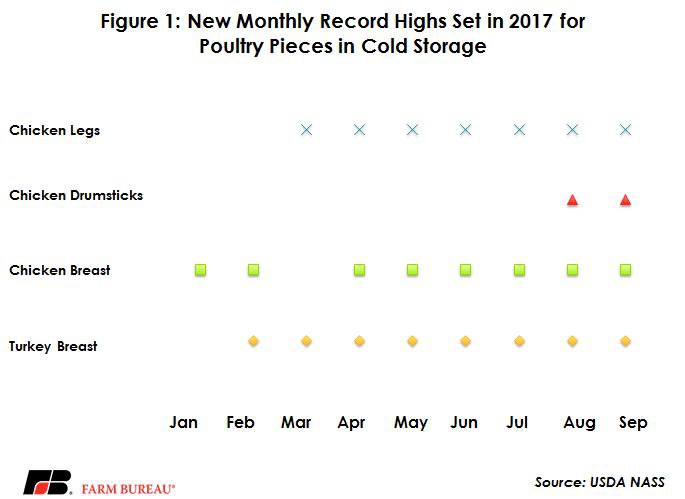

So far this year, cold storage items have produced an all-time record high for the month of September in eight of the red meat and poultry categories tracked. Among poultry items: chicken breast meat, drumsticks, legs and turkey breast hit new September records this year. Cold storage data for some categories has been tracked since the early 1900s. As time has gone on, more specific categories have evolved. For example, the chicken parts dataset only dates back to 2003, while turkey breasts have only been tracked since 2009. USDA’s National Agricultural Statistics Service prints monthly records for all the items that are tracked in inventory. This September’s new records for poultry outpaced previous records by double digits in both turkey and chicken breast categories, climbing 17 and 13 percent higher, respectively. The September drumsticks cold storage record was 9 percent higher than the previous September high, while chicken legs were only 4 percent higher.

Cold storage inventories of chicken pieces have been setting records often this year. Figure 1 shows the new monthly records in these categories.

In red meat categories, inventories built up last year. Strong demand in the face of increased production has kept cold storage levels below 2016 levels, triggering far fewer records in red meat than in poultry products. Boneless beef set a new September record high at 477 million pounds in September of last year, but this year is 7 percent below that record. Boneless hams set a new record, showing 132.6 million pounds in September cold storage. Other pork products setting records include ribs and butts. Total pork in cold storage this September was 4 percent below last year but it’s up 7 percent from August.

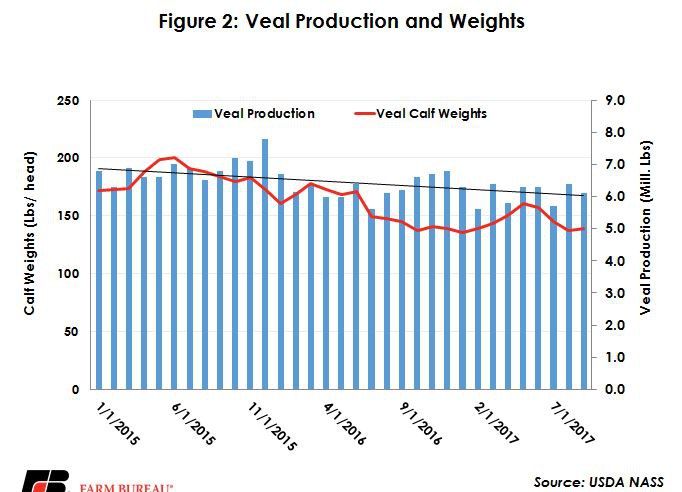

Veal inventories have continued to rise this year. September was up 24 percent compared to last year, totaling 13.7 million pounds, setting a new record. Veal inventory has grown tremendously this year setting a new record every single month. In fact, veal inventory has shown a year-over-year increase in every month since April of 2016. This year the percentage comparisons to 2016 have ranged from 24 percent to 169 percent higher.

Cold storage inventories usually build for three main reasons: 1) Exports are building. Cold storage rises ahead of large volumes going overseas in preparation for chilled/frozen container. 2) Companies believe they can make money by storing a product. This follows the classic buy low, sell high arbitrage. Buying product at low prices and paying storage fees in anticipation of rising prices in the future. 3) Weaker demand relative to the supply leads to rising inventories, i.e. there is nowhere else for it to go. The rise in veal is most likely adhering to the third axiom. Veal production and demand has been declining for decades, and this year production has not grown. Flat production and declining demand has pushed veal inventories higher.

On a side note, Tyson contacted feedlots in mid-September of 2016 stating it would not renew contracts to source Holsteins, slowing the demand for Holsteins entering feedlots. The ripple effect has been steeper discounts for black and whites going to feedlots, and fewer feedlots that will accept them, suggesting a higher volume of Holstein bull calves entering into the veal market. Calf weights have been lower this summer, contributing the lower production, shown in Figure 2. Without these lower weights, veal in cold storage could have been much higher.

Top Issues

VIEW ALL