Hog Slaughter Capacity Catches Rising Supplies

AFBF Staff

photo credit: Getty Images

Last week, Steve Meyer, Express Markets Inc., wrote for National Hog Farmer about the history made on Sept. 5, 2017, when hog slaughtering capacity increased more in a single day than it has in a whole year, for the first time ever. The opening of the Clemens Food Group plant (Coldwater, Michigan) and the Triumph-Seaboard plant (Sioux City, Iowa,) added a total of 22,200 head per day ( 12,000 and 10,200, respectively), bringing the total hog slaughter capacity up to 2.6 million hogs per week. Large capacity changes have happened over the last 12 months. During the fall of 2016 daily hog slaughter capacity was 448,320 compared to this year’s 487,435. The opening of several new plants over the last year, including those in Pleasant Hope, Missouri, Windom, Minnesota, Sioux City, Iowa and Coldwater, Michigan has resulted in a daily increase of 29,800 head of capacity, a 6 percent increase.

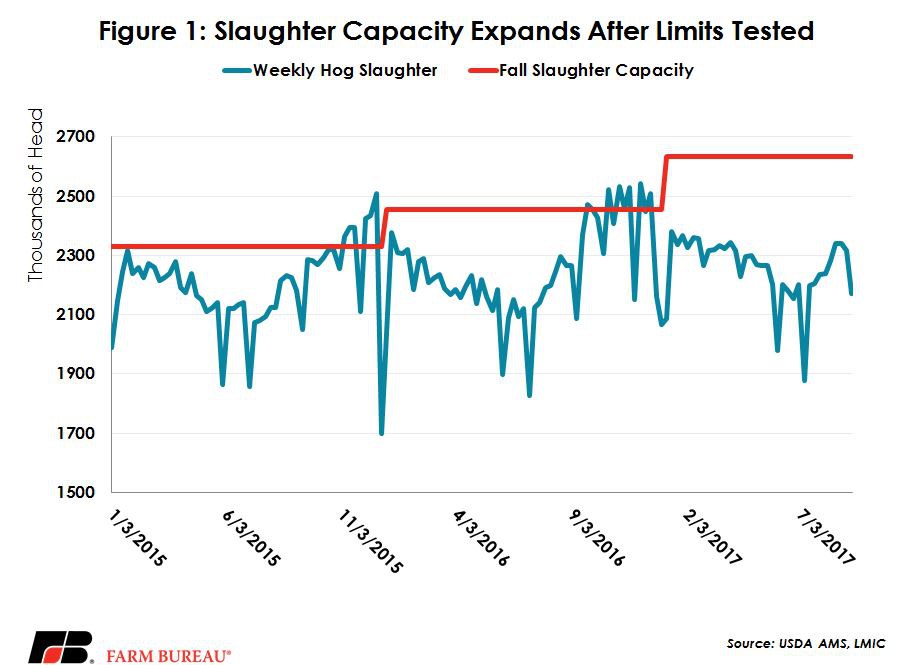

Slaughter capacity in the fourth quarter has been a topic of substantial discussion as the number of hogs has increased to meet demand and ramped up for upcoming plant openings. Last year, analysts even flirted with comparisons to 1998, when hog prices declined more than 50 percent due to a capacity squeeze. That also would have been comparable to the current situation had these new plants failed to come online. Figure 1 shows slaughter capacity step up over time as slaughter levels test it. With the onboarding of the new plants in Michigan and Iowa, slaughter capacity is expected to provide more than enough room this fall to move through the quarter without a hitch. That is, of course, if these new plants get up and running smoothly.

While it may take time to get all the bugs worked out and for the new plants to reach peak performance, if all goes as planned, this would be the first time since PEDV hit in 2014 that analysts haven’t been concerned from a capacity standpoint over the slaughter levels and the amount of hogs moving through the system. However, the June Hogs and Pigs report indicated year–over-year increases in hogs coming to market. In June 2016, the Hogs and Pigs report showed a pig crop about 1.5 million head, which was 5 percent higher than the previous year. This June, the report continued to show an increase in the pig crop, but it was only up 4 percent from last year. Still, there are 1.1 million additional market hogs are available and the number of sows farrowing continues to climb, along with hogs kept for breeding.

Hogs slaughtered has averaged 3 percent above a year ago on a weekly basis and was as high as 7 percent in the first quarter. The fourth quarter looks to continue that trend even ahead of USDA’s September Hogs and Pigs report but is unlikely to see the colossal year–over-year increases in the number hogs slaughtered seen in 2015 and 2016. In the wake of PEDV, fourth quarter slaughter jumped 6.2 percent in 2015, followed by another strong increase at 3.8 percent year-over-year in 2016. This year, the number of head slaughtered is expected to be similar to what is has been averaging over the year, about 3 to 4 percent higher.

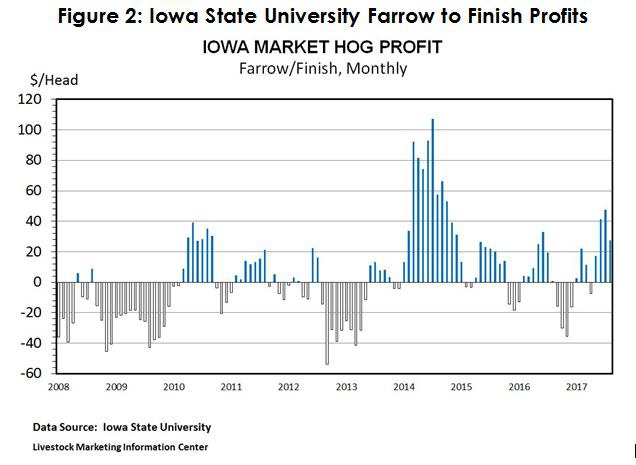

Even without slaughter capacity worries, prices are on a downward slide heading into the fourth quarter, and look to erode producer returns later in the year. Farrow–to-finish returns have been positive this year, averaging $20 per head through August, but they’re starting to slip as we head into the fall. Iowa State University estimates June and July had the highest feeding returns, both over $40 per head, while August came in at $27.54 per head. The September Hogs and Pigs report will be an important look at trends continuing in growing hog numbers. Figure 2 shows Iowa Farrow-to-Finish Returns.

Top Issues

VIEW ALL